News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

Cointribune·2025/11/05 20:30

XRP ETF: Nate Geraci predicts a launch within two weeks

Cointribune·2025/11/05 20:30

Sequans Sells 970 Bitcoins, Unsettling the Markets

Cointribune·2025/11/05 20:30

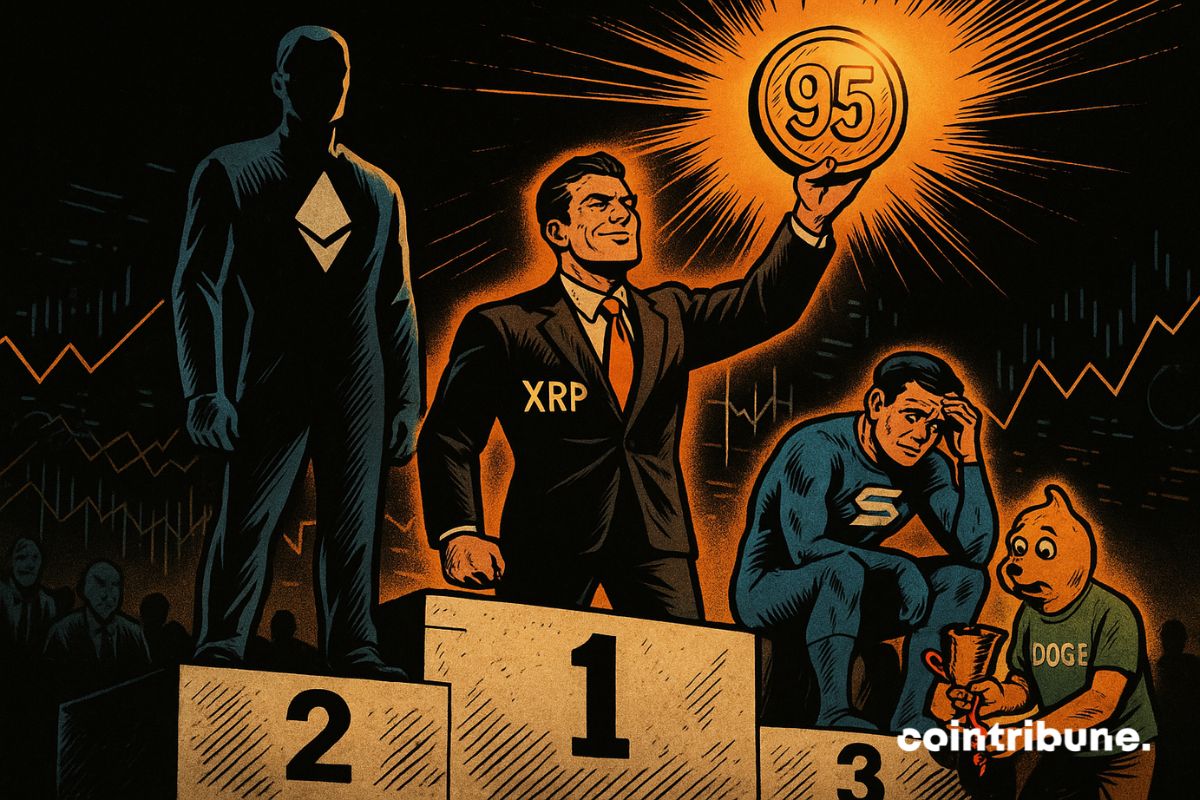

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025

Cointribune·2025/11/05 20:30

Solana Treasury Firm Forward Industries Announces $1B Share Buyback

Cointribune·2025/11/05 20:30

EU’s Plan to Expand ESMA Powers Sparks Debate Over Crypto Innovation and Market Control

Cointribune·2025/11/05 20:30

Stellar (XLM) Holds Key Support — Could This Pattern Trigger an Rebound?

CoinsProbe·2025/11/05 20:30

Is Monero (XMR) Gearing Up for a Bullish Breakout? Key Pattern Formation Suggest So!

CoinsProbe·2025/11/05 20:30

Solar Price Prediction 2025, 2026 – 2030: Is SXP A Good Investment?

Coinpedia·2025/11/05 20:21

Canada’s 2025 Federal Budget Reveals Plans to Regulate Stablecoins

Coinpedia·2025/11/05 20:21

Flash

- 14:11US Trade Representative: The United States plans to lower tariff rates on Swiss goods to 15%Jinse Finance reported that U.S. Trade Representative Katherine Tai stated that the United States plans to lower the tariff rate on Swiss goods to 15%, similar to that of the European Union. She also added that Switzerland has agreed to invest $200 billion in the United States.

- 14:10Michael Saylor: The company is buying a significant amount of BitcoinJinse Finance reported that MicroStrategy founder Michael Saylor stated the company is buying a significant amount of bitcoin and will announce its latest purchase plan next Monday.

- 13:53Bit Digital Releases Q3 Financial Report: Ethereum Holdings Increase to 153,547Jinse Finance reported that Nasdaq-listed Ethereum treasury company Bit Digital released its Q3 2025 financial report, disclosing a total revenue of $305 million for the quarter, a year-on-year increase of 33%. ETH staking revenue reached $29 million, up 542% year-on-year. As of October 31, 2025, the company held 153,547 ETH, valued at approximately $590.5 million, with an increase of 31,057 ETH in October.