XRP News Today: XRP ETFs Connect Cryptocurrency With Traditional Financial Markets

- NYSE Arca approved Franklin Templeton's XRPZ ETF, granting XRP regulated U.S. market access with a 0.19% fee waiver for first $5B until 2026. - Multiple XRP ETFs (GXRP, XRPC , XRPM) now compete, with JPMorgan predicting $4-8B in first-year inflows that could reduce supply and boost prices. - SEC's 2025 digital-asset guidance removed decade-long barriers, enabling multi-asset crypto ETFs and accelerating institutional adoption of XRP/DOGE. - Despite ~18% XRP price drop since November, analysts cite delaye

The New York Stock Exchange (NYSE Arca) has granted approval for the Franklin Templeton

The emergence of XRP spot ETFs is increasing the cryptocurrency’s visibility and accessibility within mainstream investment portfolios.

The

The regulatory landscape has undergone a dramatic transformation, paving the way for this surge in approvals.

Market responses have varied. Although XRP ETFs are expected to enhance both liquidity and credibility, the token’s price has dropped by about 18% since November 1, according to CoinGecko. Experts attribute this decline to short-term profit-taking ahead of ETF launches rather than underlying weakness. Eric Balchunas, a senior ETF analyst at Bloomberg, pointed out that institutional interest often leads to delayed price increases, referencing Bitcoin’s post-ETF performance as an example.

These approvals also reflect a broader trend of institutional adoption. Franklin Templeton’s XRPZ ETF, with its fee waiver and custody arrangement (Coinbase as the main custodian), is well-positioned to attract substantial assets. The company’s reach across 13,000 advisory firms could help accelerate XRP’s mainstream acceptance, while Grayscale’s $35 billion in managed assets adds further legitimacy. Meanwhile, DOGE’s shift to an ETF format highlights its growing acceptance beyond its meme status, with derivatives trading volume rising 30% ahead of its launch.

As the U.S. crypto sector evolves, these ETFs serve as a link between speculative digital currencies and established financial systems. With XRP now available through regulated investment products, attention turns to inflow trends and sustained demand. For now, the NYSE’s recent approvals are seen by analysts as ushering in “the most significant growth phase for XRP.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

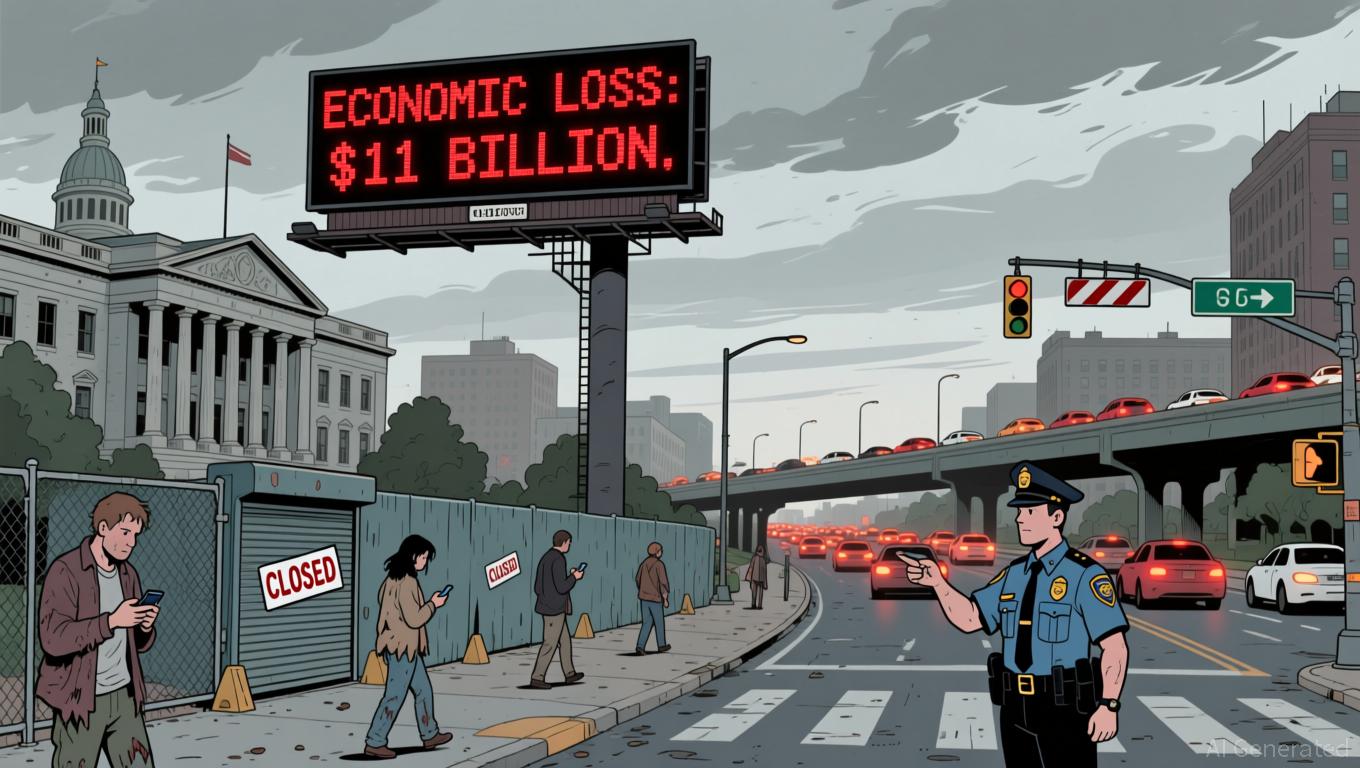

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr