Six Years, Millions, 12 Lessons: A Crypto Survival Guide

Author: Miles Deutscher

Translation: AididiaoJP, Foresight News

I have been navigating the cryptocurrency market for over 6 years. I’ve made millions, lost millions, founded crypto projects, and to be honest, I’ve experienced every imaginable emotional roller coaster in this space.

The goal of this article is simple: to break down 12 hard-earned lessons that cost me millions of dollars to learn. By reading this and applying these lessons to your own crypto journey, I hope you can become a better trader, avoid major drawdowns, and increase your chances of changing your life through cryptocurrency.

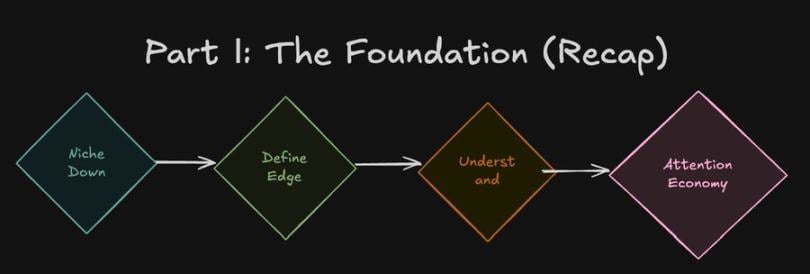

Part One: Fundamentals

Lesson One: The Power of Focusing on a Niche

There are many ways to make money in the cryptocurrency market; your task is to find the one that suits you best and become an expert in that niche.

In 2020 and 2021, I dove deep into DeFi. I mined on multiple chains, explored various DeFi ecosystems, and ran loop/governance strategies.

This gave me a lot of insight into the field: from risk management and position sizing to game theory and flywheel effects.

If I had been simultaneously doing contract trading, on-chain sniping, airdrop farming, and so on, I doubt I could have accumulated the knowledge I have now.

In crypto, being an expert in one area is better than being a jack of all trades.

Lesson Two: Edge Is Everything

The best crypto traders I know have clearly defined their edge and focus 99% of their energy on extracting the best results from it.

Your edge might be speed, precision, patience, risk management, network, or a combination of these, but you need a differentiating factor.

Your market edge largely depends on your personality, existing skill set, time in the field, and other variables.

Define your edge, master it, then execute.

Lesson Three: Only Participate in What You Understand

If you don’t understand something, don’t buy it until you do.

Many people buy tokens because of hype or FOMO, but don’t truly understand the project or its business model.

Never invest in something you don’t truly understand.

In the crypto market, if you haven’t built a solid logic or strong underlying conviction, it will be hard to withstand its volatility.

Lesson Four: Narrative > Fundamentals

Capital flow determines everything.

Narrative always precedes fundamentals.

You might research a project with the best team, the best business model, etc., but if there’s no community, no narrative, and no capital flowing into the sector, none of that matters.

Conversely, there are many tokens and sectors with “poor” fundamentals that skyrocket in price simply because they attract attention.

Study the hype, study the community, study the narrative—this is an attention economy.

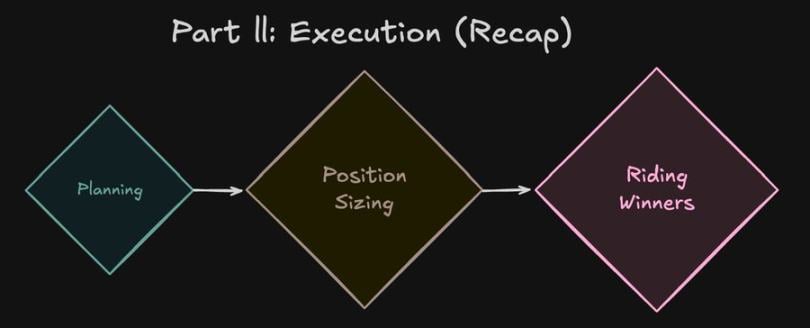

Part Two: Execution

Lesson Five: The Market Punishes Planless Traders

Always trade with a plan; never enter blindly.

Define whether this is a long-term hold or a short-term trade.

Before entering a trade, define your take-profit zones and invalidation points (both technical and fundamental).

Trading without a plan is planning to get liquidated.

In crypto, managing drawdowns is the key to long-term survival.

Lesson Six: Position Sizing Control

This is probably the number one issue retail traders mess up.

