Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

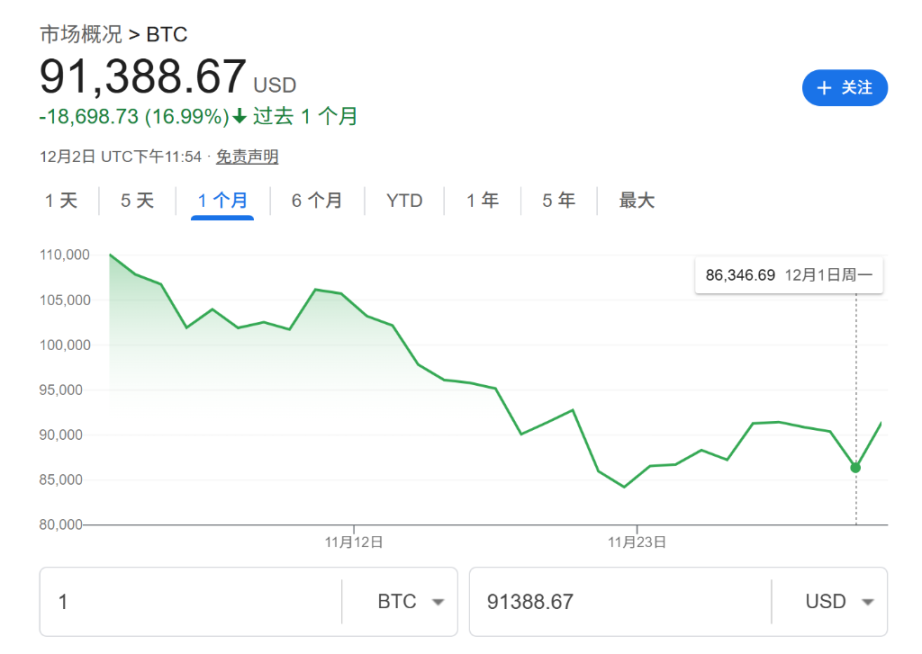

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly $500 million last quarter, but bitcoin prices subsequently fell by more than 20% this quarter, exposing the fund to significant timing risk.

Written by: Ye Huiwen

Source: Wallstreetcn

Harvard University's massive endowment fund made a major bet just before bitcoin prices peaked and pulled back, highlighting that even top institutional investors face severe timing risks as cryptocurrencies become increasingly mainstream.

According to The Wall Street Journal on December 2, based on Harvard's latest disclosed quarterly report, the wealthiest university in the United States significantly increased its holdings in the iShares Bitcoin Trust ETF to nearly $500 million last quarter. However, since the start of this quarter, bitcoin prices have dropped by more than 20%, and Tuesday's rebound failed to reverse the downward trend.

This cryptocurrency rout, which has affected Wall Street and retail investors alike, has also cast doubt on the prospects of Harvard's investment. Although any cryptocurrency loss is a drop in the bucket for its massive $57 billion endowment fund, this poorly timed bet reveals a common phenomenon: institutional investors continuing to increase their positions even after a significant rally in cryptocurrencies.

If Harvard had sold before the price drop in early October, it could have escaped unscathed or even made a small profit. But if the university still holds some or all of the shares purchased last quarter, a paper loss may now be unavoidable.

Not an Optimistic Entry Point

Documents show that Harvard University bought 4.9 million shares of the iShares Bitcoin Trust ETF last quarter (ending September 30). Since Harvard's exact purchase price is unknown, its potential loss is difficult to calculate precisely.

The best-case scenario is that these shares were bought at the lowest bitcoin price in early July of that quarter, costing Harvard about $294 million, while these shares are now worth about $255 million, representing a 14% paper loss.

In contrast, the 1.9 million shares Harvard bought before bitcoin's surge in the second quarter this year may be in much better shape.

This nearly $500 million bitcoin position accounts for less than 1% of the university's $57 billion endowment fund.

Institutions Rushing into the Crypto Track

Harvard's move is a microcosm of bitcoin's growing mainstream acceptance among institutional investors.

After this year's astonishing rally, rational capital continues to be optimistic and keeps buying. Before the current correction, bitcoin prices had risen 34% in 2025, reaching a record high of over $126,000.

Other universities also appear to have been affected by the recent cryptocurrency price drop, though to a much lesser extent. Schools reporting crypto holdings in the third quarter include Brown University, which holds $14 million worth of BlackRock Bitcoin ETF, and Emory University, which holds $52 million worth of Grayscale Bitcoin Mini Trust ETF.

The Tug-of-War Between Performance Pressure and Long-Termism

There may also be considerations of performance pressure behind Harvard's investment decisions.

Over the past decade, Harvard's annualized investment return was 8.2%, ranking near the bottom compared to Ivy League and other top schools. Although under current CEO N.P. "Narv" Narvekar's eight-year tenure, the annualized return rose to 9.6%, and the fund achieved a respectable 11.9% return in the fiscal year ending June 30, it still lagged behind MIT's 14.8% and Stanford University's 14.3%.

For long-term investors such as endowment and pension funds, as long as prices eventually rebound, paper losses are not necessarily a problem. Some institutional investors have endured the extreme volatility of cryptocurrencies for years. For example, public pension funds suffered heavy losses in the 2022 digital currency crash, but since then, bitcoin prices have risen more than fivefold.

However, some investors believe cryptocurrencies are not suitable for long-term holding. Jay Hatfield, CEO of Infrastructure Capital Advisors, said, "When you're gambling, what you need to do is sell it, not hold it."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why is the short seller who made $580,000 now more optimistic about ETH?

The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

Even BlackRock can't hold on? BTC ETF sees $3.5 billion outflow in a single month as institutions quietly "deleveraging"

The article analyzes the reasons behind cryptocurrency ETF outflows in November 2025 and their impact on issuers' revenues, comparing the historical performance of BTC and ETH ETFs as well as the current market situation. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still being iteratively updated.

Bitcoin surges to $93K after Sunday flush, as analysts eye $100K