Author: Yuuki, Deep Tide TechFlow

I. Overall Performance

1. Macro Events:

Last week, the market was significantly affected by macro liquidity events, with BTC prices fluctuating sharply around expectations for a Federal Reserve rate cut.

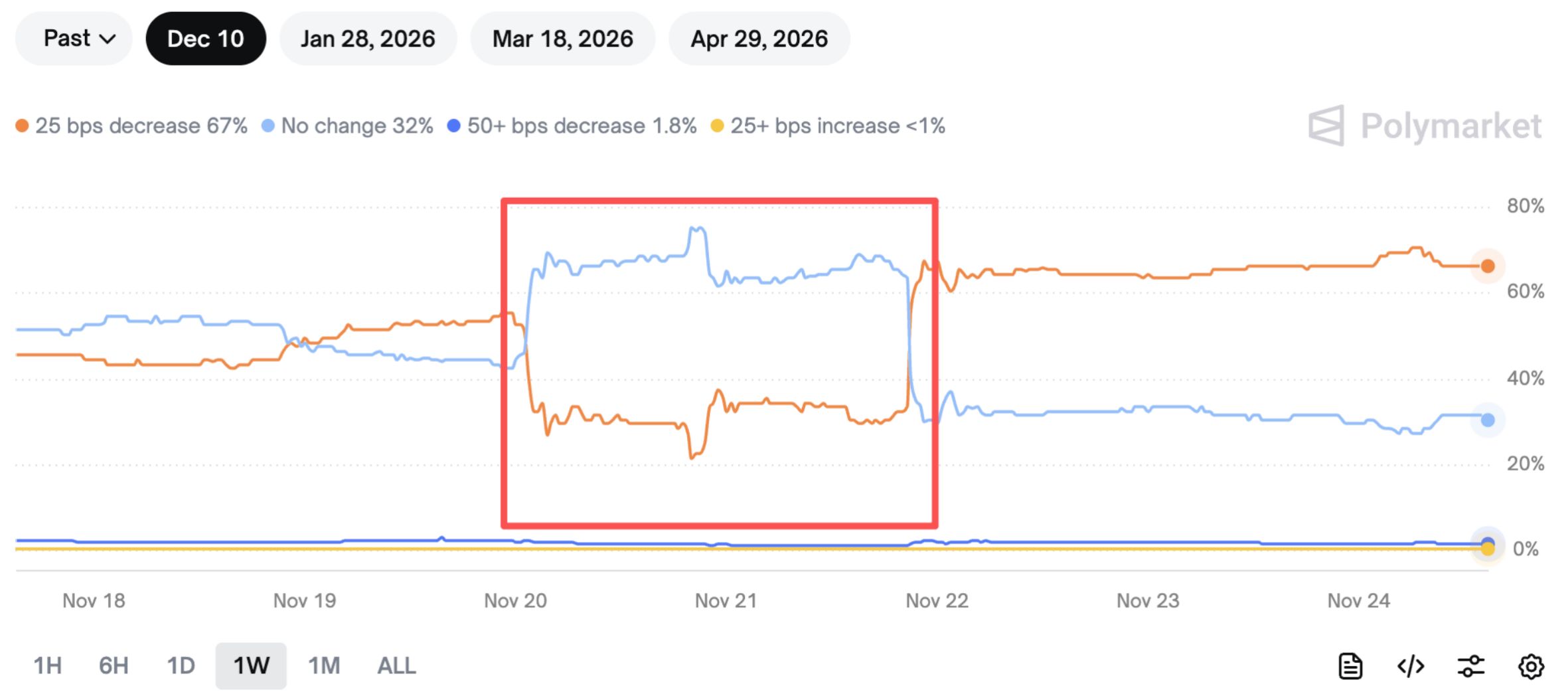

In the early morning of November 20 (GMT+8), the minutes of the Federal Reserve's October meeting were released, with hawkish wording in the document; subsequently, JPMorgan released an opinion stating that the Federal Reserve would not cut rates in December. As a result, the market continued to lower its expectations for a December rate cut by the Fed, dropping as low as 22%; BTC fell by up to 13% over two days to a weekly low of 80,600.

However, following dovish remarks by Federal Reserve official John William on the evening of November 21, market expectations for a December rate cut underwent a dramatic reversal (John William is the President of the New York Fed and the only regional Fed president with permanent voting rights, considered the de facto second-in-command at the Fed. He has historically been hawkish, so his sudden dovish stance broke market expectations).

