AI Faces Correction Risks! Cathie Wood Warns: As Interest Rates Rise Next Year, the Market Will Be "Shocked"

Cathie Wood warned that as market attention shifts from rate cuts to rate hikes, the market will face a "chilling" adjustment, and valuations in the artificial intelligence sector will undergo a "reality check." However, she denied the existence of an AI bubble at present, believing that the world is at the beginning of an AI technological revolution and that the long-term valuations of major tech companies are reasonable.

Cathie Wood warns that as the market focus shifts from rate cuts to rate hikes, the market will face a "chilling" adjustment, and valuations in the artificial intelligence sector will also undergo a "reality check." However, she denies the existence of an AI bubble, believing that the world is at the beginning of an AI technological revolution and that the long-term valuations of large tech companies are reasonable.

Written by: Zhang Yaqi

Source: Wallstreetcn

ARK Invest CEO "Sister Wood" Cathie Wood warned that as interest rates may start to rise next year, the market will face a "chilling" adjustment, and valuations in AI-related sectors will also undergo a "reality check."

On Tuesday, during the Future Investment Initiative (FII) summit held in Riyadh, Saudi Arabia, she stated that she expects the market discussion focus to shift from rate cuts to rate hikes within the next year. This shift could trigger a dramatic market reaction.

Although Wood warned of short-term adjustment risks, she explicitly refuted claims of an AI bubble. She believes that in the long run, the valuations of large tech companies are reasonable because the world is at the beginning of a technology revolution driven by AI.

Wood's remarks come at a time when major global financial institutions are increasingly concerned about the high valuations of tech stocks. Earlier this month, both the International Monetary Fund (IMF) and the Bank of England warned that global stock markets could be in trouble if investor enthusiasm for AI cools.

The Market Will Face a "Reality Check"

Wood elaborated on her views regarding short-term market risks. She predicts that as the interest rate environment changes next year, the market will experience a "shudder."

"At some point next year, we will see the market focus shift from rate cuts to rate hikes," Wood said. She pointed out that although many believe innovation is negatively correlated with interest rates, historical data does not support this view. She hopes to "dispel this notion among people."

However, Wood added that considering "the way today's algorithms operate," the upward trend in interest rates could still trigger what she calls a "reality check." This statement comes as companies and investors are pouring huge amounts of capital into the tech sector, raising concerns about overvaluation.

Refusing to Admit an "AI Bubble"

Despite warning of short-term risks, Wood remains firmly bullish on the long-term prospects of AI and denies the existence of a bubble.

"I don't think AI is in a bubble," Wood responded directly when asked about the issue. She believes this is just "the beginning of a technological revolution." She acknowledges that the market may experience a pullback because many are concerned "whether all of this is too much, too fast," but she believes that in the long run, the valuations of large tech companies will be reasonable.

Wood also pointed out that it takes time for enterprises to embrace and transform with AI. "Large enterprises need time to prepare for transformation," she added:

"This requires companies like Palantir to enter large enterprises and truly restructure them in order to fully harness the productivity gains we believe AI will unleash."

Wood's views echo the recent cautious attitude of several regulators and business leaders. Earlier this month, IMF Managing Director Kristalina Georgieva advised:

"Fasten your seatbelts: uncertainty is the new normal, and it will persist."

In addition to the IMF and the Bank of England, several well-known figures, including OpenAI's Sam Altman, JPMorgan CEO Jamie Dimon, and Federal Reserve Chairman Jerome Powell, have also expressed concerns about the risk of a stock market pullback due to the surge in AI spending.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

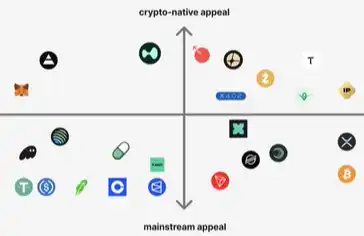

What drives the price surge of cryptocurrencies with no revenue?

Is this week’s crypto news a “trick or treat” week?

This week's top cryptocurrency headlines include Solana's new stablecoin, Microsoft's investment in OpenAI, Nvidia's investment in Nokia, and the Federal Reserve's interest rate cut decision. Is the market "trick or treat" or "treat"?

SharpLink plans $200M Ethereum deployment with Linea partnership