Monero price prediction: XMR price shows strong upward momentum as bullish sentiment rises and resistance approaches.

As of Wednesday's press time, Monero (XMR) was trading near $430, up 5% from the previous day. This privacy coin has once again attracted retail interest, as evidenced by the increase in open interest and long positions. Nevertheless, there are still some technical issues. Outlook Monero's price is approaching the key resistance level of $439, with mixed movements.

Sentiment Around Monero Turns Bullish

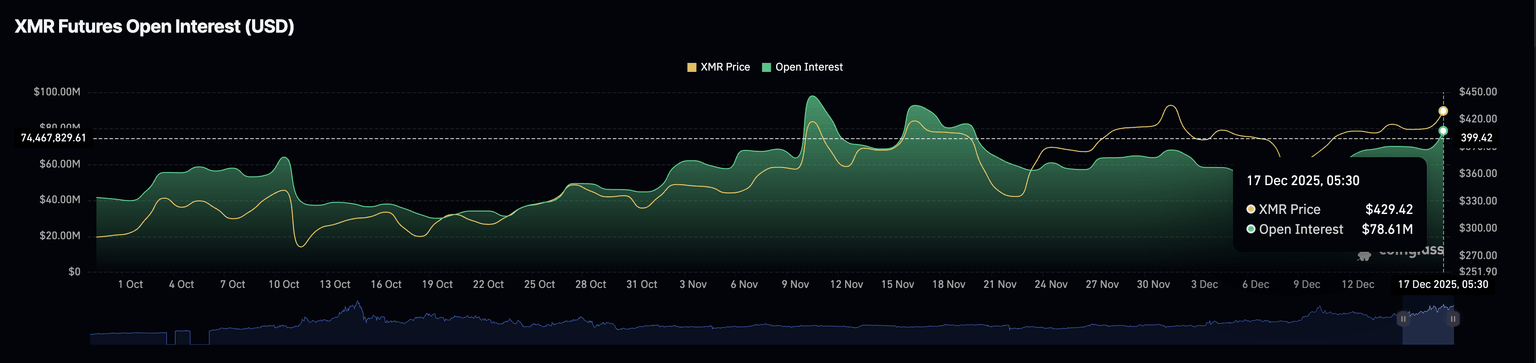

According to CoinGlass data, XMR futures open interest (OI) stands at $78.61 million, up from $68.15 million on Tuesday. The increase in open interest reflects that traders are increasing their risk exposure to XMR derivatives, including both long and short positions.