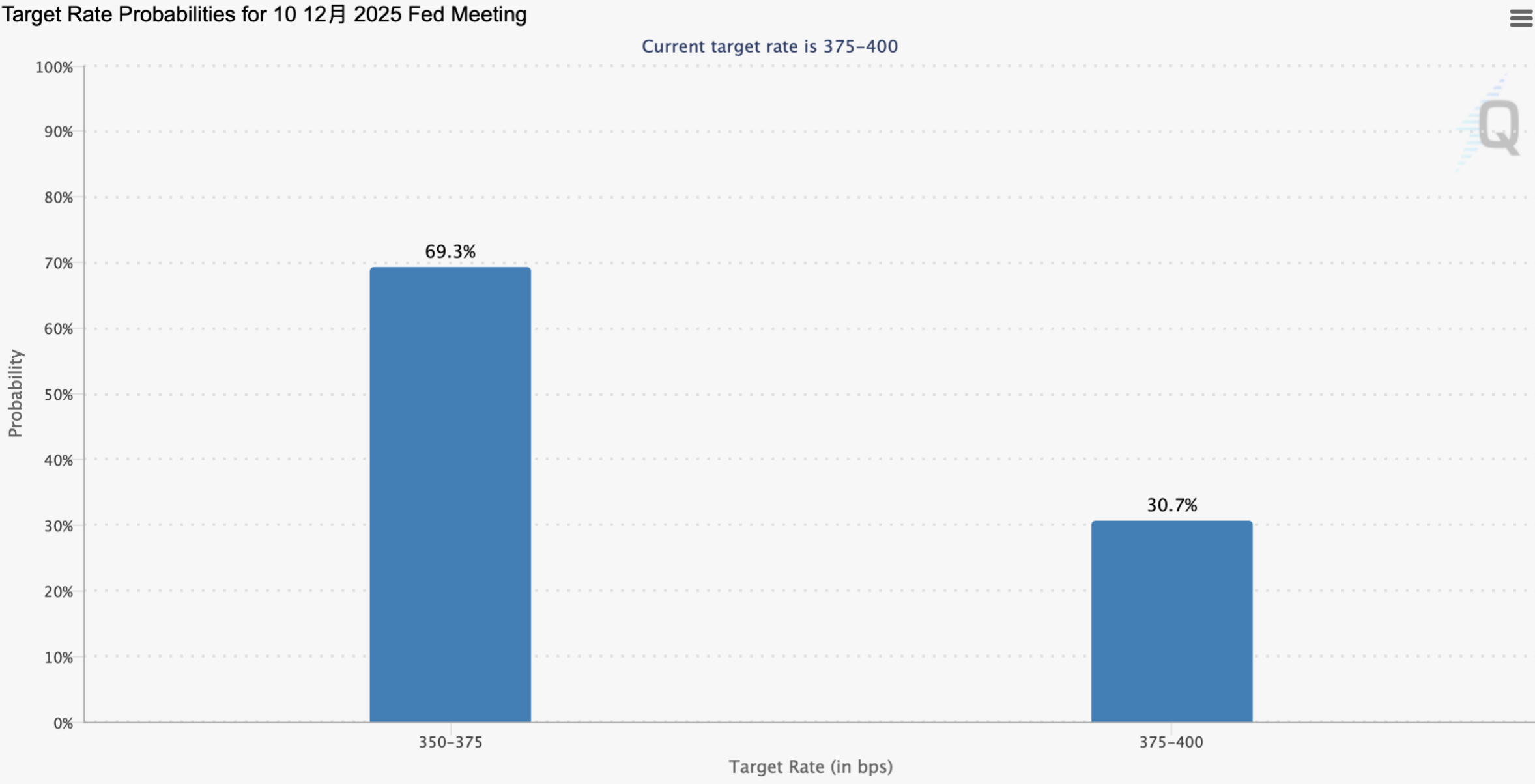

Currently, according to CME Group data, the probability of a 25 basis point rate cut in December is 69.3%; BTC and US stocks have simultaneously entered a recovery trend. Next week, on December 29, the Fed will enter a blackout period before the rate cut. Macro attention will continue to focus on Japanese bond yields, private credit default rates, the end of QT on December 1, and the pace of TGA spending as liquidity indicators.

