Despite struggling at around $27 and down over 50% in 2025, the Hyperliquid token could grow seven times in the next few years.

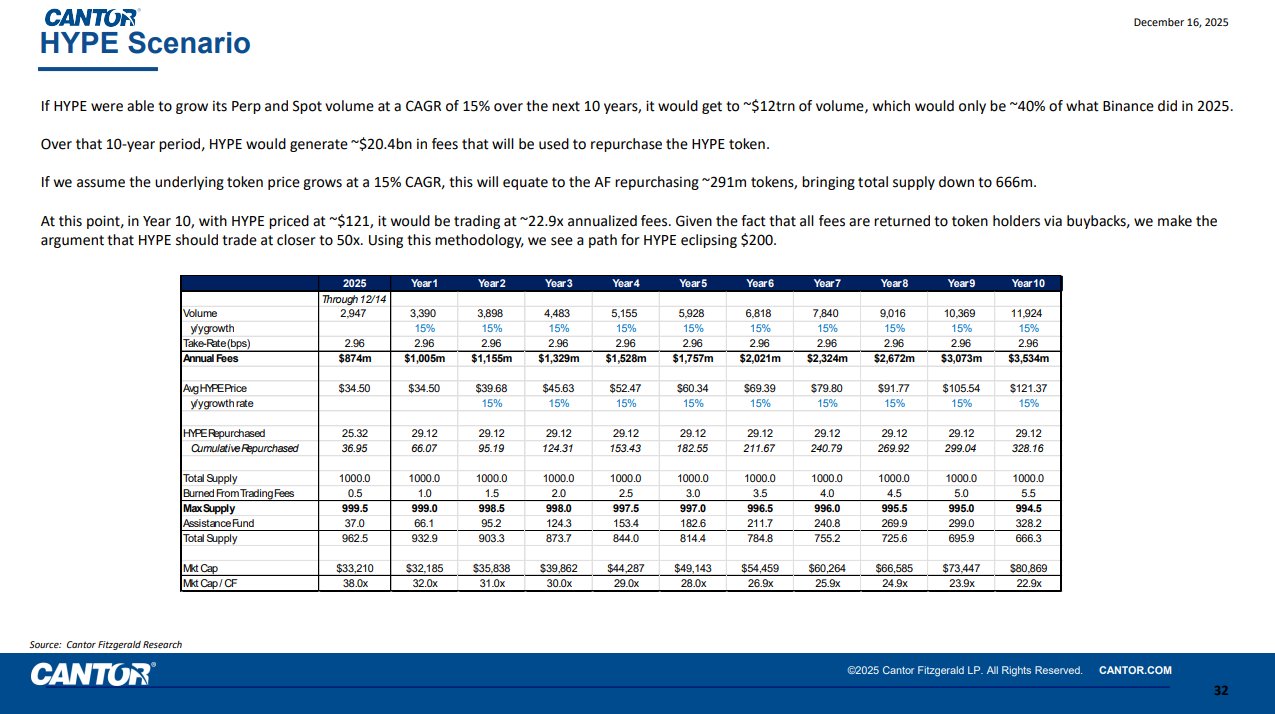

According to investment bank Cantor Fitzgerald’s latest report, Hyperliquid DEX volume could grow at a 15% annual rate, resulting in $20 billion in fees over the next 10 years.

Since most of the fees are used for token buyback, Cantor projected that Hyperliquid’s [HYPE] value could trade at a 22.9x-50x multiple of annualized fees, or between $121 and over $200 per token.

Is Lighter or Aster a threat?