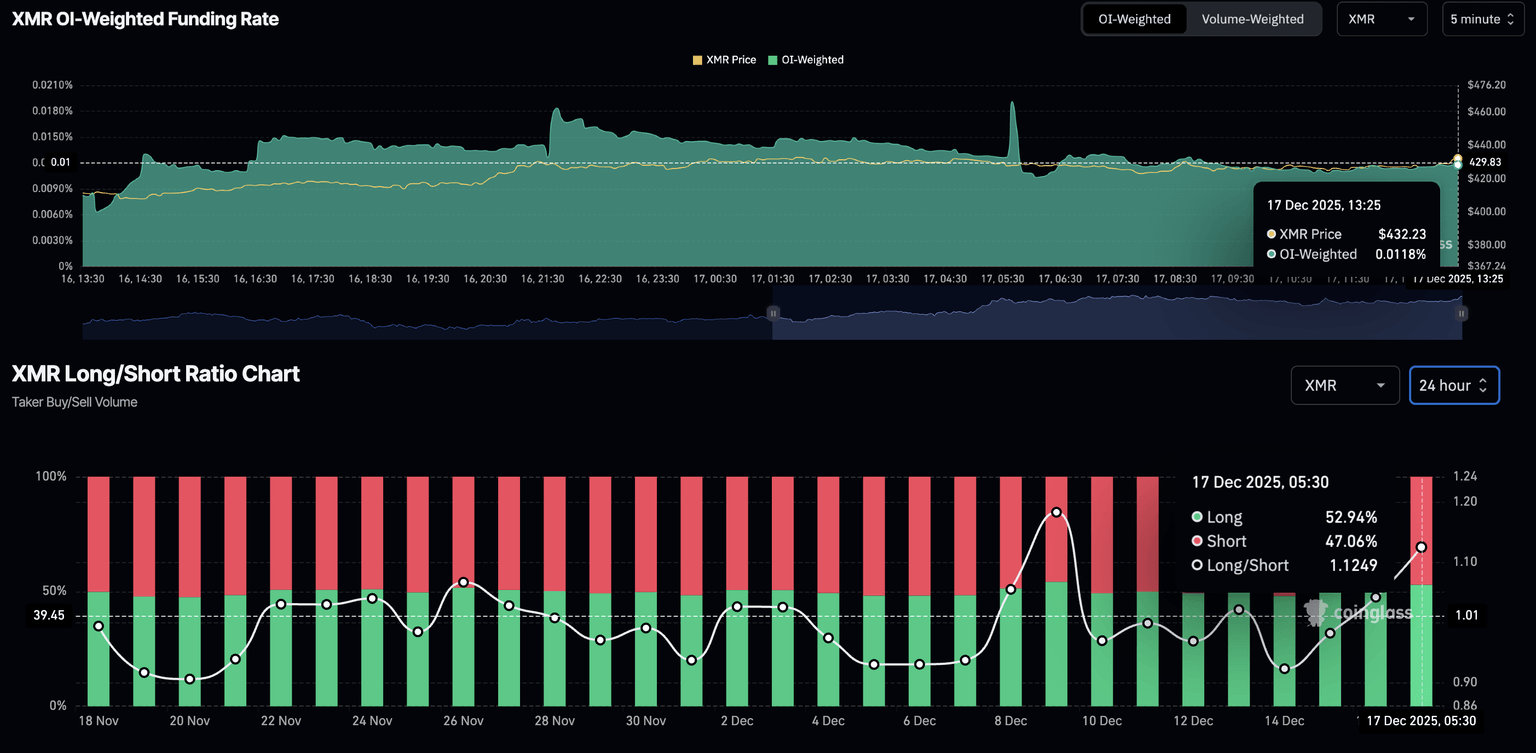

The main bullish signal comes from the weighted funding rate of open interest, currently at 0.0118%, indicating rising buying pressure as longs are willing to pay a premium to hold their positions. In addition, the long-short ratio chart shows a steady increase in long positions, rising from 47.99% on Sunday to 52.94%.