Nvidia released its earnings report last Thursday, with results exceeding expectations but failing to stabilize its stock price. Investor sentiment toward US stocks is increasingly bearish, and attention should be paid to the downside risk of US equities.

Chart: Probability of a 25 basis point Fed rate cut in December rises to 69.3%

Data source: CME Group

Chart: Dramatic reversal in rate cut expectations over November 20-21, BTC price fluctuates accordingly

Data source: Polymarket

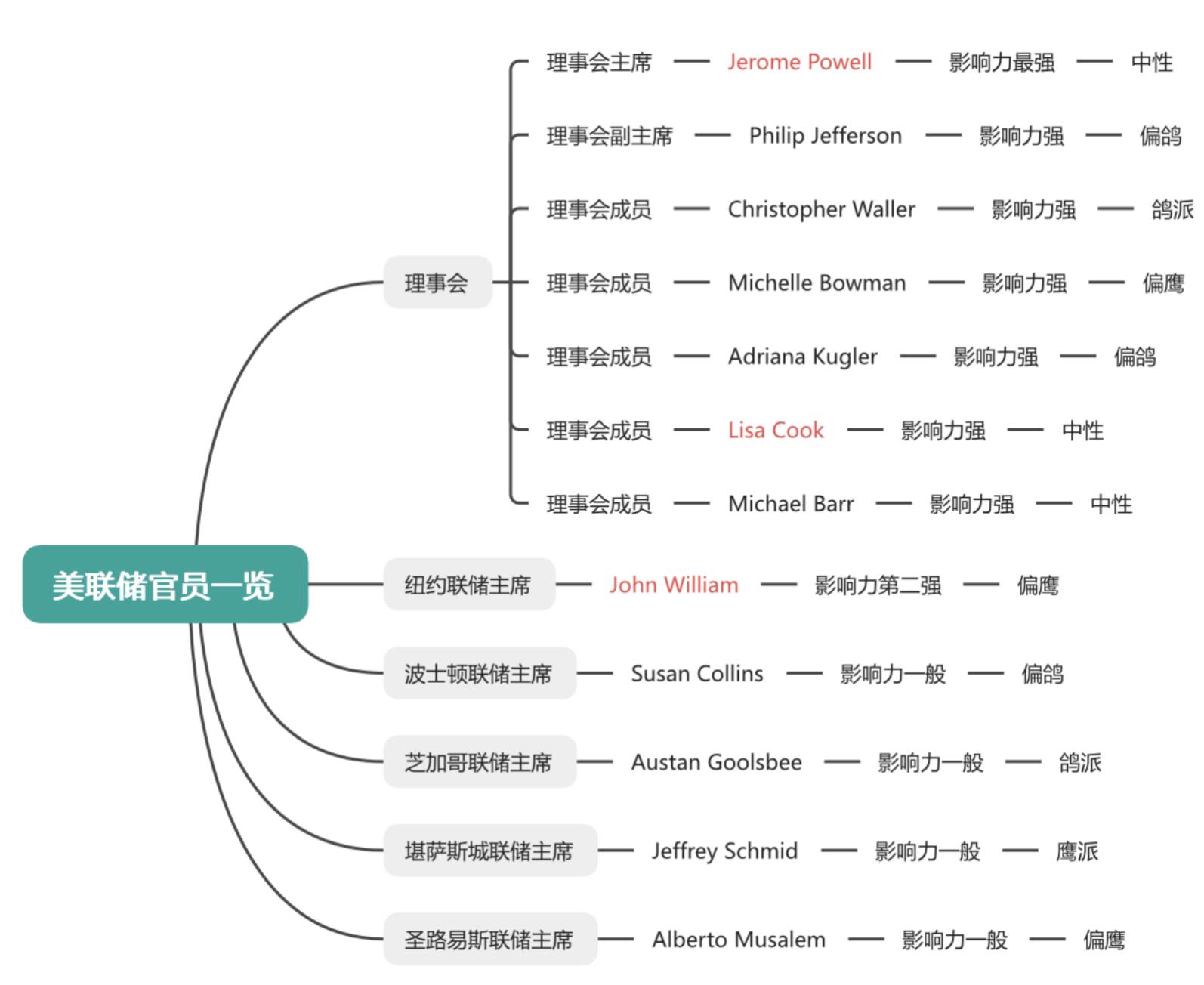

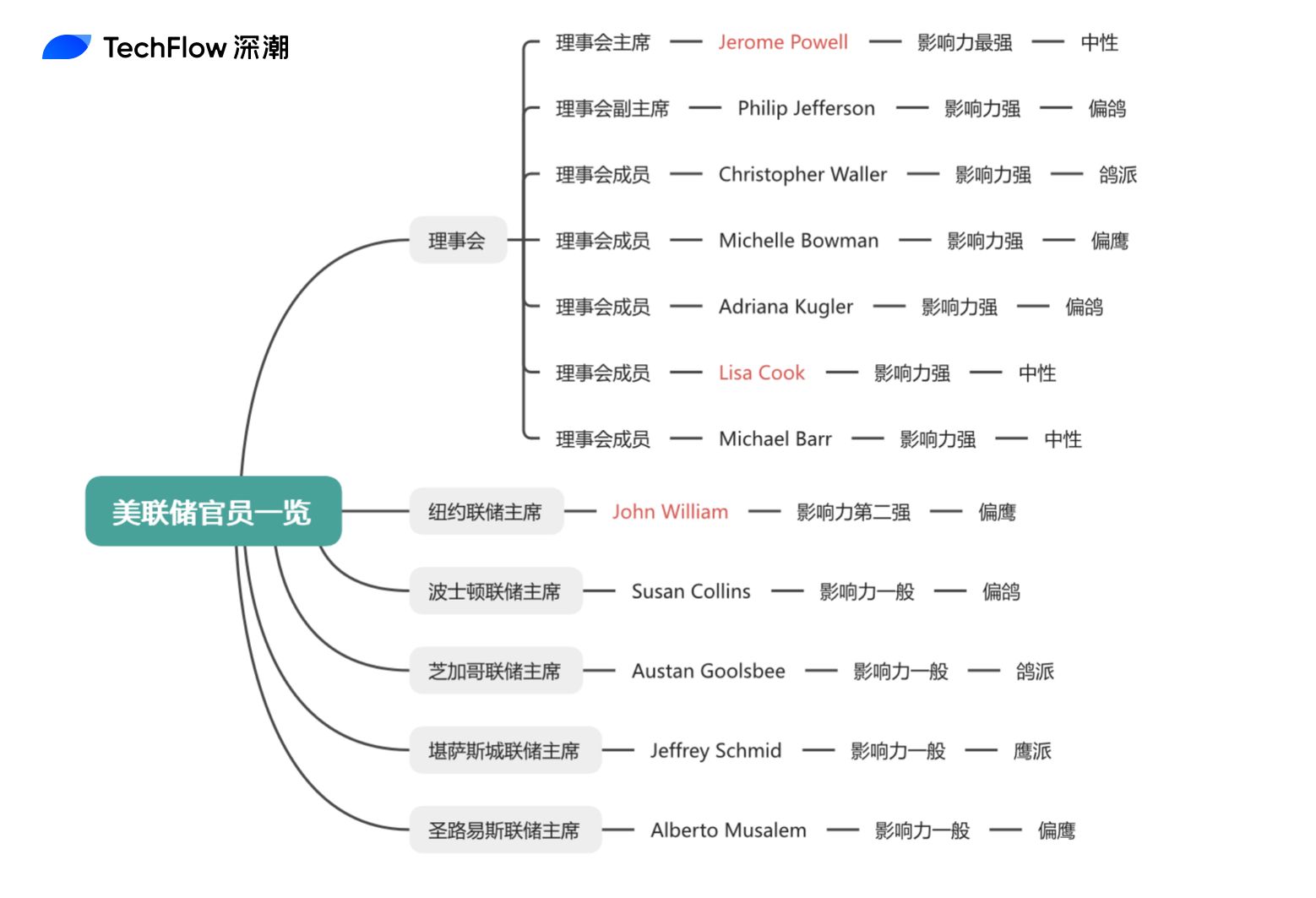

The chart below summarizes the influence and historical hawkish/dovish stances of current Fed officials. Powell and William have the strongest influence. In addition, based on current statements from Fed officials, Cook's vote may become the key vote on whether the Fed cuts rates in December.

Chart: Summary of influence and hawkish/dovish stances of current Fed officials

Data source: TechFlow compilation

The 10-year Japanese bond yield rose to 1.78%. If it continues to rise, accompanied by an appreciation of the yen, caution is needed regarding the tightening of dollar asset liquidity caused by the unwinding of yen carry trades; the narrow definition of yen carry trade (Japanese banks' short-term foreign debt) is about $350 billion, and the broad definition, including institutional overseas investments, exceeds $1 trillion.

Chart: 10-year Japanese bond yield rises to 1.78%

Data source: TradingView

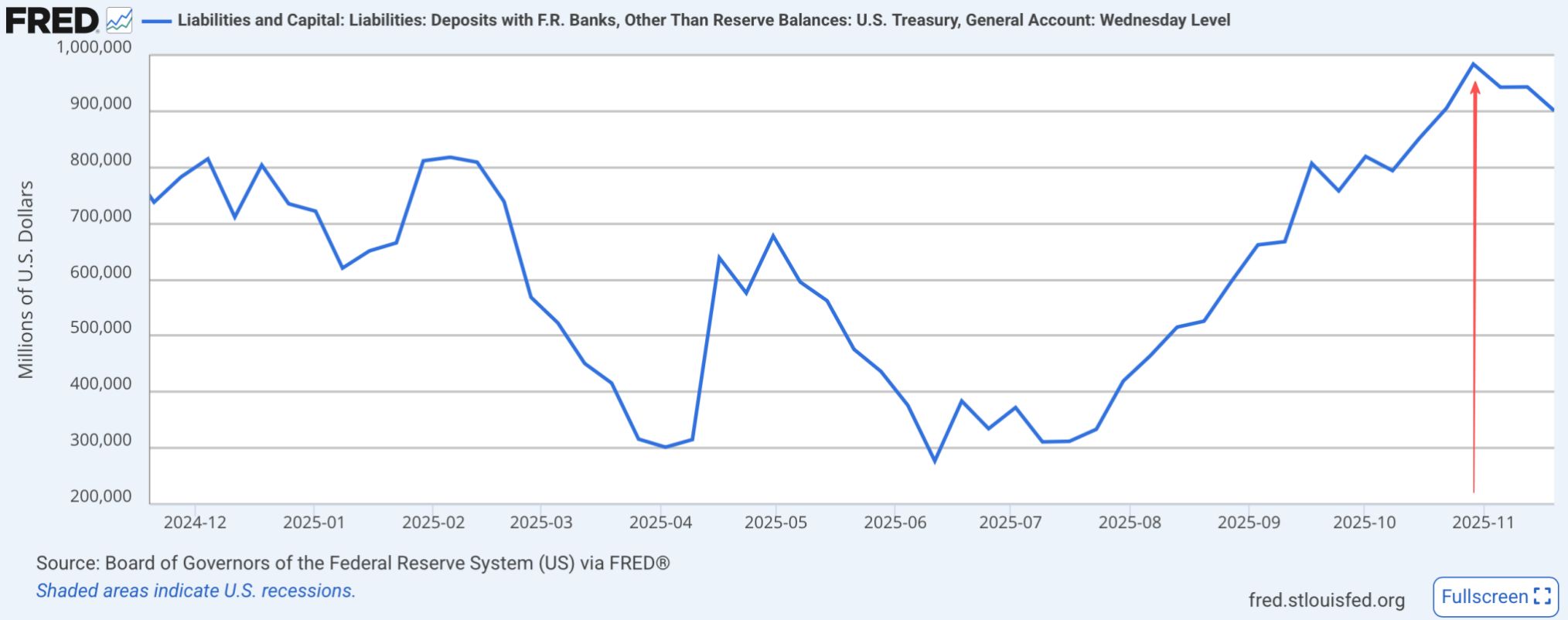

After the end of the government shutdown, the TGA account balance has not shown a significant decline, and fiscal liquidity has not yet been injected into the market.

