News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 27) | Initial jobless claims for the week ending November 22 came in at 216,000; Nasdaq ISE has proposed raising the IBIT option position limit to 1 million contracts2Bitcoin final leverage flush below $80K is possible, warns analyst3Bitcoin price risks decline below $80K as fears of ‘MSTR hit job’ escalate

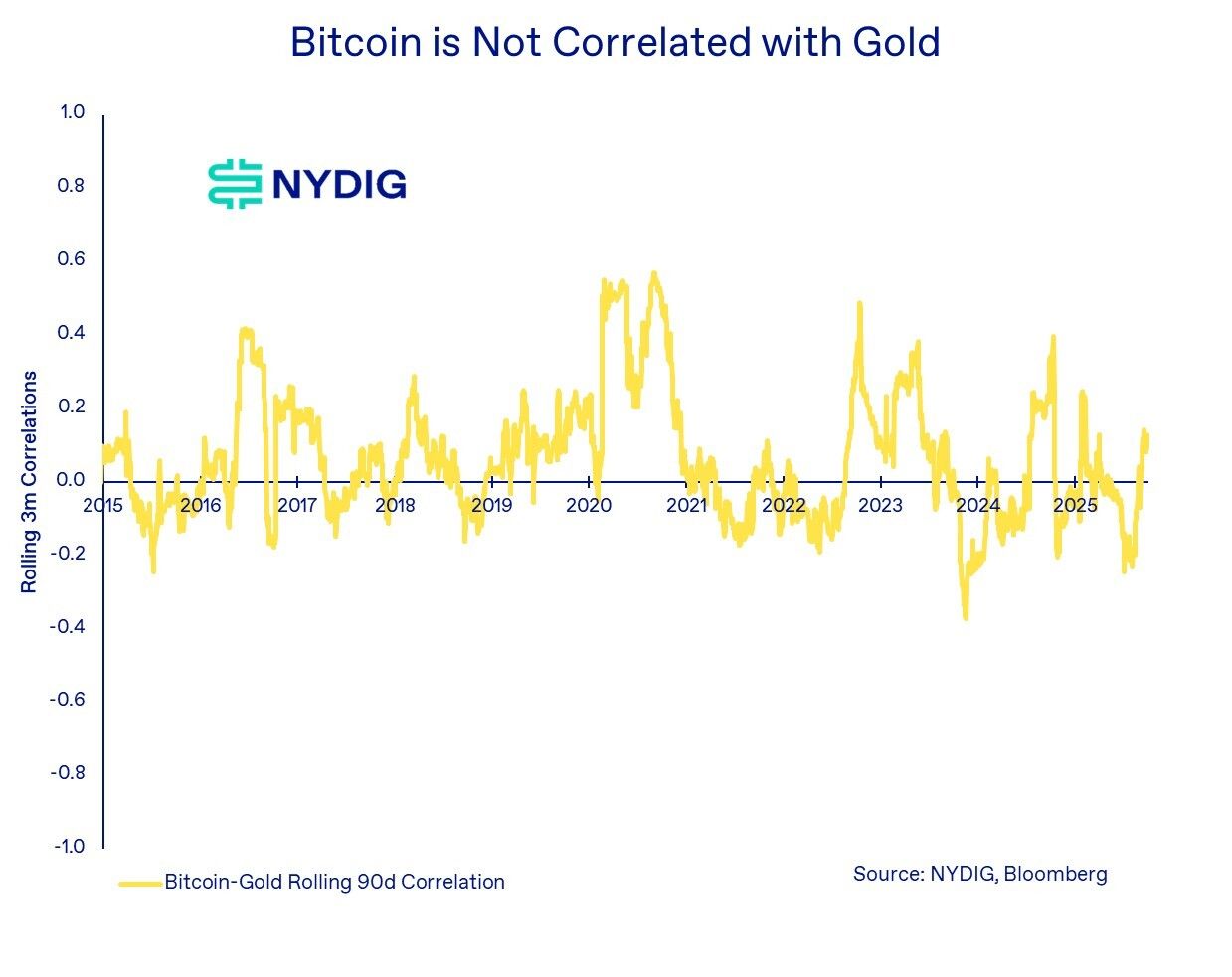

Bitcoin is no inflation hedge but thrives when the dollar wobbles: NYDIG

CryptoNewsNet·2025/10/27 04:39

Bitcoin Reclaims $115,000 as US–China Trade Hopes Lift Markets

CryptoNewsNet·2025/10/27 04:39

Bitcoin Accelerates Higher As Bulls Target Break Above $115,500 Resistance

CryptoNewsNet·2025/10/27 04:39

Buterin and Yakovenko Clash Over Ethereum Layer-2 Security

CryptoNewsNet·2025/10/27 04:39

Bitcoin Surpasses 50-Day Average, but CoinDesk BTC Trend Indicator Remains Bearish

CryptoNewsNet·2025/10/27 04:39

Altcoin Market Breakout Looms as Bitcoin Dominance Weakens

After a long accumulation phase, altcoins are showing early signs of revival. With Bitcoin dominance nearing resistance and on-chain data turning bullish, the conditions for a major Altseason breakout may finally be aligning for crypto investors.

BeInCrypto·2025/10/27 04:37

XRP Hits $26.9B in CME Futures Trading as Institutional Demand Soars

Cointribune·2025/10/27 04:33

Is Xai (XAI) Poised for a Breakout? Key Bullish Pattern Formation Suggests So!

CoinsProbe·2025/10/27 04:33

Japan’s First Regulated Yen Stablecoin Launches

JPYC Inc. launched Japan's first regulated yen-pegged stablecoin, introducing compliance-focused infrastructure in Asia's third-largest forex market challenging dollar-dominated stablecoin landscape.

BeInCrypto·2025/10/27 04:25

NYDIG Analysis Challenges Bitcoin Inflation Hedge Narrative as Dollar Weakness Emerges as Key Driver

BTCPEERS·2025/10/27 04:19

Flash

