Will XRP Price Crash to $0 in November?

XRP price has fallen back into the danger zone as global markets reel from the ongoing U.S. government shutdown—the longest full closure in history. The question now haunting traders is simple: could XRP’s slide accelerate into a total collapse this November? The short answer is no, but the next few weeks will test the coin’s resilience more than any time this year. Let’s break down what’s driving this sentiment, what the chart reveals, and what realistic scenarios could play out next.

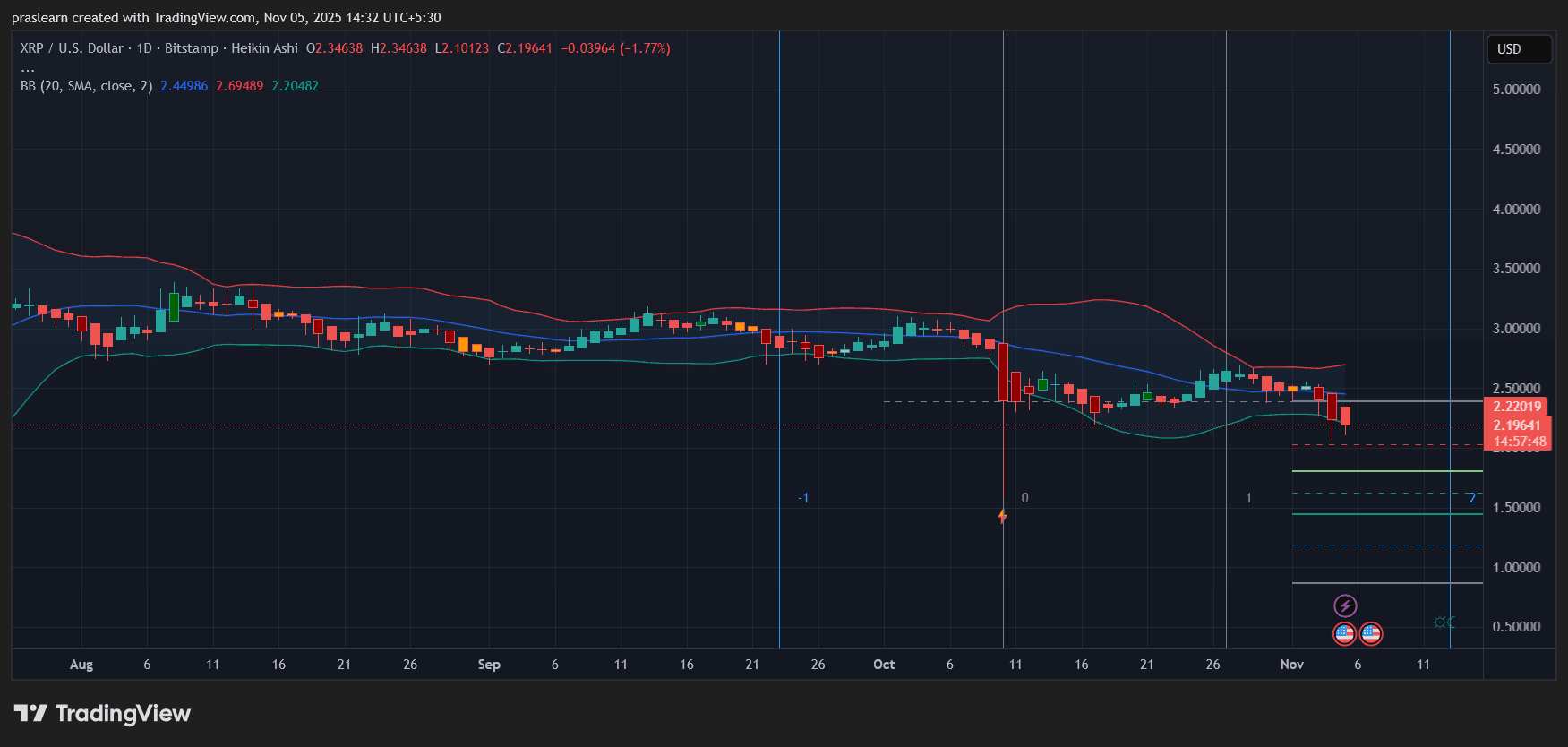

The Economic Shock: A Data Blackout Freezes Investor Confidence

At 34 days and counting, the government shutdown has frozen key economic reports—jobs, inflation, and retail sales—all of which the Federal Reserve and Wall Street rely on. Without fresh data, traders can’t gauge economic health, and uncertainty becomes the default setting.

The result? Panic.

U.S. stock indices tumbled this week, with the Nasdaq down 2% and the S&P 500 losing 1.2%. Tech giants like Palantir, Nvidia, and Tesla led the drop, pulling sentiment across all risk assets—including crypto. Bitcoin slipped below $100,000 for the first time in months , and XRP followed suit, breaking below the $2.20 level.

This isn’t about Ripple or its fundamentals . It’s about macro paralysis. When policymakers and investors are blindfolded, they retreat to safety, and speculative assets like XRP take the hardest hit.