Chart: TGA account balance

Data source: FRED

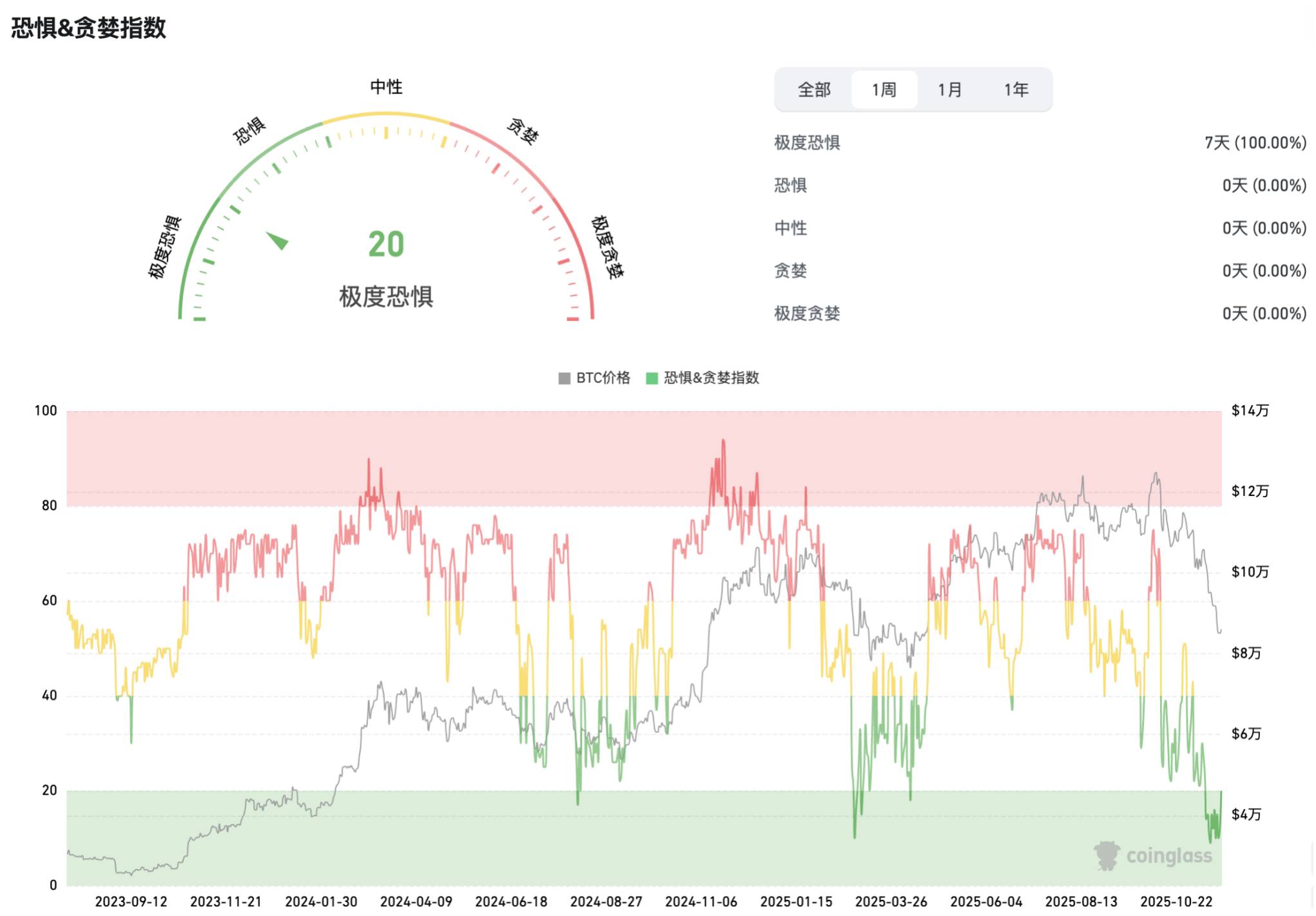

2. Market Sentiment:

Over the past 7 days, market sentiment has remained in a state of extreme fear. On November 21, after BTC broke down to 80,600 on the weekly chart, it entered a recovery trend, and the Fear & Greed Index also rose, but it still has not exited the extreme fear range. The market has now been in extreme fear for 12 consecutive days, the first time since July 2022; last time, due to the bankruptcy of FTX exchange, the market remained in extreme fear for two consecutive months from May to July 2022.

