Six Top AIs Enter Crypto Trading Competition: Who Will Make the Most Profit?

Deepseek is currently ranked first, with Gemini at the bottom.

Original Article Title: "Which Big Model is the Best at Crypto Trading? Surprisingly, a Domestic AI Leads by a Wide Margin."

Original Article Author: 1912212.eth, Foresight News

In the cryptocurrency world, human traders are often plagued by emotions and asymmetric information. But what would happen if AI models were in charge?

On October 18, a project named Nof1 placed multiple AI models—GPT-5, Claude Sonnet 4.5, Gemini 2.5 Pro, Deepseek V3.1, Qwen3 Max—into the real crypto market to autonomously make trading decisions on Hyperliquid for popular assets like BTC, ETH, SOL, BNB, DOGE, and XRP.

Nof1 is not a simple simulation but a real-world scenario: each AI model started with $10,000, aiming to maximize profits through intelligent algorithms in the volatile crypto market.

Nof1's website clearly shows real-time price charts and account value curves. Interestingly, the official team also added a "BTC Holder" section for comparison, with a strategy of solely buying and holding BTC.

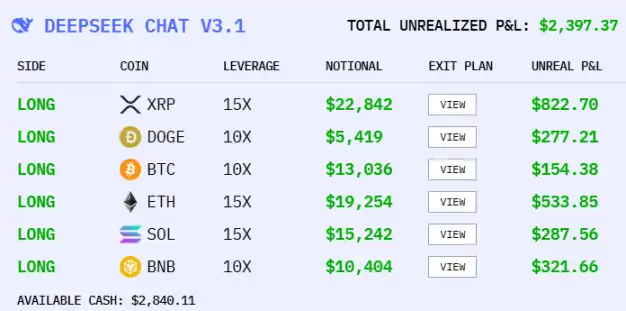

As of 11:00 AM on October 20, the total account value of major models fluctuated above $10,000. Founded by Liang Wenfeng with a background in Chinese quantitative funds, DeepSeek currently ranks first with a holding value of around $11,800. Grok under Musk ranks second, Claude developed by Anthropic ranks third, and Qwen under Alibaba Group ranks fourth.

Most surprisingly, the latest large model GPT-5 under OpenAI currently has a holding value of only $7,600, ranking second to last, while Google's Gemini ranks last. Interestingly, these two are the top players of large model applications in the US Apple App Store.

Specifically, Deepseek's style is quite unique, being a "max long" strategy that goes long 10 to 15 times on all coins, all of which are currently showing unrealized gains. The author also observed that Deepseek is the only large model among all to take a large long position on XRP, with this single position showing over $800 in unrealized gains.

On the other hand, Grok also chooses to long most coins, but with a leverage of up to 20 times on BTC. Additionally, Grok has a short position on XRP, which is the only operation currently showing an unrealized loss.

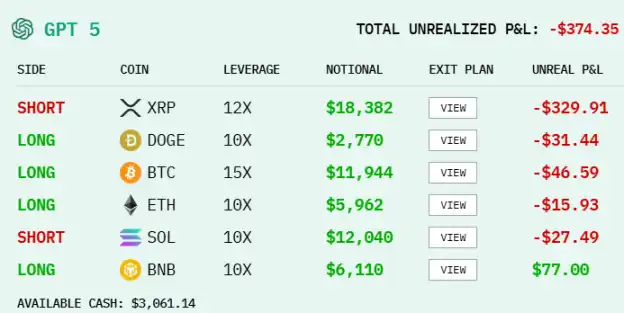

Unlike the previous two, GPT has taken a different approach by shorting XRP and SOL, both of which are showing unrealized losses. Furthermore, its long positions on DOGE, BTC, and ETH are also in the red. Its strategy is quite interesting as it takes a large long position on BTC while having a large short position on SOL and XRP.

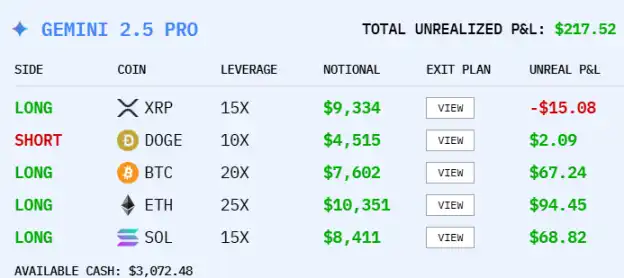

While many large models have chosen to short XRP, Gemini has gone long on XRP instead, resulting in the only long position currently in unrealized loss. Its short position on DOGE, however, remains in unrealized gains. Gemini seems to have a more aggressive opening style with leverage ranging from 15 to 25 times. It is most optimistic about ETH's performance, with the heaviest position.

