Western inscriptions debut? x402 gold rush floods into PING

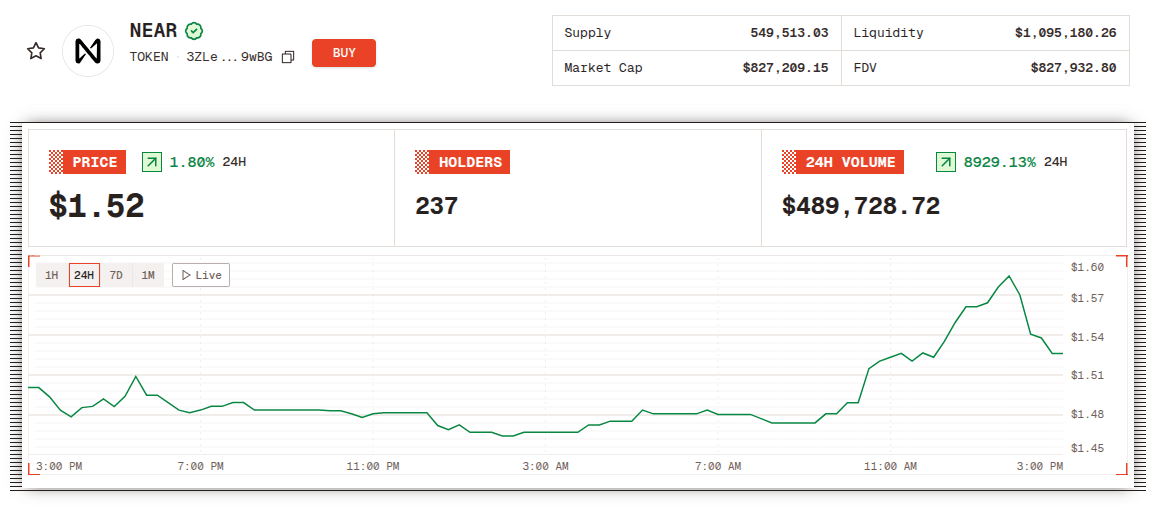

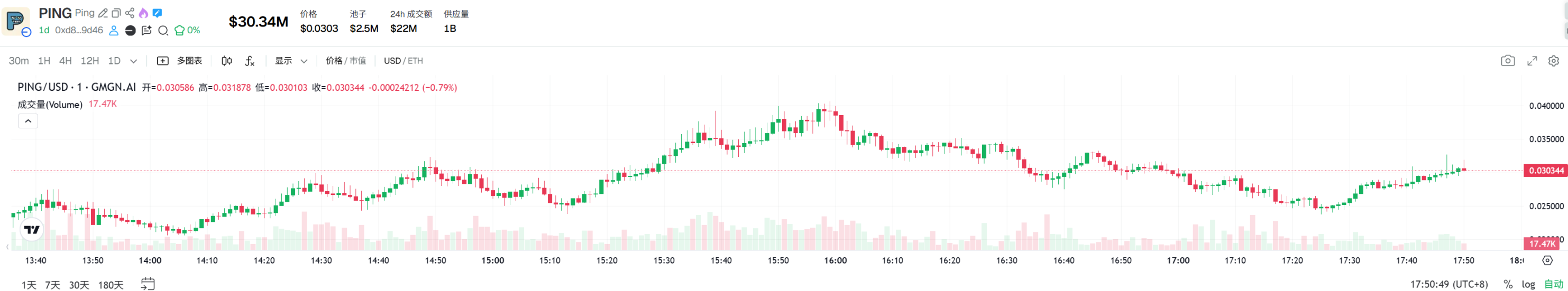

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

Written by: 1912212.eth, Foresight News

The once-booming inscription story in China has long faded away, and even ORDI is rarely mentioned anymore. However, recently, the popularity of the x402 protocol has begun to flow from discussions in Western communities to the East.

The first token issued by the x402 protocol, PING, quickly recorded returns of over tenfold. According to GMGN market data, PING currently has a market capitalization of about $30 million, with a 24-hour trading volume of $22 million.

