Author: @Jjay_dm

Translation: TechFlow

Market Update – November 24, 2025

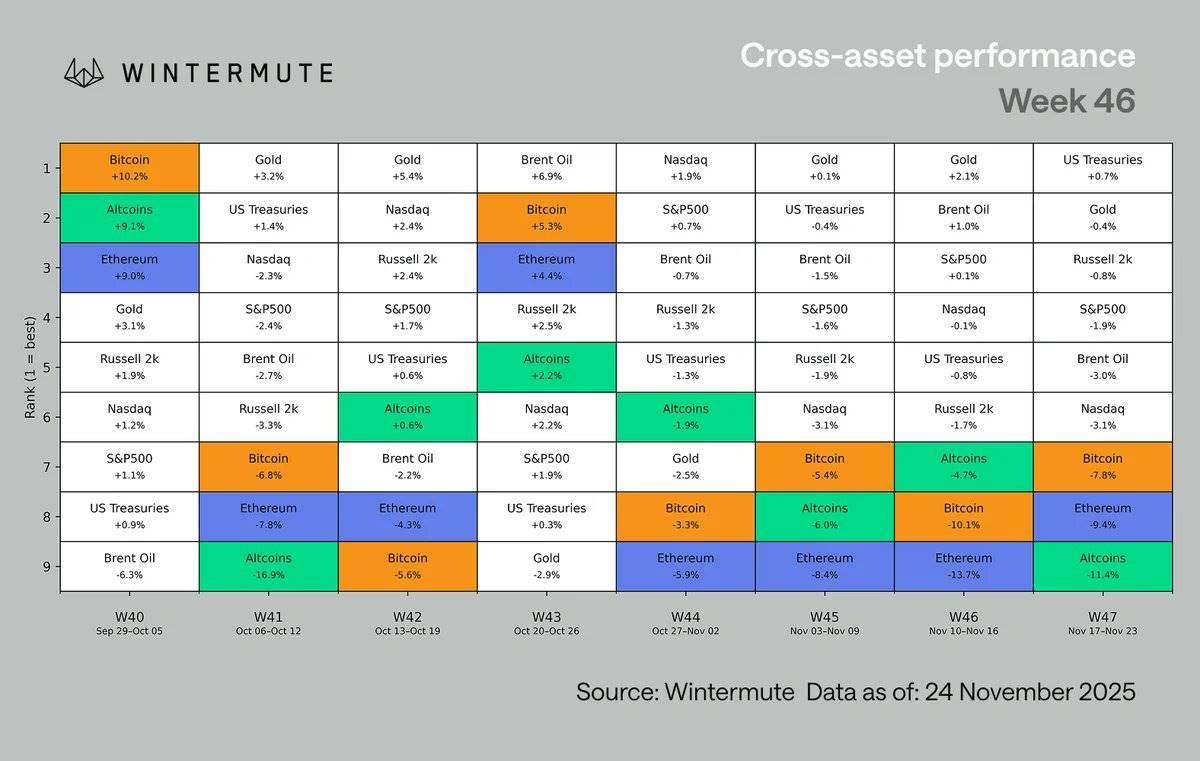

The AI-driven market momentum broke down, triggering a rotation into safe-haven assets, with the cryptocurrency market cap falling below 3 trillion USD, marking the third consecutive week as the worst-performing major asset class. Weak employment data, declining expectations for rate cuts, and pressure from the Japanese market further weighed on the market amid thin holiday liquidity. Crypto market positions have been readjusted, funding rates have turned negative, and spot trading volumes remain stable.

Macro Update

This week, risk appetite deteriorated sharply, and AI-driven stock market momentum finally stalled. Although Nvidia's earnings once again performed strongly, the related rally was short-lived, and the market quickly sold off on the rebound. This reaction marks a clear shift in market behavior: investors are using strength to reduce positions, indicating that AI trades are losing support from new buyers. As US tech stocks pulled back, the pressure was directly transmitted to the crypto market, with total market cap falling below 3 trillion USD for the first time since April.

Macro data further exacerbated market vulnerability:

-

Non-farm payrolls (NFP) increased by 119,000, but the unemployment rate rose to 4.4%

-

The probability of a rate cut in December dropped to about 30%

-

The Japanese market is under pressure, with a bear steepening of the JGB yield curve and a weakening yen, raising concerns about its continued ability to absorb US Treasuries

-

European and Asian markets also performed weakly, with China's AI sector seeing profit-taking and renewed pressure in real estate

-

UK inflation eased, but had limited impact amid low liquidity during the US Thanksgiving holiday

As a result, crypto became the worst-performing major asset class for the third consecutive week, with broad sell-offs and long liquidations causing altcoins to lead the declines.

Despite ongoing macroeconomic instability, positive changes are emerging within the internal structure of the crypto market. Since late October, when bitcoin (BTC) traded near 115,000 USD, funding rates have turned negative for the first time, and this is the longest negative streak since October 26. Leveraged funds are skewed short, while capital is flowing back into the spot market. Despite a shortened trading week due to the holiday, spot trading volume has remained surprisingly robust. This combination suggests the market has undergone a comprehensive reset, and once macro pressures ease, it will be in a more favorable and stable position.

