Tether taps HSBC executives to ramp up $12b gold strategy

Tether poached two senior executives from a bank that oversees one of the world’s most extensive gold vaults.

- Tether is doubling down on its gold bet by hiring two of HSBC’s top gold traders

- HSBC operates one of the largest private gold vaults in the world

- The stablecoin issuer currently holds more than $12 billion in physical gold

As macro uncertainty fuels renewed interest in precious metals, the world’s largest stablecoin issuer is doubling down on its gold bet. On Tuesday, November 11, Tether announced the hiring of two top gold traders from London-based HSBC.

HSBC’s global head of metals trading, Vincent Domien, will join Tether in the coming months. He’ll be accompanied by Mathew O’Neill, HSBC’s head of precious metals for Europe, the Middle East, and Africa.

The two executives’ role will be to aggressively expand the firm’s physical bullion holdings, which currently total $12 billion.

These include the reserves for the Tether Gold (XAUT) token, which has a market cap of $1.56 billion. The remaining physical gold is part of the reserves that back USDT.

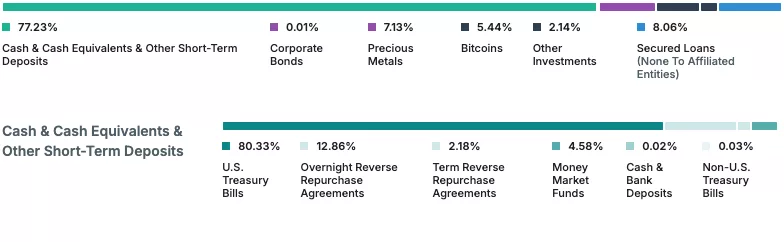

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Tether plans major gold expansion

Tether has been adding gold to its reserves at an average pace of 1 metric ton per week during September of this year. According to Bloomberg, this makes Tether one of the largest non-state buyers of gold. For this reason, taping HBSC executives makes strategic sense for the firm.

HBSC operates a vast gold reserve in London, one of the largest in the world. The company is also one of the biggest market makers in spot gold, gold futures, swaps, and options. It is also one of the core clearing members in the London Bullion Market Association. HSBC was also one of the first companies to launch a tokenized gold offering, which went live in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How PENGU USDT Sell Signals Influence Sentiment in the Crypto Market

- PENGU USDT's 2025 volatility exposed algorithmic stablecoin fragility, triggering DeFi sell-offs and reshaping trading strategies. - Contradictory technical indicators highlighted instability in algorithmic rebalancing mechanisms, while $66.6M team wallet outflows raised liquidity concerns. - Retail investors shifted to fiat-backed stablecoins post-UST collapse, accelerating USDC's market share growth amid regulatory ambiguity. - Market correlations (42-46% crypto-equity linkages) and macroeconomic press

Evaluating the Recent PENGU Price Rally: Could This Signal the Next Major Digital Asset Surge?

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be