Liquidity Shift Hidden Beneath the US-China Rivalry

Recently, I’ve been thinking for quite some time and really want to do a systematic analysis of the overall structure of the current market. Why has BTC and the entire cryptocurrency market shown a counter-cyclical phenomenon? And how can we use a complete narrative to connect AI, the China-US rivalry, and the abnormal performance of BTC and gold?

First, let’s talk about several market phenomena we are currently observing:

BTC has broken out of the bear market structure among global risk assets, with the weekly chart falling below the MA50, market liquidity has been greatly reduced, the bull market structure is on shaky ground, and even the start of this bull market is different from previous cycles (this BTC bull market started during a rate hike cycle)...

Gold keeps hitting new highs, with silver following closely behind. The precious metals market is performing as if it’s the era of massive liquidity after 2020. Even so, buying continues unabated...

The US stock market is neither particularly strong nor weak. Led by AI stocks, it has achieved an epic rally comparable to the internet bubble before 2000. People fear the bubble, yet continue to create it...

The China-US rivalry is evolving across trade, technology, AI, geopolitics, and even public opinion. The on-and-off nature of this conflict has planted the expectation in everyone’s mind that a full-scale conflict between China and the US will eventually break out...

The above are phenomena; below is a preliminary analysis:

What stage is BTC currently in?

Many people say the market has clearly entered a bear phase, while others, focusing on macro policy, argue that the bear market is still far off. The main controversy in the current market actually comes from the contradiction between technical and macro perspectives;

Let’s start with the technical side. BTC’s bull market structure usually follows a sustained, rhythmic rise. There can be pullbacks during this period, but the depth and strength of these pullbacks will not destroy the original structure of higher highs and higher lows.

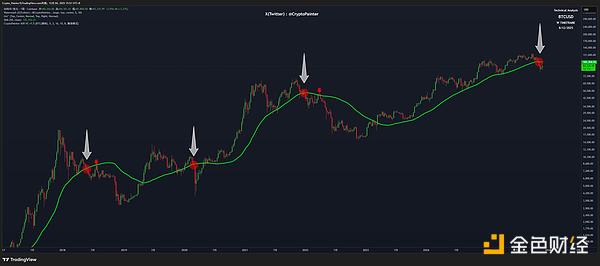

Take BTC’s weekly MA50 as an example:

Chart from Coinbase: BTCUSD spot trading pair

The iconic signal marking the end of the bull markets in 2017 and 2021 was a significant weekly drop below the MA50. The drop in 2020 caused by the pandemic was quickly recovered, so we can temporarily disregard it.

Currently, BTC’s weekly chart has once again fallen below the MA50. According to standard technical analysis, at most there will be a rebound to retest the MA50, after which the main downward wave of the bear market will begin...

From this perspective, my ASR weekly channel indicator and super trend indicator both reflect similar trend-breaking structures. For anyone who believes in the “efficient market hypothesis,” this would be seen as an early sign of a bear market...

“Outside of this market, there must be some long-term negative factor that has not yet been widely reported. Otherwise, there’s no reason for the market to choose suicide before dawn...” This is the view of most technical analysts, and I personally agree with this point.

At this point, dissenting opinions arise:

Macro analysts will say: “The rate-cutting cycle has already begun, and liquidity will eventually be released. Don’t forget the Fed’s QT just ended!”

If we look at the correlation between past cycle changes and macro policies, we can indeed easily deduce this conclusion: as long as the macro environment is in an easing cycle, the market will not truly enter a bear phase...

But the question is: “Is the correlation between macro cycles and BTC bull/bear cycles itself a constant and unchanging relationship?”

What if the fact that the Fed can regulate global liquidity solely through monetary policy becomes less effective in practice?

What if the fact that the US dollar is the only reserve currency for international trade becomes less convincing?

Would the correlation between macro cycles and cryptocurrencies also become less solid?

Theoretically, there is no answer to this question. We can only judge after the market gives us an answer. But the purpose of this article is still to find clues to possible future scenarios from subtle signs, so the best way is to gather more information!

Thus, the discussion turns to gold...

