Kevin Hassett Emerges as Trump’s Leading Candidate for Federal Reserve Chair

Quick Breakdown

- Kevin Hassett is now seen as Trump’s top contender to replace Jerome Powell as Federal Reserve chair.

- Hassett’s deep involvement in crypto policy and personal holdings in Coinbase add weight to his candidacy.

- Trump’s broader shortlist features several crypto-friendly figures who align with his push for further rate cuts.

Crypto-friendly White House economic adviser Kevin Hassett is reportedly rising to the top of President Donald Trump’s shortlist to replace Federal Reserve Chair Jerome Powell when his term ends in May.

According to a Bloomberg report citing sources close to the matter, Trump’s advisers and allies believe Hassett aligns closely with Trump’s push for aggressive rate cuts, positioning him as the most likely successor.

Hassett’s crypto credentials strengthen his case

Hassett currently heads the National Economic Council, where he oversees the White House’s digital asset working group created by Trump earlier this year. The group issued a policy-focused crypto report in July, reinforcing the administration’s interest in digital assets .

His personal financial disclosures reveal strong ties to the industry; he holds at least $1 million in Coinbase stock. He earned over $50,000 from Coinbase for serving on its Academic and Regulatory Advisory Council. He also previously advised One River Digital Asset Management, a major crypto investment firm.

When asked on Fox News whether he would accept the role of Fed chair, Hassett replied that he would “have to say yes,” noting he has discussed the possibility with Trump.

Source

:

Fox News

Source

:

Fox News

Trump’s Fed shortlist packed with crypto supporters

Hassett isn’t the only crypto-friendly name in the mix. Trump has also reportedly vetted Chris Waller, a Fed governor who publicly encouraged banks to explore decentralized finance.

Michelle Bowman, the Fed’s vice chair for supervision, suggested that Fed staff should be able to hold small amounts of crypto to understand the technology better.

Regardless of who ultimately gets the nod, analysts expect Trump to push his next chair toward lower interest rates. The Fed has already cut rates twice this year, by a total of 50 basis points.

Market expectations lean heavily toward another 25-basis-point cut in December, with CME’s FedWatch tool placing the odds near 85%.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

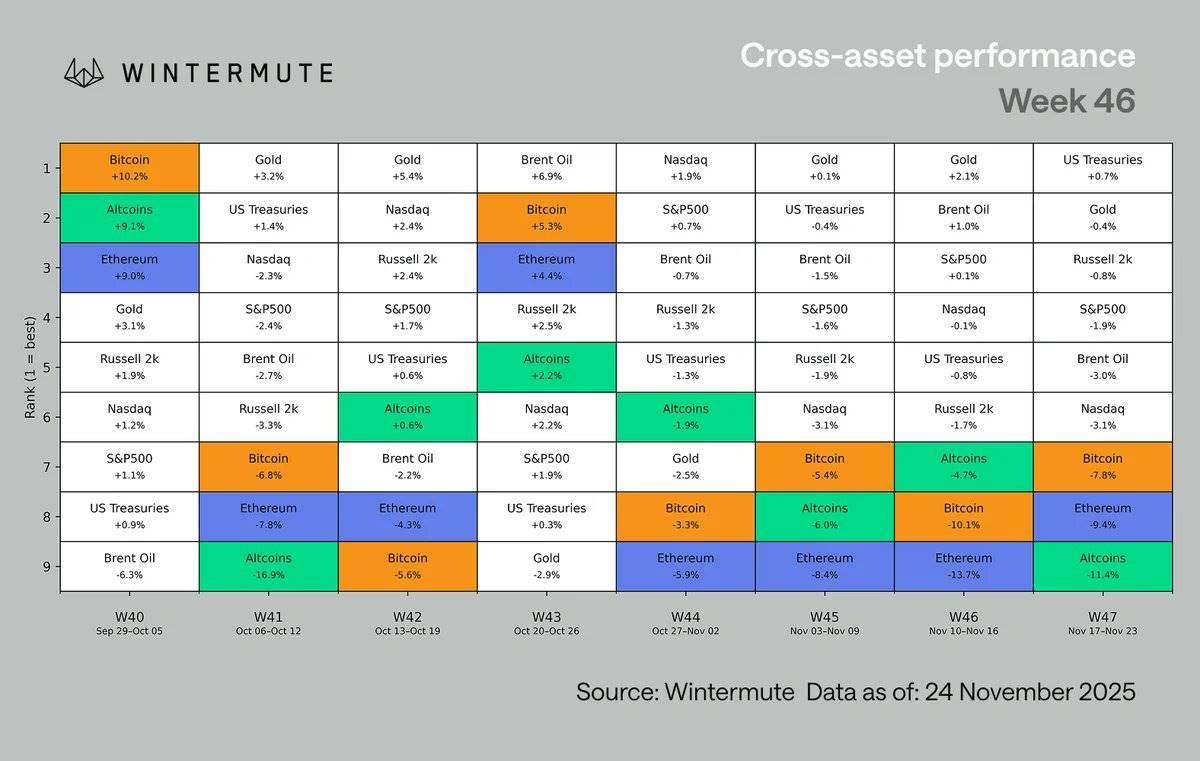

Wintermute Market Analysis: Cryptocurrency Falls Below $3 Trillion, Market Liquidity and Leverage Tend to Consolidate

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.

Former a16z Partner Releases Major Tech Report: How AI Is Eating the World

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.