News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

Bitcoin bear market OR bear trap? Here’s what your ‘quants’ are saying

CryptoSlate·2025/11/05 12:00

CZ Discusses the Memecoin Craze, Hyperliquid, and Offers Advice to Entrepreneurs

CZ's life after stepping down, reflections, and deep insights into the future of crypto.

Chaincatcher·2025/11/05 11:44

Privacy coins surge against the trend—is this a fleeting moment or the dawn of a new era?

AICoin·2025/11/05 11:39

The whale myth has collapsed! No one can beat the market forever!

AICoin·2025/11/05 11:38

Still dare to play with DeFi? This feeling is all too familiar...

Bitpush·2025/11/05 11:06

Is Bitcoin’s 4-year cycle dead or are market makers in denial?

CryptoSlate·2025/11/05 10:00

Why does bitcoin only rise when the US government reopens?

Is the US government shutdown the main culprit behind the global financial market downturn?

BlockBeats·2025/11/05 09:15

Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

If the crypto market of 2019 taught us anything, it's that boredom is often the prelude to a breakout.

BlockBeats·2025/11/05 09:14

Don't panic, the real main theme of the market is still liquidity.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

BlockBeats·2025/11/05 09:14

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet expands, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

BlockBeats·2025/11/05 09:14

Flash

- 15:26Forward Industries transferred 1.727 million SOL, worth $219.32 million, to a certain wallet address.According to a report by Jinse Finance, monitored by Lookonchain, Forward Industries has just transferred 1.727 million SOL (worth $219.32 million) to wallet address 552ptg. Previously, this institution purchased 6.834506 million SOL at an average price of $232.08 (total value $868 million). Currently, it has an unrealized loss of $718 million, with a loss rate of 45%.

- 15:21Forward Industries transfers 1.727 million SOL, worth $219 million, to wallet 552ptgAccording to ChainCatcher, monitored by Lookonchain, Forward Industries transferred 1.727 million SOL to wallet 552ptg, valued at $219.32 million. Previously, Forward Industries purchased 6.834506 million SOL at an average price of $232.08, with a total cost of $868 million. The current unrealized loss is $718 million, representing a loss ratio of 45%. .

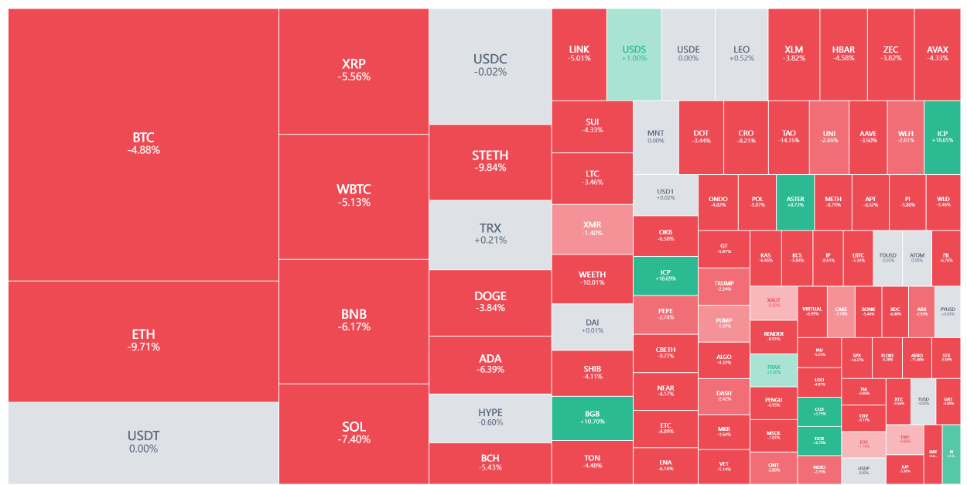

- 15:21Next Week's Macro Outlook: The Federal Reserve Will Release the Beige Book on Economic Conditions, Williams Will Deliver a SpeechChainCatcher News, according to Golden Ten Data, risk assets experienced an extremely difficult period this week, with US stocks under tremendous pressure. Interestingly, despite Nvidia releasing strong financial results and its CEO making optimistic comments, this failed to reverse the negative momentum. The situation in the cryptocurrency market was even worse. This week, bitcoin fell by 18%, marking its strongest weekly decline since mid-November 2022. Here are the key points the market will focus on in the new week (all times UTC+8): Tuesday 21:30 (UTC+8): US September retail sales monthly rate, US September PPI; Wednesday 9:00 (UTC+8): Reserve Bank of New Zealand announces interest rate decision; Wednesday 21:30 (UTC+8): US initial jobless claims for the week ending November 22; Thursday 03:00 (UTC+8): Federal Reserve releases Beige Book on economic conditions; Thursday (time to be determined): Bank of Korea announces interest rate decision; Friday: New York Fed President Williams will deliver a speech. Jefferson's views carry potential weight, as his opinions often align closely with those of Federal Reserve Chairman Powell. Since joining the Fed three years ago, Jefferson's votes have consistently matched Powell's. Notably, due to the Thanksgiving holiday in the US on Thursday and the early market close for "Black Friday" on Friday, next week's trading days will be shortened and market liquidity will be significantly reduced.