News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- XRP Ledger launches native Layer-1 smart contracts and achieves 99.999% uptime, enhancing programmability and scalability. - Security experts warn Ledger hardware wallet users of phishing and firmware risks, emphasizing operational security challenges. - XRP sees 21,595 new wallets in 48 hours, driven by institutional interest and regulatory progress in its ecosystem. - XRP Tundra introduces audited staking mechanisms using Solana's liquidity, addressing on-chain yield generation gaps. - Network processe

- UK sentences Chinese national Qian Zhimin to 11 years and 8 months for orchestrating a $6B crypto money laundering scheme involving 61,000 bitcoin . - Fraud targeted 128,000 victims via a Ponzi-like scheme promising fake crypto mining returns, with funds siphoned to Qian and converted to bitcoin before 2017. - Accomplice Senghok Ling received 4 years and 11 months; case marks UK's largest crypto confiscation and highlights cross-border digital asset tracing challenges. - Over 1,300 investors seek compens

- Zcash (ZEC) now leads privacy coins with 20–25% shielded ZEC and 30% shielded transactions, surpassing Monero in market cap. - Zcash's Zashi wallet normalizes privacy by default, while Project Tachyon targets 10,000+ private transactions/second for scalability. - Institutional support grows: Lighter raised $68M for fee-free derivatives, and Zama acquired Kakarot to advance FHE-based confidentiality. - Regulators tighten rules on privacy coins, with UK draft laws and Tornado Cash trials redefining anonymi

- Cypherpunk Technologies rebranded to Zcash-focused entity, acquiring $50M in ZEC via Winklevoss Capital-led funding. - The move positions it as a privacy-centric crypto treasury pioneer, contrasting with Bitcoin-centric corporate strategies. - Zcash's institutional adoption grows despite volatility, with 20–25% of tokens in shielded addresses and regulatory clarity emerging. - The firm balances biotech R&D with crypto operations, pending shareholder approval for its dual-track strategy on December 15, 20

- Circle reported strong Q3 2025 results with $73.7B USDC growth but stock fell 5.4% premarket as costs rise and analysts split. - Revenue surged 66% to $740M while net income jumped 202% to $214M, yet RLDC margins dropped 270 bps to 39% amid expanding balances. - Arc blockchain's public testnet attracted 100+ institutional participants, with partnerships announced with Deutsche Börse and Visa to expand stablecoin adoption. - Analysts remain divided: J.P. Morgan "Sell" vs. Monness Crespi "Buy" at $150, whi

- SoFi becomes first FDIC-insured U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL alongside traditional services. - The 2025 relaunch follows regulatory clarity from the OCC enabling crypto custody and execution, addressing prior compliance uncertainties. - CEO Anthony Noto emphasizes blockchain's potential to reshape finance through faster, cheaper transactions, aligning with 60% member preference for bank-based crypto trading. - SoFi's platform combines FDIC-insured

- Hyperliquid captured 73% of decentralized perpetual trading volume in Q3 2025, driven by $303B in trading volume and $5B TVL growth. - Retail demand fueled by 20x leverage on BTC/XRP and HIP-3 protocol optimization boosted $47B weekly volumes and $15B open interest. - Strategic partnerships like Felix HAUS agreement and 21Shares ETF filing expanded HYPE token utility while rejecting VC funding reinforced decentralization. - $10.8B HYPE token unlock poses 45% supply dilution risk, while competitors like A

