News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Dalio warns: A new round of quantitative easing is pushing the market to the brink of a bubble

Bitpush·2025/11/06 16:06

Paradigm Is Reportedly Top Holder of HYPE, Analysis Reveals Truth

On-chain analysis confirms that Paradigm is the largest holder of HYPE, controlling over 19 million tokens worth $763 million.

Coinspeaker·2025/11/06 16:00

Bank of England Accelerates Stablecoin Regulation with U.S.

Kriptoworld·2025/11/06 16:00

Zcash Soars 1000% as Privacy Coins Take Center Stage

Kriptoworld·2025/11/06 16:00

Sui consolidation narrows as 60% move risk builds

Kriptoworld·2025/11/06 16:00

Will Donald Trump’s Tariff Policies Impact Global Cryptocurrency Market Sentiment?

Trump acknowledges consumers paying more due to tariffs, as the Supreme Court questions. President established the Strategic Bitcoin Reserve with BTC, ETH, XRP, SOL, and ADA holdings. Administration reversed Biden-era actions, dropped SEC lawsuits against exchanges.

CoinEdition·2025/11/06 16:00

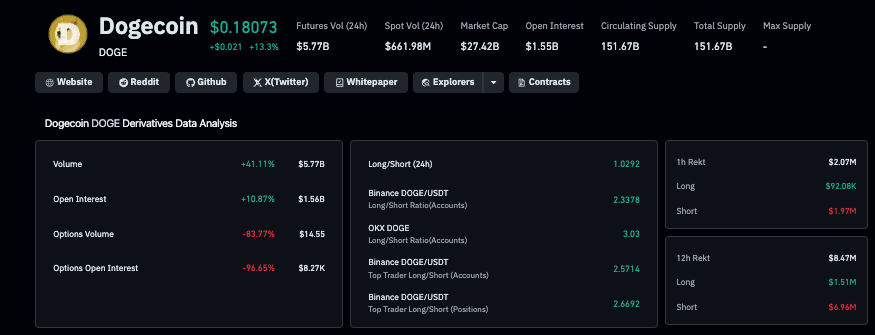

Dogecoin Price Outperforms Top 10 Crypto as Traders Bet on Elon Musk’s $1 Trillion Payday

Dogecoin rallied 6.5% following Tesla shareholders’ approval of Elon Musk’s record $1 trillion compensation package, with DOGE derivatives trading spiking 41%.

Coinspeaker·2025/11/06 16:00

Ray Dalio Slams Fed’s New “Magic Trick” — Bubble Fuel or Fiscal Fix?

Kriptoworld·2025/11/06 16:00

XRP Property Ruling in India Meets Wedge Rejection on Charts

Kriptoworld·2025/11/06 16:00

Crypto Price Analysis 11-7: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, INTERNET COMPUTER: ICP, FILECOIN: FIL

Cryptodaily·2025/11/06 16:00

Flash

- 18:54The total number of institutions currently holding Bitcoin has reached 355.Jinse Finance reported, citing Cointelegraph, that four more institutions have joined the Bitcoin camp in the past month. The total number of institutions holding Bitcoin has now reached 355.

- 18:46Data: 5.5 million SYRUP transferred from an anonymous address, routed through intermediaries, and deposited into the exchange PrimeAccording to ChainCatcher, Arkham data shows that at 02:34, 5.49999 million SYRUP (worth approximately $2.5191 million) were transferred from an anonymous address (starting with 0x9197A...) to another anonymous address (starting with 0xfD444A...). Subsequently, at 02:39, this address transferred 5.5 million SYRUP to an exchange.

- 18:05Data: "Machi Big Brother" reduced 2,880 ETH long positions in the past hour, with a liquidation price of $3,022.According to ChainCatcher, Hyperbot data shows that "Brother Machi" reduced his ETH long positions by 2,880 in the past hour. The current position is valued at $15.787 million, with an unrealized loss of $1.536 million and a liquidation price of $3,022.