Bitcoin Faces a Reality Check as Small Business Optimism Crashes

Bitcoin price is trading around 103,000 after another day of choppy price action. The broader market tone is cautious as risk assets respond to softening economic signals from the U.S. Small business optimism dropped to its lowest level since April, according to the National Federation of Independent Business (NFIB), with hiring and sales both weakening. This comes amid prolonged government shutdown worries that have stalled economic momentum. The question now is whether Bitcoin can stay resilient—or whether fading U.S. growth expectations will weigh on crypto markets too.

Economic Backdrop: A Warning Signal for Bitcoin Price

The NFIB survey paints a picture of slowing U.S. business activity, declining profits, and hiring shortages. Historically, when business confidence weakens, liquidity-sensitive assets like equities—and by extension, Bitcoin price tend to struggle. A slowdown in small business activity usually leads to weaker payrolls, reduced capital investment, and softer consumer spending.

Markets are watching the U.S. Congress closely for a resolution to the government shutdown. If the shutdown persists, data collection delays and disrupted government services could further pressure investor confidence. Bitcoin, which thrives on liquidity and speculation, could see reduced buying interest if risk sentiment deteriorates.

However, the silver lining is that weaker business data may revive expectations of Federal Reserve rate cuts earlier than anticipated. Lower interest rates often translate to higher liquidity and renewed appetite for non-yielding assets like Bitcoin. This macro uncertainty sets the stage for volatile range trading in the weeks ahead.

Technical Analysis: Bitcoin Price Struggles Below Resistance

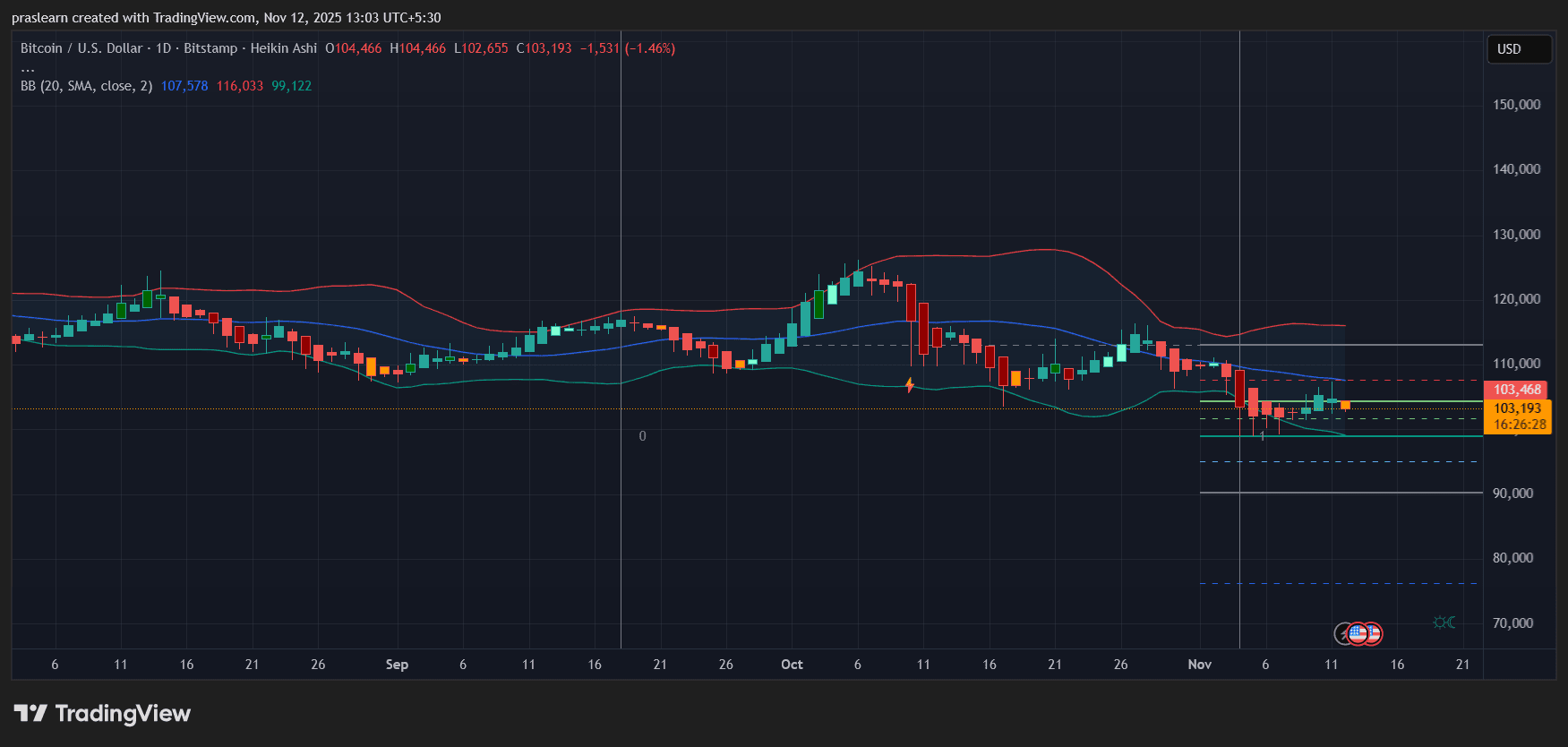

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

The daily chart shows Bitcoin price consolidating within a narrow range, with price sitting just below the midline of the Bollinger Bands (20-SMA near 107,500). The upper band at 116,000 serves as immediate resistance, while the lower band around 99,000 provides critical short-term support.

