Bitcoin Bull Score Hits Zero, First Time Since 2022 Bear Market

Bitcoin's 'Bull Score' hit zero, a level unseen since early 2022. Analysts warn the loss of momentum and slowed inflows mean Bitcoin risks an extended consolidation phase without new demand.

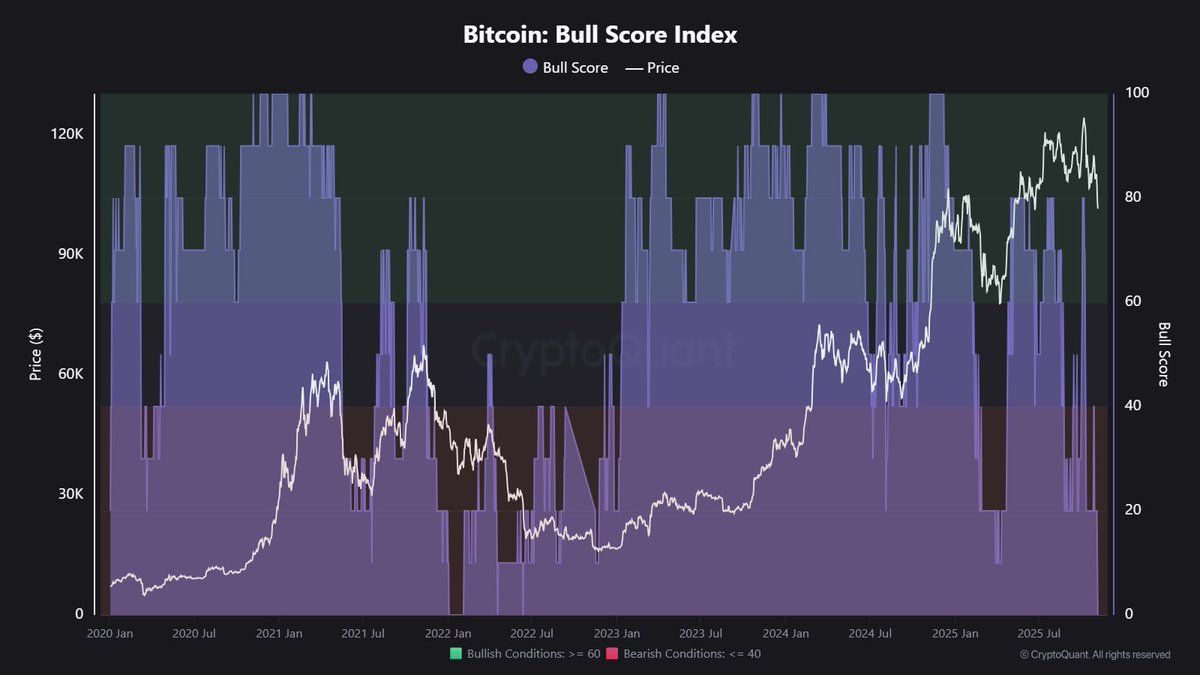

A key on-chain metric used to assess Bitcoin’s upward potential, the Bull Score, has plunged to zero out of a possible 10 points. This marks the first time the score has hit zero since January 2022, the period that preceded the last major bear market.

Data from the on-chain analytics platform CryptoQuant showed the Bull Score indicator registering zero on Thursday. Analysts warned that immediate action is required to avoid a prolonged slump.

Bull Score Signals Transition to Consolidation

The Bull Score is a composite metric designed to evaluate the market’s health and trend by integrating ten distinct on-chain and market indicators across four main categories. This includes Network Activity, Volume, Investor Profitability, and Market Liquidity.

Bitcoin: Bull Score Index. Source: CryptoQuant

Bitcoin: Bull Score Index. Source: CryptoQuant

The score is typically interpreted as a Bear Market signal when it falls below 40 and a Bull Market signal when it exceeds 60.

As of November, all 10 on-chain components of this metric are below trend. Most notably, the MVRV (Market Value to Realized Value and stablecoin liquidity on the Bitcoin network have plunged dramatically over the past month.

When Bitcoin’s MVRV ratio drops, it typically signals reduced investor profitability. It can suggest a potential undervaluation or buyer re-entry zone, depending on the context.

A declining MVRV means the market value is approaching or falling below the average cost basis of holders. In simple terms, investors are holding less unrealized profit or even losses.

Bitcoin MVRV Ratio Over The Past 3 Months. Source:

CryptoQuant

Bitcoin MVRV Ratio Over The Past 3 Months. Source:

CryptoQuant

While the score stayed extremely low throughout the 2022 bear market, the current situation is structurally different, given that Bitcoin is holding a historically high price near $100,000.

Nevertheless, why are the indicators showing this result? This is because ETF and corporate inflows slowed.

Overall, it’s evident that for a sustained upward rally, new demand must materialize. The current setup, according to the analysts, looks like an early bear-market transition.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.