Why Ethereum might lead next rally: Matt Hougan points to a catalyst investors are ignoring

Bitwise CIO Matt Hougan believes Ethereum could lead the next crypto rally, pointing to an upgrade catalyst that investors are overlooking.

- Bitwise CIO Matt Hougan says Ethereum could lead next crypto rally with Fusaka upgrade.

- The December 3 Fusaka upgrade introduces minimum Layer 2 data fee for revenue capture.

- Hougan sees tokens shifting to value capture with Uniswap proposing fee switch model.

The Fusaka upgrade scheduled for December 3 may increase Ethereum’s revenue capture by 5 to 10 times through a minimum Layer 2 data fee.

Hougan argues the market is missing a broader trend: major tokens are quickly shifting toward better value capture. Uniswap ( UNI ) is moving toward a fee switch that would burn roughly 16% of trading fees, while the XRP ( XRP ) community explores staking options.

New regulations are pushing tokens away from vague governance models toward direct economic benefits for holders.

Fusaka upgrade targets Layer 2 efficiency

The Fusaka hard fork will activate on December 3, 2025, at 21:49:11 UTC on Ethereum ( ETH ) mainnet block 13,164,544. Core developers finalized the timeline after successful tests on Holesky, Sepolia, and Hoodi testnets.

Fusaka introduces Peer Data Availability Sampling (PeerDAS), which allows validators to confirm transaction data availability by sampling small pieces rather than downloading complete data blobs.

The technology makes Layer 2 rollup operations faster, cheaper, and more efficient while reducing bandwidth requirements.

The upgrade increases the block gas limit from 45 million to as high as 150 million. Each block will accommodate more transactions, smart contracts, and data-intensive applications.

Hougan wrote on X that Fusaka introduces “a minimum fee for recording data from Layer 2s” that could multiply revenue capture five to ten times.

“I suspect the market will start to orient around the positive impacts of Fusaka soon, particularly if it’s delivered Dec. 3 as expected,” he stated.

Tokens pivot from governance to economic value

Uniswap’s proposed fee switch would burn approximately 16% of trading fees if the vote passes. “I suspect this will push UNI toward being a top 10 token by market cap over time,” Hougan wrote.

The change would shift UNI from a pure governance token to one with direct economic benefits.

The XRP community is evaluating staking mechanisms that would change token holder economics. Hougan sees this as part of a pattern where tokens are implementing value capture features.

The Bitwise CIO predicts this shift will become apparent in 2026. “The level of value capture in digital assets is up only from here. I think people look at token value capture as static. It’s not,” he wrote.

Hougan described the Fusaka upgrade as “an under-appreciated catalyst and one reason ETH could lead the crypto rebound.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO rises by 0.21% even after a 5.32% decline over the week, reflecting ongoing market fluctuations

- ALGO rose 0.21% to $0.1439 on Nov 24, 2025, but fell 5.32% weekly and 56.92% annually amid market volatility. - Persistent selling pressure and lack of project/regulatory catalysts highlight structural valuation declines since peak levels. - Analysts project continued downward pressure unless major developments like regulatory updates or institutional adoption emerge. - Investors advised to remain cautious as short-term gains fail to offset 18.77% monthly losses and broader bearish market conditions.

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

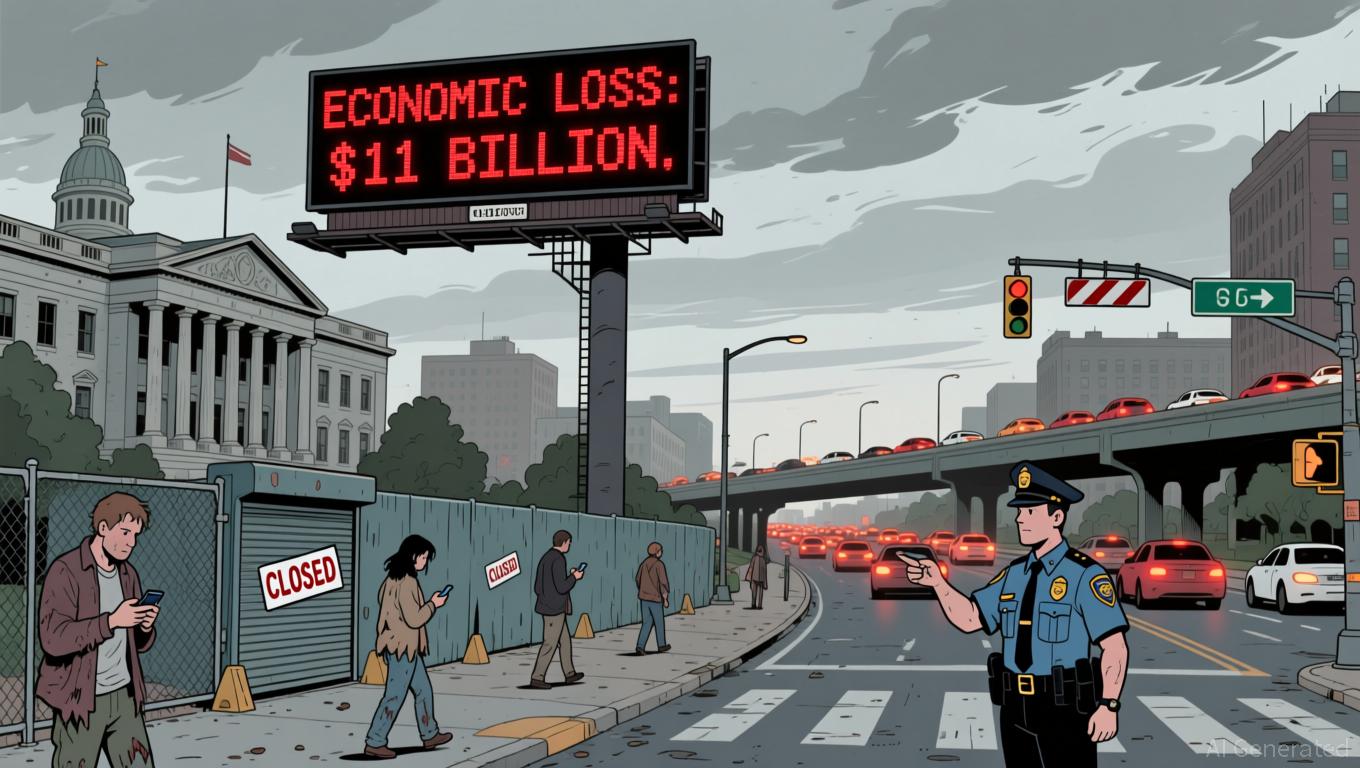

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest