Bitget Daily Digest(October 9)|UK FCA lifts retail ban on crypto ETNs; Linea to unlock 1.08 billion tokens tomorrow; Bitcoin ETF sees net inflow of 7,743 BTC in a single day.

Today's Preview

-

The UK Treasury establishes a "Digital Markets Supervisor" to advance the blockchain transformation of wholesale markets;

-

BlackRock’s Bitcoin ETF holdings exceed 800,000 BTC. This means that in 437 trading days since launch, IBIT has purchased an average of 1,836 BTC per day.

-

Linea (LINEA) will unlock 1.08 billion tokens worth approximately $29.6 million on October 10, 2025 (UTC+8);

Macro & Hot Topics

-

The UK FCA will allow retail access to crypto ETNs starting October 8, provided they are listed on FCA-approved UK exchanges. The derivatives ban remains in place;

-

A dormant Bitcoin whale sold 3,000 BTC (about $364 million USDC) on the HyperLiquid platform on October 8 after three weeks of inactivity. The whale still holds 46,765 BTC;

-

This week sees major token unlocks from several leading projects: Linea (1.08 billion tokens), Aptos (11.31 million tokens, valued at about $61.3 million), and Axie Infinity (652,500 tokens), among others—potentially impacting market liquidity;

Market Updates

-

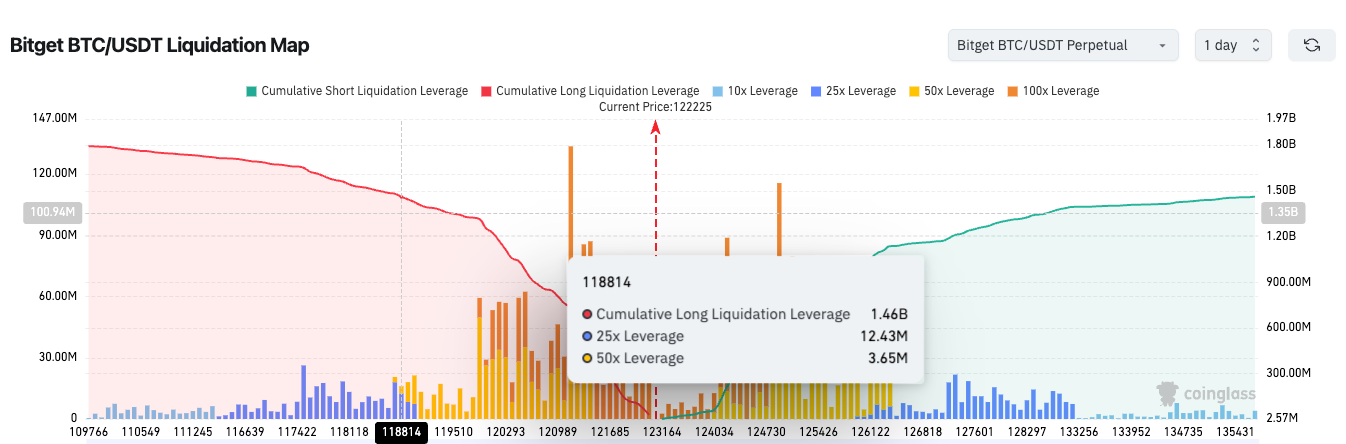

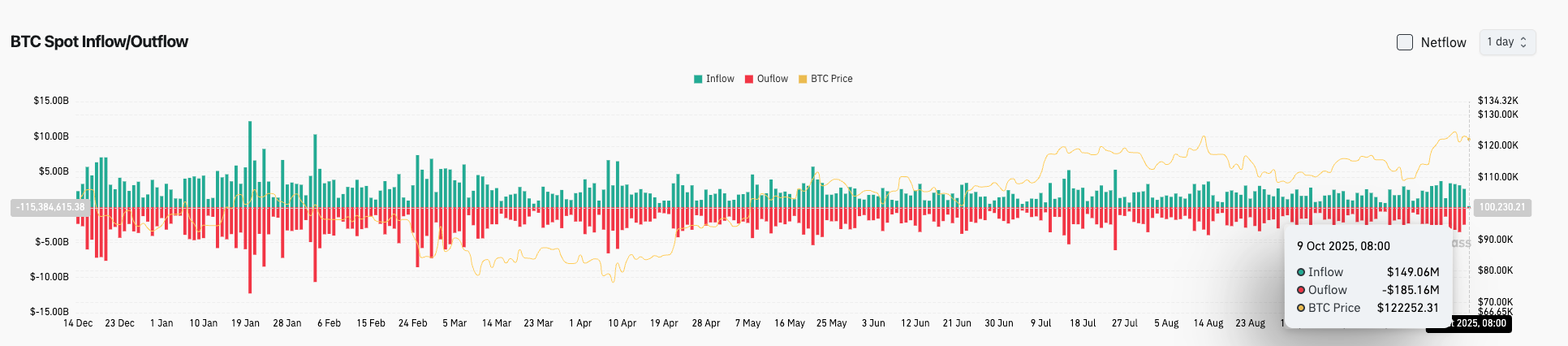

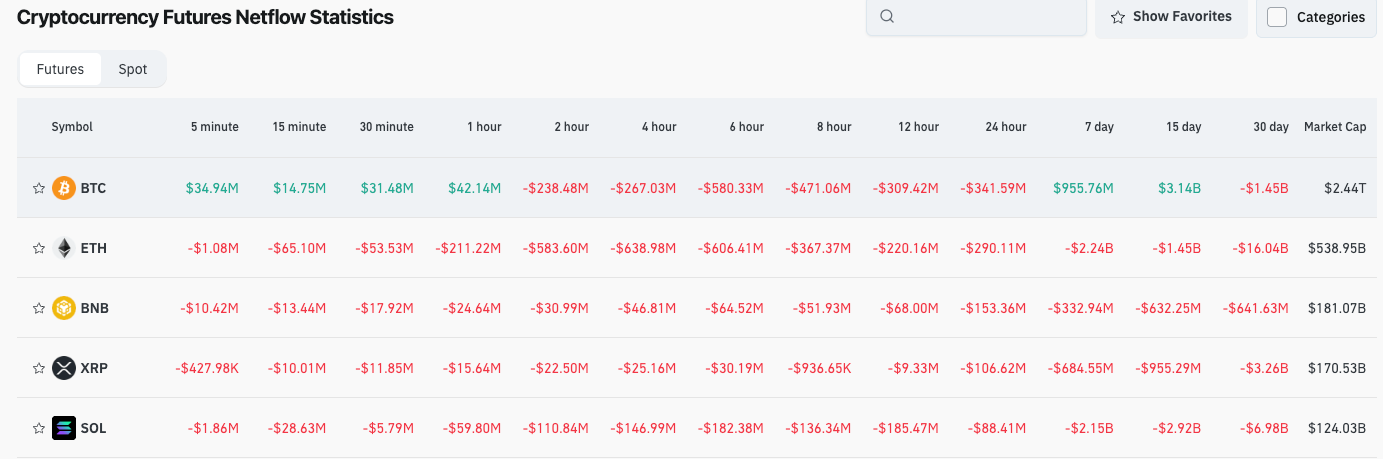

BTC and ETH experienced short-term pullbacks. Market sentiment is optimistic, with active long-short confrontation. Over the past 24 hours, total liquidations across the market reached about $431 million. Investors should stay alert to volatility risks;

