News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Standard Chartered Forecasts Bullish Bitcoin Future Despite Trade Tensions

Theccpress·2025/10/24 15:09

BlackRock Acquires 1,884 Bitcoin for Its ETF

Theccpress·2025/10/24 15:09

Dogecoin price chart projects 25% gains, but first, this must happen

Cointelegraph·2025/10/24 14:36

AI gives retail investors a way out of the diversification trap

Cointelegraph·2025/10/24 14:36

Can Ethereum reclaim $4K? ‘Smart trader’ whale raises ETH long to $131M

Cointelegraph·2025/10/24 14:36

Western inscriptions debut? x402 gold rush floods into PING

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

ForesightNews 速递·2025/10/24 14:32

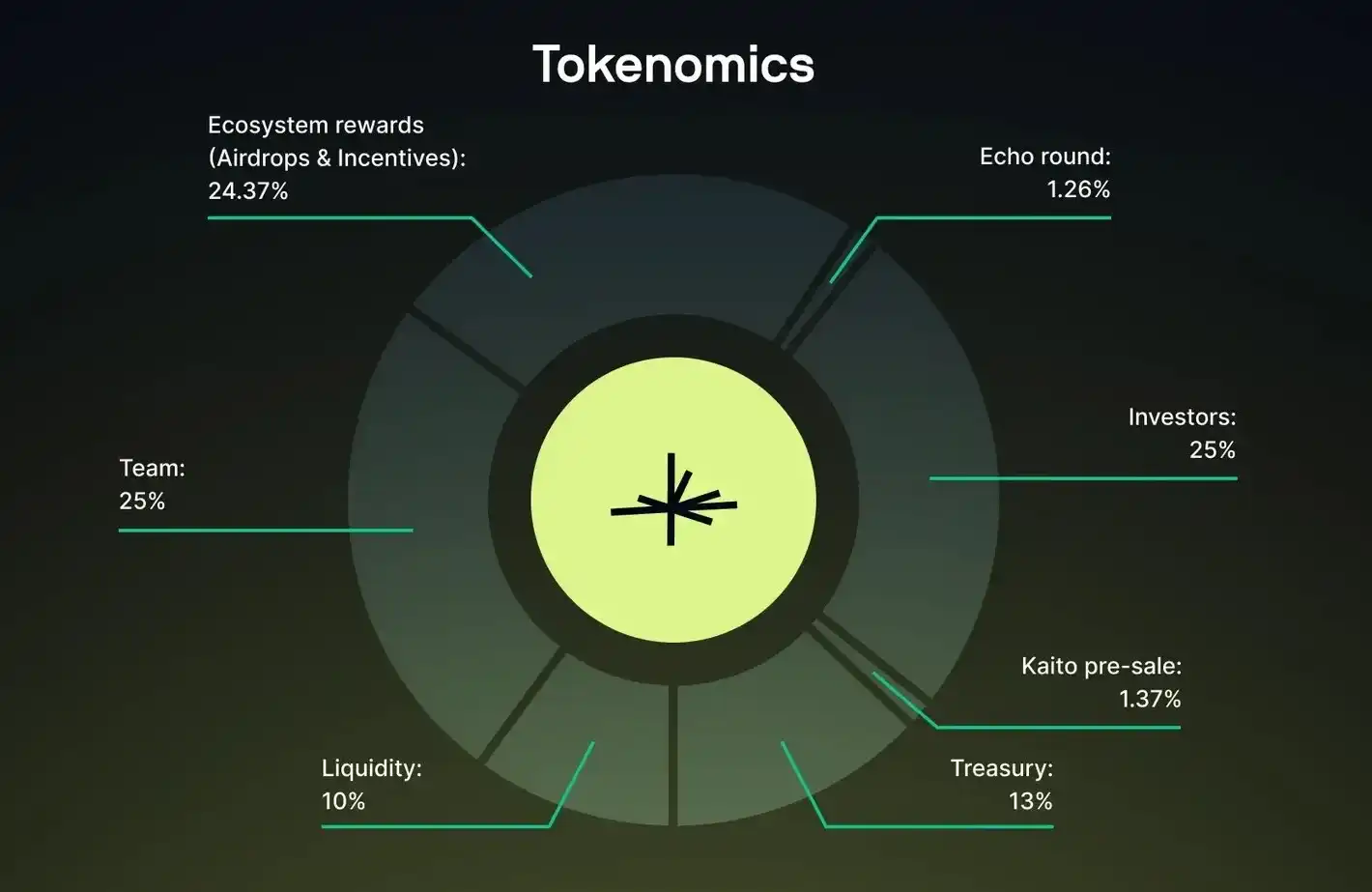

Will MegaETH, with a pre-market value of 5 billions and using an English auction, deliver excess returns?

Polymarket predicts that there is an 89% chance that MEGA will have a trading price exceeding a $2 billions FDV within 24 hours of issuance, and a 50% chance of exceeding a $4 billions FDV.

ForesightNews 速递·2025/10/24 14:31

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

TheCryptoUpdates·2025/10/24 13:33

Exclusive Interview with Brevis CEO Michael: zkVM Scaling Is Far More Effective Than L2

The infinite computing layer leads the way for real-world applications.

BlockBeats·2025/10/24 12:44

Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

BlockBeats·2025/10/24 12:43

Flash

- 16:05Ripple completes acquisition of Hidden Road, which is now renamed Ripple PrimeForesight News reported that Ripple has announced the completion of its acquisition of Hidden Road, which has now been renamed Ripple Prime. Previously, Hidden Road provided institutions with clearing, prime brokerage, foreign exchange (FX), digital assets, derivatives, swaps, and fixed income financing services. This acquisition will make Ripple a cryptocurrency company that owns and operates a global multi-asset prime brokerage. Since the announcement of the acquisition, Ripple Prime's business has grown threefold, and further growth is expected. Ripple Prime will enhance the utility and coverage of Ripple's stablecoin RLUSD. Currently, RLUSD has been used as collateral for various prime brokerage products. Some derivatives clients have chosen to hold RLUSD. According to previous Foresight News reports, Ripple announced in April this year that it would acquire the crypto-friendly prime broker Hidden Road for $1.25 billion, aiming to expand its services for institutional investors.

