Financial Black Hole: Stablecoin is Eating the Bank

Stablecoins Reshape Global Financial Architecture by Embracing a “Narrow Banking” Model to Absorb Liquidity

Original Article Title: Stablecoins, Narrow Banking, and the Liquidity Blackhole

Original Article Author: @0x_Arcana

Translation: Peggy, BlockBeats

Editor's Note: In the process of the gradual digitization of the global financial system, stablecoins are quietly becoming an undeniable force. They do not belong to banks, money market funds, or the traditional payment system, yet they are reshaping the flow of the dollar, challenging the transmission mechanism of monetary policy, and sparking a deep discussion about the "financial order."

This article starts from the historical evolution of "narrow banking," delving into how stablecoins are replicating this model on-chain and influencing the U.S. Treasury market and global financial liquidity through the "liquidity blackhole effect." In the context of policy regulation that has not been fully clarified, the non-cyclical expansion of stablecoins, systemic risks, and macro impacts are becoming new unavoidable topics in the financial world.

The following is the original article:

Stablecoins Revive "Narrow Banking"

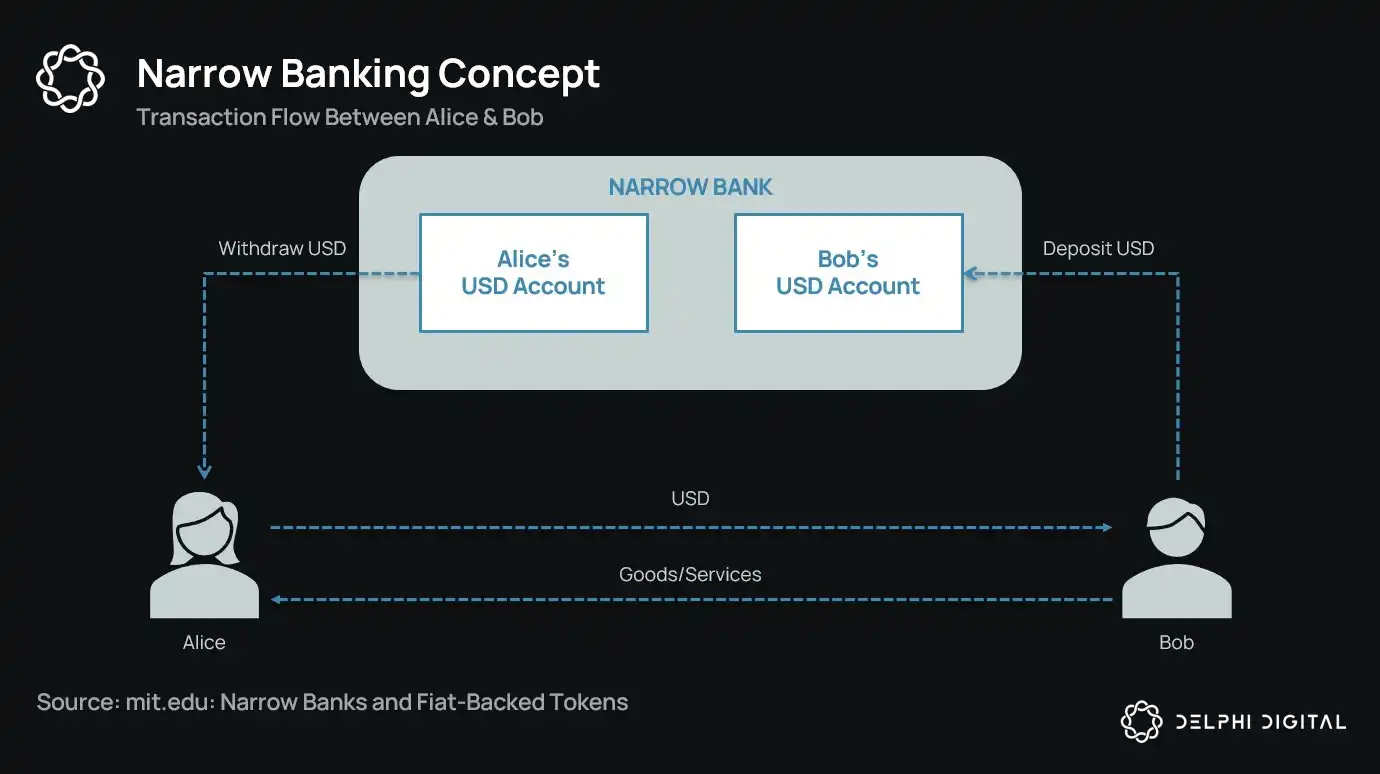

For over a century, currency reformers have continuously proposed various concepts of "narrow banking": namely, financial institutions that issue currency but do not provide credit. From the 1930s Chicago Plan to the modern The Narrow Bank (TNB) proposal, the core idea is to prevent bank runs and systemic risks by requiring currency issuers to hold only safe, liquid assets (such as government bonds).