-

US stocks showed mixed performance: Nasdaq rose 1.12%, S&P 500 up 0.58%, and Dow Jones slightly down;

News Updates

-

The US government shutdown has entered its second week, significantly delaying progress on crypto market structure legislation;

-

Wisconsin Congressman Bryan Steil stated that the Republican Party aims to advance the “CLARITY Act,” a crypto market structure bill, by 2026;

-

SEC Chairman Paul Atkins said the SEC plans to officially establish a crypto “innovation exemption” rule by the end of 2025 or early 2026 to foster the development of emerging digital asset technologies;

Project Developments

-

DeFi Development Corp. and Superteam Japan have launched Japan’s first Solana-based treasury project, DFDV JP;

-

Aptos (APT) will unlock 11.31 million APT (about 2.15% of circulating supply) on October 11;

-

Axie Infinity (AXS) will unlock 652,500 AXS (~0.25% of circulating supply) on October 9;

-

Jito (JTO) is scheduled to unlock some tokens this week, specific amounts TBD;

-

Solana treasury firm Helius plans to buy at least 5% SOL, and will seek a secondary listing in Hong Kong;

-

BlackRock's IBIT and ETCH products have reached new highs in BTC and ETH holdings, respectively;

-

HyperLiquid has become the main platform for whale BTC sell-offs;

-

Superteam Japan continues to expand Solana ecosystem partnerships in Japan;

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.