- 16:04Grayscale Multi-Asset Crypto Fund GDLC Rings Opening Bell at the New York Stock ExchangeForesight News reported that Grayscale announced its multi-asset crypto fund, Crypto 5 ETF (stock code: GDLC), rang the opening bell at the New York Stock Exchange to celebrate the listing of GDLC. GDLC, formerly known as Grayscale Digital Large Cap Fund, is a multi-asset cryptocurrency ETP that allows investors to invest in bitcoin, ethereum, Solana, XRP, and Cardano. It began trading on the New York Stock Exchange Arca in September this year.

- 16:04Bloomberg: TeraWulf's $3.2 billion bond issuance makes it the first crypto mining company to raise funds in the high-yield marketForesight News reported, citing Bloomberg, that TeraWulf has become the first cryptocurrency mining company to raise funds in the high-yield market through a $3.2 billion junk bond issuance. This transaction marks the largest junk bond deal led by Morgan Stanley since the famous 1989 leveraged buyout of RJR Nabisco. The deal attracted over $11 billion in orders, thanks to a "backstop" guarantee provided by Google, a subsidiary of Alphabet Inc. This guarantee will take effect once the data center is operational and leased by the UK startup Fluidstack. According to sources, to ease concerns about unfinished infrastructure, about a week before the transaction launched, TeraWulf's senior management hosted nearly 40 potential investors at a site near Buffalo, New York, for more than three hours of Q&A. In addition, creditors will receive a 7.75% yield, significantly higher than the 5.7% average yield for bonds with similar ratings, which also contributed to the success of the deal. According to sources, cryptocurrency miner Cipher Mining Inc. is the next target and is expected to issue several billions of dollars in junk bonds, which will also be backed by Google. Morgan Stanley is charging substantial fees for its role. The investment bank advised on TeraWulf's convertible bond deal in August and is now working with Cipher to issue similar bonds.