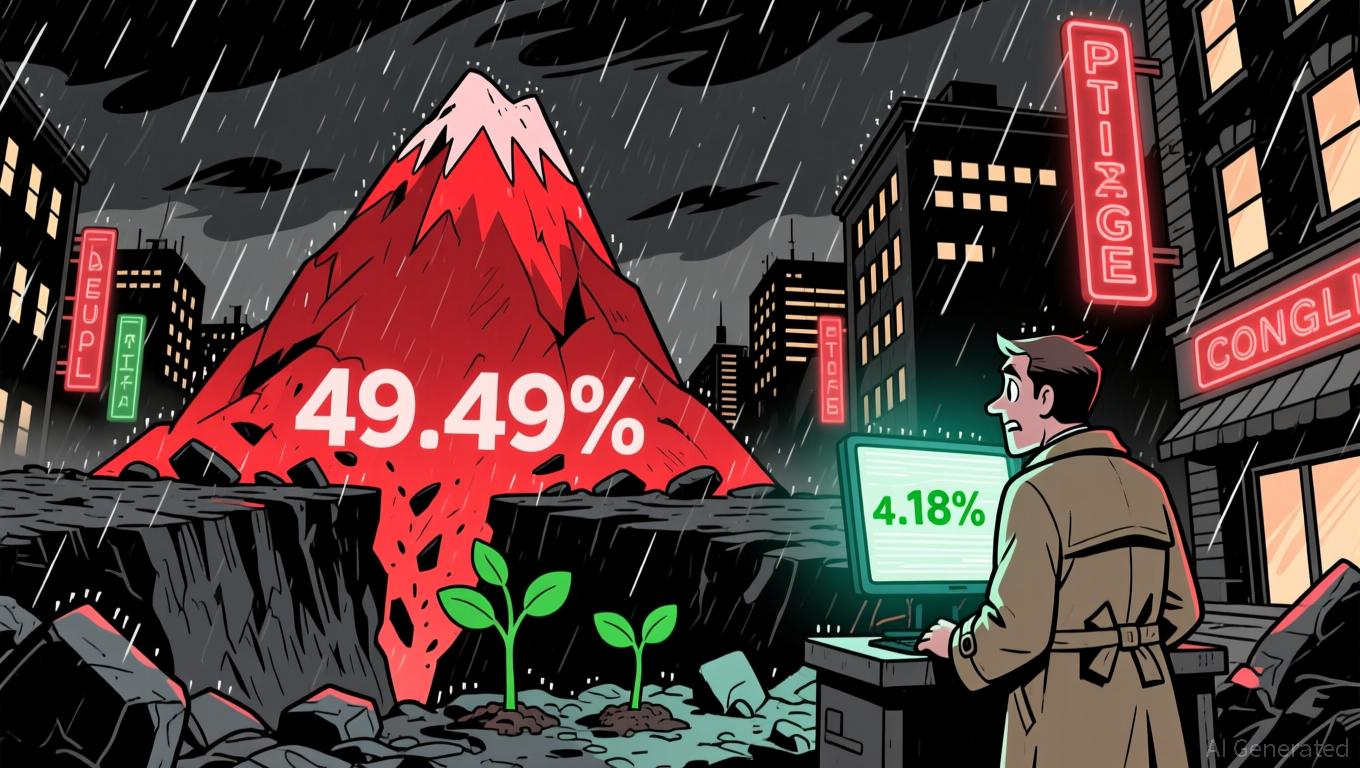

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

On November 24, 2025, YFI (yearly interest factor) saw its value climb by 1.18% in the past 24 hours, bringing its price to $4,036. Despite this brief upward movement, the overall trend remains negative: in the last seven days, YFI has fallen by 9.16%, and over the previous 30 days, it has lost 14.24%. Most notably, the asset has suffered a 49.49% decrease over the past year, highlighting a persistent bearish pattern even with the recent short-term rise.