Chart: Market sentiment was extremely fearful last week

Data source: Coinglass

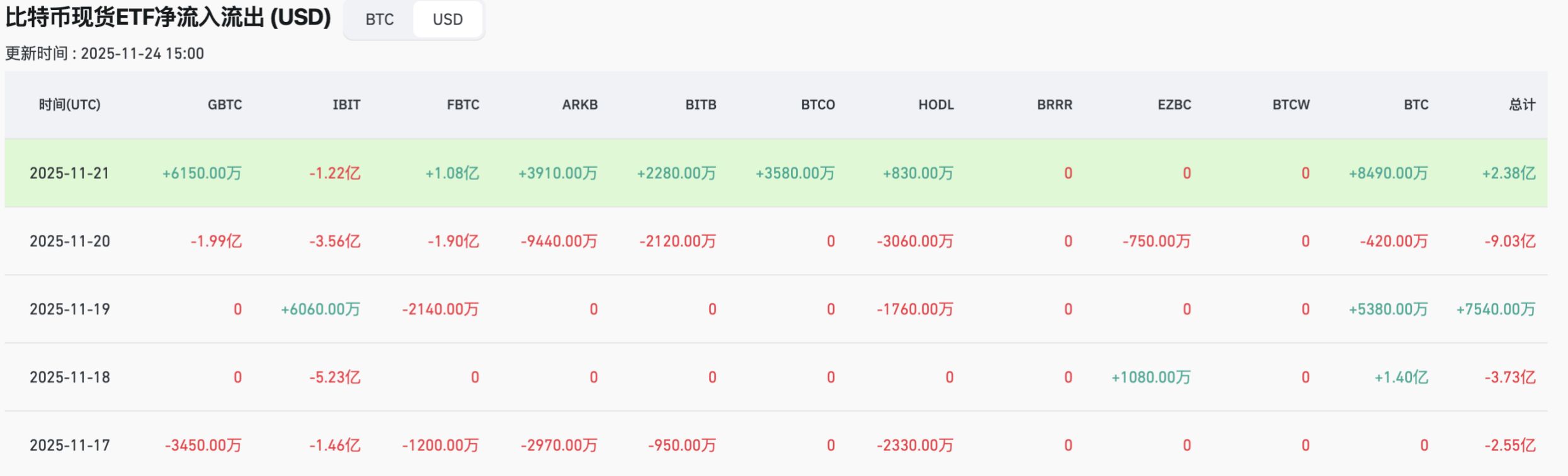