However, regulatory agencies have always rejected the implementation of narrow banking.

Why? Because despite being theoretically safe, narrow banks would disrupt the core of the modern banking system—the credit creation mechanism. They would extract deposits from commercial banks, hoard risk-free collateral, and break the connection between short-term liabilities and productive loans.

Ironically, the crypto industry has now "revived" the narrow banking model in the form of fiat-backed stablecoins. The behavior of stablecoins is almost entirely consistent with narrow banking liabilities: they have full collateral, are redeemable instantly, and are primarily backed by U.S. Treasury bonds.

During the Great Depression, after a series of bank failures, economists from the Chicago School proposed an idea: to completely separate money creation from credit risk. According to the 1933 "Chicago Plan," banks had to hold 100% reserve against demand deposits, loans could only come from time deposits or equity, and could not use deposits for payments.

The original intent of this concept was to eliminate bank runs and reduce the instability of the financial system. This is because if banks cannot lend out deposits, they would not fail due to liquidity mismatches.

In recent years, this idea has resurfaced in the form of a "narrow bank." Narrow banks accept deposits but only invest in safe, short-term government securities such as Treasury bills or Federal Reserve reserves. A recent example is The Narrow Bank (TNB), which applied in 2018 to access the Federal Reserve's Interest on Excess Reserves (IOER) but was denied. The Federal Reserve was concerned that TNB could become a risk-free, high-yield deposit substitute, thus "weakening the transmission mechanism of monetary policy."

Regulators are genuinely concerned that if narrow banks were to succeed, they might weaken the commercial banking system by siphoning deposits away from traditional banks and hoarding safe collateral. Essentially, narrow banks create money-like instruments but do not support the credit intermediation function.

My personal "conspiracy theory" view is that the modern banking system is fundamentally a leveraged illusion, predicated on no one trying to "find the exit." And narrow banks happen to threaten that model. But upon closer examination, it's not so much a conspiracy—it just exposes the fragility of the existing system.

Central banks do not directly print money but regulate indirectly through commercial banks: encouraging or limiting lending, providing support in crises, and maintaining sovereign debt liquidity by injecting reserves. In exchange, commercial banks receive zero-cost liquidity, regulatory tolerance, and an implicit bailout commitment in times of crisis. In this structure, traditional commercial banks are not neutral market participants but tools of state intervention in the economy.

Now, imagine a bank saying, "We don't want leverage, we just want to offer users a secure currency backed 1:1 by government bonds or Federal Reserve reserves." This would render the existing fractional reserve banking model obsolete and directly challenge the current system.

The Federal Reserve's rejection of TNB's master account application is a manifestation of this threat. The issue is not that TNB would fail, but that it might actually succeed. If people could have a currency that is always liquid, has no credit risk, and still earns interest, why would they keep money in traditional banks?

This is where stablecoins come into play.

Fiat-backed stablecoins almost replicate the narrow bank model: issuing digital liabilities redeemable for U.S. dollars and backed 1:1 by secure, liquid off-chain reserves. Like narrow banks, stablecoin issuers do not use reserve funds for lending. Although issuers like Tether currently do not pay interest to users, that goes beyond the scope of this article. This article focuses on the role of stablecoins in the modern monetary structure.

Assets are risk-free, liabilities can be redeemed instantly, and they have the characteristics of fiat currency; there is no credit creation, no maturity mismatch, and no leverage.

Although narrow banks were "strangled" by regulatory authorities in the budding stage, stablecoins have not faced similar restrictions. Many stablecoin issuers operate outside the traditional banking system, especially in high-inflation countries and emerging markets, where there is a growing demand for stablecoins—regions that often struggle to access USD banking services.

From this perspective, stablecoins have evolved into a "digitally native Eurodollar," circulating outside the U.S. banking system.

