Bitcoin News Update: Institutional Ban Proposal Triggers Crypto Community Outrage: JPMorgan Faces Scrutiny

- Bitcoin advocates and MicroStrategy supporters launch JPMorgan boycott after MSCI plans to exclude crypto-focused firms from global indices. - Influencers like Grant Cardone withdraw $20M from JPMorgan, while Max Keiser urges "crash JP Morgan" to defend crypto sector stability. - JPMorgan analysts warn MSCI's policy could trigger $8.8B outflows for MicroStrategy, worsening its liquidity crisis amid Bitcoin's 30% decline. - MSCI's January 15 decision risks triggering index fund sell-offs, potentially crea

Bitcoin Community Calls for

The

The potential removal has triggered swift opposition. Cardone, a well-known Bitcoin supporter,

JPMorgan’s involvement in spreading the MSCI update has provoked strong criticism.

The consequences could reach beyond MicroStrategy.

Since joining the Nasdaq 100 in December 2024, MicroStrategy has benefited significantly,

This dispute highlights the ongoing friction between innovation and established norms in the crypto world. As the January 15 deadline nears,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO rises by 0.21% even after a 5.32% decline over the week, reflecting ongoing market fluctuations

- ALGO rose 0.21% to $0.1439 on Nov 24, 2025, but fell 5.32% weekly and 56.92% annually amid market volatility. - Persistent selling pressure and lack of project/regulatory catalysts highlight structural valuation declines since peak levels. - Analysts project continued downward pressure unless major developments like regulatory updates or institutional adoption emerge. - Investors advised to remain cautious as short-term gains fail to offset 18.77% monthly losses and broader bearish market conditions.

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

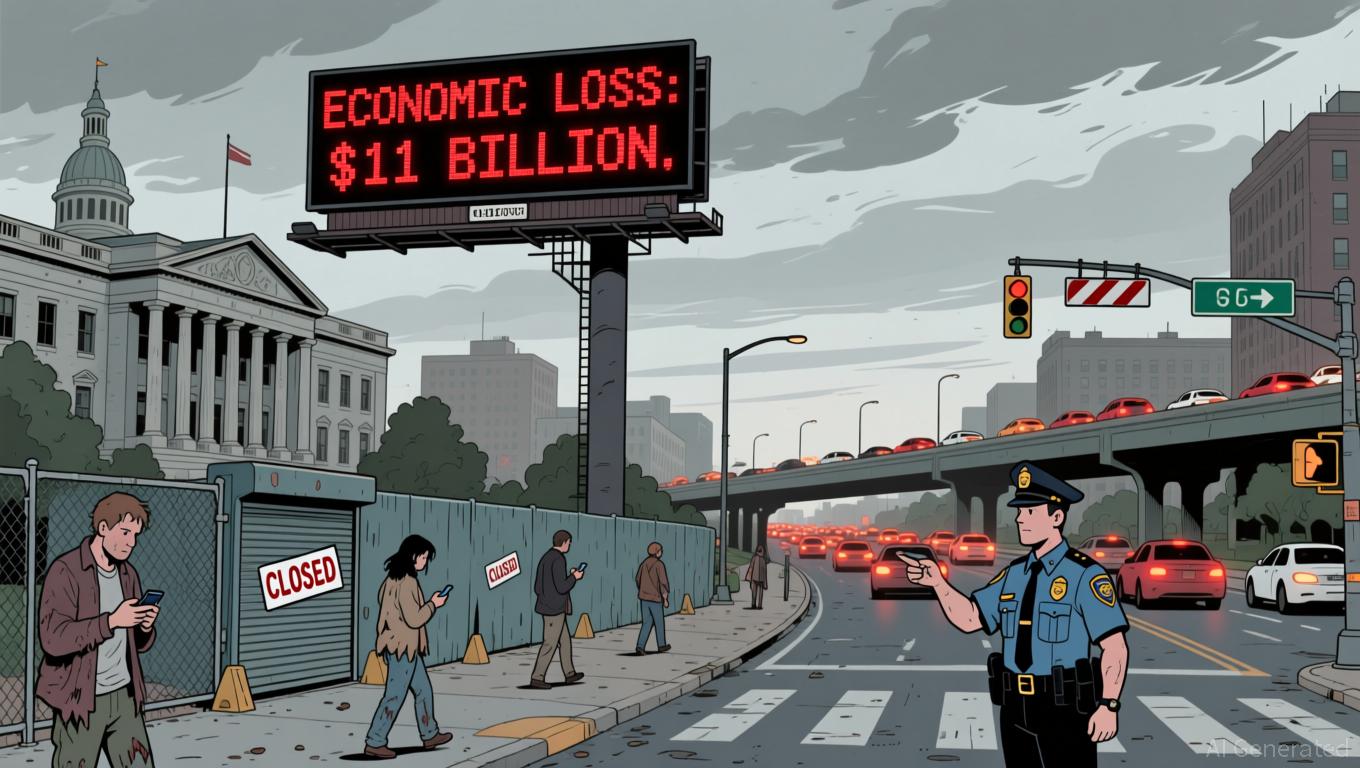

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest