News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 18) | Fidelity Solana Spot ETF Launches Tonight in U.S. Markets; Public Companies Net-Buy Over $847 Million in BTC Last Week; All Three Major U.S. Indexes Close Lower2Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom3Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Metaplanet Secures $100M Bitcoin-Backed Loan to Expand BTC Holdings and Support Share Buyback

DeFi Planet·2025/11/06 10:27

Race for U.S. XRP ETFs Heats Up Ahead of Mid-November Launch Window

DeFi Planet·2025/11/06 10:27

Bitcoin’s new problem: it’s not leverage, it’s long-term holders cashing out

Coinjournal·2025/11/06 10:09

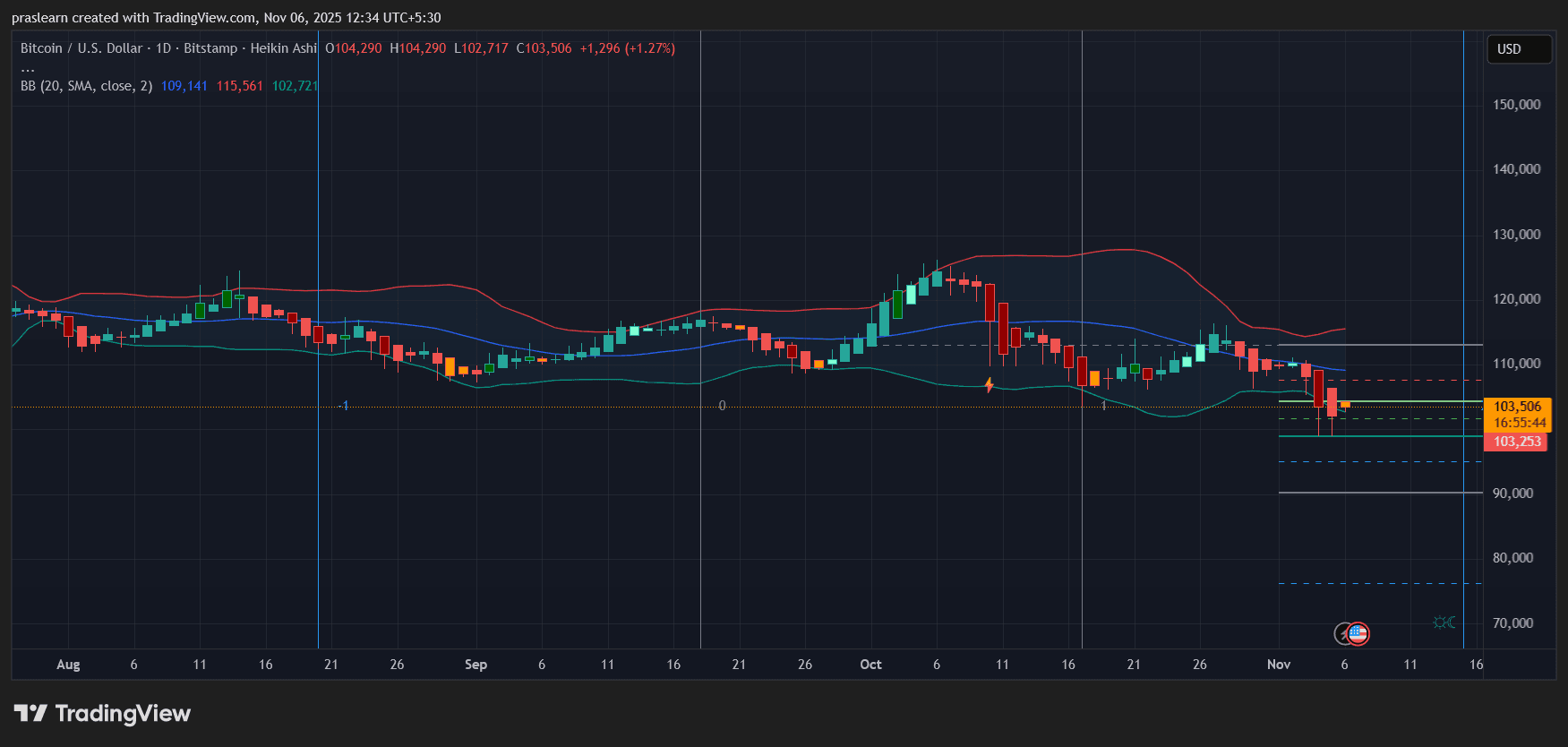

Bitcoin in Trouble? November Could Decide BTC’s Next Big Move

Cryptoticker·2025/11/06 10:00

Ethereum Enters “Opportunity Zone” After 5 Months; What Does This Mean For Price?

After a 15% drop, Ethereum has entered a key reversal zone, with historical data and technical indicators aligning to suggest that ETH may be nearing a pivotal recovery point.