You might pick the right coin at the right time, but if you don’t size your entry correctly, it’s meaningless.

Conversely, you might pick the wrong coin at the wrong time, and if you’re overexposed, it could devastate your entire portfolio.

Based on your risk tolerance and portfolio size, you should set the proportion of risk capital per trade (and this proportion should be determined by preset standards: e.g., conviction level, market conditions, market cap, liquidity, etc.).

Lesson Seven: Let Winners Run, Cut Losers Quickly

I keep seeing this mistake.

People sell strong coins and switch to less mature ones, trying to catch uptrends.

You should let winners run as long as possible and cut losers as quickly as possible.

Crypto trading is all about momentum; ride the wave as long as you can and avoid getting wiped out.

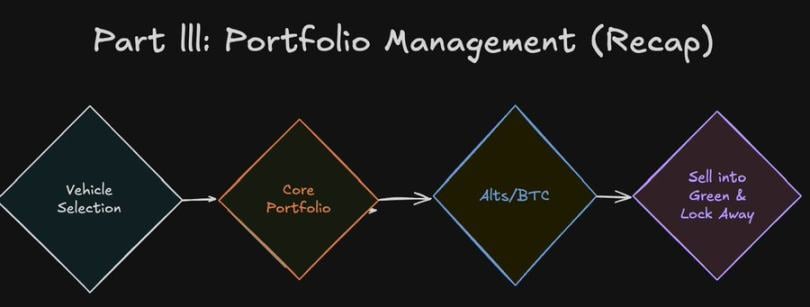

Part Three: Mastering Portfolio Management

Lesson Eight: Tool Selection

Depending on where you are in your journey, you’ll use different tools to achieve your goals.

The tools I used to make my first $10,000 in crypto are completely different from those I use now to manage millions.

Smaller capital can actually be an advantage, as it allows you to trade low-liquidity tokens. There are so many mispricing opportunities to exploit. For big whales, playing these games isn’t worth it, but you can.

Some examples include: airdrop farming, arbitrage, low market cap on-chain tokens, etc.

Lesson Nine: Concentrate, Don’t Over-Diversify

Diversification makes sense for wealth preservation.

But for success, over-diversification can do more harm than good.

I strongly recommend most people hold only 5-10 positions as their core portfolio.

This ensures you have enough time to manage these positions, stay updated, and adjust regularly. A bloated portfolio slows your reaction time.

During market bubbles, you can go beyond this range to seize opportunities, but what you really need is a core portfolio of 5-10 high-conviction assets.

I break this rule with my “degen” portfolio, but it only accounts for 10-20% of my total. If you want to cast a wide net, do it in an isolated environment and concentrate most of your funds on high-conviction plays.

Lesson Ten: From Altcoins to Bitcoin

Remember: your goal is to accumulate bitcoin.

Use altcoins as a source of profit, then accumulate bitcoin.

Then you’ll start treating your trades differently (e.g., charting against bitcoin, analyzing risk factors relative to bitcoin, analyzing macro trends affecting bitcoin, which in turn affect altcoins).

This is a very powerful mindset and can significantly improve your risk management on its own.

Lesson Eleven: Sell During Rallies, Then Lock in Profits

Last cycle, I re-gambled a lot of profits simply because I had stablecoins sitting on exchanges, and I kept gambling with them.

My framework should have been:

Step 1: Always take profits during big altcoin rallies.

Step 2: Convert stablecoins back to fiat to “lock in” gains. Alternatively, withdraw to a hard-to-access cold wallet to prevent overtrading.

Part Four: Modern Secrets

Lesson Twelve: Let AI Do the Heavy Lifting

You should document your entire crypto journey to collect data about yourself and improve.

You can do this by posting on X, integrating MCP with Notion databases, private Google Docs, or whatever works for you.

After recording and collecting data, share it with AI to help identify blind spots in your edge.

Not using a documentation + AI system puts you at a huge disadvantage, and since crypto is a zero-sum game, you really need to fight for every inch of edge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unraveling the Reasons for the Dramatic Price Surge of Virtuals Protocol (VIRTUAL)

Fueling the Surge: How Coinbase's x402 Protocol Integration Drove Virtuals Protocol Token to Double its Value

Metaplanet Unveils BTC Focused Capital and Repurchase Strategy

Mt. Gox Delays Bitcoin Repayments to 2026

Crypto Market Crash Wipes Out $79 Billion in 12 Hours