Monad (MON) Risks a Slide to Listing Lows as Big Players Walk Away — Last Hope At $0.028?

Monad’s early December run has lost its momentum. The token surged more than 51% between December 1 and 3 but failed twice at the same level, forming a clean double top that usually signals exhaustion. At the same time, the Monad price indicators that normally support a continuation have flipped, showing that large buyers, smart-money

Monad’s early December run has lost its momentum. The token surged more than 51% between December 1 and 3 but failed twice at the same level, forming a clean double top that usually signals exhaustion. At the same time, the Monad price indicators that normally support a continuation have flipped, showing that large buyers, smart-money traders, and derivatives participants are stepping away.

With support thinning and liquidity leaving the order books, Monad (MON) is inching toward lows last seen on the listing day.

Double Top Forms as Money Flow Weakens

The first signs of weakness appeared on the four-hour chart. The Monad (MON) price approached the $0.033 region twice and was rejected both times, confirming a double top.

The failure coincided with the Chaikin Money Flow, which measures whether money is entering or leaving the asset, failing to climb above the zero line. Staying below zero shows that large spot buyers were not confident enough to push the breakout.

CMF has now broken beneath its rising trendline, a sign that big-wallet demand is weakening instead of rising. When larger spot holders reduce buying pressure during a retest, the rally often loses its foundation.

Big Wallets Leaving:

TradingView

Big Wallets Leaving:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Smart money is mirroring that behavior. The Smart Money Index tried to rebound but rolled over quickly and is now drifting back toward its signal line. This group usually steps in early during short-term corrections, but this time the index shows hesitation, suggesting rebound confidence is fading.

If it slips beneath the trendline that guided the last Monad price bounce, near-term recovery hopes weaken further.

Smart Money Stepping Back:

TradingView

Smart Money Stepping Back:

TradingView

Together, the double top, declining CMF, and fading smart-money participation form the first wave of pressure against MON’s latest rally. But spot concerns aren’t the only ones in play.

Derivative Traders Close Exposure as Liquidity Leaves the Market

The derivatives MON market adds a second, stronger wave of pressure.

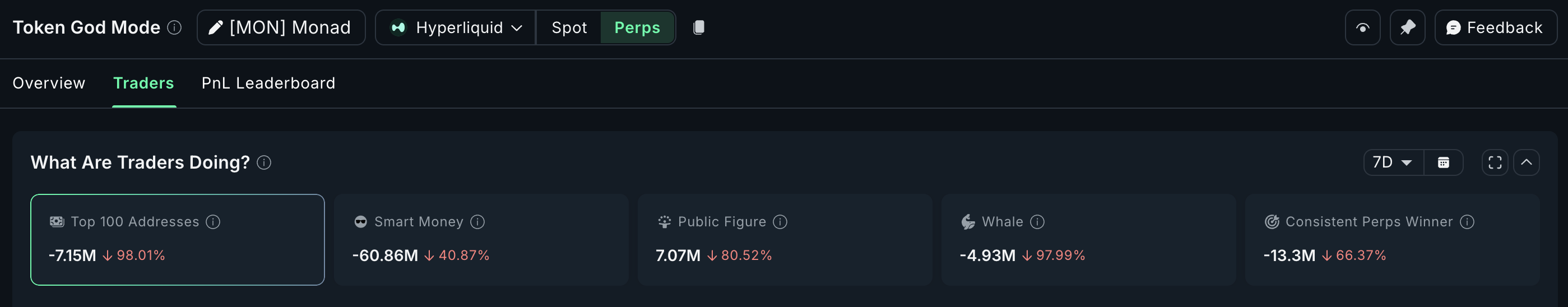

Over the last seven days, multiple major trading cohorts have sharply reduced their perpetual futures exposure.

The top 100 addresses have cut their positions by 98%, smart-money perps have reduced exposure by 40.87%, public-figure traders have dropped 80.52%, whales have exited 97.99% of their positions, and consistent perps winners — the traders who typically time trends well — have reduced exposure by 66.37%.

Monad Perp Traders Exiting:

Nansen

Monad Perp Traders Exiting:

Nansen

These are not mere signs of aggressive shorting. They show traders closing positions, pulling liquidity, and stepping out of the market altogether. Whatever positions remain now are mostly net short, highlighting the bearishness.

This kind of across-the-board reduction leaves the price in a fragile state. With spot buyers easing, smart money rolling over, and derivatives liquidity evaporating, Monad does not have enough support to absorb larger sell flows without slipping into deeper levels.

