ASTER Jumps 12%—But Are Big Holders Quietly Heading for the Exits?

Aster’s short-term bounce may be masking deeper weakness. With whales, smart money, and retail investors all trimming positions, the ASTER price now faces a make-or-break moment near $1.59 — a level that could determine whether the token reverses its downtrend or confirms further selling.

Aster (ASTER) has gained over 12% in the past 24 hours, but the bounce may not tell the full story. Despite the short-term uptick, the ASTER price is still down over 22% in seven days. The market’s mood looks uncertain, and while today’s rally might excite traders, on-chain signals show that conviction is fading fast.

All major holder groups seem to be moving in the same direction, and not the bullish one.

Whales, Smart Money, and Retail All Pull Back

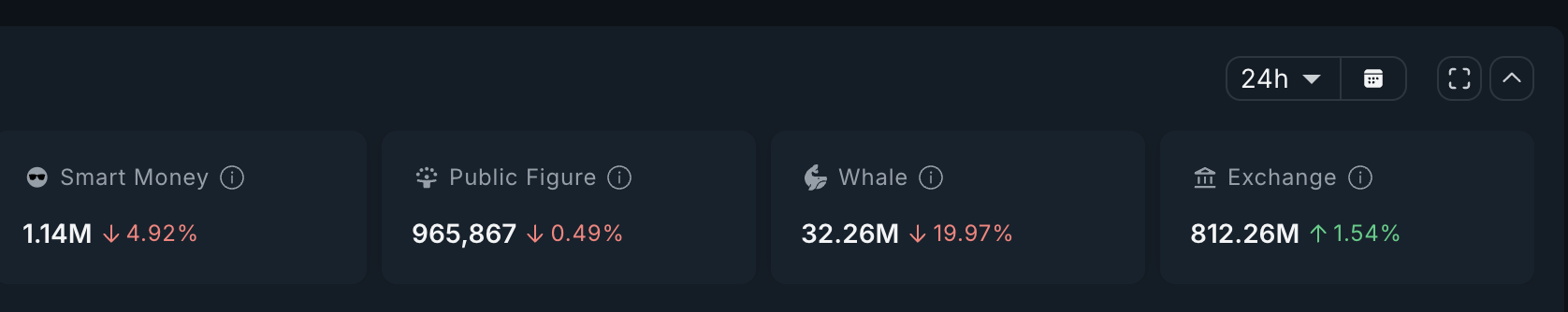

On-chain data shows that conviction among Aster’s largest investors has weakened sharply.

Whales holding more than 10 million ASTER have offloaded nearly 20% of their total stash in the past week, dropping about 8.05 million ASTER, worth roughly $12.07 million at the current ASTER price.

Smart money addresses — typically early, informed investors — have also trimmed holdings by about 5% (almost 59,000 tokens), while overall exchange balances have risen by 12.32 million tokens in the last 24 hours.

That increase in exchange reserves often signals more tokens being prepared for sale, even from retail, reinforcing the bearish flow.

ASTER Holders Retreat:

ASTER Holders Retreat:

