News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

Sam Altman’s Worldcoin Rolls Out ‘Proof of Human’ IDs at Global FIFA and NFL Venues

CryptoNewsFlash·2025/11/05 13:15

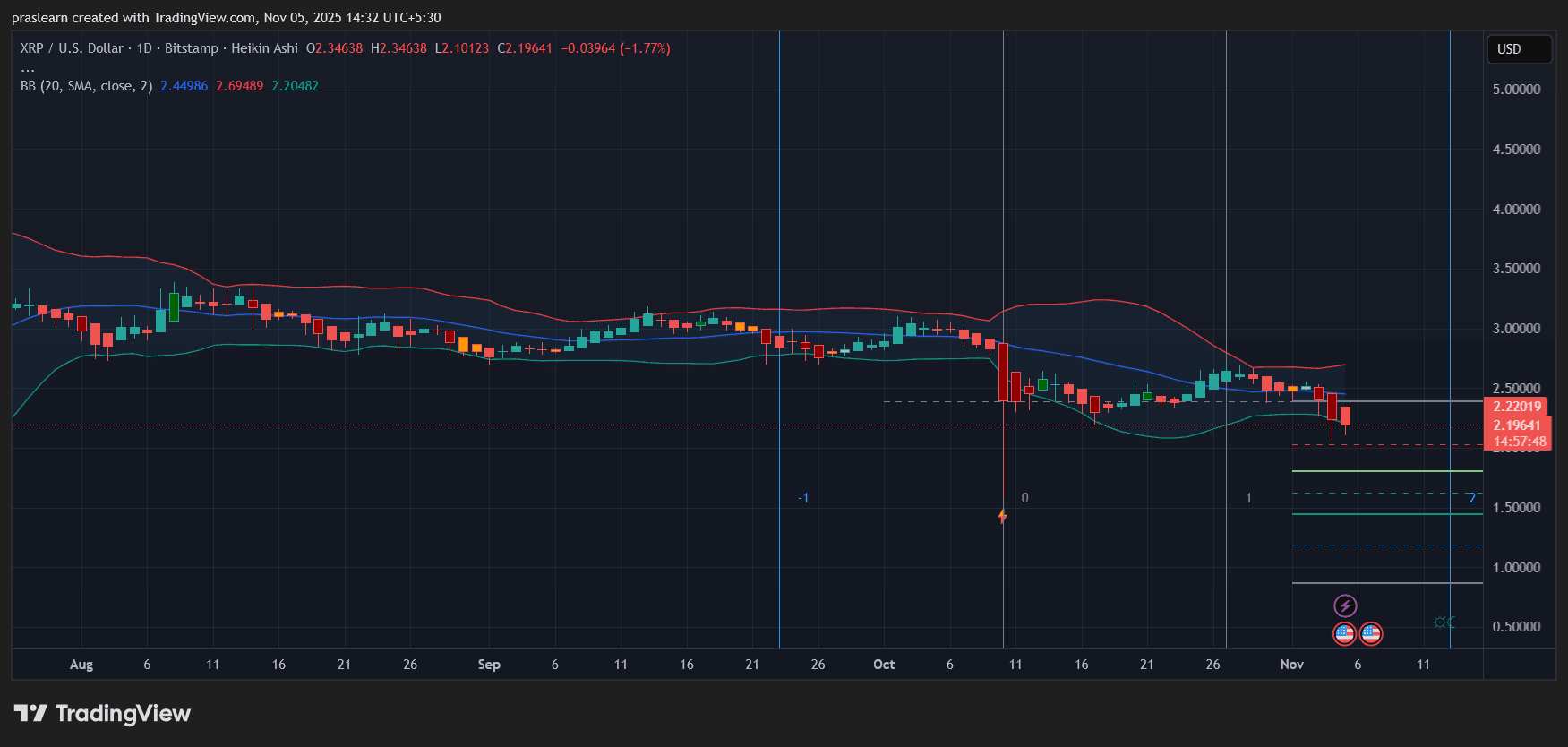

Franklin Templeton Eyes XRP ETF Launch as Market Pullback Hits XRP Hard

CryptoNewsFlash·2025/11/05 13:15

Bitcoin’s “Red October” Spills Into November: BTC Drops Below $100K

CryptoNewsFlash·2025/11/05 13:15

Everything You Need to Know About Cardano Summit 2025 in Berlin

CryptoNewsFlash·2025/11/05 13:15

VeChain Launches Hayabusa Testnet Ahead of December Mainnet Upgrade

CryptoNewsFlash·2025/11/05 13:15

IOTA Ambassador Program Levels Up: Earn $IOTA with GiveRep’s New Automated Rewards

CryptoNewsFlash·2025/11/05 13:15

Bitcoin and Ethereum ETF Outflows Hit 3-Month High, Near $1B Total

CryptoNewsFlash·2025/11/05 13:15

Ripple Expands Enterprise Reach With Another Acquisition of Wallet Platform

CryptoNewsFlash·2025/11/05 13:15

Will XRP Price Crash to $0 in November?

Cryptoticker·2025/11/05 13:03

How the EU’s Digital Euro Plan Could Hand Power to the US

Europe’s digital money ambitions are facing backlash from banks and lawmakers, who fear the ECB’s digital euro and strict crypto rules could weaken innovation and inadvertently hand economic power to the US.

BeInCrypto·2025/11/05 13:01

Flash

- 14:05Data: A major whale in the loop lending market liquidated and sold off 700 WBTC at a loss of $21.68 millionChainCatcher News, according to on-chain analyst Yu Jin's monitoring, as bitcoin has recently experienced a deep correction, a whale who purchased 700 WBTC through a looping loan strategy four months ago saw their lending position approach liquidation. Today, the whale has capitulated and fully closed the position, incurring a loss of up to 21.68 million USD.

- 13:34Analysis: Bitcoin plunges into danger zone, options factors intensify market volatilityChainCatcher News, according to Bloomberg, bitcoin has plummeted, putting the market in a dangerous situation. Option-based sell-offs have further intensified volatility. Bitcoin has fallen by about 25% so far this month. This decline is mainly driven by spot selling, including outflows from major exchange-traded funds (ETFs), sales of long-dormant wallet assets, and a decrease in demand from momentum investors, among other factors. On the other hand, option trading positions have also amplified price fluctuations. When bitcoin falls below certain price levels, traders need to adjust their hedges to maintain neutral positions. This process, known as "Gamma exposure," further magnifies price volatility. One key level is $85,000, which was breached on the 21st. There is concentrated demand for put options near this strike price, forcing market makers to hedge large exposures. In such situations, traders are usually in a "short Gamma" state and will further sell bitcoin to maintain balance, thereby accelerating the decline.

- 13:22This week, US spot bitcoin ETFs saw a net outflow of $1.2168 billion, with IBIT accounting for over $1 billion in outflows.BlockBeats News, November 22, according to monitoring by farside, this week the net outflow from US spot Bitcoin ETFs reached $1.2168 billion, including: · IBIT net outflow of $1.0857 billion; · FBTC net outflow of $115.8 million; · BITB net outflow of $7.9 million; · ARKB net outflow of $85 million; · BTCO net inflow of $35.8 million; · EZBC net inflow of $3.3 million; · HODL net outflow of $63.2 million; · GBTC net outflow of $172.4 million; · Grayscale BTC net inflow of $274.1 million.