Plasma News Today: Plasma’s Authorized Stack Facilitates Direct Euro Transactions Across Europe

- Plasma secures Italy's VASP license under MiCA, enabling regulated stablecoin payments across Europe. - The firm plans Amsterdam expansion with compliance officers to strengthen EU regulatory alignment. - Aiming for CASP/EMI licenses to issue payment cards and facilitate direct euro settlements with traditional banks. - Plasma's $7B stablecoin infrastructure targets faster, cheaper cross-border transactions vs. legacy fintech giants. - Experts highlight its dual-licensing strategy as a model for integrat

Plasma, a blockchain network specializing in stablecoin payments, has obtained a Virtual Asset Service Provider (VASP) license in Italy, representing a significant milestone in its efforts to broaden stablecoin payment services throughout Europe. On October 23, the company shared in a

With the VASP license, granted under the MiCA (Markets in Crypto-Assets) regulations, Plasma is now authorized to conduct crypto-related transactions and safeguard digital assets in the region. The firm is currently pursuing further regulatory approvals, such as MiCA’s Crypto Asset Service Provider (CASP) designation and an Electronic Money Institution (EMI) license. These additional licenses would permit Plasma to issue payment cards, manage client funds, and process direct euro transactions with conventional banks. Adam Jacobs, who leads

The new Amsterdam location, which will be overseen by a recently appointed chief compliance officer and a money laundering reporting officer, highlights Plasma’s dedication to meeting EU regulatory requirements. The Italian branch, formerly called GBTC Italia, will now operate as Plasma Italia SrL, while the Dutch office will be known as Plasma Nederland BV. Jacobs pointed out the Netherlands’ status as a "payments center" and its importance for "controlling more of the payment process, from stablecoin settlements to regulated financial infrastructure," according to CoinDesk.

Plasma’s expansion is in line with the increasing need for stablecoin-based payment options, which have handled $46 trillion in yearly transactions—outpacing established fintech leaders like PayPal and

Regulatory specialists highlight that Plasma’s VASP license, along with its dual approach to MiCA and EMI licensing, could simplify integration with established banking networks. By minimizing fragmentation between crypto custody and fiat payment channels, Plasma aims to facilitate direct euro transactions and attract financial institutions looking for more affordable cross-border payment solutions, according to Cryptonomist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

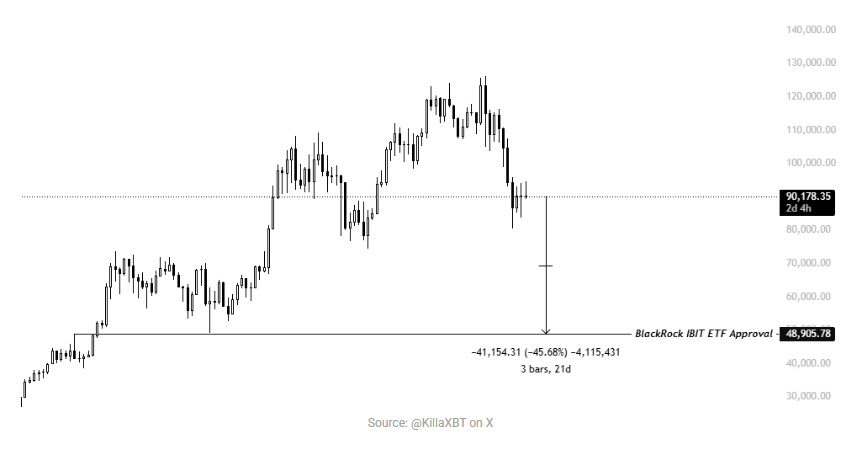

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why