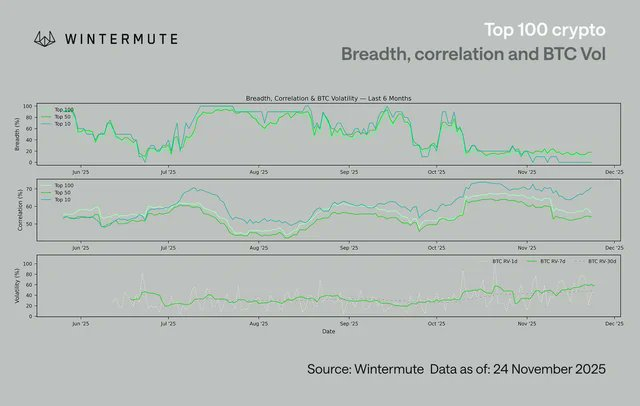

Among the top 100 tokens by market cap, correlations are mainly concentrated in the top 10, which also performed the worst. This reflects that the largest assets are trading as a single macro block, fully tied to broader risk sentiment. For tokens ranked 50 to 100, declines were relatively smaller, and early signs of decoupling have appeared, with trading increasingly driven by unique factors. This aligns with the actual market situation: some narrow narratives (such as proxy protocols, privacy, decentralized IoT DePIN) are still driving short-term outperformance, even as the overall market remains weak.

Meanwhile, bitcoin volatility continues to climb, with 7-day realized volatility (RV) rebounding to near the 50 level.

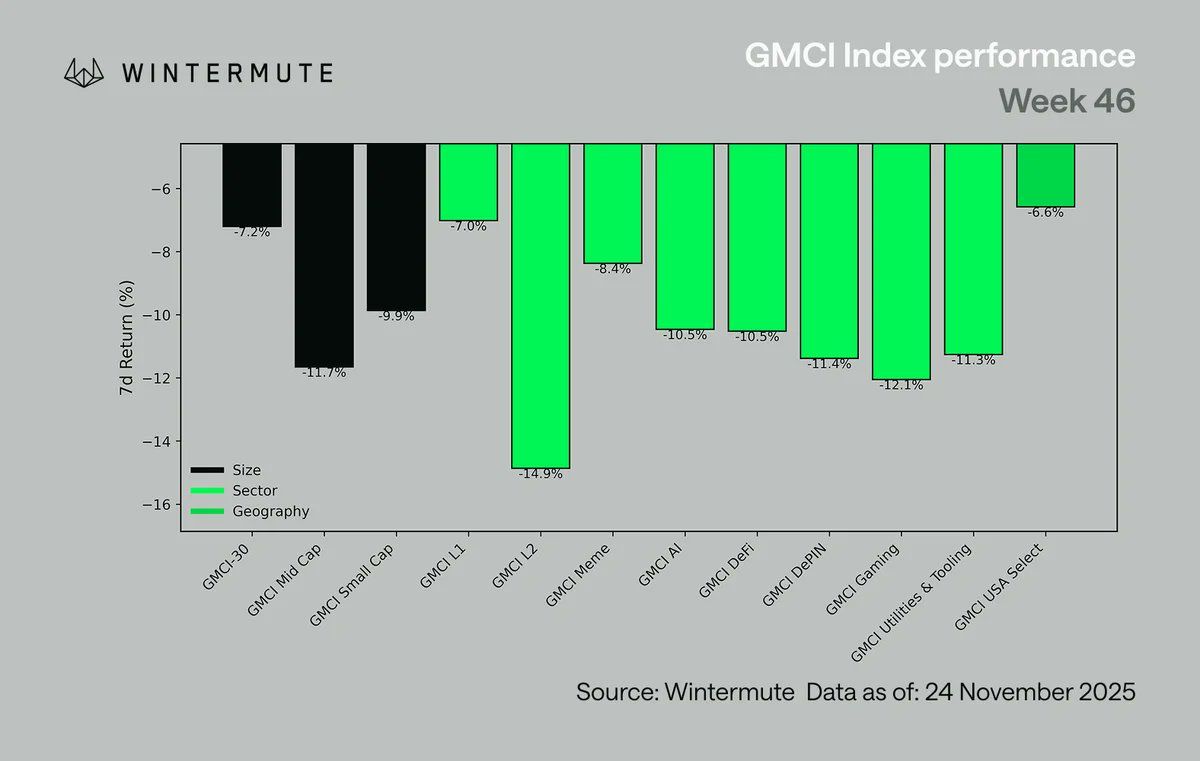

All sectors performed weakly, with the most volatile areas hit hardest by the sell-off:

-

Layer 2 (L2) fell by 14.9%

-

Gaming sector dropped 12.0%

-

Decentralized IoT (DePIN) declined 11.4%

-

Artificial Intelligence (AI) fell 10.5%

-

Small and mid-cap assets also lagged

-

Core Layer 1 protocols (Core L1s) dropped 7.0%, GMCI-30 Index (@gmci_) fell 7.2%, showing relatively better performance

This round of declines was almost indiscriminate, clearly reflecting that macro-driven broad-based risk-off sentiment has enveloped all sectors.

The chart above shows Monday-to-Monday data, so it differs from the first chart.

Our View:

Although the digital asset market is deeply entrenched in a wave of macro-driven deleveraging, the market is now at a stage where consolidation is finally becoming possible.

After experiencing macro-driven deleveraging—first due to the cooling of the AI frenzy, then pressured by the Federal Reserve's adjustment of market expectations—the internal structure of the market has now significantly improved. Mainstream assets are showing more obvious relative strength, market sentiment has been fully cleared out, and leverage risk has also dropped sharply. Total perpetual open interest has fallen from about 230 billion USD in early October to about 135 billion USD now, mainly due to deleveraging of long-tail assets and systematic capital outflows. This shift has pushed market activity back to the spot market, where depth and liquidity have performed better than expected amid thin holiday liquidity.

This is crucial: when leverage drops to such low levels and the spot market becomes the main trading flow, market recovery is often more orderly than the mechanical squeezes seen at the start of the year. The presence of negative funding rates and net short perpetuals also reduces the risk of further forced liquidations, providing the market with more breathing room, especially if the macro environment stabilizes. The coming days will determine how we enter the final month of the year, but after weeks of macro pressure, the market finally has the conditions for consolidation.