This Is How XRP Price Decline Is a Precursor To A Bigger Bounce Back

Despite its recent slump, XRP’s improving on-chain metrics hint at a brewing rebound, with a decisive move above $2.35 potentially marking the start of a larger upward trend.

XRP has struggled to reclaim upward momentum after multiple failed recovery attempts over the past few weeks.

Market conditions have kept the altcoin subdued, but the recent consolidation may be setting the stage for a rebound. Indicators now show early signs of stabilization, hinting at renewed bullish potential.

What Are The Indicators Saying About XRP?

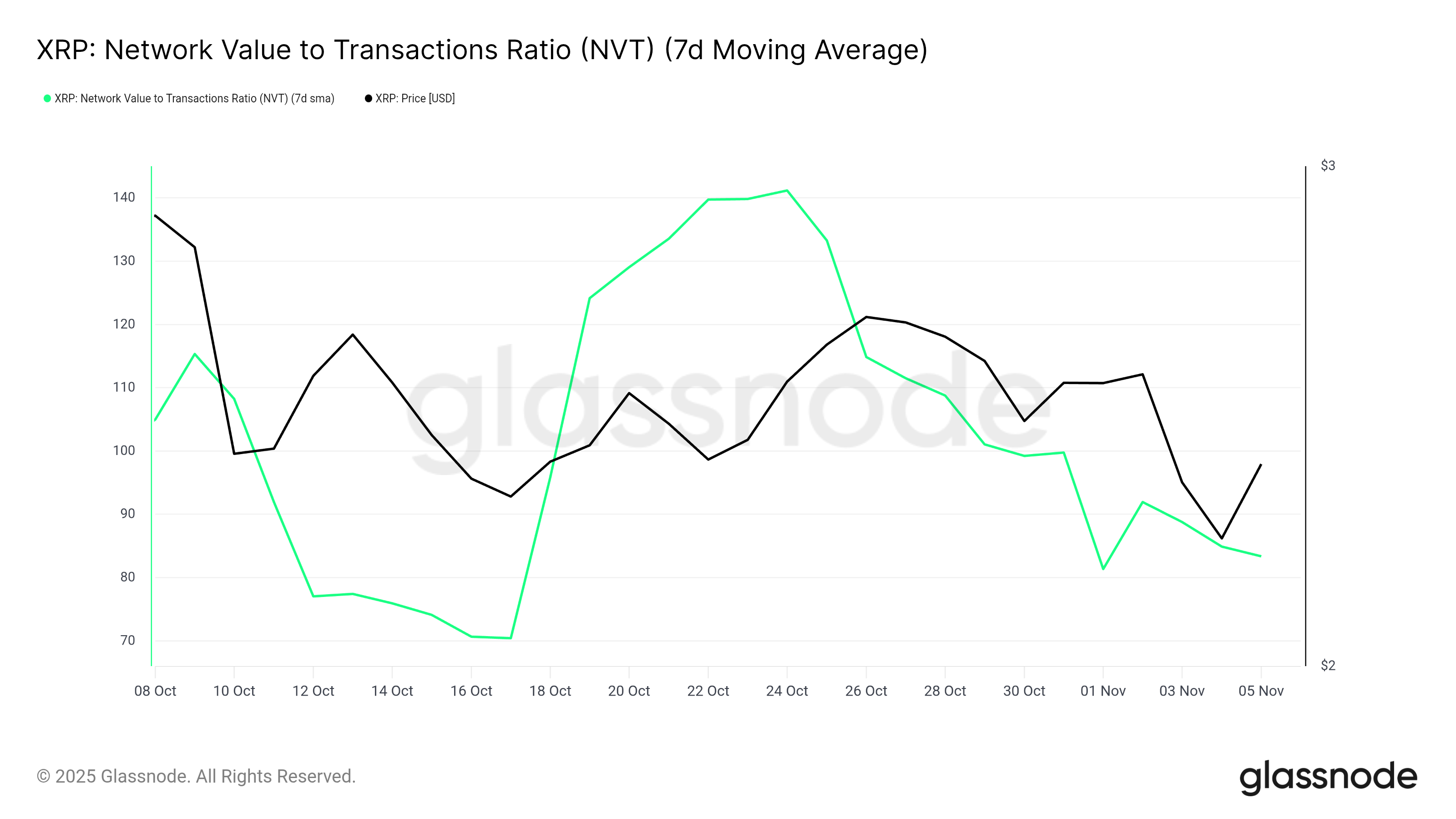

The Network Value to Transactions (NVT) ratio highlights improving conditions for XRP. The indicator has declined steadily in recent days, signaling that the asset is not in danger of being overbought. A lower NVT suggests healthy network activity relative to valuation, laying the groundwork for sustainable price growth.