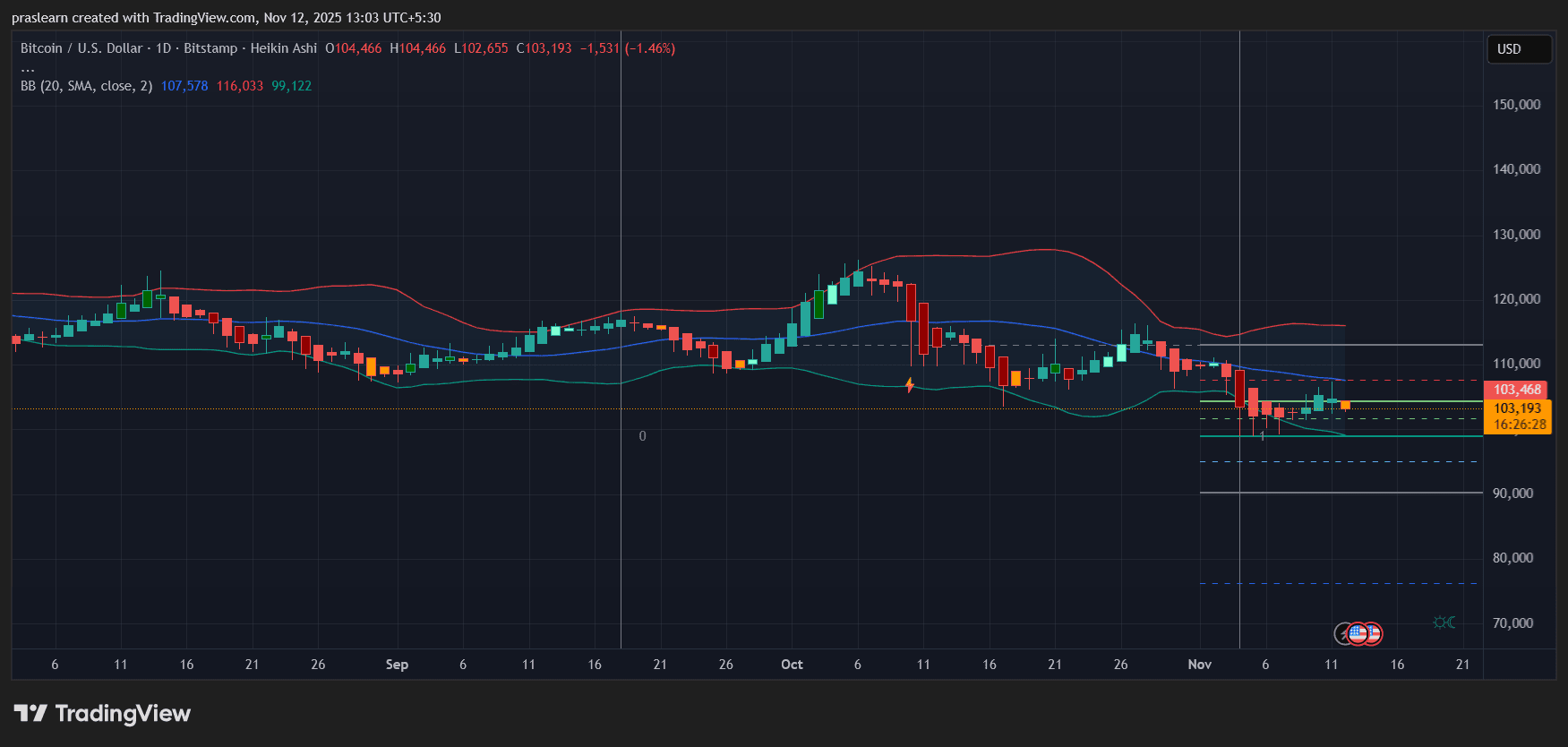

- PENGU token surged 12.8% in 24 hours amid crypto rebound, driven by Bitcoin's 4.3% rise to $106,100. - Short-term bullish momentum emerged with 33% volume spike to $202M, but long-term bearish indicators persist via declining OBV and converging MACD. - Whale inflows ($157K) and a 13.69% token burn boosted optimism , though $7.68M in leveraged short positions highlight market volatility. - PENGU's price action reflects memecoin dynamics, balancing Bitcoin-linked risks with speculative potential from real-

- UAE completes first government transaction using Digital Dirham CBDC via mBridge platform, settling in under two minutes. - Pilot by UAE Ministry of Finance and Dubai Department of Finance validates cross-border and domestic payment capabilities without intermediaries. - Officials highlight CBDC's role in enhancing financial transparency, reducing settlement times, and advancing UAE's fintech leadership goals. - Global CBDC adoption grows with 137 countries exploring digital currencies, as UAE plans phas

- 02:47Former Chairman of the Hong Kong Securities and Futures Commission: Stocks are essentially a type of tokenChainCatcher news, according to 21st Century Business Herald, former chairman of the Hong Kong Securities and Futures Commission, Anthony Neoh, stated in an exclusive interview that Nasdaq in the United States has begun piloting tokenized stock trading and is using stablecoins (such as USDC) for settlement. Tokens are not a new concept; stocks are essentially a type of token. If stocks are turned into digital tokens on the blockchain, all operations can be completed within one system, achieving instant settlement. By combining asset tokenization with central bank digital currencies, the entire market operation model can be reshaped. For Hong Kong to establish such a new capital market based on asset tokenization, it needs to overcome three challenges: technological infrastructure, regulatory framework, and market acceptance.

- 02:43The number of crypto projects with a current market value exceeding 100 millions has decreased by nearly 20% compared to the 2021 peak.On November 13, according to data monitored by analyst Route2FI, there are currently 388 crypto projects with a market capitalization exceeding $100 million (including stablecoins), which is lower than the 477 projects in November 2021, representing a decrease of 18.6%. Route2FI's analysis suggests that the main reasons for the decrease in the number of projects include: November 2021 was close to the previous cycle's altcoin peak, while this cycle's altcoins have not yet experienced a frenzy of price surges; at that time, tokens with low circulating supply and high fully diluted valuations were uncommon, and if the count were based on fully diluted valuations exceeding $100 million, the current number would be higher than in 2021; liquidity and capital are increasingly concentrating in major projects such as bitcoin, ethereum, solana, and leading Layer 2 networks, making it difficult for smaller altcoins to achieve high valuations; after several market cycles, both retail and institutional investors have become more selective, tending to choose tokens with utility and proven ecosystems.

- 02:43Japanese exchanges study measures to curb listed companies from hoarding cryptocurrenciesJinse Finance reported that as concerns grow over losses caused by the cryptocurrency hoarding frenzy, Japanese exchange groups are considering measures to limit the growth of digital asset fund management companies listed on the market. According to sources familiar with the matter, options under consideration include tightening regulations on backdoor listings and requiring companies to undergo new audits. As the plans have not yet been made public, they requested anonymity. They added that no formal course of action has been determined at this time. One source said that since September, due to obstruction by Japanese exchanges, three listed Japanese companies have suspended their plans to purchase cryptocurrencies; these companies were told that if they adopted cryptocurrency purchases as a business strategy, their financing capabilities would be restricted. (Golden Ten Data)