XRP Price Prediction: Weak Momentum, Heavy Resistance

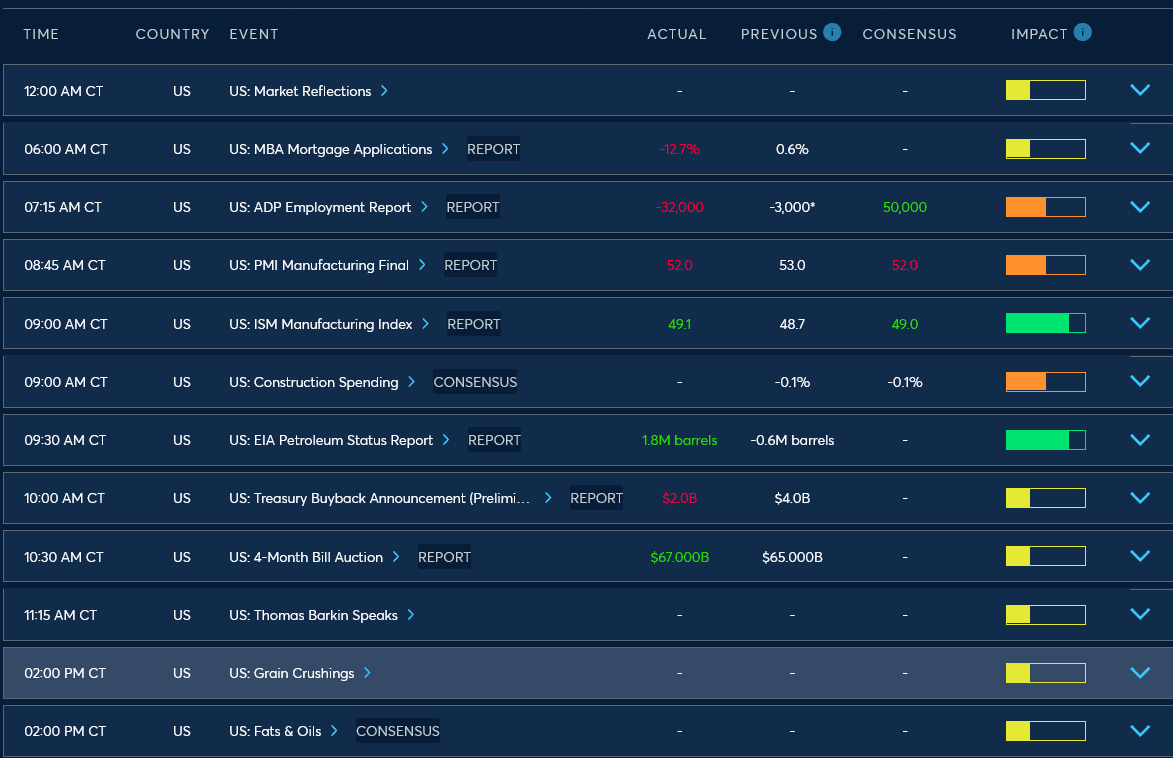

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

The daily XRP price chart paints a worrying short-term picture. Price is sitting around $2.19 after failing to stay above the $2.30–$2.40 range. The Bollinger Bands (BB 20, 2) show a bearish breakout below the mid-band ($2.45), with the lower band now acting as weak support near $2.20.

Heikin Ashi candles confirm sustained selling pressure—multiple red bodies with longer lower shadows suggest bears are still in control, though buyers are trying to defend the current level. The broader structure shows a gradual series of lower highs and lower lows since August, signaling exhaustion in bullish momentum.

If $2.00 breaks, the next stops are $1.80 and $1.50. Those are historical liquidity zones where price briefly consolidated in late 2024. The psychological level at $1.00 remains distant but not impossible if broader markets worsen.

The Macro Connection: When the U.S. Sneezes, Crypto Catches a Cold

The shutdown’s ripple effects go far beyond government payrolls. It’s holding up data used to price interest rate expectations. That uncertainty means no one knows whether inflation is cooling or surging—and that alone can send speculative markets into freefall.

Meanwhile, the dollar index has climbed to 100.23, showing global demand for safety. When the dollar strengthens, crypto weakens. Gold and oil are both down, showing that risk-off sentiment has taken over everything. Until the shutdown ends, liquidity will likely stay trapped in safe assets, leaving XRP and peers exposed to volatility spikes and sell-offs.

XRP Price Prediction: Will XRP Price Actually Crash to $0?

Realistically, no. XRP’s network, liquidity, and institutional use cases are too established for a complete collapse. Ripple’s partnerships in remittance corridors and its ongoing adoption in cross-border payments continue to provide intrinsic value that most speculative coins lack.

But can $XRP lose another 30–50% this month if macro conditions worsen? Absolutely. If the shutdown drags past mid-November and delayed inflation data sparks panic over Fed policy, XRP could retest $1.50 or even briefly dip below it before finding a floor.

The key level to watch remains $2.00. A clean daily close below that could open the door for a deeper correction. Conversely, a strong bounce above $2.35 would invalidate the immediate bearish bias and set up a recovery toward $2.80.

Final Take: XRP’s Fate Rests on Politics, Not Price Action

For now, XRP price isn’t crashing to zero—but it’s stuck in a perfect storm of uncertainty. Traders are flying blind without U.S. economic data, and technicals reflect that tension. As long as the shutdown persists, expect more red candles, false breakouts, and sudden sell-offs.

If Washington resolves its standoff soon, markets could stabilize, and XRP price might quickly recover lost ground. But if the deadlock extends through mid-November, the selling could deepen fast.

In short, XRP’s future this month isn’t about crypto. It’s about the U.S. government reopening—and how long the world can handle trading without a compass.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How are those who followed CZ's trades doing now?

Whether it’s CZ personally getting involved, the community creating a meme atmosphere, or YZi Labs providing investment backing, so-called "calls" are just a spark, while the community riding on the concept adds fuel to the fire. When the two meet, the market heats up. This also demonstrates that the market itself needs hotspots to maintain attention and liquidity.

The Butterfly Effect of the Balancer Hack: Why Did XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet increases, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

Whale "7 Siblings" scoops up 38,000 ETH in two days! What signal does this send?