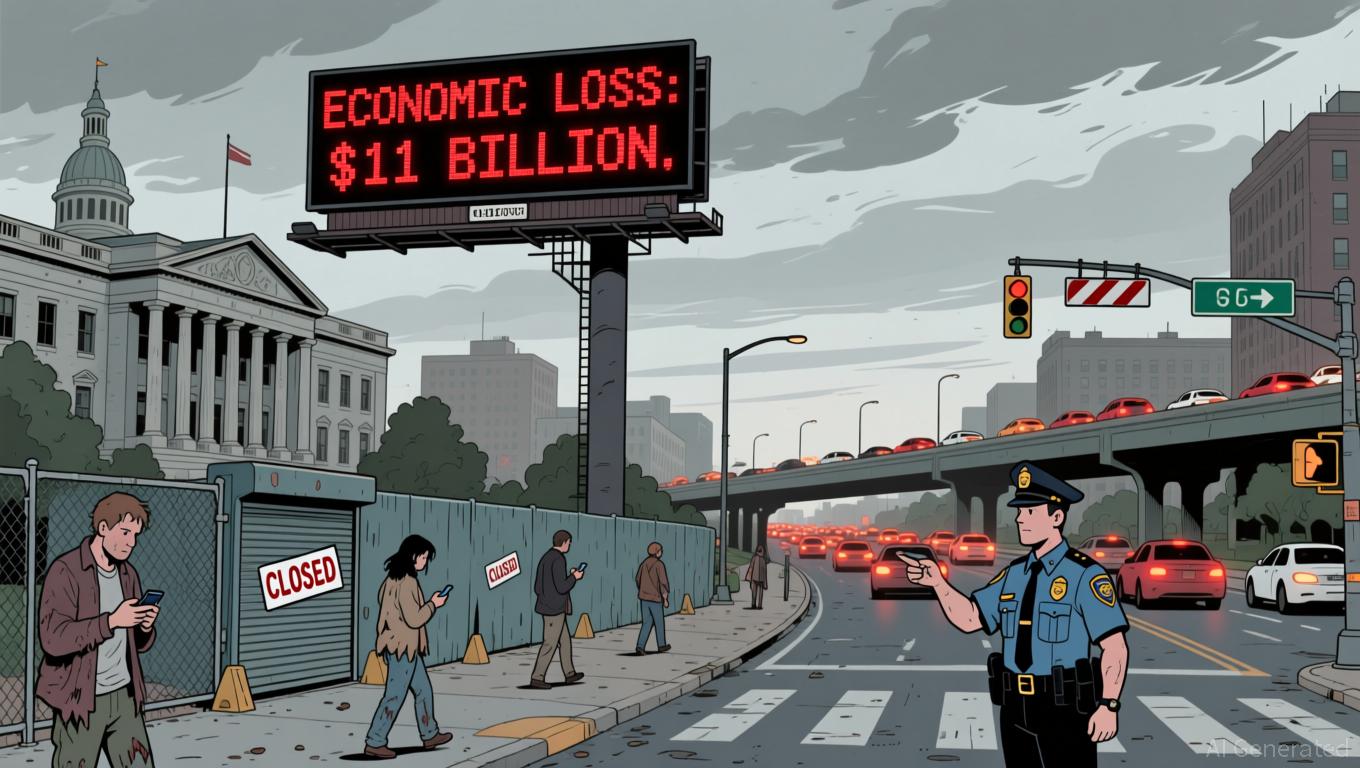

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitkub’s $200 Million IPO Boosts Hong Kong’s Aspirations to Become a Leading Crypto Center

- Thailand's Bitkub plans a $200M Hong Kong IPO to expand beyond its volatile domestic market. - The move leverages Hong Kong's crypto-friendly regulations and $27.8B IPO fundraising momentum in 2025. - Thailand's 10% stock market slump contrasts with Hong Kong's growth, highlighting regional market divergence. - Bitkub's listing would strengthen Hong Kong's "Fintech 2030" ambitions as a global crypto hub.

Bitcoin News Update: Kiyosaki Offloads BTC, Moves to Gold: Inflation Concerns Fuel Optimistic 2026 Forecast

- Robert Kiyosaki advises "buy the dip" despite selling $2.25M BTC, forecasting $250k BTC by 2026 and $27k gold . - Bitcoin's 33% monthly drop and $1.9B liquidations reflect market turmoil, with ETF outflows hitting $3.79B in November. - Kiyosaki reinvests BTC proceeds into surgery centers and billboards, targeting $27.5k/month tax-free income by 2026. - Analysts highlight BTC's strong fundamentals but warn of potential 50% drawdowns, contrasting Kiyosaki's bullish stance.

Animoca Opens Doors for Institutions in Web3 Following ADGM Authorization

- Animoca Brands secures in-principle ADGM approval to operate as a regulated fund manager, advancing its Middle East expansion strategy. - The UAE's ADGM regulatory framework attracts blockchain firms, with Animoca aiming to create institutional-grade Web3 investment pathways. - Conditional approval requires meeting capital/compliance standards, aligning with global trends of institutional entry into Web3 markets. - ADGM's endorsement strengthens Animoca's position as a key Web3 infrastructure player, lev

BitMine ETH Purchase: Tom Lee Buys $82M During Market Dip

Quick Take Summary is AI generated, newsroom reviewed. BitMine purchased 28,625 ETH worth $82.11 million. Purchase happened during a market dip, showing confidence. BitMine is steadily building a long-term Ethereum treasury. Other institutions may follow, boosting market sentiment.References Tom Lee's BitMine has bought 28,625 $ETH worth $82.11 million.