Chainlink ETF Eyes Imminent Debut —Will LINK Finally Break Its Slump?

Chainlink (LINK) is about to get its first-ever spot ETF as Grayscale’s GLNK begins trading on December 2 on NYSE Arca. However, after recent altcoin ETFs failed to lift prices, investors are left asking whether LINK will break the trend or become the next casualty of weak market sentiment. Grayscale Pushes Ahead With Third ETF

Chainlink (LINK) is about to get its first-ever spot ETF as Grayscale’s GLNK begins trading on December 2 on NYSE Arca.

However, after recent altcoin ETFs failed to lift prices, investors are left asking whether LINK will break the trend or become the next casualty of weak market sentiment.

Grayscale Pushes Ahead With Third ETF Launch in Two Weeks

The rollout marks Grayscale’s third ETF deployment in under 14 days, following GDOG and GXRP, with the Zcash (ZEC) ETF also in the pipeline.

It also reinforces the firm’s strategy of expanding beyond Bitcoin and Ethereum, targeting altcoins with strong institutional narratives.

Grayscale Chainlink Trust ETF (Ticker: $GLNK) offers investors direct exposure to $LINK. $GLNK starts trading on @NYSE Arca tomorrow.

— Grayscale (@Grayscale) December 2, 2025

The ticker for the prospective financial instrument is GLINK, with the notice already in.

Grayscale’s GLINK ETF.

Grayscale’s GLINK ETF.

However, the market backdrop is challenging as recent altcoin ETFs failed to life the prices of Solana and XRP.

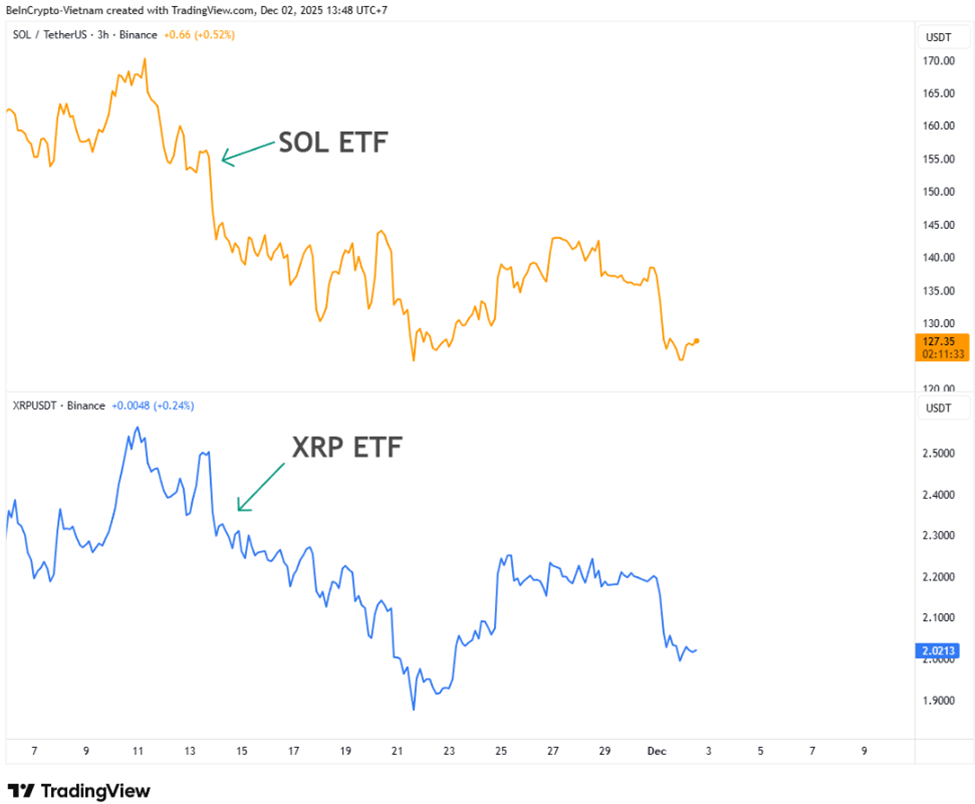

Altcoin ETFs Are Not Rallying Prices—And Data Shows It

Despite initial excitement, recently launched altcoin ETFs have underperformed as market sentiment shifts to a risk-off stance.

- The SOL ETF, launched November 13, is down 18%.

- The XRP ETF, launched November 14, is down over 10%.

Solana and XRP Price Performances Following Their Respective ETF Launches.

Solana and XRP Price Performances Following Their Respective ETF Launches.

The broader altcoin liquidity has weakened alongside fading ETF-driven inflows. This raises the key investor question: Will GLNK trigger a meaningful LINK price rally, or follow the same pattern of post-launch selloffs?

Chainlink (LINK) Price Performance.

Chainlink (LINK) Price Performance.

As of this writing, with only hours to the financial instrument’s debut, LINK was trading for $12.09, down by almost 1% in the last 24 hours.

Whale Accumulation Reveals Deep Losses Ahead of ETF Day

Meanwhile, Onchain Lens identified a major LINK whale who spent months accumulating the asset.

“A whale has been gradually accumulating LINK from OKX and Binance. Over the past 6 months, the whale has accumulated 2.33 million LINK for $38.86 million, currently valued at $28.38 million, facing a loss of $10.5 million,” they wrote.

The whale’s address, tracked via Nansen, highlights a significant unrealized loss heading into ETF debut day. Heavy underwater positions can increase the risk of short-term selling into any ETF-driven liquidity spike.

Yet not all signals are bearish.

Data from CryptoQuant shows that LINK’s circulating supply on exchanges just dropped to its lowest level since 2020.

LINK Supply on Exchanges.

LINK Supply on Exchanges.

Analysts note that every time this chart exhibits this behavior, the price does not remain low for long.

$LINK supply on exchanges just nuked to levels we haven’t seen since 2020.Every time this chart does this → price doesn’t stay cheap for long.Smart money has been quietly loading while CT argued about memes.If you know, you know.

— Ronnie M Green (@ronniemgreen) December 2, 2025

Historically, declining exchange balances have foreshadowed major Chainlink rallies, as reduced supply often tightens available liquidity during periods of high demand. The timing, just hours before GLNK launches, is notable.

Tomorrow’s Chainlink ETF debut creates a rare crossroad:

- Bearish forces: weak altcoin ETF performance, negative market sentiment, large underwater whale positions.

- Bullish forces: shrinking exchange supply, sustained long-term accumulation, and an upcoming influx of traditional-market exposure via GLNK.

For investors, the critical window will be the first 72 hours of ETF trading, when flows, volume, and sentiment will reveal whether GLNK is a catalyst, or simply another ETF launch overshadowed by macro pressure.

Either way, Chainlink enters this week as one of the most-watched altcoins in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How PENGU USDT Sell Signals Influence Sentiment in the Crypto Market

- PENGU USDT's 2025 volatility exposed algorithmic stablecoin fragility, triggering DeFi sell-offs and reshaping trading strategies. - Contradictory technical indicators highlighted instability in algorithmic rebalancing mechanisms, while $66.6M team wallet outflows raised liquidity concerns. - Retail investors shifted to fiat-backed stablecoins post-UST collapse, accelerating USDC's market share growth amid regulatory ambiguity. - Market correlations (42-46% crypto-equity linkages) and macroeconomic press

Evaluating the Recent PENGU Price Rally: Could This Signal the Next Major Digital Asset Surge?

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be