The rebound of global risk assets on Tuesday: Major changes at asset management giant Vanguard

This conservative giant, which once firmly resisted crypto assets, has finally compromised and officially opened access to Bitcoin ETF trading for its 8 million clients.

This conservative giant, which once firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to 8 million clients.

Written by: Ye Zhen

Source: Wallstreetcn

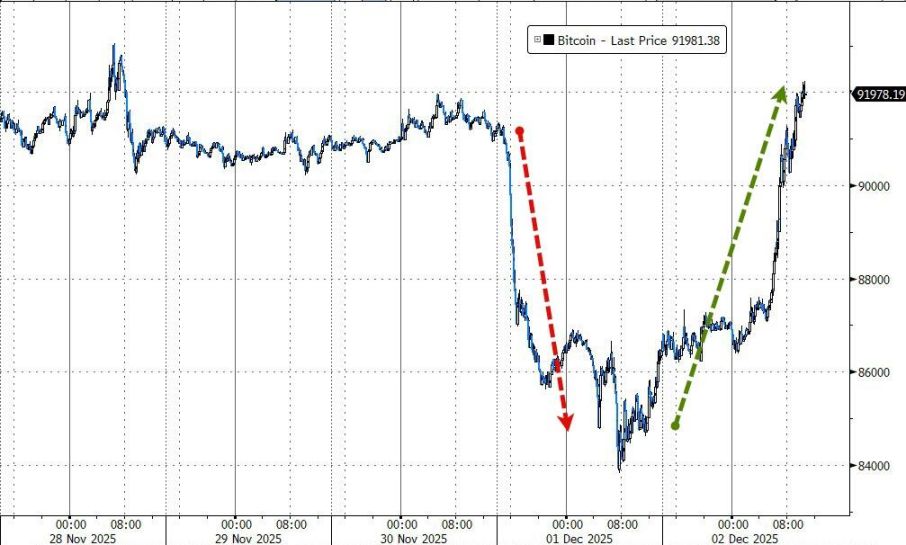

On Tuesday, bitcoin and other cryptocurrencies led a rebound in risk assets, driven by a major shift from global asset management giant Vanguard.

After Monday's plunge, bitcoin strongly reclaimed the $90,000 mark on Tuesday with a daily gain of over 6%, and Ethereum returned above $3,000. Meanwhile, Trump hinted that his economic advisor Kevin Hassett is a potential candidate for Federal Reserve Chair. Coupled with the stabilization of Japanese bond auctions, this put pressure on U.S. Treasury yields and the dollar index, easing market liquidity concerns and fueling a significant global risk asset rally.

On Tuesday, Vanguard confirmed that clients can now purchase third-party crypto ETFs and mutual funds, such as BlackRock's iShares Bitcoin Trust ETF, through its brokerage platform. This marks the first time the asset management giant, known for its conservative investment philosophy, has opened crypto investment channels to its 8 million self-directed brokerage clients.

Bloomberg analyst Eric Balchunas pointed out that this is a classic "Vanguard effect." On the first trading day after Vanguard's shift, bitcoin surged at the U.S. stock market open, and BlackRock's IBIT saw trading volume exceed $1 billion within 30 minutes, indicating that even conservative investors want to "add some excitement" to their portfolios.

Vanguard had previously firmly refused to get involved in the crypto sector, arguing that digital assets are too speculative and volatile, inconsistent with its core philosophy of long-term balanced portfolios. The current shift reflects ongoing retail and institutional demand pressure, as well as concerns about missing out on a rapidly growing market opportunity.

As BlackRock achieves great success with its bitcoin ETF, Vanguard's loosening stance on this emerging asset class, while adhering to "Bogleism," will have a profound impact on future capital flows.

Vanguard's Major Shift: From "Resistance" to "Openness"

The core driver behind this market sentiment reversal is the attitude change from Vanguard, the world's second-largest asset management company. According to Bloomberg, starting Tuesday, Vanguard allows clients with brokerage accounts to buy and trade ETFs and mutual funds that primarily hold cryptocurrencies (such as BlackRock's IBIT).

This decision is a clear compromise. Since the U.S. approved spot bitcoin ETFs in January 2024, Vanguard had banned trading of such products on its platform, citing "high volatility and speculation of digital assets, unsuitable for long-term portfolios." However, as bitcoin ETFs attracted tens of billions of dollars in assets, and BlackRock's IBIT remained at $70 billion even after pullbacks, ongoing demand from clients (both retail and institutional) forced Vanguard to change its stance.

In addition, Vanguard's current CEO Salim Ramji was formerly an executive at BlackRock and a long-time advocate of blockchain technology. His appointment is seen as one of the internal factors behind this policy shift. Vanguard executive Andrew Kadjeski stated that crypto ETFs have withstood market volatility and that management processes are now mature.

However, Vanguard is still exercising some restraint: the company has made it clear that it currently has no plans to launch its own crypto investment products, and leveraged and inverse crypto products remain excluded from its platform.

The Duel of Two Giants Faces a Reshuffle

This move by Vanguard once again brings its three-decade rivalry with BlackRock to the forefront. According to the book "The First Lesson in Global ETF Investing," the two companies represent fundamentally different investment philosophies and business models.

BlackRock represents "technique." Founder Larry Fink comes from a top bond trading background, and BlackRock's original mission was "to make better trades." Its core competitiveness lies in its powerful risk control system "Aladdin" and its comprehensive product lineup. BlackRock's iShares has over 400 ETFs covering all types of global assets. For BlackRock, ETFs are tools to meet client trading needs and build portfolios, so it does not exclude any asset class. Whether promoting ESG investing to avoid "climate risk" or being the first to launch a spot bitcoin ETF (IBIT surpassed $10 billion in scale within 7 weeks of listing, far exceeding Vanguard's expectations and breaking the gold ETF's three-year record), BlackRock has always aimed to be the best "shovel seller" in the market.

Vanguard adheres to "the way." Although founder John Bogle has passed away, his philosophy remains Vanguard's soul: the best long-term choice for investors is to hold broad-market index funds, and Vanguard's mission is to minimize costs. Thanks to its unique "mutual ownership" structure, Vanguard's fees are extremely low, with only about 80 ETFs, mainly focused on broad-based indices like VOO and VTI. Its client base mainly consists of long-term investors and advisors sensitive to fees.

The differences between the two companies are vividly reflected in spot bitcoin ETFs. BlackRock submitted its application as early as June 2023, and its IBIT ETF surpassed $10 billion in assets within 7 weeks of listing, breaking the gold ETF GLD's record by 3 years. Vanguard, on the other hand, only allowed clients to trade third-party crypto products this week.

The market is pragmatic. As Vanguard's share of the U.S. ETF market continues to approach and may even surpass BlackRock, spot bitcoin ETFs have become a key variable. Facing BlackRock's huge first-mover advantage in crypto assets and strong client demand for diversified allocation, Vanguard ultimately chose to loosen its trading channels.

Although Vanguard's crypto policy adjustment came late, the potential demand from its 8 million self-directed clients should not be underestimated. This change could not only affect short-term capital flows but may also reshape the long-term competitive landscape between the two giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.