BlackRock surpasses 800 BTC in its Bitcoin ETF

- BlackRock's IBIT reaches 800.000 BTC under management

- Fund records a sequence of US$4 billion in inflows

- Participation represents 3,8% of the total bitcoin supply

The IBIT spot bitcoin ETF, managed by BlackRock, surpassed the 800.000 BTC milestone in assets under management, equivalent to approximately US$97 billion, less than two years after starting trading in January 2024. The milestone was reached after a new positive sequence of capital inflows, which added more than US$4 billion in just seven days.

According to latest data released According to the manager, IBIT held 802.257 BTC, corresponding to approximately 3,8% of the total supply of 21 million bitcoins. Last Wednesday alone, the fund received US$426,2 million in net inflows—approximately 3.510 BTC—consolidating its position as the largest institutional vehicle for bitcoin exposure on the market.

The performance puts BlackRock's ETF ahead of companies that hold corporate bitcoin reserves, such as Strategy, led by Michael Saylor, which holds 640.031 BTC, valued at about $78 billion.

Spot Bitcoin ETFs in the United States have been experiencing strong demand. Last week alone, the sector accumulated $5,7 billion in inflows, of which $4,1 billion came from IBIT. According to Timothy Misir, head of research at BRN,

“The eight-day streak of ETF inflows underscores persistent structural demand, while corporate treasury holdings continue to expand, reinforcing the narrative of bitcoin as a strategic reserve asset.”

Bloomberg analyst Eric Balchunas highlighted that IBIT was the ETF with the highest weekly flow among all products listed in the US, totaling US$3,5 billion, approximately 10% of all net ETF volume.

Since its inception, the fund has accumulated over $65 billion in net inflows, exceeding market expectations. BlackRock CEO Larry Fink even stated that "IBIT is the fastest-growing ETF in the history of ETFs," demonstrating the strength of institutional appetite for Bitcoin and solidifying the asset as a key component of global investment portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What is the future of Bitcoin treasury companies?

Whoever can first turn BTC holdings into yield-generating assets will be able to achieve sustainable premiums again.

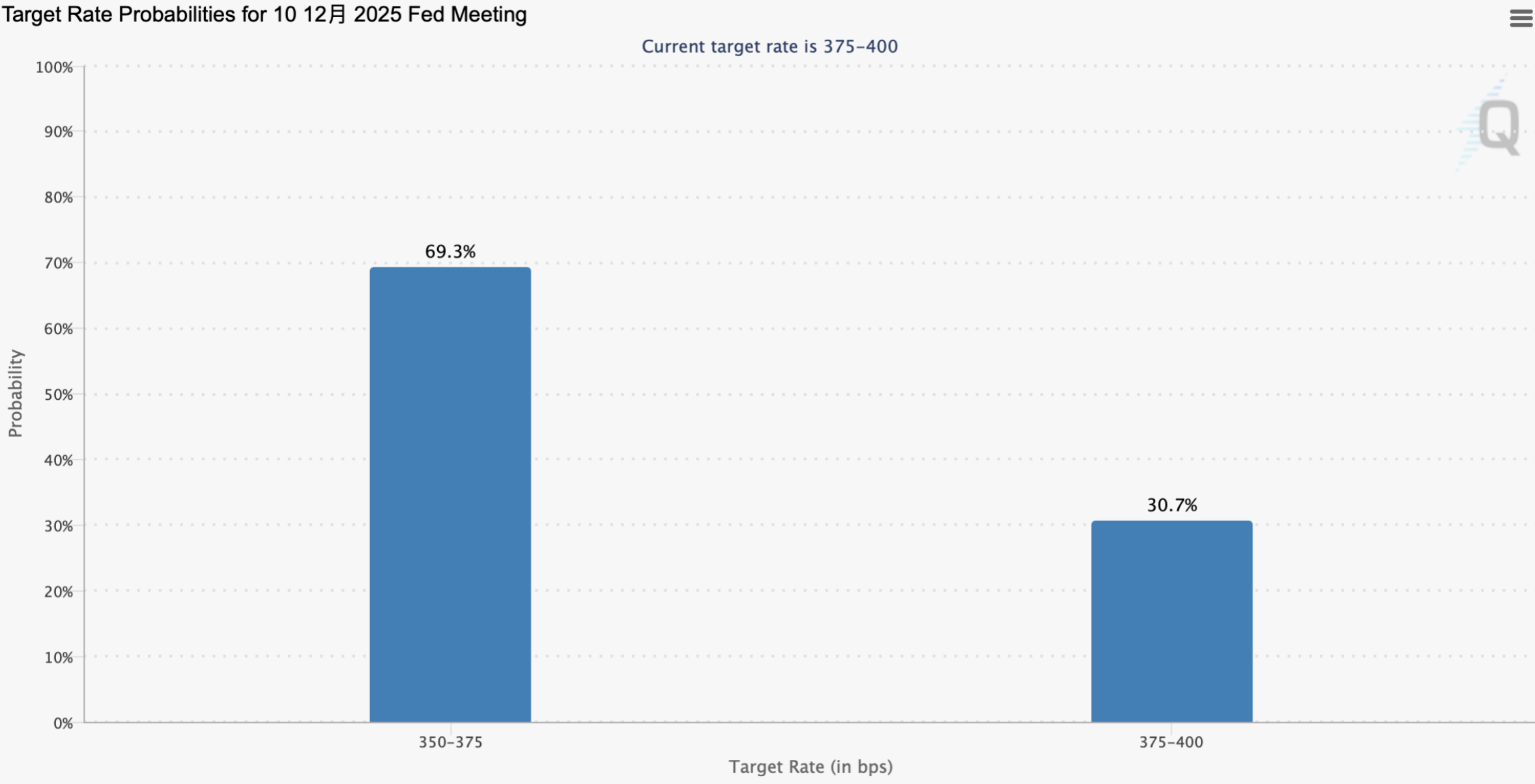

Powell’s ally makes a major statement: Is a December rate cut reversal now highly likely?

There are divisions within the Federal Reserve regarding a rate cut in December, but due to a weakening job market and statements from senior officials, market expectations have shifted in favor of a rate cut. Economists believe the Federal Reserve may take action to address economic weakness, but internal disagreements focus on policy tightness, interpretations of inflation, and contradictions between employment and consumption. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still in the process of iterative updates.

MSTR to be "removed" from the index, JPMorgan research report "caught in the crossfire," crypto community calls for "boycott"

JPMorgan warned in a research report that if MicroStrategy is eventually excluded, it could trigger a mandatory sell-off amounting to 2.8 billions USD.

Weekly Crypto Market Watch (11.17-11.24): Market Continues to Decline, Potential for Recovery as Rate Cut Expectations Rise

The reversal of Fed rate cut expectations has led to significant volatility in BTC prices, with the market remaining in a state of extreme fear for 12 consecutive days. ETF funds continue to flow out, the altcoin market is sluggish, and investor trading enthusiasm is waning.