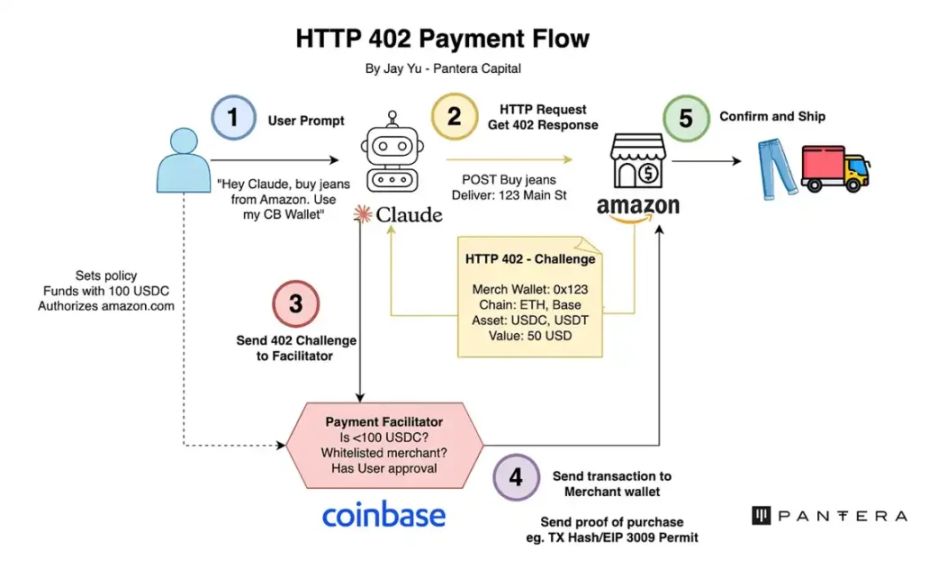

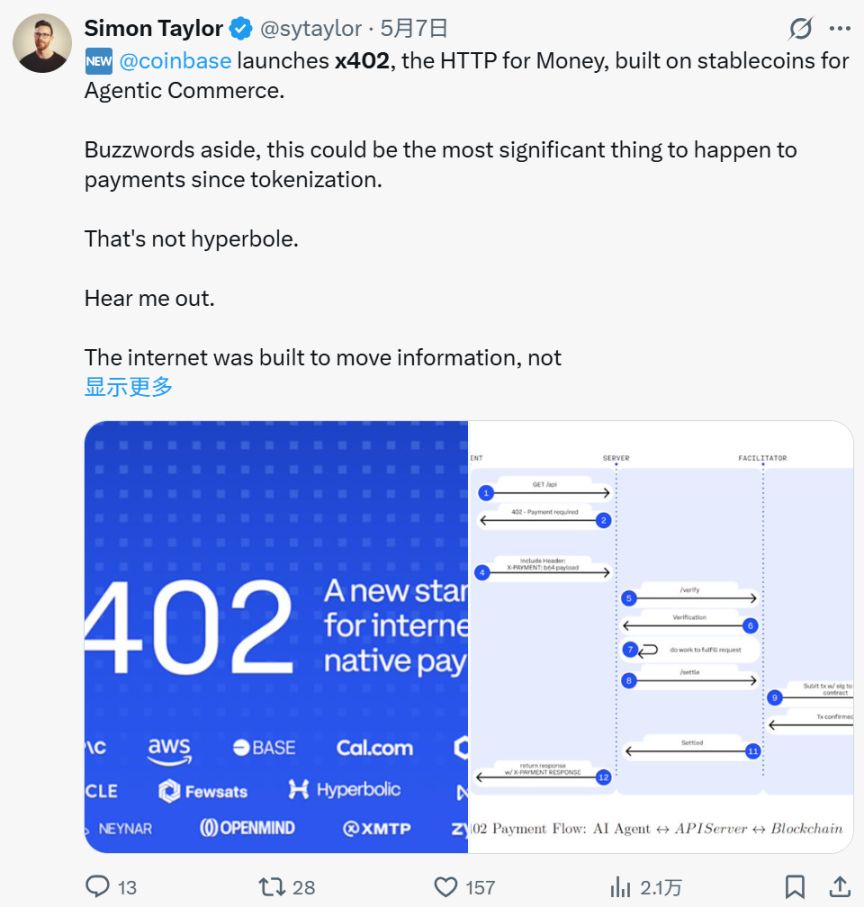

In January 2025, Coinbase officially launched the x402 protocol, positioning it as an "Internet-native payment standard" aimed at activating the HTTP 402 code and deeply integrating with the Base chain. Early versions focused on developer toolkits, providing Python and Node.js libraries for easy integration.

Its name is derived from the HTTP 402 status code (Payment Required), a long-unused HTTP response code indicating that payment is required to access a resource. x402 cleverly activates this code, embedding payment functionality through blockchain technology to enable seamless transactions without registration, email, OAuth, or complex signatures.