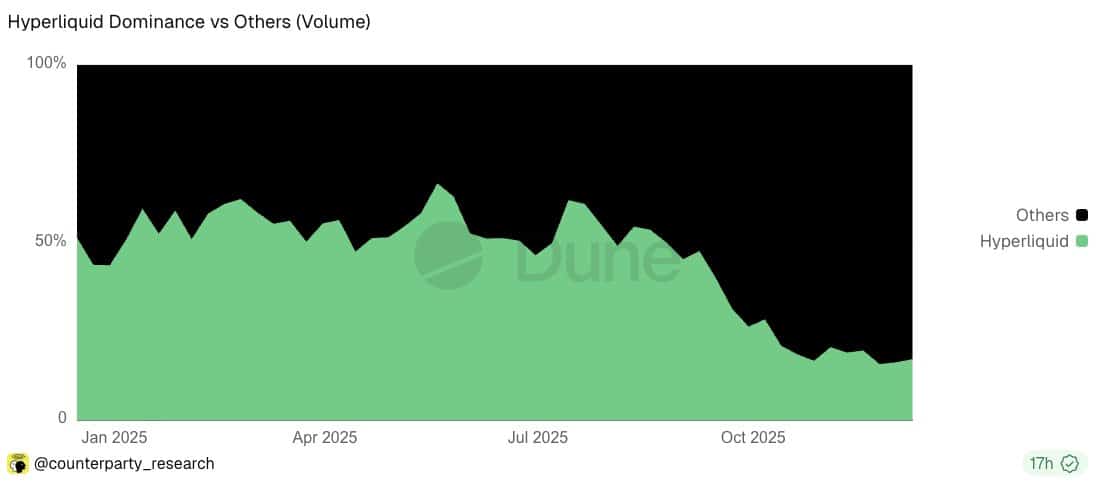

Hyperliquid DEX has evolved into a dominant perpetual platform with CEX-level features.

However, new players, including Lighter, Binance Labs-backed Aster, and others, have reduced its market share to 17%. This was a decline from 60% market dominance in May, indicating a 40% drop in share.

Although Cantor acknowledged that competition will drive short-term sentiment, it downplayed the long-term impact of rivals.

“We believe fears over the current competitive landscape to be overblown, as ‘point tourists’, or those hopping from platform to platform to earn points.”

It added that HYPE-focused crypto treasuries led by Hyperliquid Strategies and Hyperion DeFi will drive further adoption of the platform.

Bullish catalysts for HYPE

With the likely launch of U.S. spot HYPE ETFs, these could be positive catalysts for the token in the mid-term. Perhaps, it could help reverse the 54% losses in 2025 and boost sentiment despite monthly unlocks.

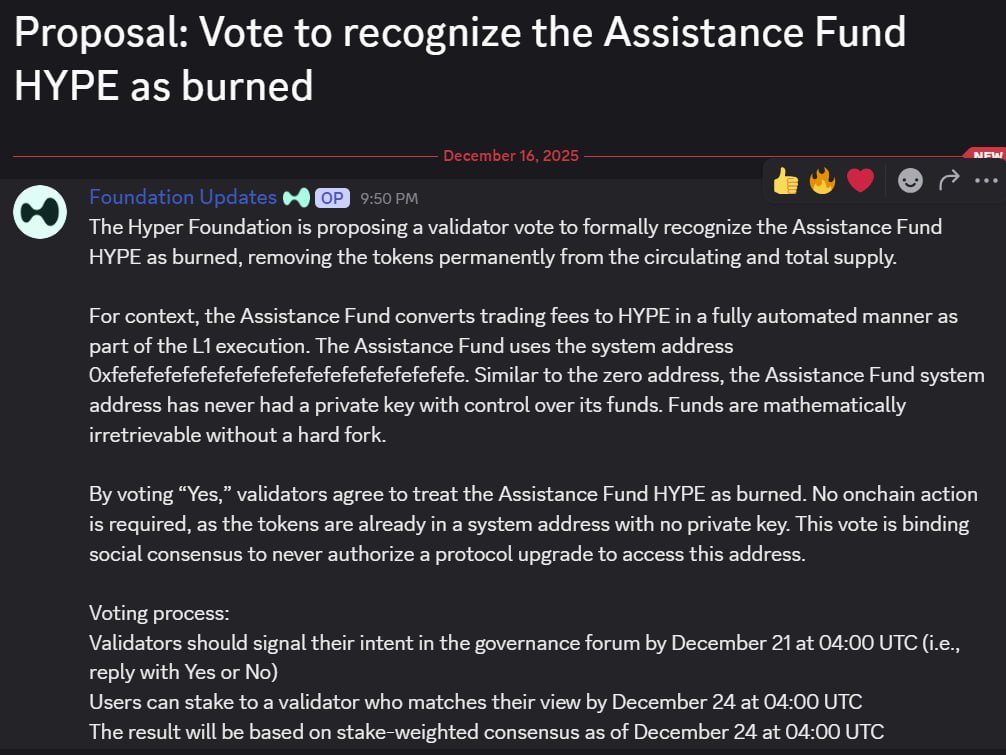

Besides, Hyperliquid Foundation has proposed to burn the 37 million tokens from the buyback program and could remove 13% of the supply, a deflationary move that could boost HYPE’s valuation.

