Key Market Information Discrepancy on November 24th – A Must-Read! | Alpha Morning Report

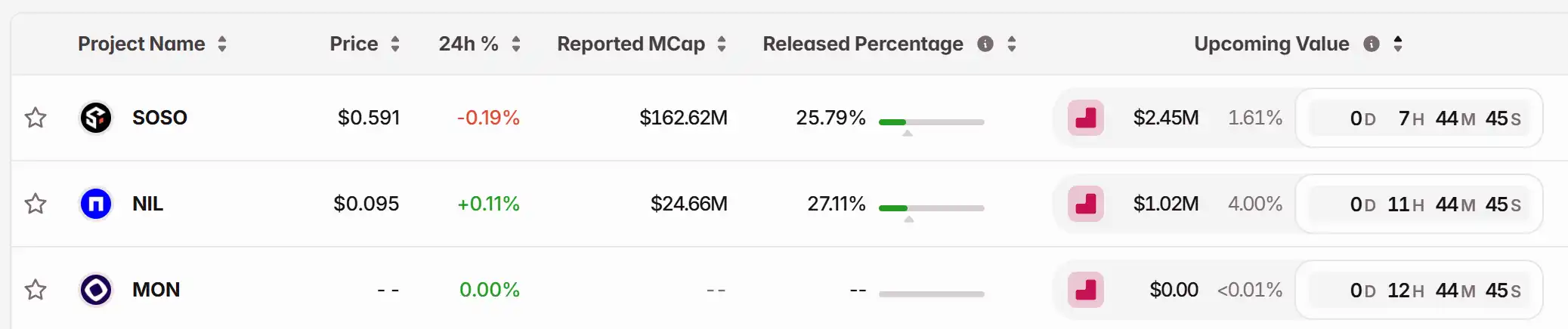

1. Top News: Bitcoin Surges Above $88,000 This Morning Before Retracing 2. Token Unlock: $SOSO, $NIL, $MON

Top News

1. Bitcoin Surges Above $88,000 This Morning Before Pulling Back

2. Federal Reserve Entering Quiet Period, Institutions Maintain December Rate Cut Expectation

3. Altcoins Recovering, PIPPIN Surges Over 148% in 24 Hours

4. TNSR Surges Over 80% in 24 Hours, Currently Trading at $0.1838

5. $213 Million Liquidated in the Past 24 Hours, Majority of Liquidations on Short Positions

Articles & Threads

1. "Crypto's Strongest Bulls and Bears Dialogue: Has the Four-Year Crypto Cycle Lost Its Edge?"

The 2025 crypto market is at a delicate inflection point: Bitcoin ETF approval, the intertwining of liquidity cycles and debt refinancing periods, AI hype diverting funds, traditional finance and tech giants accelerating blockchain adoption. In such a backdrop, the market structure exhibits anomalies, with a lack of buying interest in small-cap assets, underperformance of high-performance public chains like Solana, and investor sentiment swinging between extreme optimism and panic.

2. "What Have the Mainstream Perp DEXes Been Up To Lately?"

While the entire crypto market seems to be in another "bear market" phase, enthusiasm for new tracks has not diminished much. Especially in the derivatives track of Perp DEX, many traders and community users are focusing more on the high-frequency, structured, and gamified perpetual market. This is why yet-to-launch Perp DEXes can still produce impressive data in a downturn environment.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Reasons 2025 Investors Prefer Noomez’s Open Burn Process to Bitcoin’s Reliability

- Noomez ($NNZ) emerges as a 2025 bull cycle presale standout, leveraging deflationary mechanics, fixed supply, and aggressive token burns to drive scarcity and value. - Unlike Bitcoin/Ethereum's stable but limited growth, Noomez's 28-stage price curve and transparent "Noom Gauge" track burns and liquidity, addressing rug pull risks. - Stage 4 presale at $0.0000187 offers 66% APY staking rewards and multi-crypto payment support, positioning it as a high-risk/high-reward alternative to traditional assets. -

As the S&P 500 Faces Turbulence, Industries Diverge Between Risk and Potential

- VIX index fluctuates between 23-27 in late November 2025, sparking debates about S&P 500's trajectory amid heightened volatility. - MSCI's potential removal of $52B MicroStrategy from indexes risks $2.8B sell-off, threatening crypto-linked equity sentiment via passive fund exposure. - Sector divergence emerges: FTAI Aviation upgrades to 'BB' while Sabre Corp. faces negative outlook due to debt burdens and weak profitability. - Energy giants Saudi Aramco ($1.69T) and ExxonMobil ($492B) remain pivotal as s

Bitcoin News Update: Institutional Ban Proposal Triggers Crypto Community Outrage: JPMorgan Faces Scrutiny

- Bitcoin advocates and MicroStrategy supporters launch JPMorgan boycott after MSCI plans to exclude crypto-focused firms from global indices. - Influencers like Grant Cardone withdraw $20M from JPMorgan, while Max Keiser urges "crash JP Morgan" to defend crypto sector stability. - JPMorgan analysts warn MSCI's policy could trigger $8.8B outflows for MicroStrategy, worsening its liquidity crisis amid Bitcoin's 30% decline. - MSCI's January 15 decision risks triggering index fund sell-offs, potentially crea

XRP News Today: XRP ETFs Connect Cryptocurrency With Traditional Financial Markets

- NYSE Arca approved Franklin Templeton's XRPZ ETF, granting XRP regulated U.S. market access with a 0.19% fee waiver for first $5B until 2026. - Multiple XRP ETFs (GXRP, XRPC , XRPM) now compete, with JPMorgan predicting $4-8B in first-year inflows that could reduce supply and boost prices. - SEC's 2025 digital-asset guidance removed decade-long barriers, enabling multi-asset crypto ETFs and accelerating institutional adoption of XRP/DOGE. - Despite ~18% XRP price drop since November, analysts cite delaye