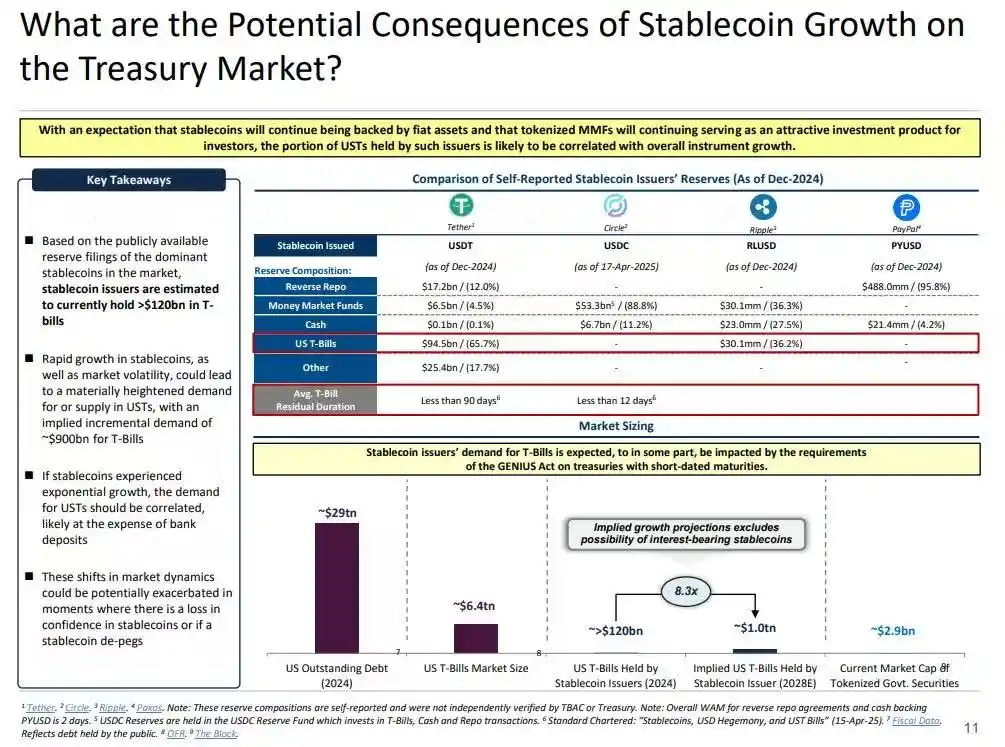

However, this has also raised a key question: What impact will stablecoins absorbing a sufficient amount of U.S. Treasury bonds have on systemic liquidity?