This activity highlights the continued instability within the

The recent changes in YFI’s price mirror the broader sense of unpredictability in the market. Short-lived gains can often be attributed to shifts in liquidity, economic indicators, or speculative trades. However, since there have been no notable news or events linked to YFI, this movement likely stems from general market forces. Traders are watching closely for any signs of stabilization, but the prevailing downward trend continues to dominate.

Given the asset’s performance over the past year, investors should approach with caution, as it remains highly responsive to economic shifts and changing market sentiment. While the latest increase is encouraging, it does not necessarily signal a reversal of the broader trend. Uncertainty is still being factored into the market, and only a sustained period of growth could indicate a potential change in direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

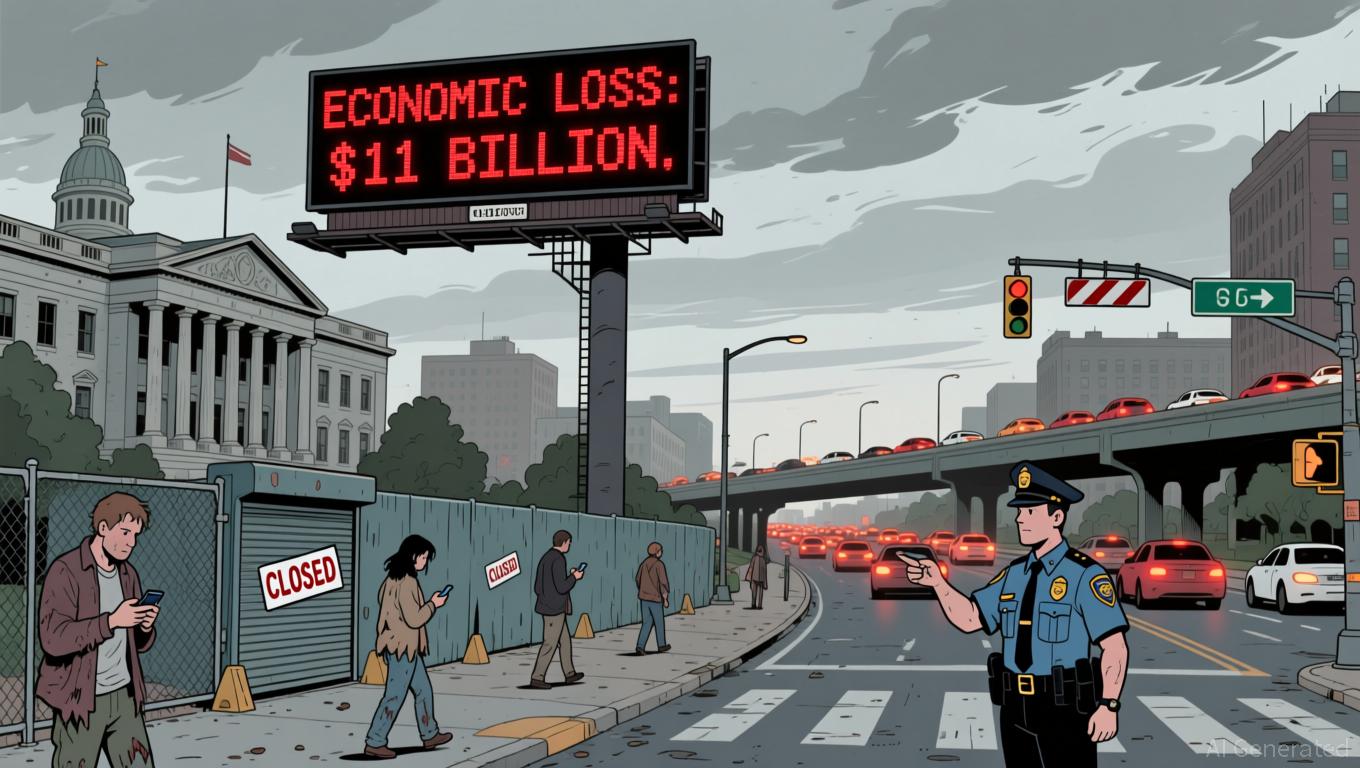

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr