News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

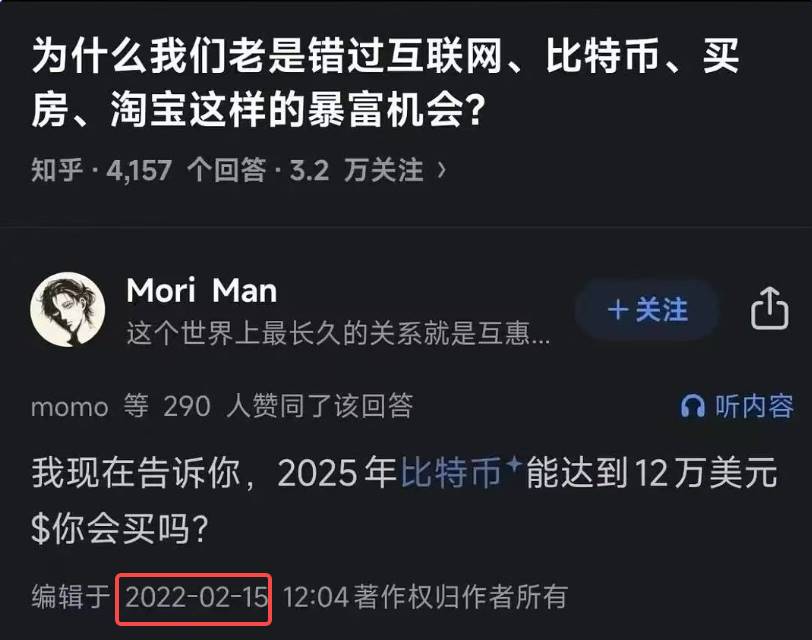

$1 million could possibly arrive by 2028.

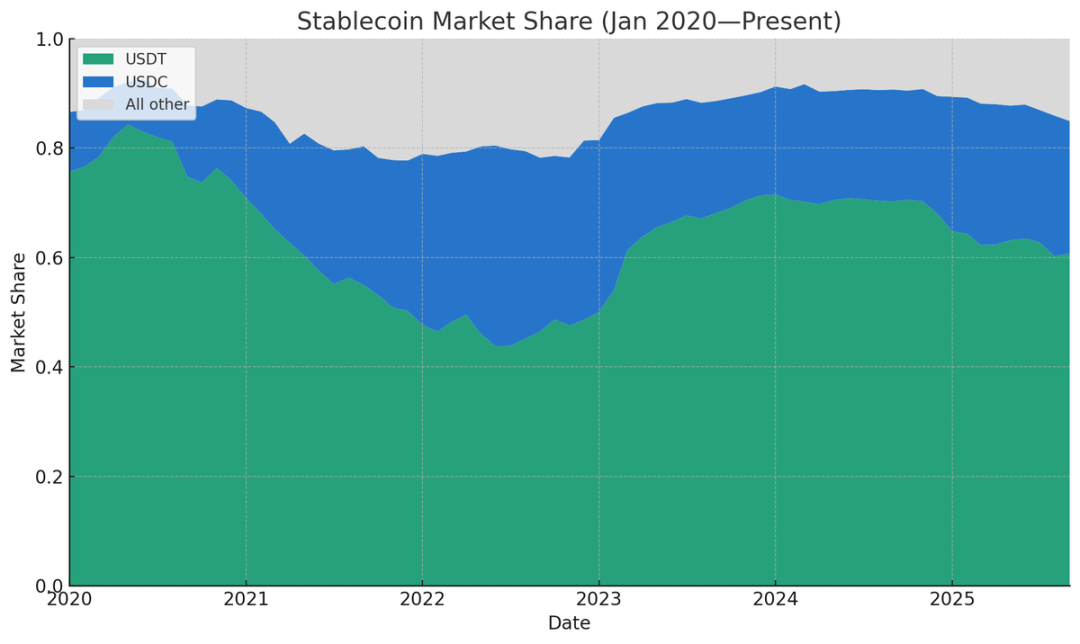

Multiple factors are gradually breaking the duopoly of Tether and Circle.

The value of the 640,031 bitcoins held by MicroStrategy once exceeded $80 billion. This amount puts the scale of its corporate treasury close to the levels of Amazon, Google, and Microsoft, each of which holds approximately $95 billion to $97 billion in cash or cash equivalents.

Explore how BlockDAG’s $420M presale and TGE code frenzy spark record demand, while Chainlink price recovery and Algorand price prediction boost market optimism.Algorand Steadies With Promising 2025 ForecastChainlink Eyes Strong Reversal MomentumBlockDAG’s Global F1® Partnership Fuel Market MomentumFinal Word!

- 06:02Arthur Hayes New Article: Bitcoin’s Four-Year Bull Cycle May Fail, USD and RMB Liquidity Become Key VariablesBlockBeats News, October 9, Arthur Hayes, co-founder of a certain exchange, published his latest article "Long Live the King!". The article states that each bitcoin bull market peak is related to changes in the "price and supply" of the US dollar and the Chinese yuan, and that the current cycle differs from the previous four-year pattern. He reviewed the three cycles from 2009 to 2021: when US dollar/Chinese yuan credit growth slowed or contracted and interest rates rose, bitcoin peaked and declined; when there was large-scale US dollar QE, helicopter money, or strong credit expansion in China, the price strengthened. The article points out that the Federal Reserve's tendency to lower interest rates and expand money supply, together with signals from China ending deflation and moderately increasing credit, may extend the current rally.

- 06:02LAVA surpasses $0.16, with a 24-hour increase of 193%BlockBeats News, on October 9, according to market data, the token LAVA of modular blockchain infrastructure developer Lava Network is currently priced at $0.1603, with a 24-hour increase of 193%.

- 06:02Bank of America becomes the reserve custodian for stablecoin payments by digital bank AnchorageBlockBeats news, on October 9, crypto-friendly digital bank Anchorage Digital Bank announced that Bank of America has become its reserve custody service provider for payment stablecoins. It is reported that Anchorage Digital Bank is currently a crypto-native bank holding a U.S. federal charter, operating under the direct supervision of the Office of the Comptroller of the Currency (OCC).