Nine of America’s largest banks, including JPMorgan, Bank of America, and Citibank, are under scrutiny after a new report by the OCC revealed they restricted financial services to the crypto sector between 2020 and 2023.

The OCC’s findings suggest that crypto firms faced systematic barriers under the guise of “financial crime considerations,” fueling fresh concerns over debanking and institutional bias against the digital asset sector.

As trust in banks wanes once again, investor focus is shifting back to the top decentralized projects.

In this article, we’ll take a look at the top three: DeepSnitch AI, XRP, and our Solana price prediction.

Crypto debanking scandal reignites SOL momentum outlook amid OCC investigation

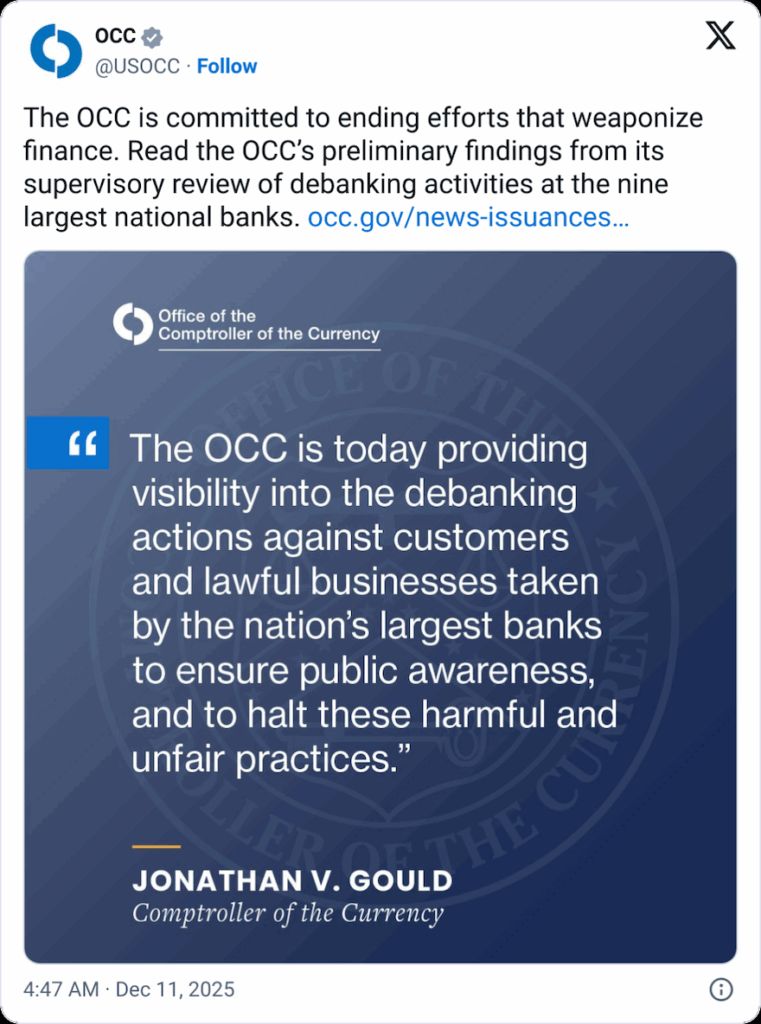

The Office of the Comptroller of the Currency (OCC) confirmed that nine of the United States’ largest banks, including JPMorgan, Bank of America, and Wells Fargo, restricted financial services to crypto firms between 2020 and 2023. These banks made “inappropriate distinctions” in service access based on lawful business activity, the OCC said, directly implicating sectors such as cryptocurrency, oil and gas, and firearms.

The investigation followed a 2023 executive order from President Trump, aimed at reviewing religious and political discrimination in banking. While Comptroller Jonathan Gould condemned the practices as a misuse of charter power, the OCC may refer its findings to the Justice Department for further action.

Crypto issuers, exchanges, and token administrators were targeted under the guise of “financial crime considerations,” contributing to a renewed wave of institutional distrust. For Solana market indicators, this backdrop could signal a stronger shift toward decentralized platforms, especially as traders seek safety and upside beyond the traditional system. Here are three tokens that could go furthest in 2026:

- XRP: ETF momentum meets short-term selling pressure

XRP traded around $2.01 on December 11, down 7.5% over the past week, despite bullish catalysts. The Cboe just approved the 21Shares XRP ETF, marking the fifth spot ETF approval for the token and signaling increasing institutional acceptance.

Still, whale activity has stirred caution. One whale investor is holding an XRP long position valued at $78.45 million, currently in deep unrealized losses. With trading volume exceeding $4.1 billion in 24 hours, XRP remains liquid and active, but near-term price forecasts remain cautious, clustering in the $2.50 – $2.85 range if ETF momentum sustains.

Next, we’ll look at the Solana price prediction and SOL investor sentiment:

- Solana price prediction: Cautious optimism as Solana market indicators hold amid wider rotation

The Solana price prediction is showing signs of stabilization following a volatile week. SOL traded at around $131.05 on December 11, reflecting a 9% drop over seven days despite strong fundamentals. Daily volume topped $7.3 billion, placing Solana among the top movers by liquidity.

Bhutan’s recent launch of a sovereign gold-backed token on the Solana blockchain has renewed attention on its global use case. Still, on-chain data reveals that many SOL holders are currently selling at a loss , highlighting bearish sentiment in the short term. According to FXStreet, the Solana price forecast may remain muted until liquidity conditions improve.

Yet the Solana price prediction for 2025 remains firmly bullish over the long term. With major treasury entities like Galaxy Digital and Forward Industries continuing to accumulate, many investors see current levels as an attractive entry. Most long-range models now estimate the Solana price prediction between $165 and $190 by mid-2026, if broader crypto adoption resumes.

However, from a SOL momentum outlook, the reality is clear. Solana’s upside is increasingly capped due to its $73B market-cap.

What’s the verdict?

At a $73B market cap, Solana’s price prediction may still climb, but it won’t 100x.

FAQs

Can SOL reach $1000?

Most Solana price prediction models suggest that $1,000 is unlikely without a massive increase in adoption, liquidity, and global market cap.

What price will Solana be in 2025?

The average Solana price prediction for 2025 ranges between $165 and $190, depending on treasury accumulation, market momentum, and regulatory clarity.

Is Solana or XRP better?

Solana boasts a larger ecosystem and higher transaction throughput, while XRP is making strides in institutional adoption via ETFs.