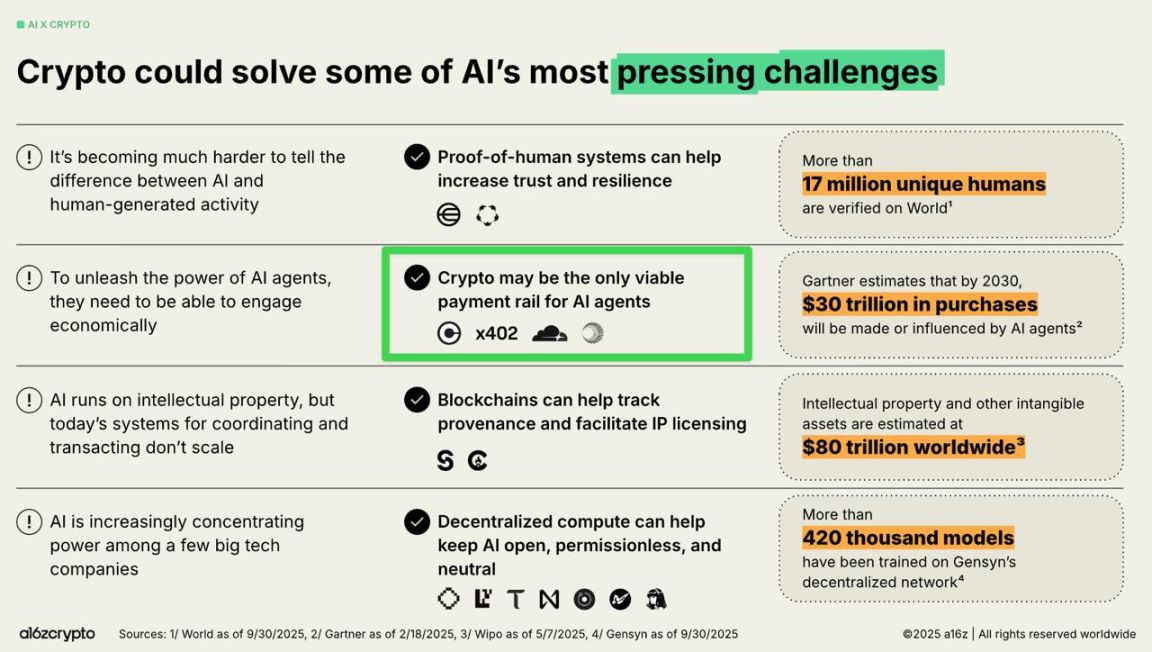

At its core, x402 leverages its low cost and high speed. The protocol supports micropayments in stablecoins such as USDC, with settlement times of just 2 seconds and zero protocol fees. This makes it particularly suitable for autonomous payment scenarios involving AI agents. For example, an AI agent can directly request an API and pay a small fee for data without human intervention. This addresses pain points in traditional payment systems, such as account creation, KYC verification, and fiat conversion, ushering in the era of "agent-to-agent" payments.

The protocol workflow includes: the client initiates an HTTP request, the server returns a 402 code with payment details; the client generates an EIP-712 signature to authorize fund transfer; a facilitator (such as Coinbase's CDP) processes the transaction and ensures compliance (e.g., KYT/OFAC checks). This applies not only to Web3 applications but can also extend to Web2 services, enabling cross-sector integration.

The core value of x402 lies in empowering the AI economy. With the rise of AI agents, such as autonomous agents needing real-time payment tools, data, or computing resources, x402 provides a frictionless solution. It supports multi-chain compatibility, including Avalanche, Polygon, and Solana, with further expansion planned. Compared to traditional payments like Visa or Google's AP2, x402 focuses more on decentralization and instant settlement, avoiding T+2 delays.