This lack of excessive volatility is beneficial for XRP’s next move. It indicates a balanced market environment where price shifts are driven by organic demand rather than speculation. This stability is vital for building a strong foundation for a potential breakout in the near term.

XRP NVT Ratio. Source:

Glassnode

XRP NVT Ratio. Source:

Glassnode

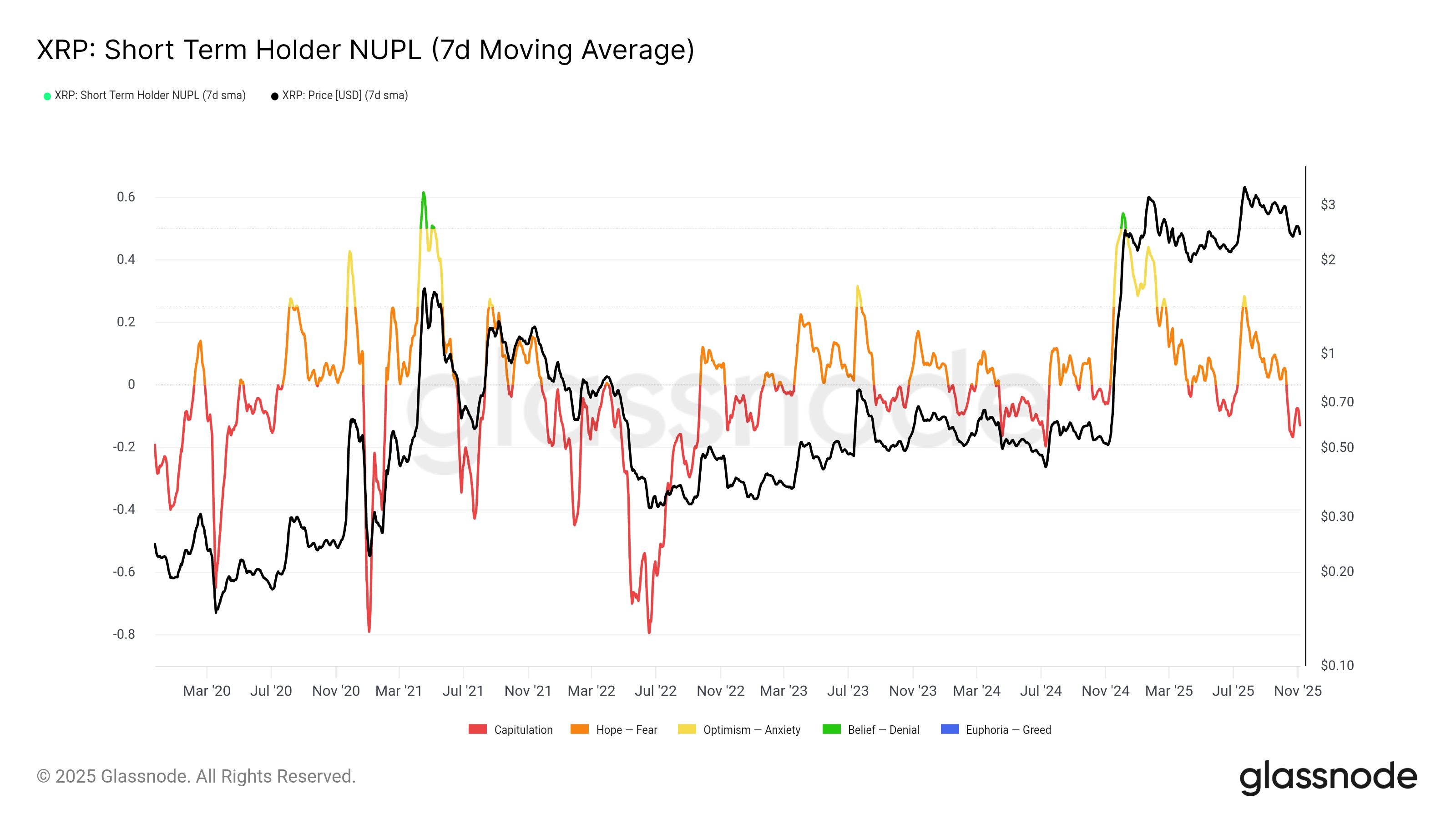

The Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) ratio is currently in the capitulation zone. Typically, this would be concerning during a prolonged bear market, but historical data suggests otherwise for XRP. Each dip into this zone in past cycles has preceded a significant rally in the following weeks.

As long as STH-NUPL remains above the -0.2 threshold, the outlook remains positive. This positioning shows that investor losses have not yet reached extreme levels, leaving room for recovery.

