News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Cathie Wood warned that as market attention shifts from rate cuts to rate hikes, the market will face a "chilling" adjustment, and valuations in the artificial intelligence sector will undergo a "reality check." However, she denied the existence of an AI bubble at present, believing that the world is at the beginning of an AI technological revolution and that the long-term valuations of major tech companies are reasonable.

What the x402 protocol represents is far more than just an optimization of payment methods; it is a paradigm shift in the value exchange layer of the internet.

Through a workaround, the U.S. President could even pardon himself.

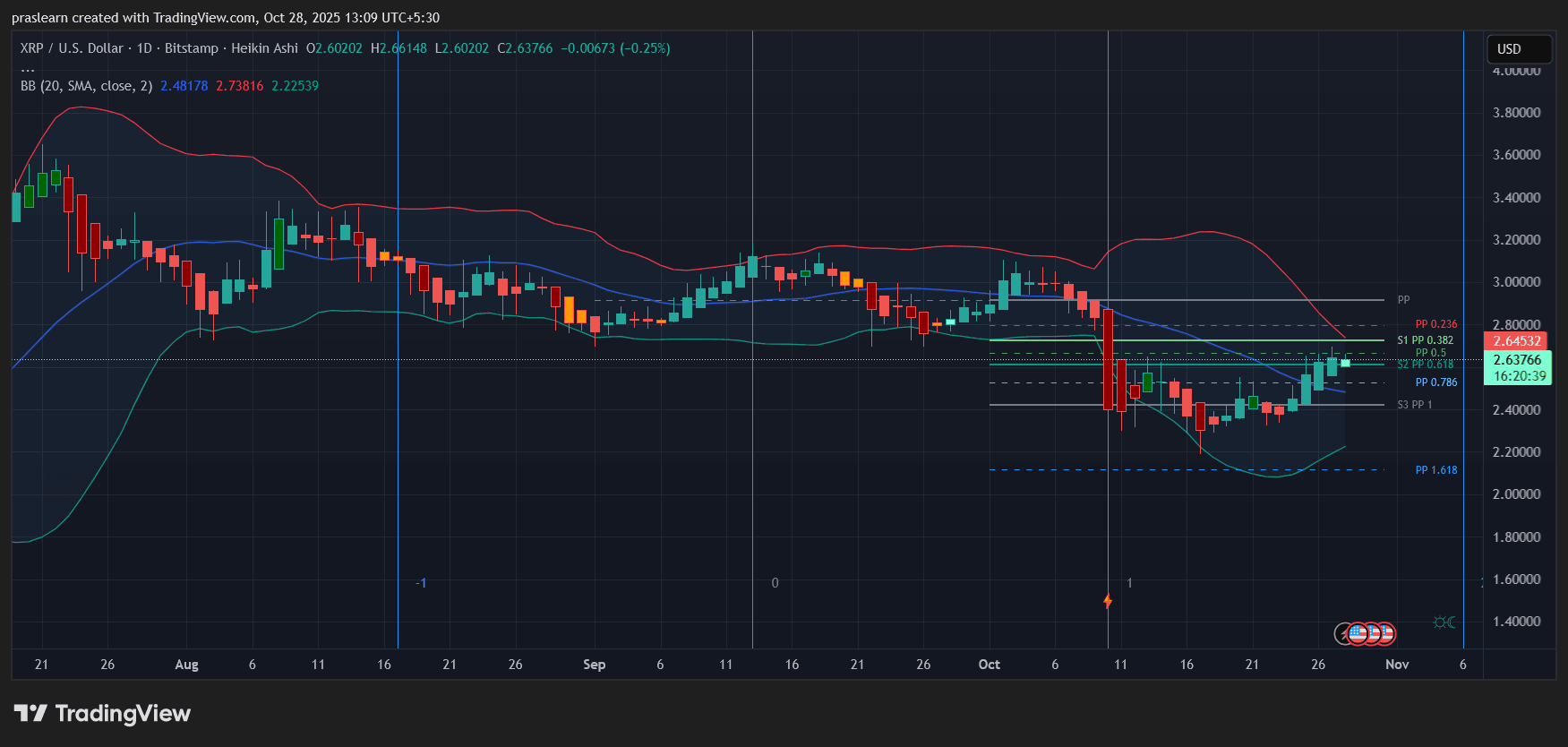

It is very important to clearly identify the type of trading you are involved in and make the appropriate adjustments.

- 04:14Yilihua: WLFI rises 50% against the trend, ETH is severely undervaluedChainCatcher news, Yilihua posted on the X platform stating that the WLFI team continues to invest in buybacks, and WLFI has recently surged 50% against the market trend. According to research and investment data, ETH is being heavily shorted by multiple platforms and institutions, which may lead to a short squeeze in the future. Compared to four years ago, under favorable conditions such as stablecoins, ETF, DAT, and policies, the price of ETH is severely undervalued.

- 04:02US-listed company Reliance sells previously held digital assets and reallocates to Zcash (ZEC)Foresight News reported that US-listed company Reliance Global Group (NASDAQ: RELI) has announced the completion of a strategic adjustment to its Digital Asset Treasury (DAT), positioning Zcash as the crypto reserve asset in its future digital asset treasury. The company stated that it has sold its previously held DAT assets and reallocated the proceeds to Zcash (ZEC), with the specific amount undisclosed. According to a previous Foresight News report, Reliance had previously purchased ADA and ETH as part of its DAT strategy, with the specific amounts undisclosed.

- 04:02WLFI spent 7.79 million USD on-chain to buy back approximately 46.56 million WLFI tokens.Foresight News reported, according to monitoring by Lookonchain, WLFI repurchased WLFI tokens on-chain in the past 5 hours, spending a total of 7.79 million USD1 to purchase 46.56 million WLFI at an average price of $0.1674 per token during this period.