News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 13)|Portal to Bitcoin mainnet launch and $50M funding; BTC and ETH rebound in short term, over $8.5B liquidated in 24 hours; 2XRP Targets $5.25 After Holding Strong Near the $1.5 Assembly Zone3Clues of the "End of the Bull Market": The "Bull's Tail" Is the Fattest and Everyone Is Bullish

Here’s how ‘Nasdaq bubble burst’ will ‘crater Bitcoin’

CryptoNewsNet·2025/08/10 11:05

Ripple Price Analysis: Will XRP Break Above $4 This Week?XRP Price Analysis: Technicals

CryptoNewsNet·2025/08/10 11:05

Michael Saylor is not sweating the rise of Ethereum treasury companies

CryptoNewsNet·2025/08/10 11:05

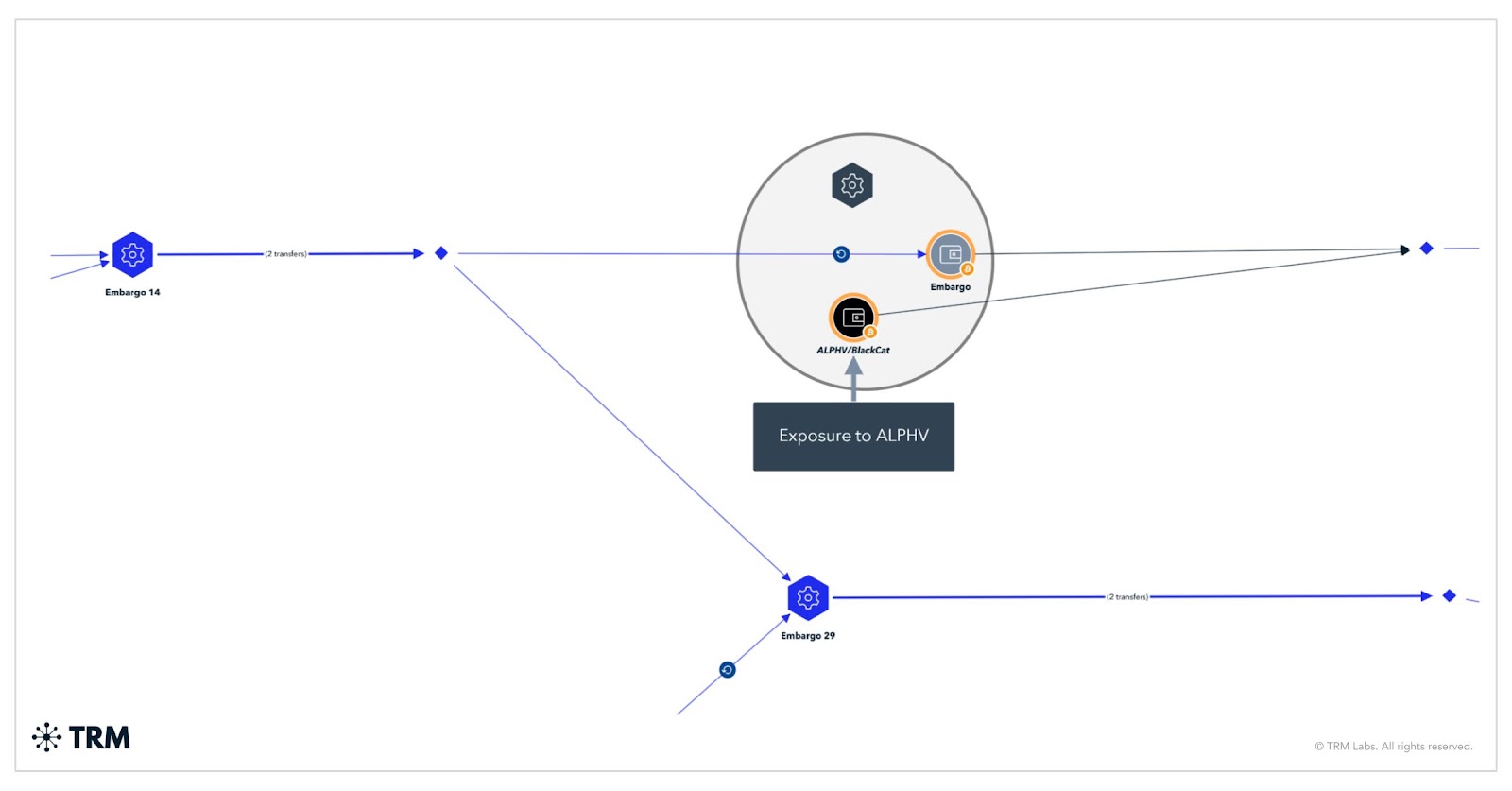

Embargo ransomware group moved $34M in crypto since April: TRM Labs

CryptoNewsNet·2025/08/10 11:05

Bitcoin Price: Remarkable Surge Above $118,000!

BitcoinWorld·2025/08/10 11:00

Best presale crypto to buy now: why Bitcoin Penguins is grabbing eyeballs

Coinjournal·2025/08/10 11:00

Bo Hines Moves From Public Office To Private Sector

Cointribune·2025/08/10 10:55

Ethereum Tops $4K As Hayes Reloads

Cointribune·2025/08/10 10:55

Hyperliquid (HYPE) Soars Higher While Tracing Key Fractal Pattern – What Could Come Next?

