News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The market may have entered a mild bear market.

Sideways movement is not the end, but the starting point for increasing positions.

Elon Musk's trillion-dollar compensation plan will be put to a vote on Thursday. The board of directors has made it clear: either retain him with this sky-high package, or face the risk of a potential stock price drop if he leaves.

Despite its recent slump, XRP’s improving on-chain metrics hint at a brewing rebound, with a decisive move above $2.35 potentially marking the start of a larger upward trend.

The market may have entered a mild bear market.

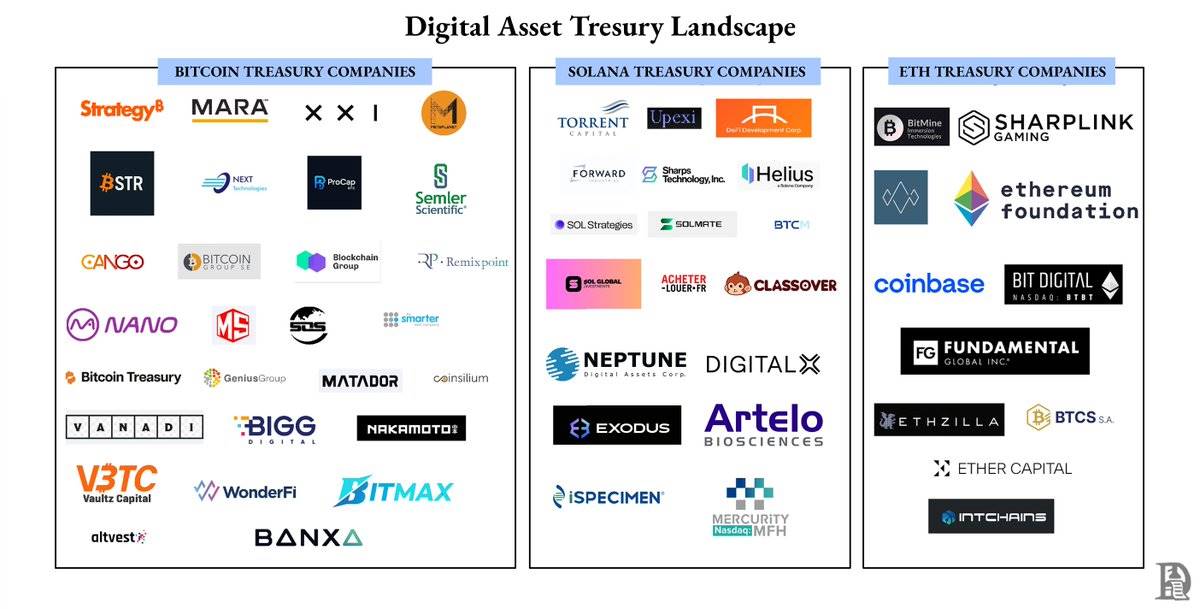

How did DATCo grow from a fringe corporate experiment into a powerful force spanning Bitcoin, Ethereum, and various altcoins, with a scale of 130 billions USD?

When "tokenization" loses its meaning: Why are we paying a premium to buy gold on-chain?

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

- 17:22SOL treasury company Forward Industries deposits 1.443 million SOL into an exchangeAccording to a report by Jinse Finance, as monitored by Onchain Lens, three hours ago, the Forward Industries address deposited 1,443,507 SOL, worth $201.34 million, into the exchange Prime. It is not yet confirmed whether this was a sale. It is reported that Forward Industries (NASDAQ: FWDI, formerly FORD) is currently the world's largest SOL (Solana native token) treasury company. According to its latest treasury update on November 15, 2025, the company holds approximately 6.91 million SOL, accounting for more than 1.25% of Solana's total circulating supply.

- 16:57The White House is reviewing the proposed crypto asset reporting frameworkChainCatcher reported that the White House is currently reviewing a proposed rule submitted by the U.S. Department of the Treasury, which would enable the United States to join the international Crypto-Asset Reporting Framework (CARF). Once approved and implemented, this framework will allow the IRS to automatically obtain transaction information from U.S. citizens’ overseas cryptocurrency accounts in order to combat international tax evasion. CARF is a global agreement created by the Organisation for Economic Co-operation and Development (OECD) in 2022, aiming to enhance the transparency of crypto asset transactions through the automatic exchange of information among member countries. Advisors to former U.S. President Trump have previously released reports recommending that the U.S. adopt CARF, believing it would prevent U.S. taxpayers from transferring digital assets to overseas digital asset exchanges and promote the development of the U.S. digital asset market. CARF has already been signed and adopted by dozens of countries, including most G7 members and major crypto hubs such as Singapore and the UAE. Its global implementation is scheduled to begin information exchange in 2027. The White House emphasized that the proposed CARF rules should not impose any new reporting requirements on decentralized finance (DeFi) transactions.

- 16:50Sharps Technology stock hits all-time low after filing its first quarterly financial reportJinse Finance reported that Sharps Technology has released its quarterly financial report for the first time after adopting a Solana-centric digital asset reserve strategy. The data shows that its core medical device business revenue is negligible, while the company holds nearly 2 million SOL tokens. The Nasdaq-listed company disclosed in regulatory filings that as of September 30, the fair value of its digital asset portfolio was $404 million, but this figure reflects the price level at the end of the quarter. Based on the current SOL price of about $138, the company's holdings have significantly shrunk in value to $275 million. The company's stock price fell to a historic low this week, having declined for several consecutive months since peaking at $16 at the end of August. According to Google Finance data, the stock price fell below $2.90 on Monday morning, with a market capitalization significantly lower than the current implied value of its Solana holdings.