News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

DASH Price Prediction 2025: Will DASH Hit $74, Losing 50% or Show Strong Revival?

Coinpedia·2025/11/05 20:21

Crypto Market Crash: What’s Really Behind the Bitcoin Sell-Off?

Coinpedia·2025/11/05 20:21

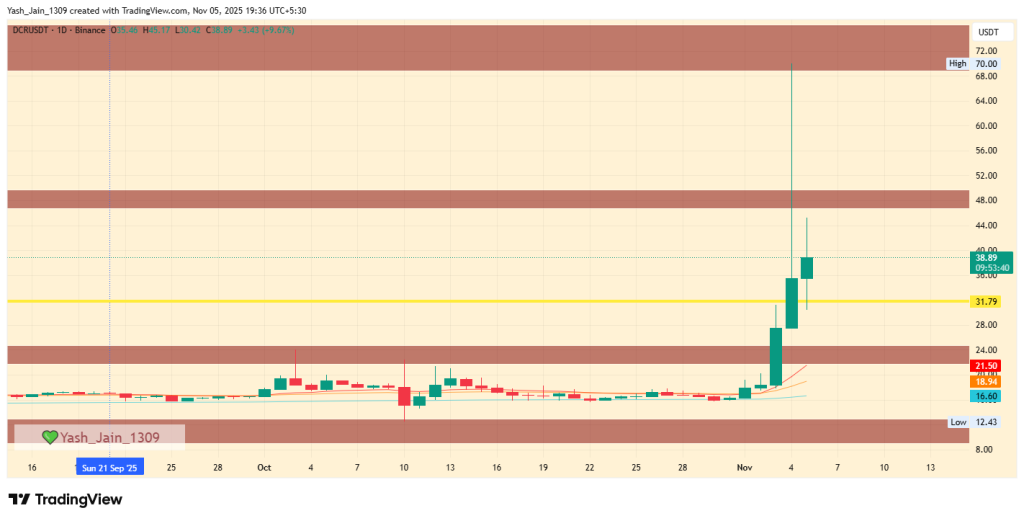

Decred Price Prediction 2025: Is a 65% Crash to $25 Coming?

Coinpedia·2025/11/05 20:21

Bitcoin and Ether ETFs record fifth consecutive day of outflows as crypto prices remain under pressure

Coinjournal·2025/11/05 20:18

Europe gets its first stablecoin infrastructure ETP as Virtune lists on Nasdaq and Xetra

Coinjournal·2025/11/05 20:18

Monero (XMR) jumps to 5-month high as privacy coins lead surprise market rally

Coinjournal·2025/11/05 20:18

Ripple announces $500M raise at $40 billion valuation

Coinjournal·2025/11/05 20:18

Lido adopts Chainlink CCIP to secure cross-chain wstETH transfers across 16+ blockchains

Coinjournal·2025/11/05 20:18

Canada Follows U.S. in Regulating Stablecoins, Budget Earmarks $10M for Oversight

CryptoNewsFlash·2025/11/05 20:18

ZEC News: Privacy Coin Zcash Soars 700% as Galaxy Digital Highlights Growing Adoption

CryptoNewsFlash·2025/11/05 20:18

Flash

- 08:38Data: Machi increases 25x leveraged ETH long position to $24.76 millionAccording to ChainCatcher, monitored by HyperInsight, Huang Licheng has just increased his 25x leveraged ETH long position to $24.76 million, currently with an unrealized loss of $2.06 million. The average entry price is $3,418.22, and the liquidation price is $3,050.07.

- 08:26Data: Machi Big Brother slightly increased his long position in Ethereum to 7,745 ETH, with a liquidation price of $3,047.88.According to ChainCatcher, Hyperbot data shows that "Machi Big Brother" Huang Licheng has just slightly increased his 25x leveraged Ethereum long position, with his current holdings rising to 7,745 ETH. The liquidation price is $3,047.88, and the current unrealized loss is $1.968 million. In addition, Huang Licheng has placed 8 ETH limit sell orders in the $3,188.8–$3,400 range.

- 08:11Bitcoin market depth drops about 30% from this year's peak, crypto market cap gives back annual gainsAccording to ChainCatcher, citing Bloomberg and Kaito data, bitcoin market depth has dropped by about 30% from this year's peak, indicating that market liquidity has also shrunk significantly. In the options market, traders are increasingly betting on volatility, with rising demand for neutral strategies such as straddles and strangles. The total market capitalization of cryptocurrencies has already given back the gains made earlier this year, and market sentiment may remain subdued until further positive news emerges. Max Gokhman, an executive at Franklin Templeton, stated that the correlation between cryptocurrencies and macro risks may remain high until institutions participate more deeply in the crypto market and investment targets are no longer limited to bitcoin and ethereum.