BeInCrypto·2025/11/06 10:00

Bitcoin Bull Score Hits Zero, First Time Since 2022 Bear Market

Bitcoin's 'Bull Score' hit zero, a level unseen since early 2022. Analysts warn the loss of momentum and slowed inflows mean Bitcoin risks an extended consolidation phase without new demand.

BeInCrypto·2025/11/06 09:50

MegaETH announces token sale allocation strategy

Different allocation strategies for existing community members and long-term investors.

Chaincatcher·2025/11/06 09:09

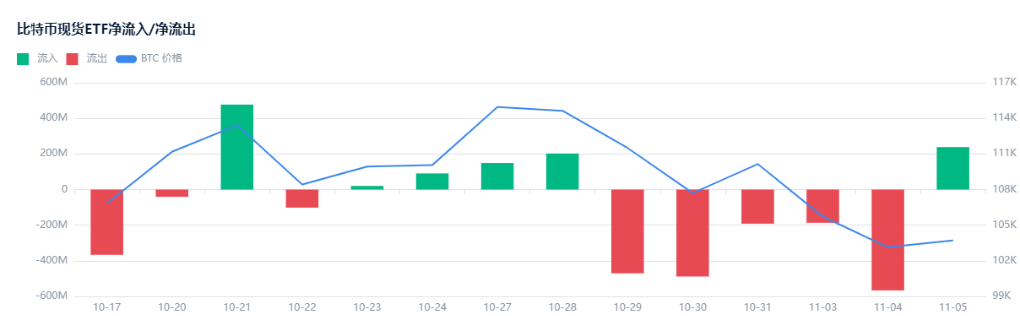

ADP employment data exceeds expectations, so why is the market falling instead of rising?

AICoin·2025/11/06 09:06

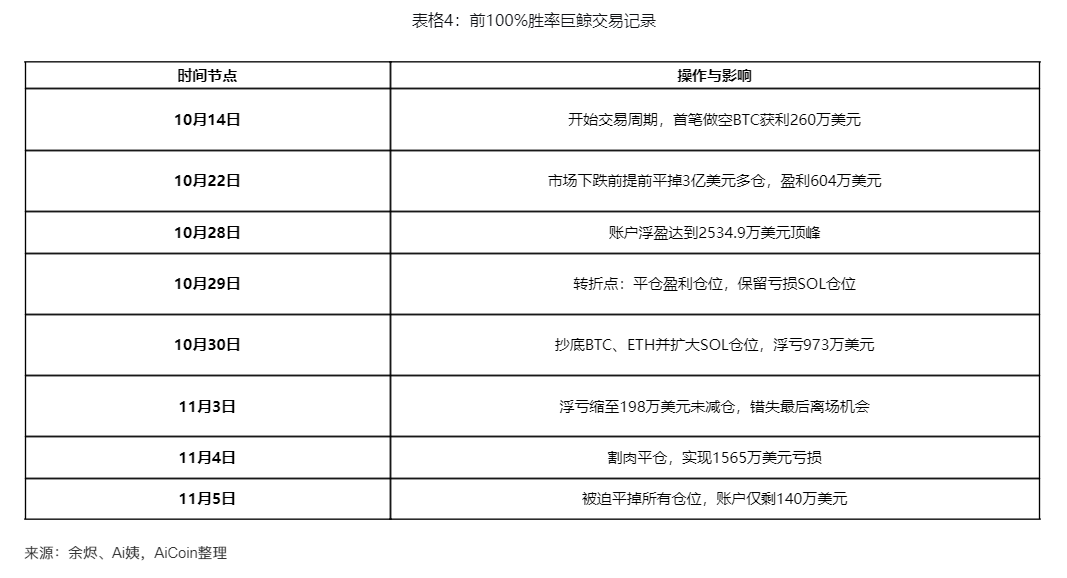

The Fall of the Hyperliquid Whale: A High-Leverage Feast Turns into a Capital Graveyard

AICoin·2025/11/06 09:06

How Wall Street’s Ripple bet gives XRP a big institutional role

CryptoSlate·2025/11/06 09:00

Flash

- 07:52A certain whale increased holdings by 134,000 SOL today, accumulating a total purchase of 324,000 SOL within one month.Foresight News reported, according to monitoring by Lookonchain, that during the market downturn, a certain whale purchased another 134,680 SOL today (approximately $17.85 million). Over the past month, this whale has accumulated a total purchase of 324,568 SOL at an average price of around $160 (approximately $44 million), currently holding an unrealized loss of about $8 million.

- 07:52Mt. Gox transfers 10,423 BTC to a new wallet, worth approximately $936 millionForesight News reported, according to monitoring by Lookonchain, Mt. Gox has transferred 10,423 BTC (approximately $936 million) to a new wallet.

- 07:47Spot gold falls below $4,000 per ounceJinse Finance reported that spot gold has fallen below the $4,000/ounce mark for the first time since November 10, dropping more than 1% intraday.