Liquidity Blackhole Thesis

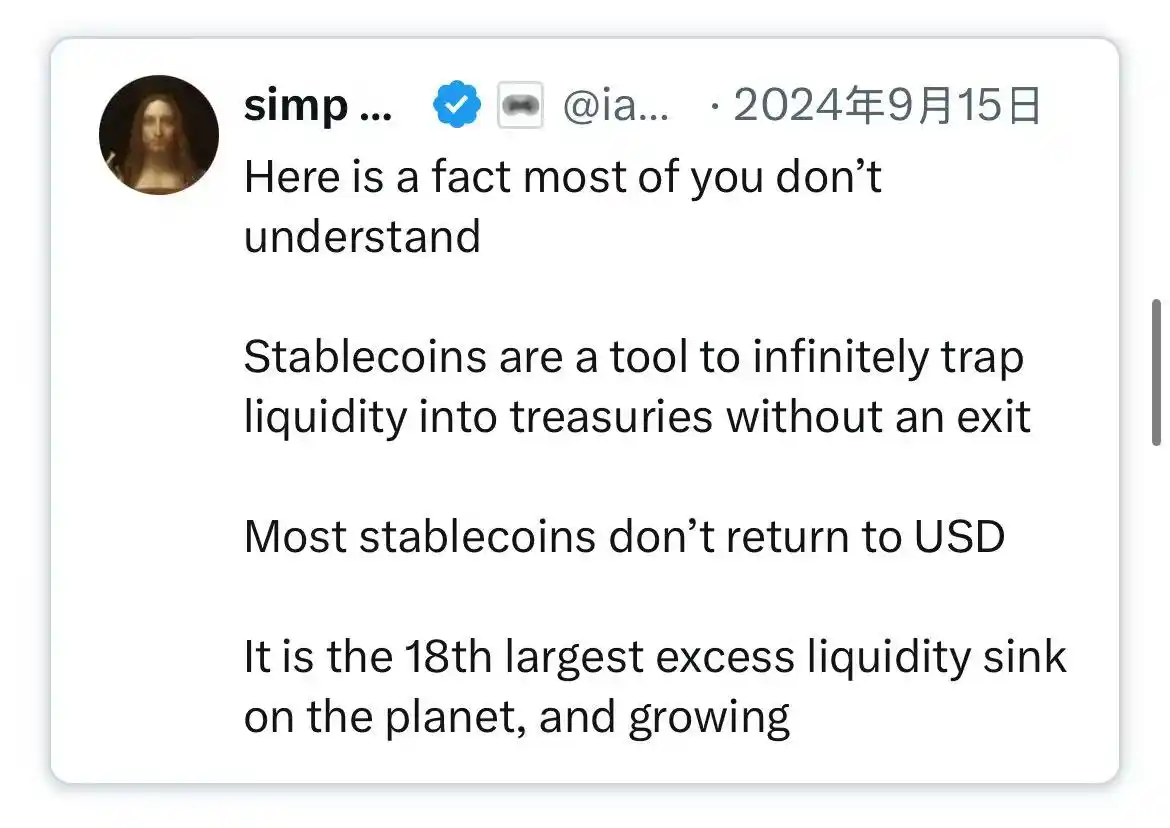

As stablecoins expand in scale, they are increasingly resembling global liquidity "islands": absorbing USD inflows while locking up secure collateral in a closed loop that cannot re-enter the traditional financial cycle.

This could lead to a "liquidity blackhole" in the U.S. Treasury market—where a significant amount of Treasury bonds are absorbed by the stablecoin system but cannot circulate in the traditional interbank market, thus affecting the overall financial system's liquidity supply.