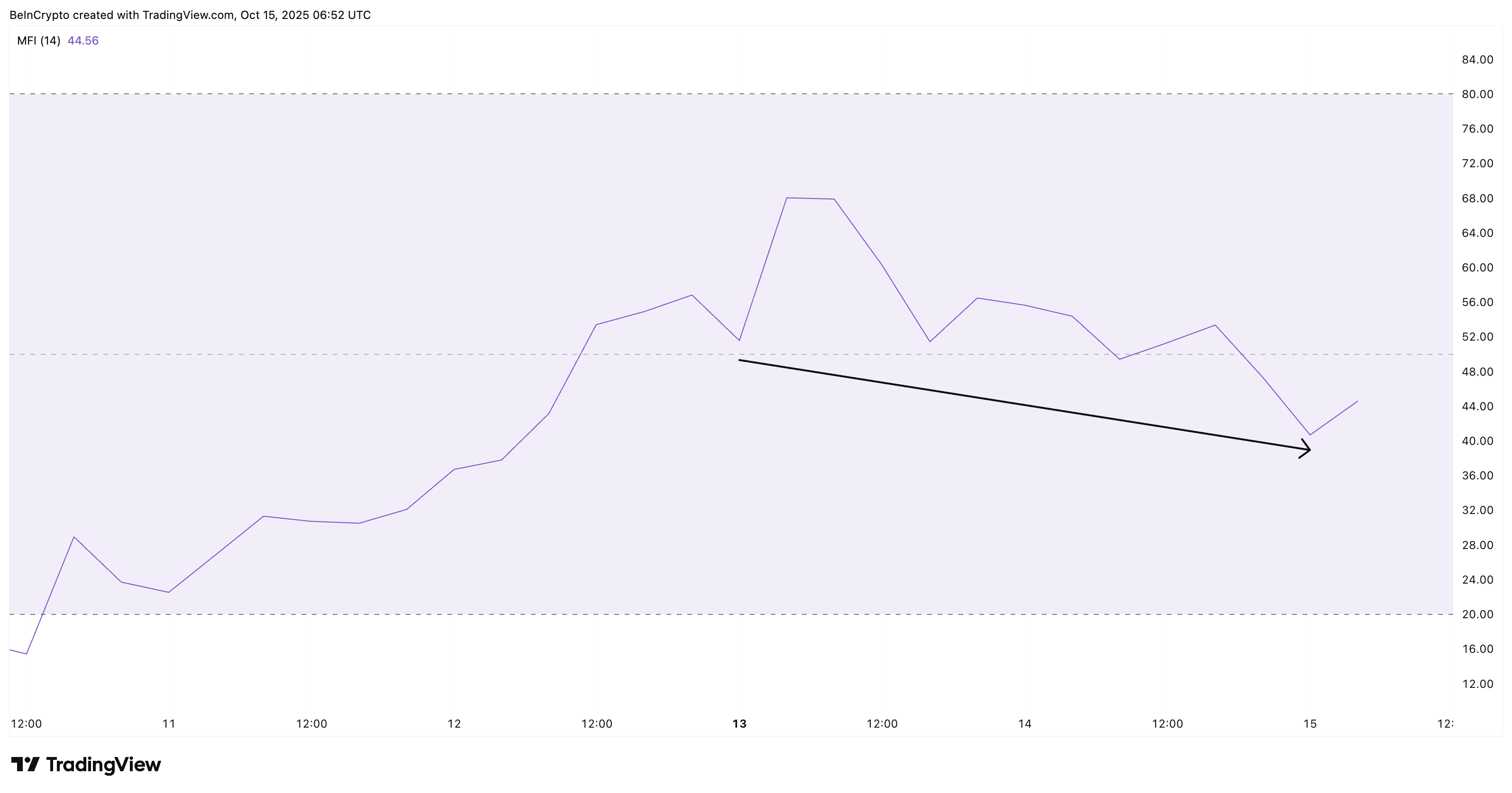

Retail sentiment on the technical chart mirrors this weakness. The Money Flow Index (MFI) — an indicator that tracks buying and selling pressure using both price and volume — continues to make lower lows, showing that smaller traders are not buying the dip. Retail interest appears to be drying up as prices grind lower.

ASTER Retail Not Showing Interest:

ASTER Retail Not Showing Interest:

Combined, these shifts create a rare consensus across all trading groups — with whales, smart money, and retail all cutting exposure.

ASTER Price Faces Bearish Setup — $1.59 Is Key

On the 4-hour chart, the ASTER price trades inside a descending triangle, a structure that often signals weakening demand. The triangle’s bases sit around $1.30, $1.15, and $0.98, which now act as critical support zones. A breakdown below these levels could trigger deeper corrections.

To change that outlook, the token must close above $1.59, a key resistance level that would invalidate the short-term bearish trend. A clean break above this level could open paths to $1.72 and even $2.02, flipping short-term momentum and disproving the uniform bearishness seen across holder data.

ASTER Price Analysis:

ASTER Price Analysis:

The Relative Strength Index (RSI) — which measures price momentum — also shows a hidden bearish divergence (marked by the red arrow), where RSI rises while prices make lower highs. This pattern typically hints at fading strength and a possible continuation of the ASTER price downtrend unless bulls reclaim control.

For now, ASTER sits at a crossroads. Every major trading group seems to agree on selling — but if $1.59 breaks, that consensus could turn out to be wrong.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] Scroll Co-founder: The Inevitable Path of ZK

"Tether" in 2025: Capital Analysis

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

The first SUI ETF is listed, an SEC meeting reveals regulatory disagreements, bitcoin price drops due to employment data, US debt surpasses 30 trillions, and the IMF warns of stablecoin risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

On its first day of trading, the "first domestic GPU stock" saw an intraday peak increase of 502.03%, with its total market value once exceeding 300 billions RMB. Market analysis shows that a single lot (500 shares) could earn up to 286,900 RMB at the highest point.