Monero Shows Strong Momentum, Breakout Probability Increases

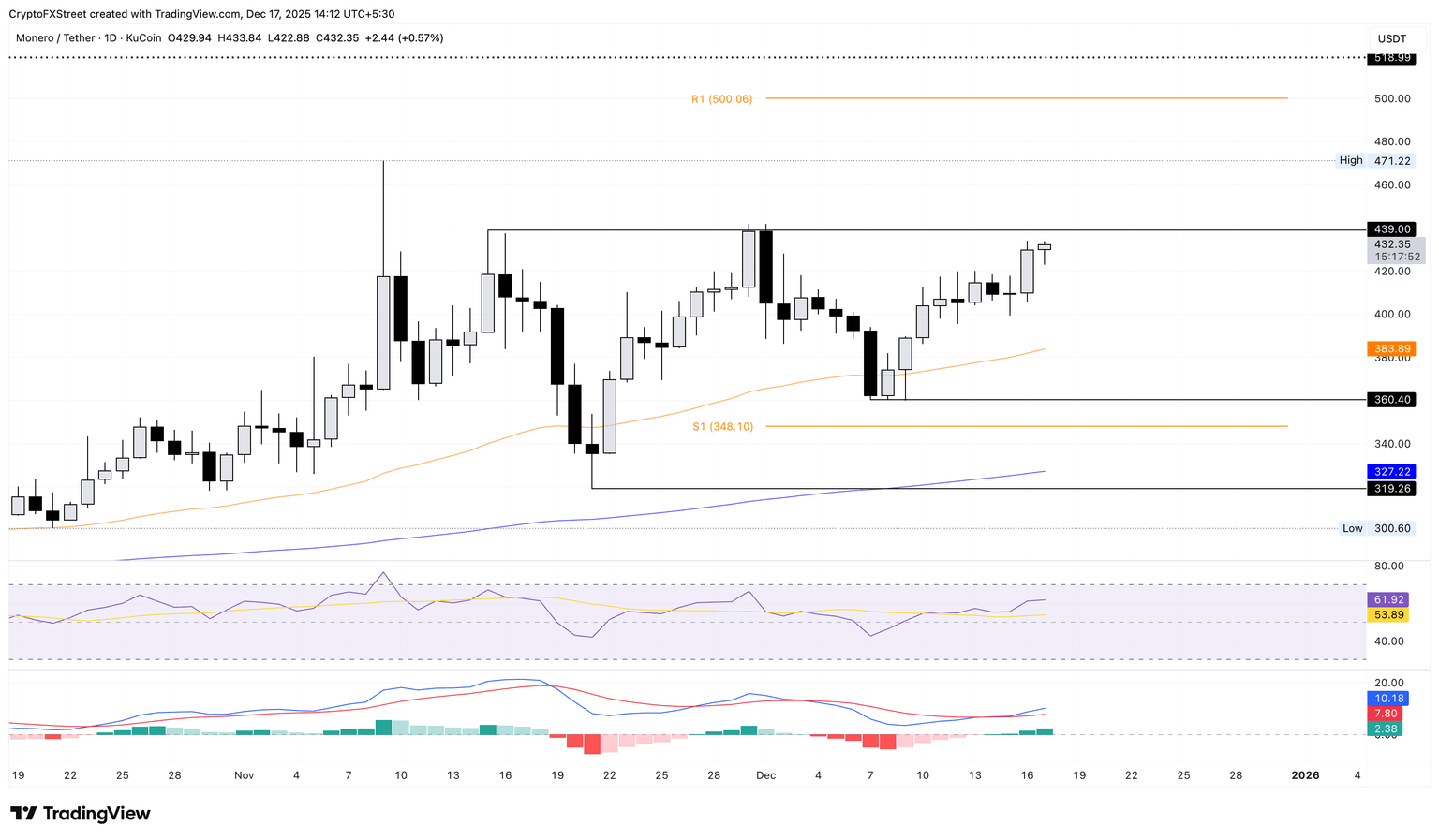

Since rebounding from a low of $360 on December 8, Monero (XMR) has been steadily rising and is now approaching $439. The $439 level has acted as resistance, halting Monero's rise twice since mid-November. If Monero's V-shaped rebound can break through this resistance, it is likely to continue rising toward the November 9 high of $471.

Technical indicators on the daily chart show that the privacy coin is building momentum, increasing the likelihood of a breakout rally. The Relative Strength Index (RSI) is currently at 61 and still rising, with room to climb before entering the overbought zone, indicating growth potential.

On Tuesday, the Moving Average Convergence/Divergence (MACD) indicator crossed above the signal line, indicating a shift in trend momentum to bullish. If the MACD continues to rise and the green histogram bars remain above the zero axis, it will indicate strengthening bullish pressure.

On the downside, if XMR fails to hold above $400, it may test the 50-day exponential moving average at $383.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Fraud Suit Forces Crypto VC Shima Capital into Wind-Down

Nearly 100 billions Shiba Inu (SHIB) saved the world within 24 hours

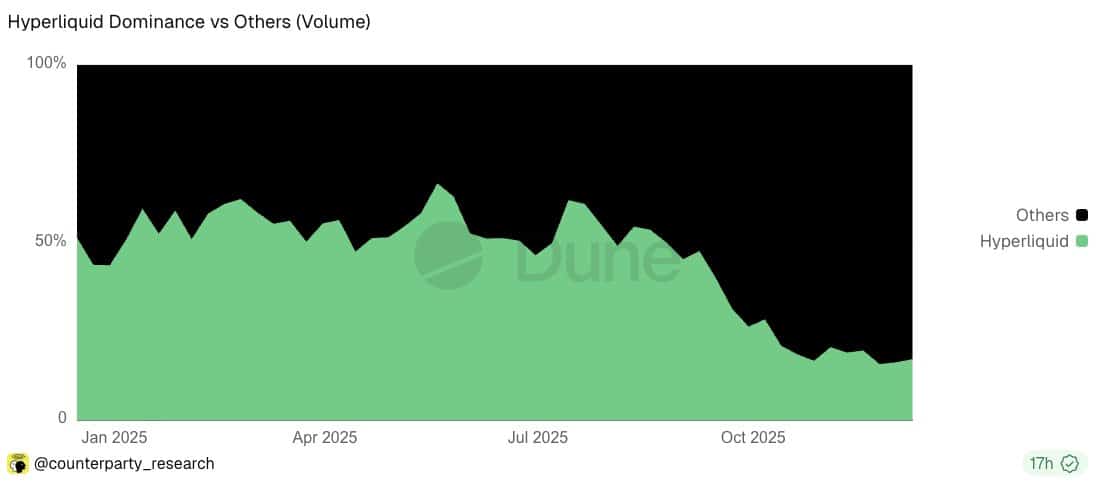

Cantor turns bullish on Hyperliquid, sees ‘a path for HYPE eclipsing $200’

Aave Ends SEC Probe, Outlines 2026 Roadmap To Refocus DeFi Growth