Key Levels Point Toward a Clear Downside Path For The Monad Price

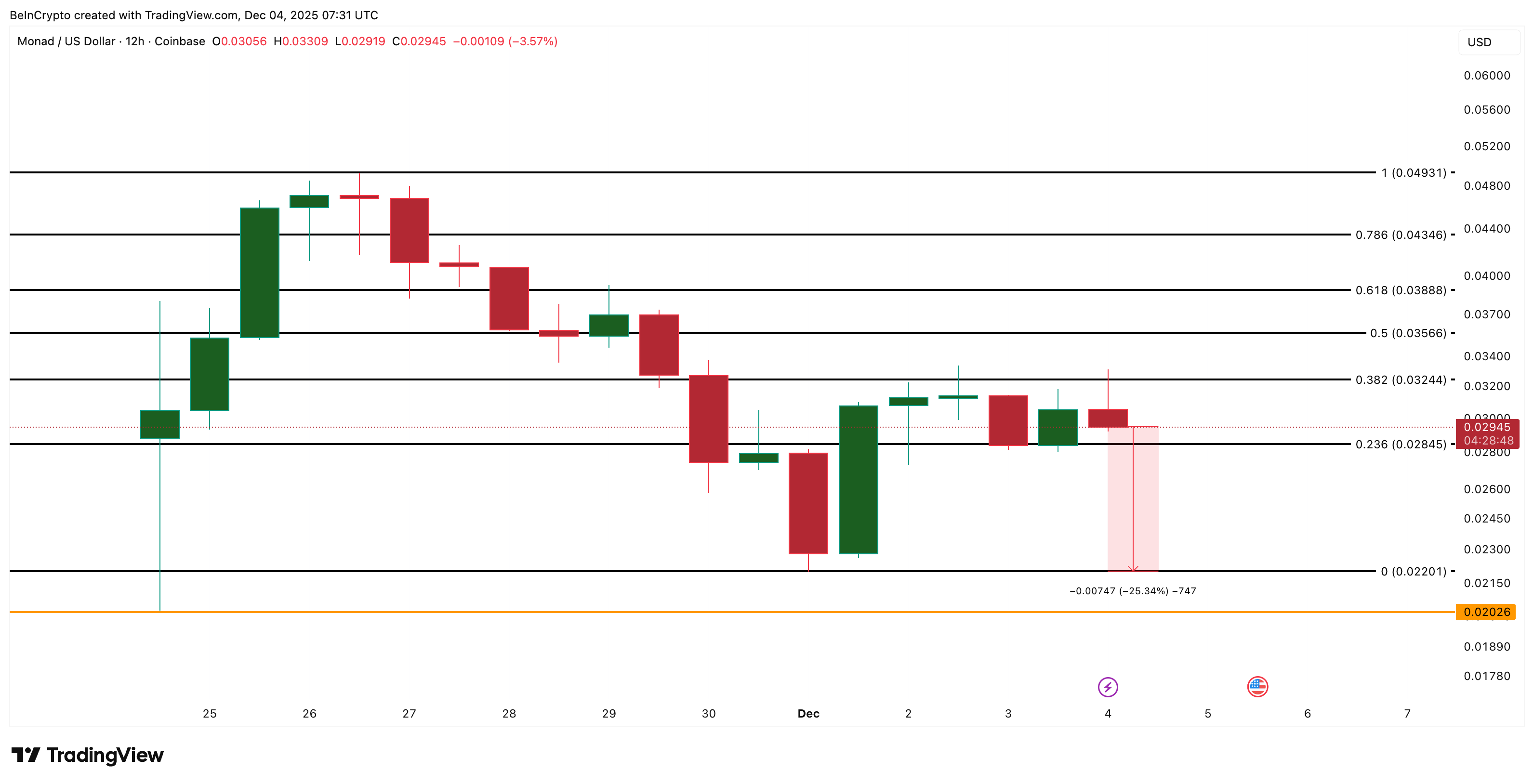

Monad is trading near $0.029, sitting just above the $0.028 support that has held since December 2. If the token loses this level, the next area sits near $0.022.

That would be a 25% dip from the current levels. A clean break under $0.022 opens the possibility of revisiting the post-launch low around $0.020, the same zone where the Monad price traded shortly after being listed on Coinbase.

Monad Price Analysis:

TradingView

Monad Price Analysis:

TradingView

For the structure to turn bullish again, Monad needs to reclaim $0.038, the key Fibonacci level that capped its rally. Breaking above it would open the path toward $0.043 and possibly $0.049.

Until that happens, the trend leans downward, and the coordinated exit across big wallets, smart money, and derivatives keeps pressure tilted to the downside.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How PENGU USDT Sell Signals Influence Sentiment in the Crypto Market

- PENGU USDT's 2025 volatility exposed algorithmic stablecoin fragility, triggering DeFi sell-offs and reshaping trading strategies. - Contradictory technical indicators highlighted instability in algorithmic rebalancing mechanisms, while $66.6M team wallet outflows raised liquidity concerns. - Retail investors shifted to fiat-backed stablecoins post-UST collapse, accelerating USDC's market share growth amid regulatory ambiguity. - Market correlations (42-46% crypto-equity linkages) and macroeconomic press

Evaluating the Recent PENGU Price Rally: Could This Signal the Next Major Digital Asset Surge?

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be