News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Philippines introduced a bill to acquire 10,000 BTC over five years, locking holdings for two decades. Supporters highlight diversification benefits, while critics warn of risks as global governments accelerate sovereign Bitcoin accumulation.

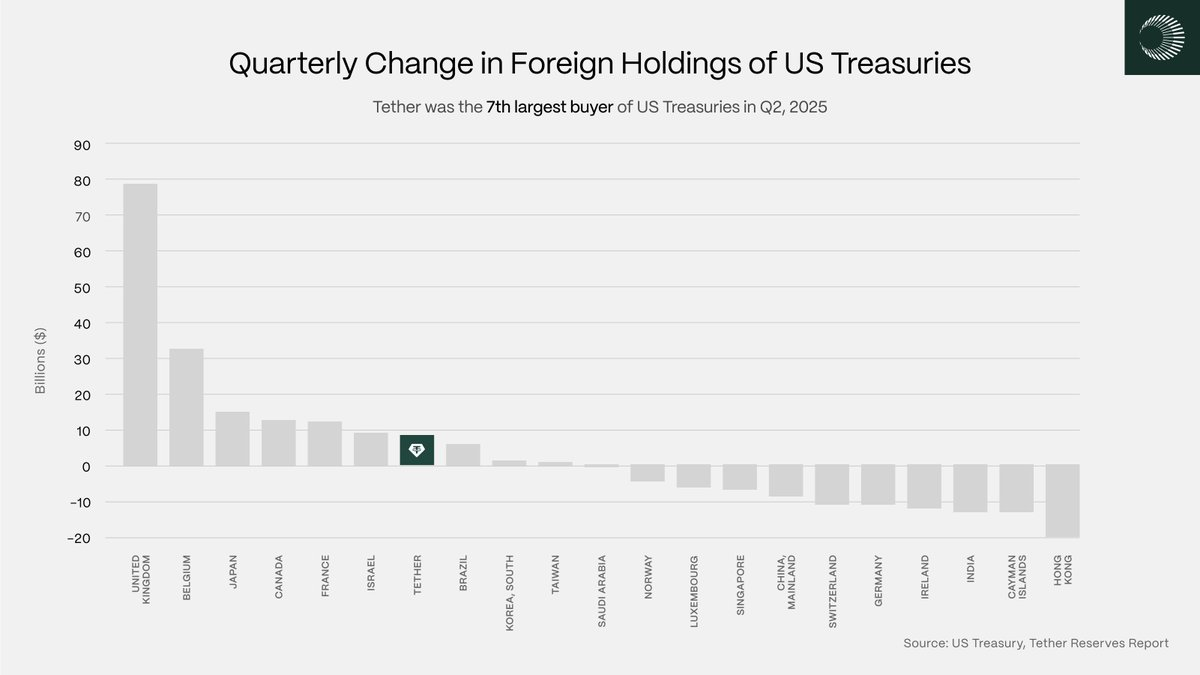

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

BTC and ETH rally on dovish Fed signals

Japan’s Financial Services Agency (FSA) is preparing sweeping changes to its digital asset framework. The changes, which combine tax reforms and regulatory upgrades, could introduce exchange-traded funds (ETFs) tied to cryptocurrencies. The initiative signals Japan’s intent to integrate crypto into mainstream finance and attract broader investment. Tax Burden Under Review The reform package, reported domestically, … <a href="https://beincrypto.com/japan-fsa-crypto-tax-overhaul-etf-reforms-2026/">Con

- 10:55CME: All markets remain suspended except for the BrokerTec EU marketJinse Finance reported that CME: BrokerTec EU market is now open and trading. Due to a cooling issue at the CyrusOne data center, all other Chicago Mercantile Exchange Group markets remain suspended.

- 10:51AIsa's cumulative transaction count on the x402 network has surpassed 10.5 million, making it the largest transaction contributor in the x402 ecosystem.ChainCatcher news, according to real-time data from x402scan, the AI micropayment infrastructure project AIsa has now surpassed 10.5 million cumulative transactions on the x402 network, accounting for 15.9% of the network's total of approximately 65.9 million transactions.The weekly growth rate exceeds 200%, and this proportion has significantly increased from about 7% two weeks ago, making it one of the largest, fastest-growing, and most stable entities in the current protocol. Industry insiders point out that in the x402 ecosystem, "number of transactions" better reflects actual network activity than "transaction amount." Unlike traditional payments, which are dominated by high-value transactions, the core scenarios of x402 include API calls, model inference, data access, and other AI agent micropayments, characterized by high frequency, low value, and automation. The continuous growth in transaction count indicates that the protocol's invocation density in real production scenarios is steadily increasing. AIsa serves AI developers for real-world applications, applying x402 to actual transaction scenarios, enabling various AI applications to call LLM Token, API resources, and data resources as needed. Reportedly, AIsa currently mainly operates on the Base chain, and AIsa is advancing commercial-grade facilitator applications together with Coinbase Developer Platform (CDP). AIsaplans to expand to networks such as Solana, Polygon, and X Layer, which will gradually provide native x402 support, to achieve higher concurrency and lower-cost AI Agent micropayment capabilities.

- 10:43Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.BlockBeats News, November 28, Greeks.live researcher Adam released today's options settlement data: 143,000 BTC options are expiring, with a Put Call Ratio of 0.51, the max pain point at $98,000, and a notional value of $13 billion. 572,000 ETH options are expiring, with a Put Call Ratio of 0.48, the max pain point at $3,400, and a notional value of $1.71 billion. Researcher Adam stated that the main options data shows that implied volatility has fully rebounded compared to last month. The main term IV for BTC averages around 45%, while the main term IV for ETH is below 70%, both at relatively high levels for this year. Around settlement, the large block trading volume and trading proportion of bitcoin options have continued to rise, mainly due to position rolling needs. However, large block trading in ethereum is very limited, reflecting different market characteristics. This year's Q4 market performance can be described as the worst in recent years. Due to macro uncertainties and other factors, there is significant market divergence, and leveraged trading is not recommended.