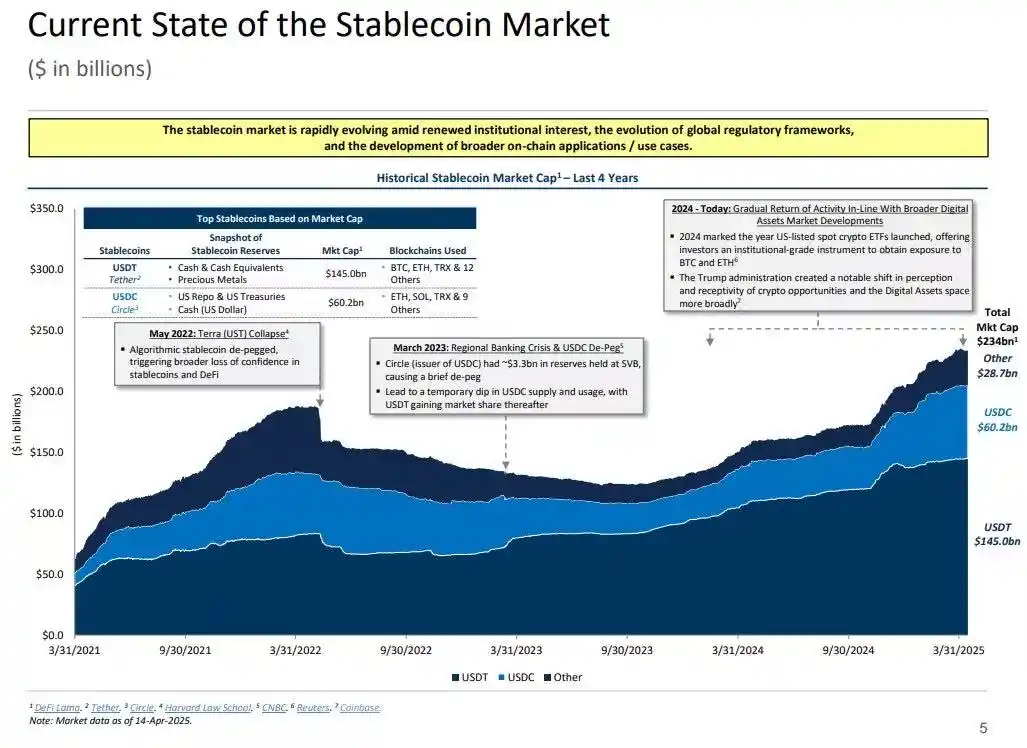

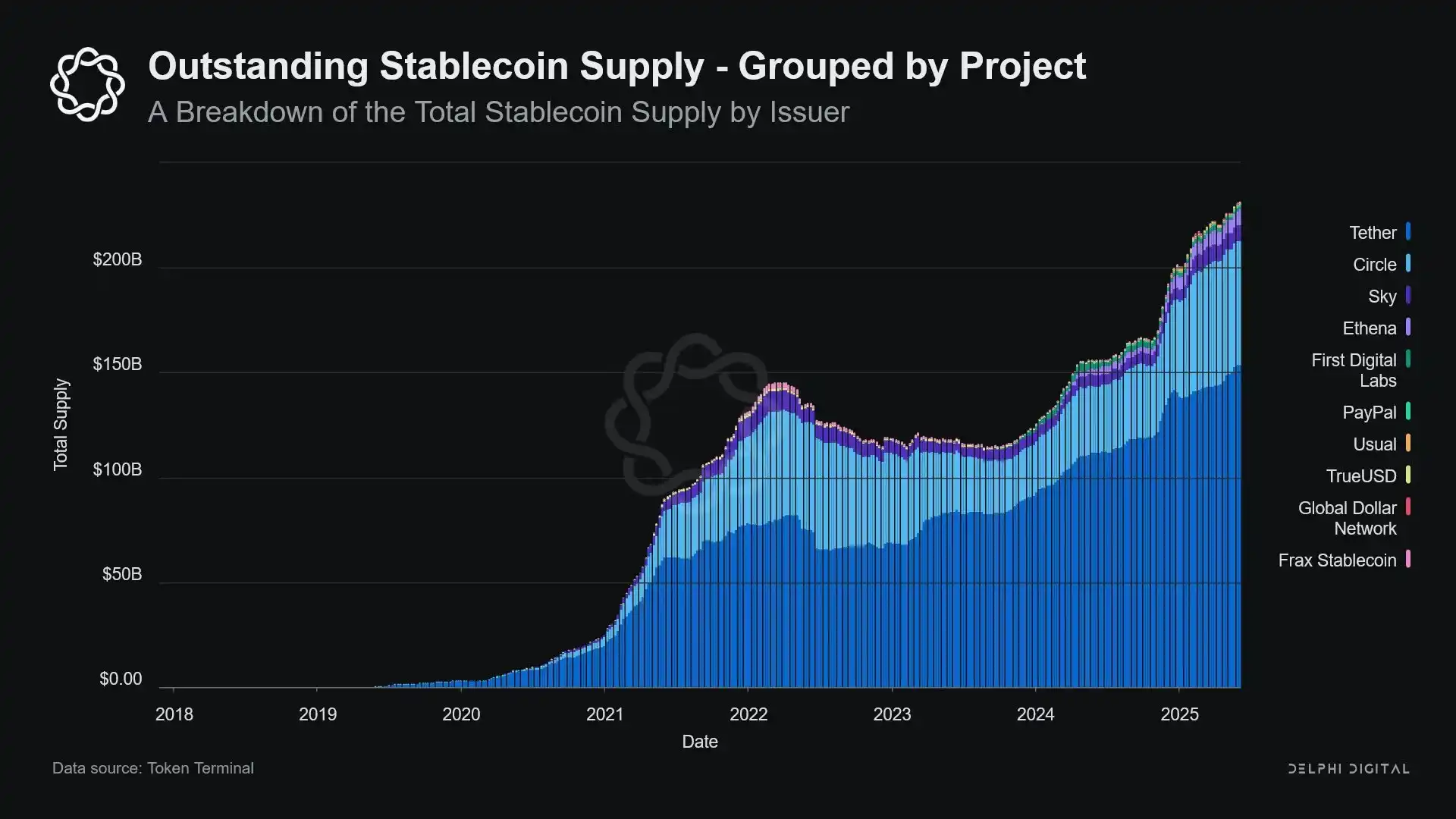

Stablecoin issuers are long-term net buyers of short-term U.S. Treasury bonds. For every dollar of stablecoin issuance, there must be equivalent asset backing on the balance sheet—usually Treasury securities or reverse repo positions. However, unlike traditional banks, stablecoin issuers do not sell these Treasury bonds for lending or to shift to risk assets.

As long as stablecoins remain in circulation, their reserves must be continuously held. Redemption only occurs when users exit the stablecoin system, which is very rare because on-chain users typically only swap between different tokens or use stablecoins as a long-term cash equivalent.

