News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Ark Invest’s Cathie Wood lowered her Bitcoin forecast to $1.2 million per coin by 2030, attributing the adjustment to stablecoins’ rapid expansion in payments and savings.

Bitcoin.com partners with Concordium to offer identity verification and payment services to over 75 million wallet users, using zero-knowledge proofs for privacy.

JPMorgan projects Bitcoin could reach $170,000 within 12 months, driven by favorable volatility metrics versus gold and stabilizing futures markets post-October liquidations.

Midnight Network has recorded 1,000,000 in mining addresses, marking a robust adoption by community members.

Quick Take Stable Labs’ USDX stablecoin, built to maintain its peg using delta-neutral hedging strategies, lost its peg to the dollar on Thursday, dropping below $0.60. Protocols including Lista and PancakeSwap are monitoring the situation.

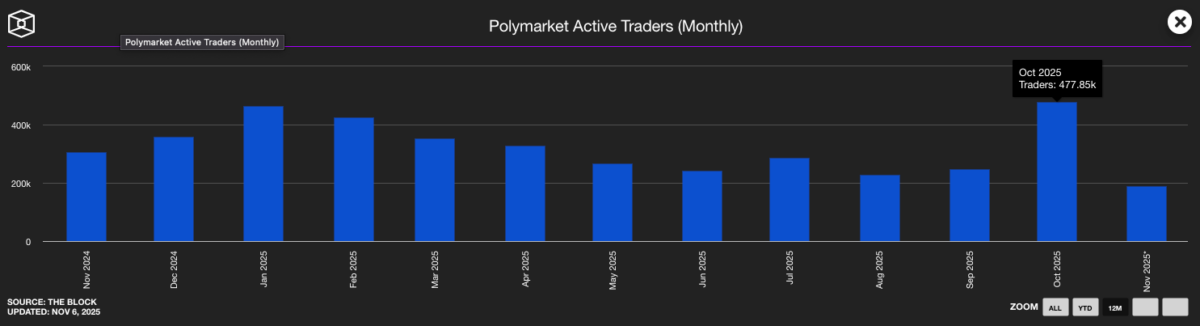

Google now displays real-time prediction market probabilities from Polymarket and Kalshi in search results, making crowd-sourced financial forecasts accessible to billions of daily users.

- 13:34Analysis: Bitcoin plunges into danger zone, options factors intensify market volatilityChainCatcher News, according to Bloomberg, bitcoin has plummeted, putting the market in a dangerous situation. Option-based sell-offs have further intensified volatility. Bitcoin has fallen by about 25% so far this month. This decline is mainly driven by spot selling, including outflows from major exchange-traded funds (ETFs), sales of long-dormant wallet assets, and a decrease in demand from momentum investors, among other factors. On the other hand, option trading positions have also amplified price fluctuations. When bitcoin falls below certain price levels, traders need to adjust their hedges to maintain neutral positions. This process, known as "Gamma exposure," further magnifies price volatility. One key level is $85,000, which was breached on the 21st. There is concentrated demand for put options near this strike price, forcing market makers to hedge large exposures. In such situations, traders are usually in a "short Gamma" state and will further sell bitcoin to maintain balance, thereby accelerating the decline.

- 13:22This week, US spot bitcoin ETFs saw a net outflow of $1.2168 billion, with IBIT accounting for over $1 billion in outflows.BlockBeats News, November 22, according to monitoring by farside, this week the net outflow from US spot Bitcoin ETFs reached $1.2168 billion, including: · IBIT net outflow of $1.0857 billion; · FBTC net outflow of $115.8 million; · BITB net outflow of $7.9 million; · ARKB net outflow of $85 million; · BTCO net inflow of $35.8 million; · EZBC net inflow of $3.3 million; · HODL net outflow of $63.2 million; · GBTC net outflow of $172.4 million; · Grayscale BTC net inflow of $274.1 million.

- 12:55Bloomberg: Wall Street Faces Stress Test as Bitcoin FallsChainCatcher news, according to Bloomberg, the cryptocurrency market has experienced a rapid and unexpectedly large-scale brutal sell-off in recent weeks. Friday's decline pushed the price of bitcoin close to $80,500, marking its worst monthly performance since 2022. Bitcoin's total market capitalization has evaporated by about $500 billions, and other altcoin markets have also suffered heavy losses. Although the price of bitcoin remains above the level it was at when Trump won the presidential election, its rally during Trump's first year in office has largely faded. This month, investors have withdrawn billions of dollars from 12 bitcoin-related ETFs. Digital Asset Reserve Companies (DATs), inspired by Michael Saylor's Strategy Inc., are also facing even steeper outflows. Fadi Aboualfa, Head of Research at Copper Technologies Ltd., stated that institutional investors do not have a "HODLing" mentality; they rebalance their portfolios when the market declines. This crash lacked the previous systemic pressures and obvious scandal events. Cantor Fitzgerald & Co. analysts Brett Knoblauch and Gareth Gacetta believe that most of the decline can be attributed to the flash crash on October 10, an event that may have had a greater impact on the balance sheets of many large participants than initially expected, forcing them to sell. The flash crash on October 10 liquidated $19 billions in crypto bets within a few hours, exposing issues of insufficient weekend trading liquidity and excessive leverage accumulation on some exchanges. Liquidity in the crypto market remains very low, and market makers weakened by the crash are struggling to step in and support prices. According to Coinglass data, about $1.6 billions in bets were liquidated on Friday. The crypto market is acting as a proxy for rapid risk appetite and is interacting with the volatile trading of tech stocks. Adam Morgan McCarthy, Senior Research Analyst at blockchain data company Kaiko, pointed out that medical device companies or cancer research companies rebranding themselves as "cryptocurrency reserve companies" is a signal of the market cycle. According to CoinMarketCap data, the Fear and Greed index, which measures crypto market sentiment, fell to 11 out of 100 on Friday, entering the "extreme fear" zone.