CoinsProbe·2025/08/10 10:55

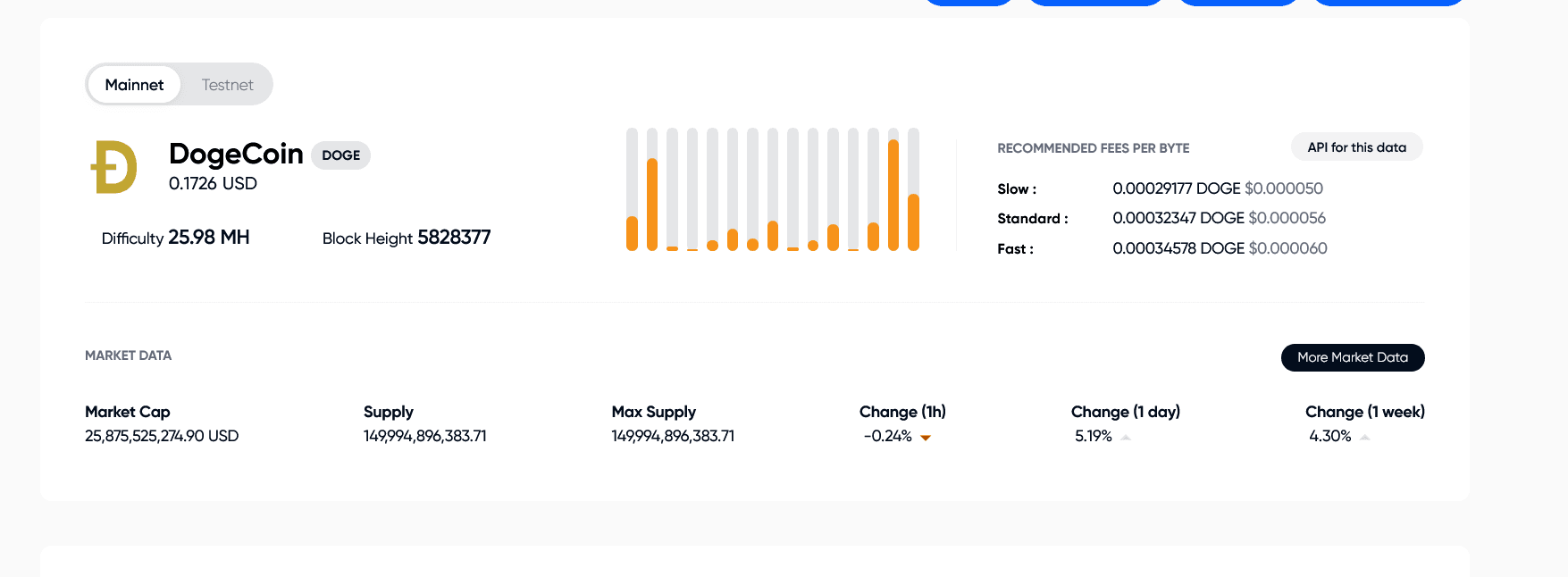

Dogecoin News: Is DOGE About to Pump Hard?

Cryptoticker·2025/08/10 10:45

Flash

- 01:51JPMorgan executive: The bank will participate in cryptocurrency trading business, but will still not provide custody servicesAccording to ChainCatcher, market sources report that the head of JPMorgan's digital asset markets business has confirmed that the bank plans to enter the cryptocurrency trading business. However, there are currently no plans to launch custody services. The company stated that it is instead exploring cooperation with third-party custodians to support its continuously developing digital asset business. JPMorgan acknowledged that through new business integration, bitcoin and related cryptocurrencies will significantly expand their market coverage.

- 01:41glassnode: Excess leverage has been cleared after the crash, while structural capital and institutional demand remainChainCatcher reported that glassnode released its weekly market report, stating that despite the severe impact of the crash event, the overall market structure remains intact. Bitcoin spot trading volume continues to be high, ETF inflows persist, and entity-adjusted transfer volumes indicate strong on-chain activity. These dynamics suggest that while leveraged participants have been forced out, structural capital and institutional demand still exist. Deleveraging marks a significant and necessary adjustment for the bitcoin market. Excessive leverage has been cleared, speculative positions have been reduced, and short-term market sentiment has been realigned. Although liquidity and broader market participation remain unchanged, momentum has slowed and profit-taking has cooled off. The market has now entered a consolidation phase, characterized by renewed caution, selective risk-taking, and a more prudent rebuilding of confidence in both the spot and derivatives markets.

- 01:25Data: A certain hacker address bought back 9,240 ETH, with swing trading increasing its holdings by 280 ETHChainCatcher reported that a suspected hacker bought back 9,240 ETH ($39.45 million), making a profit of 280 ETH ($1.18 million) through ETH trading. On September 1, he withdrew 8,960 ETH from Tornado Cash and sold it at $4,382 per ETH, exchanging it for $39.264 million DAI. Five hours ago today, he bought back 9,240 ETH at a price of $4,269 per ETH. Through this round-trip trade, he ended up with 280 more ETH.