This makes stablecoin issuers a unidirectional liquidity "blackhole": they absorb Treasury bonds but rarely release them. When these Treasury bonds are locked in custody reserve accounts, they exit the traditional collateral loop—unable to be re-pledged and not usable in the repo market, effectively removed from the currency circulation system.

This results in a "Sterilization Effect." Just as the Federal Reserve's Quantitative Tightening (QT) tightens liquidity by removing high-quality collateral, stablecoins are also doing the same thing—but without any policy coordination or macroeconomic objectives.

Even more potentially disruptive is the concept of so-called "Shadow Quantitative Tightening" (Shadow QT) alongside a continuous feedback loop. It is non-cyclical, not adjusted based on macroeconomic conditions, but rather expands as demand for stablecoins grows. Moreover, since many stablecoin reserves are held in offshore, less transparent legal jurisdictions outside the United States, regulatory visibility and coordination challenges are heightened.

What's worse, this mechanism may become pro-cyclical in certain situations. When market risk aversion sentiment rises, demand for on-chain USD often increases, driving stablecoin issuance up, further withdrawing more US treasuries from the market—exactly when the market needs liquidity the most, intensifying the black hole effect.

Although the scale of stablecoins is still much smaller compared to the Fed's Quantitative Tightening (QT), their mechanisms are highly similar, and the macro impact is also strikingly similar: reduced circulating treasuries in the market; tightening liquidity; and upward pressure on interest rates.

Moreover, this growth trend shows no signs of slowing down, but rather has significantly accelerated in the past few years.

Policy Tensions and Systemic Risks

Stablecoins are at a unique crossroads: they are neither banks nor money market funds, nor are they traditional payment service providers in the conventional sense. This identity ambiguity creates structural tensions for policymakers: too small to be considered a systemic risk for regulation; too important to be simply banned; too useful yet too risky to be allowed to develop freely in an unregulated state.

A key function of traditional banks is to transmit monetary policy to the real economy. When the Federal Reserve raises interest rates, banks tighten credit, adjust deposit rates, and alter credit conditions. However, stablecoin issuers do not lend, so they cannot transmit interest rate changes to a broader credit market. Instead, they absorb high-yield US treasuries, do not offer credit or investment products, and many stablecoins do not even pay interest to holders.

The Federal Reserve's rejection of The Narrow Bank's (TNB) access to a master account is not due to credit risk concerns but rather a fear of financial disintermediation. The Fed is concerned that if a risk-free bank offers an interest-bearing account backed by reserves, it could attract a significant amount of funds out of commercial banks, potentially disrupting the banking system, squeezing credit space, and concentrating monetary power in a "liquidity-sterilized vault."

The systemic risk brought about by stablecoins is similar—except this time, they don't even require access to the Fed.

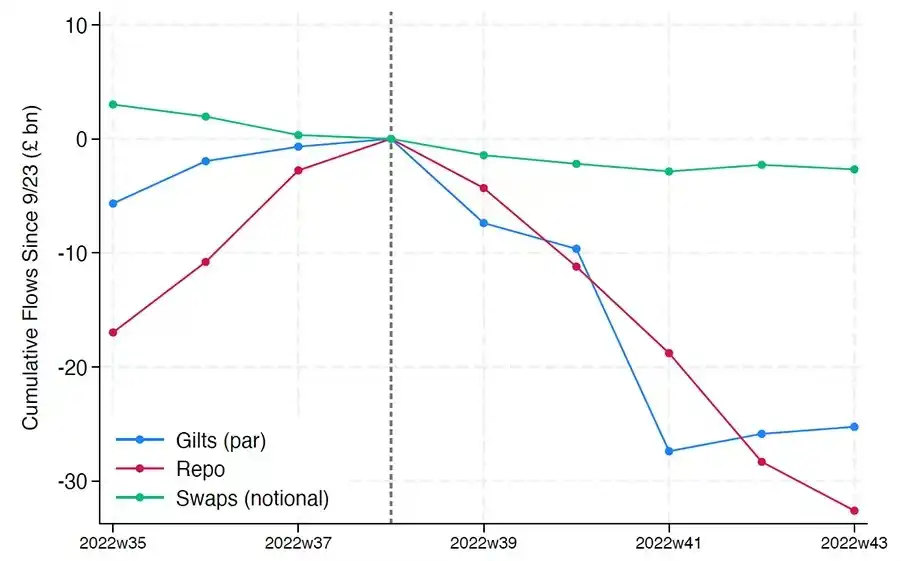

Furthermore, financial disintermediation is not the only risk. Even if stablecoins do not offer a yield, there is still a "bank run risk": once the market loses confidence in the reserve quality or regulatory stance, it could trigger a large-scale redemption frenzy. In such a scenario, the issuer may be forced to sell government bonds under market pressure, similar to the 2008 money market fund crisis, or the 2022 UK LDI crisis.