Will $25 level hold?

Still, the short-term muted price action was worrying. Based on these catalysts, the current levels could be a discounted window to add positions.

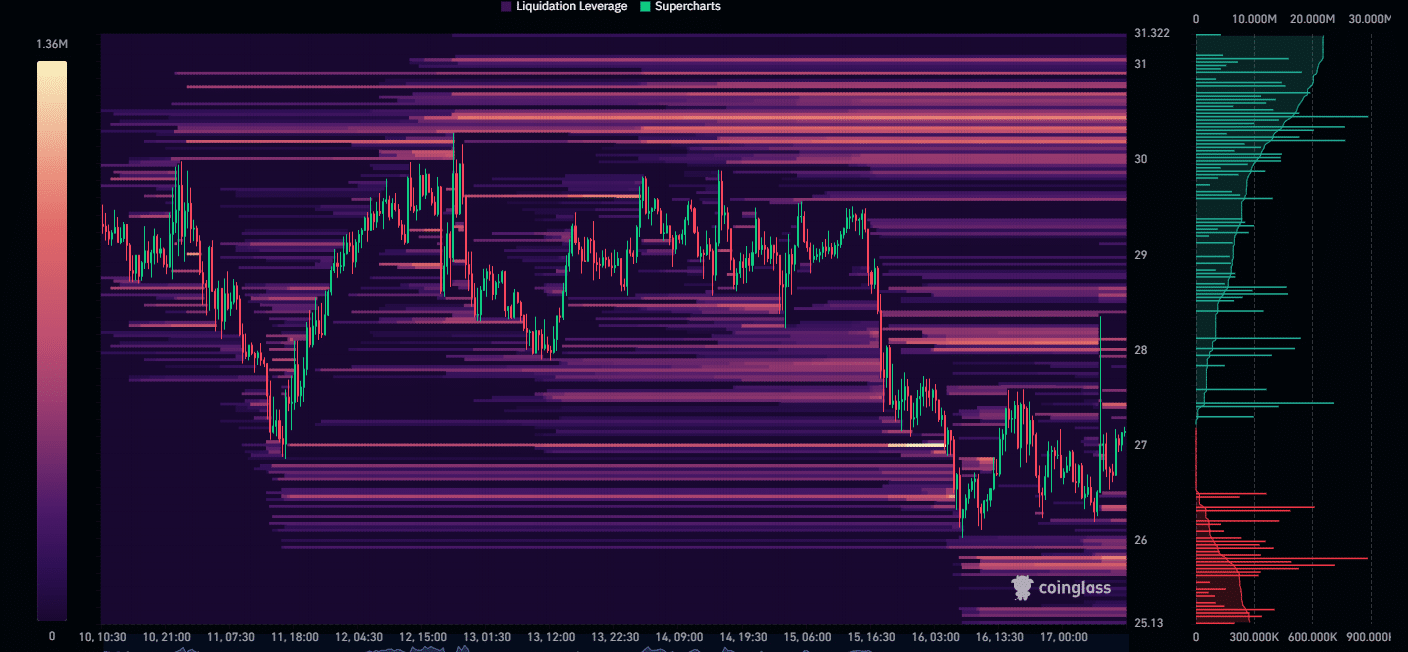

However, a whale with $60 million long position risks being liquidated if the price wicks below $25.

On the 1-week liquidation heatmap, key liquidity pockets were at $25.8 (lower side) and at $30.4 and $31.5 on the upside. This meant that during this week’s volatility, the price action could tag these levels.

Final Thoughts

- Cantor downplayed the current Hyperliquid competition fears as ‘overblown’ and projected long-term dominance in the perps market.

- HYPE price could range between $25 and $30 in the short term.