Is gold gradually becoming the new monetary anchor?

To answer the above questions, I think starting with gold is the best angle.

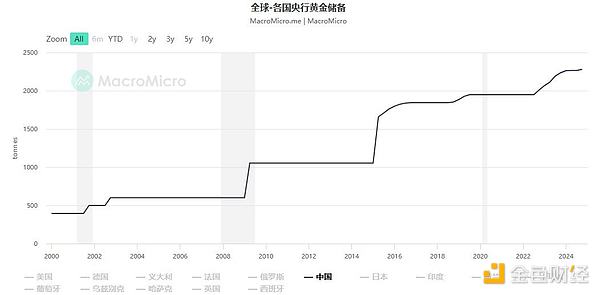

Simply put, the People’s Bank of China’s frenzied gold purchases reveal a completely different direction for future monetary anchoring strategies between China and the US.

China Central Bank gold reserve curve

What China is currently doing is to one day bind the RMB to gold, and at the right time, take over the current status of the US dollar. Unlike the Bretton Woods system, China is implementing a “decentralized” gold corridor architecture at the practical level. The globally distributed vault system can achieve a distributed ledger network similar to BTC miners.

This gives the new system a perfect foundation of monetary credit, which happens to be the monetary attribute the US dollar is gradually losing. For more details, you can check the article linked above. What we mainly need to discuss here is:

Does this, to some extent, reduce the status of the US dollar? And does it also reduce the actual control of the Federal Reserve?

To answer this, we must first ask: “What is the monetary foundation of the US dollar?”

Last century, it was gold, so the dollar was called the “gold dollar,” but that ultimately failed...

Later, it was oil, so the dollar was called the “petrodollar,” but with the development of new energy and gradual changes in the oil settlement system, this monetary foundation is also loosening...

After that, it was America’s technological leadership, military superiority, cultural dominance, and its vastness. But over time, we gradually found that cultural dominance became increasingly odd—LGBT seems to have ruined this advantage—and military superiority has long been drained by the military-industrial complex. Today, almost no one believes the US could win a local war at China’s doorstep...

This isn’t my opinion; it’s actually what the Pentagon itself says...

So, what’s left as the foundation of the dollar?

It seems only technological leadership remains, and here, technological leadership mainly refers to AI ...

If technological leadership is also gradually lost, the dollar will gradually lose its current status as a reserve currency. Consequently, the influence of the Federal Reserve’s monetary policy on the outside world may decline. In other words, the Fed’s status does not come from its governmental authority, but from the dollar itself.

To give an extreme example, when other countries in the world no longer use the dollar, all of the Fed’s policies can only affect the domestic economy. Externally, apart from the exchange rate, there will be almost no substantial impact.

Thus, following this logic chain, we find that the macro cycle brought by the Fed requires the stability of the dollar’s status, the stability of the dollar’s status requires the stability of America’s international status, and America’s international status currently depends on the stability of its technological leadership, which is now entirely maintained by the US AI industry’s advantage...

Here comes another question: “Is AI’s leading position currently stable?”

Is there a bubble in AI right now? Is its leading position stable?

See, we in the crypto world love to make connections. To answer whether BTC has entered a bear market, we end up talking about whether there’s a bubble in the US AI industry??

Before writing this article, I conducted a poll, asking everyone to judge intuitively, without overthinking, which has a bigger bubble: NVDA or BTC?

The result was a 4:6 split, with nearly 60% believing that AI, or NVDA, has a bigger bubble...

Why do people have this intuitive judgment?

We can look at the data:

You can search “US stock AI circular financing” for more details. I’ll briefly describe the process, as shown in the diagram above:

NVDA invests in OpenAI, whose valuation soars;

OpenAI signs cloud service orders with other giants, whose valuations soar because the orders are so large...

Cloud service companies, to fulfill these orders, place even larger orders with NVDA to buy chips, so NVDA’s valuation soars again... completing the loop...

Currently, all companies in the AI sector are participating in this loop to varying degrees, which has brought prosperity to the US stock market and indirectly to the US economy.

Ordinary investors see nothing wrong with this loop, but those of us who have been in crypto and DeFi for years can already sense something is off...

If this circular financing structure is based on real demand—say, someone really needs a factory to produce a large number of drones for war—then logically there’s no problem. But all the circular financing in the AI sector is currently based on “future demand”...

If there really is such huge demand in the future, then AI is not a bubble. The problem is, what if there isn’t? Or if demand falls far short of expectations?

Remember the classic case during the Great Depression, when factories dumped milk?

To figure out how big AI’s future demand will be, I’ve subscribed to most mainstream products, and recently I’ve been using Cursor for Vibe Coding...

I can feel this is a huge market, but compared to the overall valuation of the US stock AI sector, the market size seems to be missing a few zeros...

Of course, this is just my personal feeling. Maybe some people think expectations and valuations are perfectly matched.

After discussing the bubble, let’s talk about whether this leading position is stable.

My view is that the leading position is still relatively stable for now. There is a generational gap between the first and second place, but the gap is slowly narrowing. The biggest lead is not necessarily in technology, but in capital.

The US government has been doing everything it can to maintain this advantage. We can see this from Trump’s actions. On the other hand, Sam’s public statements also confirm this: the scale of the AI industry’s capital has now reached the “Too big to fail” stage.

Therefore, the conclusion is: the bubble is huge, but the leading position is also quite solid, and this solidity itself comes from the huge bubble, because the US government absolutely will not allow China to surpass it in technology.

See, this is another loop: the bubble is huge, so the government will always bail it out, allowing circular financing to continue, which makes the bubble even bigger, and the government even more protective...

This precisely explains why the emergence of low-cost DeepSeek previously could cause such a huge blow to the AI sector in the US stock market...

You might ask, what does this have to do with BTC and cryptocurrencies?

Next comes the final part:

Liquidity transfer under the China-US rivalry

The logic is as follows, let’s break it down step by step:

The China-US rivalry has reached a stage where it has become a potential currency war;

The US dollar is on the defensive, while China is building a new currency settlement network behind the scenes (gold surging), and the most critical defensive point for the dollar is AI and technology;

The AI industry has an obvious bubble, and it’s a bubble that cannot burst; otherwise, the US could lose this currency war;

Therefore, a large amount of liquidity in the entire financial market will flow into AI and technology fields;

The fiscal bull market that started in 2023 released a lot of liquidity, and both the crypto market and AI benefited, because at that time, their market caps were not high;

This liquidity was gradually consumed as interest rates remained high, until 2025, when the exponentially growing demand for liquidity began to expand and could no longer sustain the continuous growth in market valuations.

The Fed’s rate cuts are too slow, and the cost of high interest rates gradually becomes apparent;

Liquidity becomes scarce, so the most liquidity-sensitive “canary” falls first—yes, that’s BTC...

The technical side shows bear market signals before the macro side turns bearish;

This triggers an ongoing “technical bear market.”

In summary, the current predicament of cryptocurrencies actually comes from the liquidity needs of maintaining the prosperity of the US stock market...

To put it bluntly, both cryptocurrencies and AI are the sons of the current American landlord, but AI is the biological son, and crypto is the adopted son. So when there’s plenty of food, both sons can eat their fill. When there’s not enough, the adopted son goes hungry first...

The biological son’s grades are better than the neighbor’s son, but the neighbor has many sons, and now the only thing the landlord can show off is his own son’s report card...

But what the landlord doesn’t know is that although the son’s grades are good now, in the future, after entering the workforce, he may not earn more than the neighbor’s sons. The current pampering is all for the hope that the biological son will succeed in the future...

But recently, the neighbor’s son attended two days of tutoring, and that month’s quiz scores were the same as the landlord’s son. This really rattled the landlord, so he decided to step up his efforts!

To help his biological son improve faster, the landlord cut off the adopted son’s food and fully supported the biological son...

The kicked-out wild child still wonders if he can get a meal at the neighbor’s house, but the neighbor put up a sign at the door: Wild children not allowed!!

Now, the wild child can only rely on himself...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.