News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum2Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets3Solana ETF Hit 18-Day Inflow Streak

MegaETH Raises $50 Million, Achieves $1 Billion Valuation Instantly

Coinlineup·2025/10/28 05:03

Best Crypto for the Future: Why BlockDAG Leads Ahead of Pudgy Penguins, Ripple & Cardano

Coinlineup·2025/10/28 05:03

Does a weaker dollar drive Bitcoin price now?

CryptoSlate·2025/10/28 05:00

Solana Price Could See a “Long” Winter If This “Squeeze” Risk Plays Out

Solana’s price action is walking a fine line between rebound hopes and a long squeeze risk. On-chain metrics show holders reducing exposure while leverage continues to pile up, leaving SOL just 10% away from a potential cascade that could decide whether it faces a long winter or breaks out instead.

BeInCrypto·2025/10/28 05:00

The "100% win rate whale" adds another 41 million!

AICoin·2025/10/28 04:21

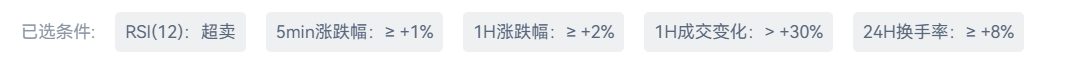

Unlock Precision Gold Mining: Practical Guide to AiCoin Conditional Token Selection Function

AICoin·2025/10/28 04:20

AiCoin Daily Report (October 28)

AICoin·2025/10/28 04:19

Six Years, Millions, 12 Lessons: A Crypto Survival Guide

Bitpush·2025/10/28 04:03

Messari: Trading US stocks on Perp DEX, the next new blue ocean

However, current data indicates that it will be difficult to achieve a breakthrough in this field in the short term.

BlockBeats·2025/10/28 03:54

$2.7 trillion evaporates from gold—Is liquidity about to flow into Bitcoin?

Over $2.7 trillion in gold market value disappeared within just one week. As investors shift their risk, bitcoin may become the next major liquidity magnet.

Cryptoticker·2025/10/28 03:54

Flash

- 12:41JPMorgan has sold more than 772,400 shares of Strategy stockJinse Finance reported, according to BitcoinTreasuries.NET, an exchange with assets totaling $4.6 trillion has disclosed the sale of 772,453 shares of Strategy stock, valued at $134 million.

- 12:41BlackRock transfers 900 BTC worth $77.59 million to an exchange againJinse Finance reported, according to Onchain Lens monitoring, BlackRock has once again transferred 900 BTC, worth $77.59 million, to a certain exchange, with a total transfer of 3,722 BTC and 36,283 ETH.

- 12:32NABE annual survey: U.S. economic growth will accelerate slightly next year, but inflation may remain highBlockBeats News, November 24, the National Association for Business Economics (NABE) stated in its annual forecast survey that the U.S. economic growth will slightly accelerate next year, but job growth will remain weak, and the Federal Reserve will slow the pace of further interest rate cuts. This survey covered 42 professional forecasters, and the results showed that the median economic growth forecast is 2%, higher than the 1.8% in the October survey. Increases in personal spending and business investment are expected to drive economic growth higher, but nearly all professional forecasters agree that the new import tariffs imposed by the Trump administration will drag down the growth rate by at least 0.25 percentage points. The survey report stated, "Respondents believe that the 'tariff impact' is the biggest downside risk to the U.S. economic outlook." Stricter immigration enforcement is also seen as a factor restraining economic growth, while improved productivity is considered the most likely factor to push economic growth above expectations. In addition, inflation is expected to be 2.9% by the end of this year, slightly lower than the 3% forecast in the October survey, and is expected to drop only slightly to 2.6% next year, with tariffs expected to contribute 0.25 to 0.75 percentage points. By historical standards, job growth is still expected to be relatively moderate, with about 64,000 new jobs added per month, far below recent averages. The unemployment rate is expected to rise to 4.5% in early 2026 and remain at that level throughout the year. Due to persistently high inflation and only a slight increase in the unemployment rate, the Federal Reserve is expected to cut interest rates by 25 basis points in December, but only cut another 50 basis points next year, approaching the roughly neutral level of monetary policy. (Golden Ten Data)