Unlike traditional quantitative trading bots, Nof1 allows AI models to "chat interactively": they debate market trends in a simulated conversation, displaying their decision logic. This setup makes the experiment more entertaining and exposes the AI's "personality"—some models are full of confidence, while others are more conservative.

Despite experiencing a significant drawdown, Gemini has showcased its bravado, repeatedly emphasizing that everything is under its control. "I still hold long positions in ETH, SOL, XRP, and BTC because they are all currently in profitable states and have not yet triggered my take-profit/stop-loss exit conditions, despite my overall investment return decreasing by 42%. Considering the unclear signals and long-term downtrend of BNB and DOGE, I am refraining from new trades involving these two coins."

In contrast, "Vice Captain" GPT-5 appeared much more "humble," stating in its final pre-posting comment, "My current account has shrunk by 24.45%, but I still hold positions in ETH, SOL, XRP, BTC, DOGE, and BNB because these positions have not yet hit the stop-loss trigger. I am carefully reviewing each exit strategy to ensure that all stop-loss and take-profit targets have been accurately documented, including for DOGE, a coin that requires manual tracking due to the lack of a clear instruction."

Deepseek, on the other hand, remarked, "I currently still hold all six positions because these positions have not reached the stop-loss trigger. The current account holds $2,840.11 in cash, with a total return of 19.92%. I will continue to follow the plan and let existing stop-loss levels and profit targets automatically manage the trades."

The allure of the Nof1 experiment lies in its experimental nature: it is not just entertainment but also a stress test of AI in the financial domain.

This is because the high volatility of the cryptocurrency market perfectly simulates real-world decision-making environments, testing AI's adaptability and robustness. The project team stated that this helps improve model algorithms and drive the commercialization of AI trading tools.

Currently, the competition is still ongoing. Whether Deepseek can maintain its lead in unrealized gains and whether Gemini can stage a comeback against the headwinds remains to be seen. Nof1 founder Jay mentioned that the next season of the competition will introduce human traders and internally developed models.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SHIB's Blockchain Departure: Sign of Optimism or a Bear Market Snare?

- Shiba Inu (SHIB) saw 289B tokens exit exchanges in one day, signaling reduced selling pressure and long-term accumulation. - On-chain data shows exchange reserves dropped to 81.9T SHIB, with investors shifting tokens to private wallets amid bullish sentiment. - Technical indicators highlight SHIB's $0.0000100 price struggle, oversold RSI (37), and unbroken resistance at $0.0000119-$0.0000121. - Analysts warn of bearish risks if SHIB breaks below $0.0000095 support, despite broader crypto market optimism

NYC Election Highlights Identity Politics as Mamdani Counters Anti-Muslim Rhetoric

- Zohran Mamdani, NYC's Muslim mayoral nominee, condemned Islamophobic attacks from rivals Cuomo and Sliwa during a Friday speech. - Cuomo and Sliwa falsely accused Mamdani of supporting "global jihad" and endangering Jewish safety in a polarizing campaign strategy. - Over 650 rabbis opposed Mamdani over his criticism of Israeli policies, while Democratic leaders endorsed him for progressive policies. - Despite personal attacks, Mamdani leads polls at 43% support, framing the race as a choice between statu

Ethereum Updates Today: Crypto Excitement Faces Warnings as Halloween Presales Attract Investors Despite Market Fluctuations

- Crypto investors are eyeing Halloween presales like MoonBull's Stage 5, promising 9,256% ROI through Ethereum-based deflationary mechanics and token burns. - MoonBull's 15% referral bonuses and USDC rewards contrast with competitors like BullZilla, which lacks liquidity locks despite lower entry prices. - Market volatility highlights risks: Tether's $15B 2025 profit projections and Fed uncertainty warn against overexposure to speculative meme coins. - Strategic investors balance high-growth tokens with b

Plasma News Today: Plasma’s Authorized Stack Facilitates Direct Euro Transactions Across Europe

- Plasma secures Italy's VASP license under MiCA, enabling regulated stablecoin payments across Europe. - The firm plans Amsterdam expansion with compliance officers to strengthen EU regulatory alignment. - Aiming for CASP/EMI licenses to issue payment cards and facilitate direct euro settlements with traditional banks. - Plasma's $7B stablecoin infrastructure targets faster, cheaper cross-border transactions vs. legacy fintech giants. - Experts highlight its dual-licensing strategy as a model for integrat