XRP STH NUPL. Source:

Glassnode

XRP STH NUPL. Source:

Glassnode

XRP Price Can Bounce Back

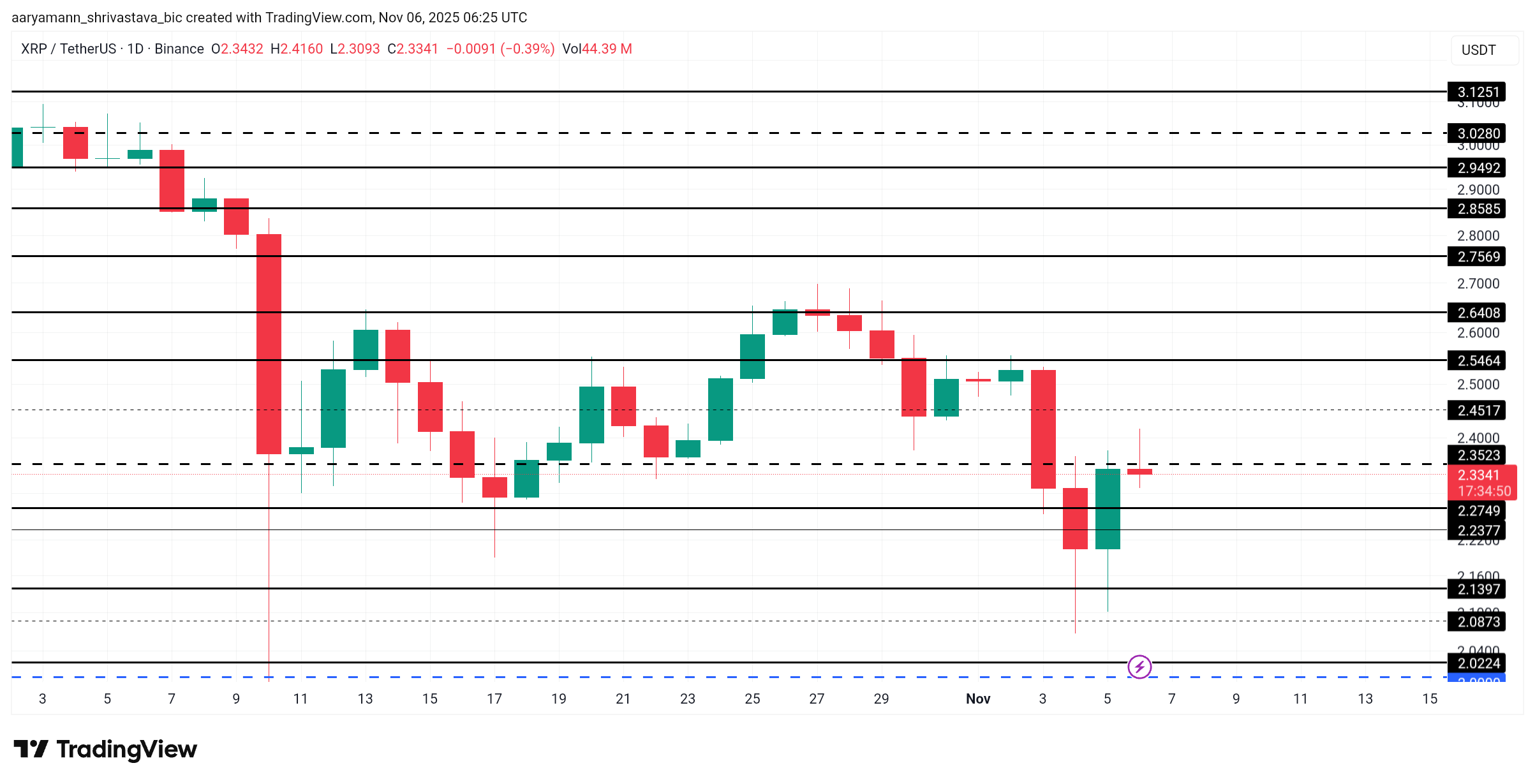

XRP price is currently trading at $2.33, just under the $2.35 resistance zone. Breaching this critical level is essential for confirming a short-term recovery. This will also likely reestablish bullish sentiment among traders.

If XRP can secure a breakout above $2.35, it could rise toward $2.54 and possibly $2.80, reversing recent declines. Such a move would reinforce market confidence and attract stronger inflows from sidelined investors.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if bullish conditions fail to materialize, XRP may slip through the $2.27 support level it has held for weeks. A drop below this point could drag the price down to $2.13, invalidating the bullish thesis and extending the correction phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink Announces $104M Profit on the Back of Its Ethereum Strategy

Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Digital Asset ETPs See $2 Billion Outflows Amid Policy Uncertainty