The Heikin Ashi candles reflect a gradual loss of bullish momentum since late October’s rally. Consecutive red candles with small bodies indicate indecision rather than a deep correction. Volume has thinned out, suggesting traders are waiting for a macro trigger—perhaps the government funding vote—to determine direction.

So far, 103,000 is acting as a weak pivot zone. A break below 102,000 could open the door to the 99,000–97,000 support cluster, while a daily close above 107,500 might trigger a short-term bullish breakout toward 110,000.

Momentum Indicators: Neutral-to-Bearish Bias

The Bollinger Band squeeze pattern also signals potential volatility ahead. Historically, when BTC price volatility compresses to this degree, a strong directional move tends to follow—often within 5–10 trading days. Given the current structure, that move could go either way depending on macro cues.

Bitcoin Price Prediction: Key Levels to Watch

- Resistance: 107,500 (20-day SMA), followed by 110,000 and 116,000

- Support: 102,000 (short-term), 99,000 (lower Bollinger Band), and 97,000 (October swing low)

- Invalidation: A daily close below 97,000 would confirm a deeper correction toward 90,000

If Bitcoin price closes above 107,500 with rising volume, a rebound toward 110,000 becomes probable. However, failure to hold 102,000 would suggest a continuation of the descending channel that began in mid-October.

Macro and On-Chain Crosscurrents

Despite the soft U.S. data, Bitcoin’s on-chain health remains stable. Exchange reserves continue to trend lower, suggesting that long-term holders are not panic-selling. Meanwhile, stablecoin inflows have plateaued, implying that traders are waiting on macro clarity before re-entering the market.

The next few days will be critical as the U.S. House of Representatives votes on the spending bill. If the shutdown officially ends, we could see a short-term relief rally across equities and Bitcoin alike. But if political deadlock persists, a dip below 100,000 wouldn’t surprise.

30-Day Bitcoin Price Prediction: Choppy, Then Directional

In the near term, BTC price is likely to oscillate between 99,000 and 110,000 until a macro catalyst breaks the range. A confirmed end to the government shutdown could lift sentiment and push BTC toward 115,000–118,000. Conversely, continued fiscal gridlock or disappointing economic data could send prices to retest 95,000 or even 90,000 by early December.

Bitcoin’s current setup reflects a market in wait-and-see mode. The technical picture favors consolidation, while macro signals—like weakening small business confidence—tilt sentiment cautiously bearish. Yet, the underlying resilience of $BTC holder base and cooling inflation may provide a safety net.

For now, traders should watch 102,000 and 107,500 closely. A break of either side will likely define Bitcoin’s direction heading into year-end. Until then, volatility compression suggests patience might pay off more than prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Debt Fluctuations Surge Amid AI-Driven Borrowing Growth and Fed Faces Fiscal Uncertainty

- U.S. Debt Volatility Index hits one-month high in November, reflecting market anxiety amid government shutdown resolution and fiscal risks. - AI infrastructure debt surges 112% to $25B in 2025, driven by tech giants’ $75B in bonds for GPU/cloud projects, raising overleveraging concerns. - Fed faces mixed signals: October job losses push December rate cut odds to 68%, while gold/silver rise 2-3% as investors seek safe havens amid fiscal/geopolitical risks. - Delayed economic data from shutdown complicates

ChainOpera AI Token Plunge: An Alert for Investors in AI-Based Cryptocurrencies

- ChainOpera AI Index's 54% 2025 collapse exposed systemic risks in AI-driven crypto assets, driven by governance failures, regulatory ambiguity, and technical vulnerabilities. - C3.ai's leadership turmoil and $116.8M loss triggered sell-offs, while the CLARITY Act's vague jurisdictional framework created legal gray areas for AI-based crypto projects. - Model Context Protocol vulnerabilities surged 270% in Q3 2025, highlighting inadequate governance models as 49% of high-severity AI risks remain undetected

Navigating the Dangers of New Cryptocurrency Tokens: Insights Gained from the COAI Token Fraud

- COAI token's 2025 collapse exposed systemic risks in algorithmic stablecoins, centralized governance, and fragmented regulatory frameworks. - xUSD/deUSD stablecoins lost dollar peg during liquidity crisis, while 87.9% token concentration enabled panic selling and manipulation. - Regulatory gaps pre-collapse allowed COAI to exploit loosely regulated markets, but post-crisis reforms like MiCA and GENIUS Act now demand stricter compliance. - Investor sentiment shifted toward transparency, with demand for re

Filecoin (FIL) to Bounce Back? This Emerging MA Fractal Setup Suggests So!