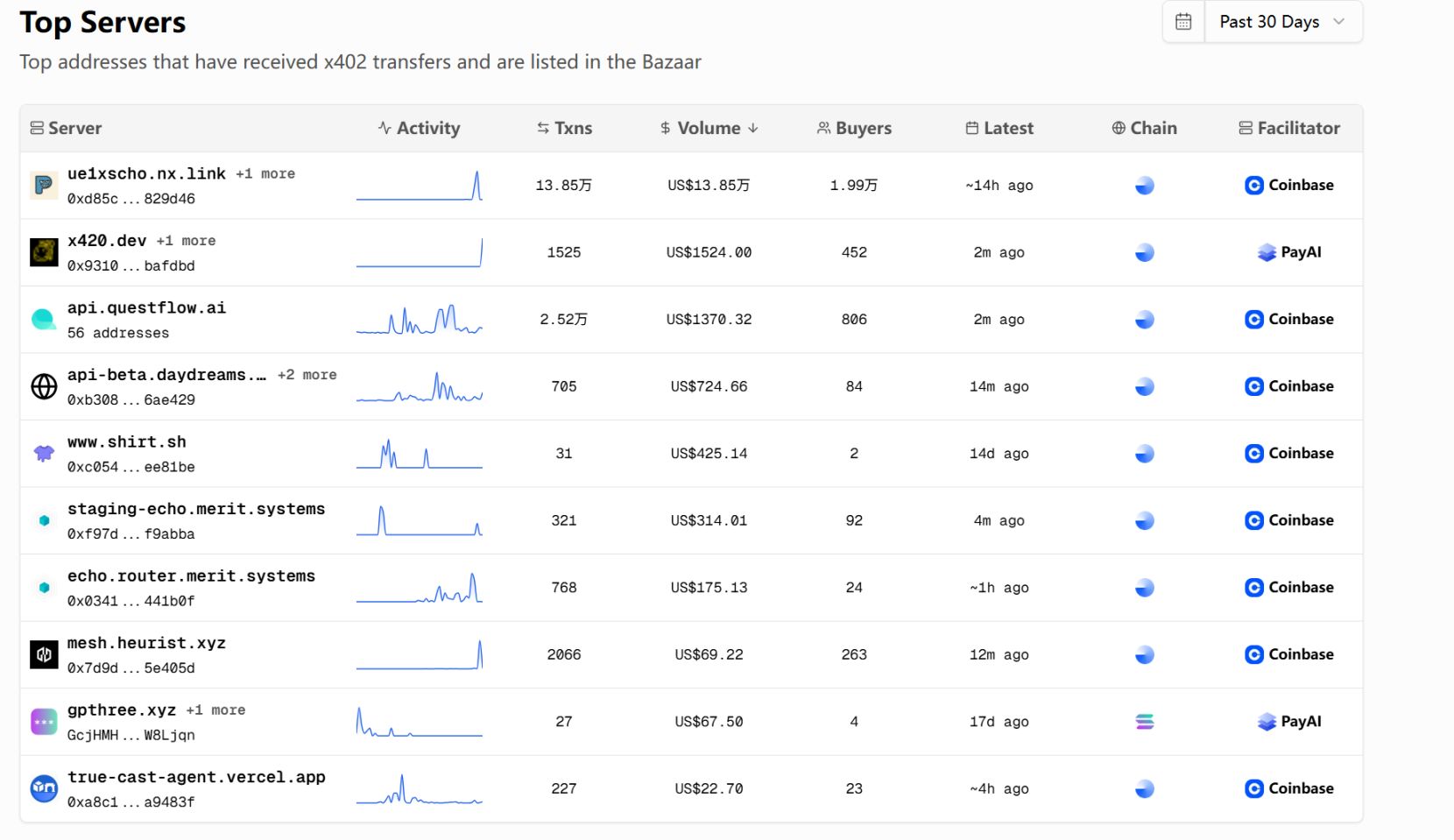

This month, x402 has seen explosive growth within the Base ecosystem. The protocol's open-source nature has attracted numerous projects, including Kite AI (providing identity and payment infrastructure for agents), Questflow (multi-agent coordination layer), and Firecrawl (web scraping API). The ecosystem page shows dozens of projects covering infrastructure, client integration, and server endpoints. Meanwhile, x402's trading volume has surged, especially after the launch of PING, with total trading volume exceeding $14 million in the past 7 days and 31,400 buyers.

The PING token was launched on the Base chain on October 23 (address 0xd85c31854c2B0Fb40aaA9E2Fc4Da23C21f829d46). Users pay $1 USDC via the CLI interface to randomly receive 5,000 PING, with uncertain success rates, similar to inscription minting.

Users enter the official website, then enter the contract address in the search box or find the corresponding token, connect their wallet, and the Fetch $1 label will be displayed.

Participants can choose based on a comprehensive consideration of trading volume, number of buyers, and number of transactions (Txns).

Currently, the x402 ecosystem also includes several projects that have issued tokens and those that have not, such as Questflow (SANTA), AurraCloud (AURA), Meridian (MRDN), and Kite AI (which has completed $33 million in financing and has not yet issued a token).

As early as May this year, user Simon Taylor commented, "x402 allows digital currency to flow like data, creating a truly meaningful subscription alternative in the Internet economy." He boldly predicted: x402 can bring security to money like HTTPS and become the standard supporting trillions of transactions.

The explosive popularity of x402 seems to remind some players of the prelude to inscriptions, with its market cap soaring from 0 to $30 million in a short time. As one community member commented, "To put it simply, the reason for the explosive narrative of x402 is just this: the market is extremely hungry for narratives that are systematic, logical, and imaginative."

A user with the Twitter ID nake13 stated that x402 is simply a very basic payment protocol. "x402 is not quite like the payment platforms we imagine, because it's so simple you can't imagine it. It only focuses on the verifiability of on-chain payments, and that's it. It doesn't have any extra features, such as whether the merchant delivers the product after the user pays, or if the user wants a refund, etc.—x402 doesn't care. It only cares whether the user has made a payment for a 'product' and tells the merchant the payment result, and that's the end of it."

Although x402 is currently enjoying some popularity, the crypto market's heat changes rapidly. Foresight News reminds participants to pay attention to risk control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Critical Bitcoin 2026 Forecast: Fidelity Executive Predicts Market Struggles

Revolutionary Move: Forward Industries to Tokenize Its Shares, Unlocking 6.8M SOL Treasury

Digital Euro Breakthrough: ECB Completes Crucial Technical Preparations, Lagarde Reveals

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral