Bitcoin Tops $122K After Inflation Drops and Bulls Stay in Control

- Bitcoin sets a new ATH at $122,540, with a strong bullish trend in place

- The inflation rate dropped to 0.092 percent, which is the lowest level seen this year

- Metaplanet now owns 16,352 BTC after spending $93.6M on a fresh 797 BTC purchase.

Bitcoin has hit a record high by surging past $122k. As of press time, the pioneer cryptocurrency was trading at $122,357.10, increasing by 3.85% over the past 24 hours and 12% over the past 7 days.

The cryptocurrency opened at $119,086.65, which hit an intraday high of $121,492, and marked its low at $118,90. This upward move positions BTC firmly within a rising channel, and now testing the $121,431.54 resistance level, with sustained bullish signals across technical and on-chain indicators.

Bitcoin’s Technical Structure

Bitcoin continues to trade above its 9-day Simple Moving Average, which is currently sitting at $114,290.60, and is reflecting firm bullish momentum. Beneath this level lies a visible Fair Value Gap (FVG) between $113,265 and $114,290, a potential short-term support zone should price reverse.

Source:

Two rounded bottom patterns—validated by successive bullish candlesticks—support the current trend. These formations align with previously established breakout zones, which now act as crucial accumulation and continuation areas.

The MACD indicator displays further bullish confluence. The MACD line stands at 3,334, far above the signal line at 2,087. This also results in a positive histogram of 1,246.68. This widening spread reflects rising buying pressure and increasing momentum.

The Fibonacci extension levels also provide a structured downside framework. Key correction zones appear at $105,100 (1.0), $100,658 (1.272), and $95,007 (1.618). These levels also serve as possible retracement points in case of market pullbacks.

Bitcoin’s On-Chain Metrics

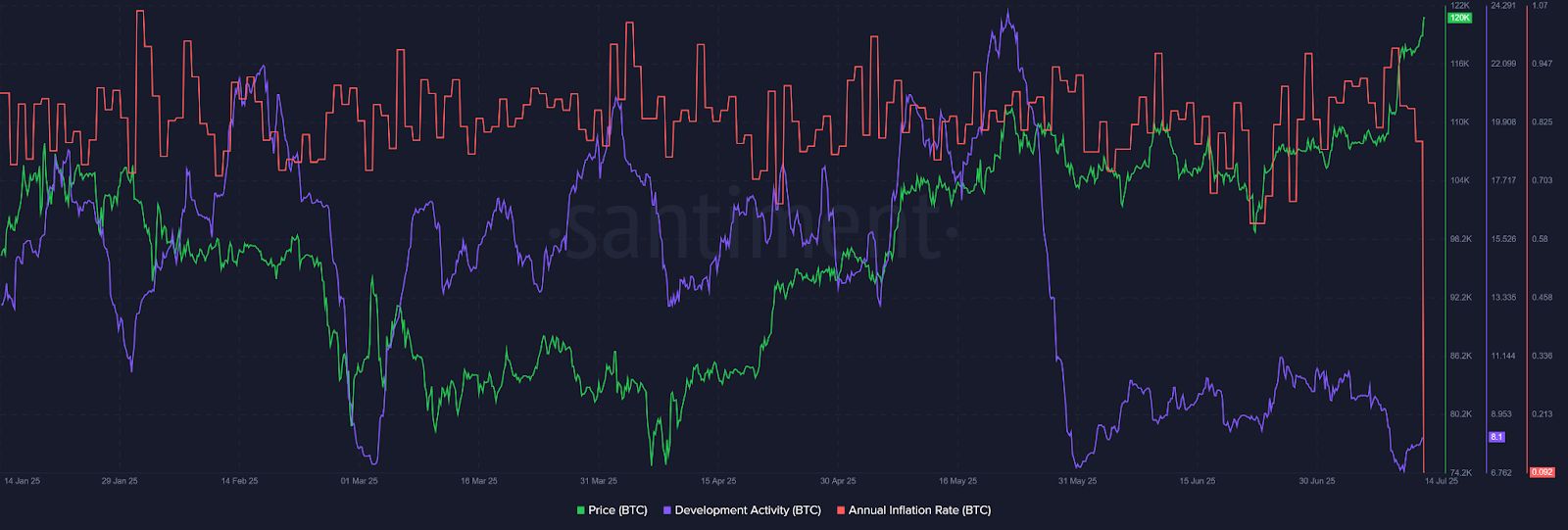

Data from Santiment reveals a sharp decline in Bitcoin’s annual inflation rate, now at just 0.092%—its lowest level year-to-date. In January, the rate hovered around 0.7%. Since then, it has steadily decreased, collapsing by over 86.8% by mid-July. This tightening in the circulating supply may partly explain the current price surge.

Source:

At the same time, Bitcoin’s development activity has seen a dramatic fall. From 24.291 on April 28, the metric has dropped to just 8.1 as of July 14. This 66.6% decrease over two and a half months marks a notable slowdown in GitHub submissions tied to the Bitcoin project. Despite the decline, market optimism remains unaffected, and the price trajectory continues to climb.

Price data indicates that BTC was trading around $93,000 in late April before rising above $104,000 in June. The rally has intensified into July, bringing it above $121,000 in mid-month trading.

Metaplanet Expands BTC Reserves With $93.6M Purchase

While Bitcoin was making history on the charts, Metaplanet, commonly referred to Japanese MicroStrategy, is accumulating BTC. The Japanese public firm Metaplanet disclosed the purchase of 797 BTC for approximately $93.6 million, at an average cost of $117,451 per coin. CEO Simon Gerovich announced the acquisition today.

The purchase increases Metaplanet’s total BTC holdings to 16,352 coins, which were acquired at an average cost of $100,191 each. This positions the company among the leading corporate holders of Bitcoin in Asia.

Related: Bitcoin Hits $118K, Defying Warnings from Top Critics

Market analyst Ken Thung spoke about the strategic distinction between the regulatory framework of Japan and that of the United States based on Bitcoin treasury policies. In the meantime, the response of the community to X was that it felt very strongly about the aggressive build-up approach of Metaplanet.

It is evident that one of the main factors that have highly contributed to Bitcoin’s breakthrough beyond 120,000 might include these large-scale purchases, macroeconomic signals, and limited supply.

The post Bitcoin Tops $122K After Inflation Drops and Bulls Stay in Control appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.

Tether: The Largest Yet Most Fragile Pillar in the Crypto World

In-depth Analysis of the Ethereum Fusaka Upgrade: Core Changes and Ecosystem Impact