- 21:22Analysis: BlackRock IBIT holders return to profit, ETF selling pressure may easeBlockBeats News, November 27, according to Cointelegraph, holders of BlackRock's spot bitcoin ETF IBIT have returned to profitability after bitcoin rebounded above $90,000, indicating that the sentiment of one of the key investor groups driving the market this year may be shifting. Arkham data shows that the cumulative profit of holders of BlackRock IBIT, the largest spot bitcoin fund, has recovered to $3.2 billion. Arkham stated: "At the peak of their profits and losses on October 7, holders of BlackRock IBIT and ETHA were collectively almost $40 billion in profit, but this figure dropped to $630 million four days ago. This means that the average cost of all IBIT purchases is now nearly at break-even." As ETF holders are no longer under pressure, the pace of bitcoin ETF sell-offs may continue to slow down. Since the recorded net outflow of $903 million on November 20, the situation has significantly improved.

- 21:22Aave founder: UK plans to classify DeFi deposits as "no gain, no loss," benefiting crypto lending tax treatmentBlockBeats News, November 27, Aave founder and CEO Stani.eth posted that "HM Revenue & Customs has published the results of its consultation on the taxation of DeFi activities (including lending and staking) in the UK. A particularly interesting conclusion is that when users deposit assets into Aave, the deposit itself is not considered a disposal for capital gains tax purposes, thus creating a no gain, no loss approach. This is a major victory for UK DeFi users who wish to borrow stablecoins using cryptocurrency as collateral." We advocate for DeFi and ensure that the tax treatment of interactions with lending protocols reflects economic reality: users who borrow against collateral to meet liquidity needs do not intend to dispose of their assets. We fully support this approach and hope these changes will be reflected in UK tax law as soon as possible."

- 21:21The probability of "Bitcoin reaching $100,000 again this year" on Polymarket rises to 50%BlockBeats News, on November 27, the probability of "bitcoin reaching $100,000 again this year" on Polymarket has risen to 50%. In addition, the probability of it reaching $110,000 again is currently reported at 18%, while the probability of falling below $80,000 is reported at 37%.