Unlike banks, stablecoin issuers do not have a "lender of last resort." Their shadow banking nature means they can quickly grow into a systemic role but could also unravel just as rapidly.

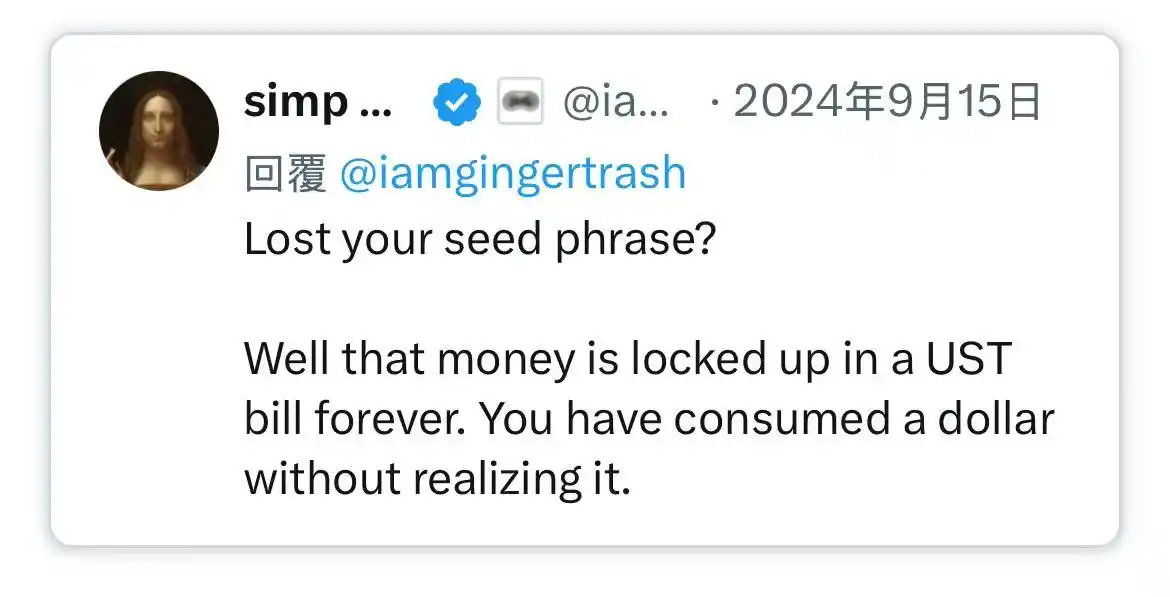

However, like Bitcoin, there is also a small number of cases of "seed phrase loss." In the context of stablecoins, this means that some funds will be permanently locked in U.S. Treasuries, unable to be redeemed, effectively becoming a liquidity black hole.

The issuance of stablecoins was initially just a fringe financial product in the crypto trading venue, but has now become a major conduit of dollar liquidity, running through exchanges, DeFi protocols, and even extending to cross-border remittances and global business payments. Stablecoins are no longer on the fringes of the infrastructure; they are gradually becoming the underlying architecture for conducting dollar transactions outside the banking system.

Their growth involves "sterilizing" collateral by locking up secure assets in cold storage reserves. This is a form of off-balance sheet contraction outside central bank control—an "ambient QT" (quantitative tightening).

While policymakers and the traditional banking system are still striving to maintain the old order, stablecoins have quietly begun reshaping it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Brace for Fed Decision — Will Rate Cuts Ignite the Final Bull Run?

Airdrop Warm-up: Check Out This MetaMask Season 1 Points Interaction Guide

The MetaMask Rewards event will last for 90 days and will distribute more than $30 million worth of $Linea token rewards.

US stocks opened higher, with Nvidia's total market capitalization surpassing $5 trillion.

After "profit-oriented restructuring," OpenAI paves the way for IPO—Is the AI boom about to reach its peak?

OpenAI is expected to spend $115 billion by 2029, while its revenue this year is projected to be only $13 billion, resulting in a significant funding gap.