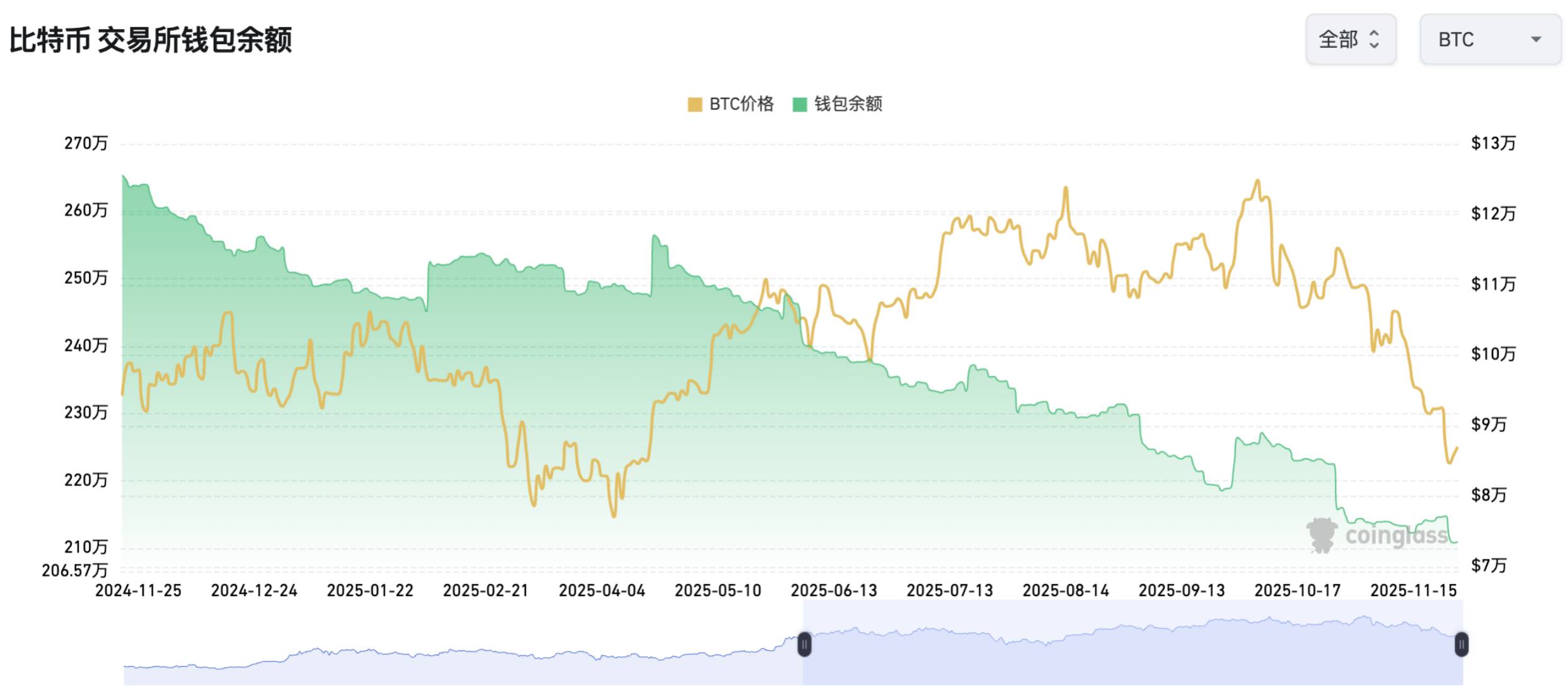

3. Specific Data:

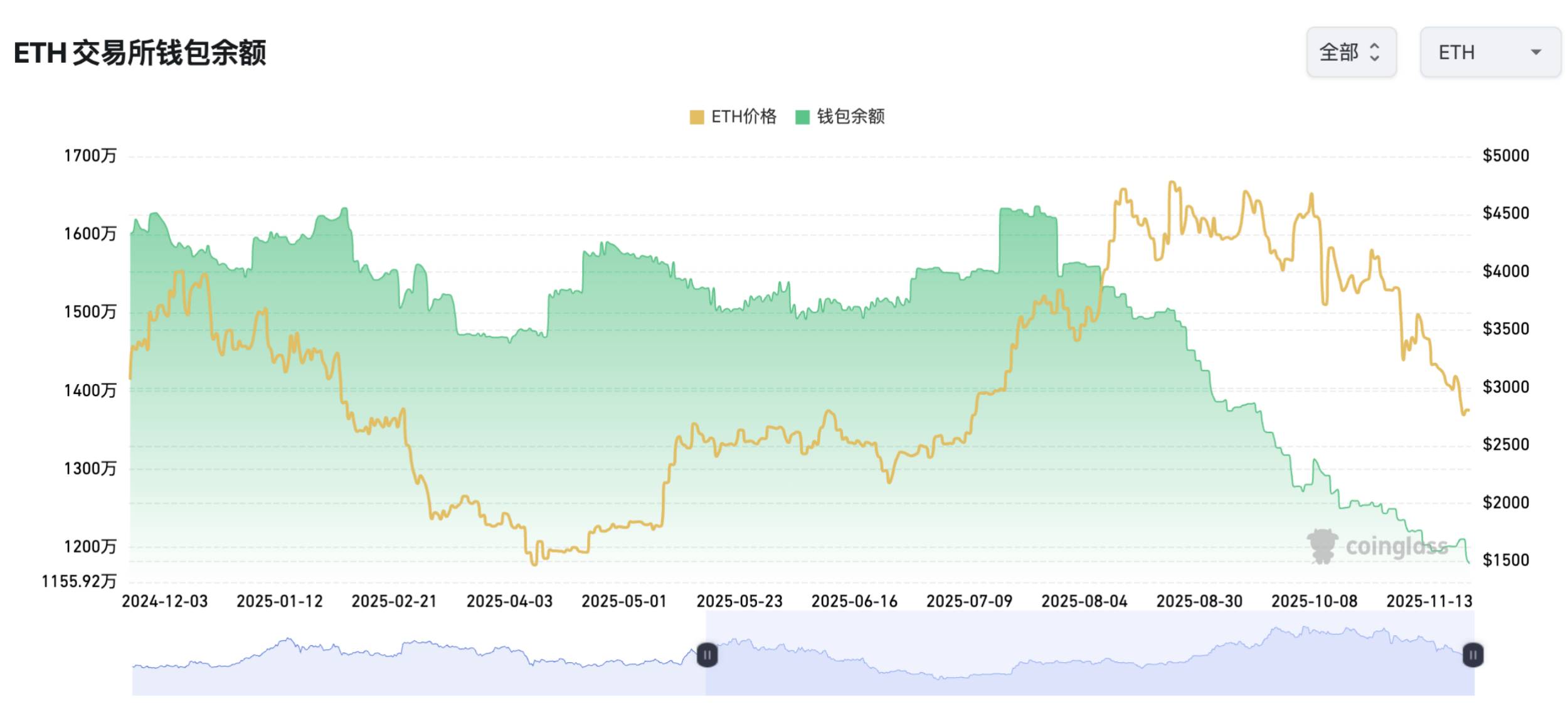

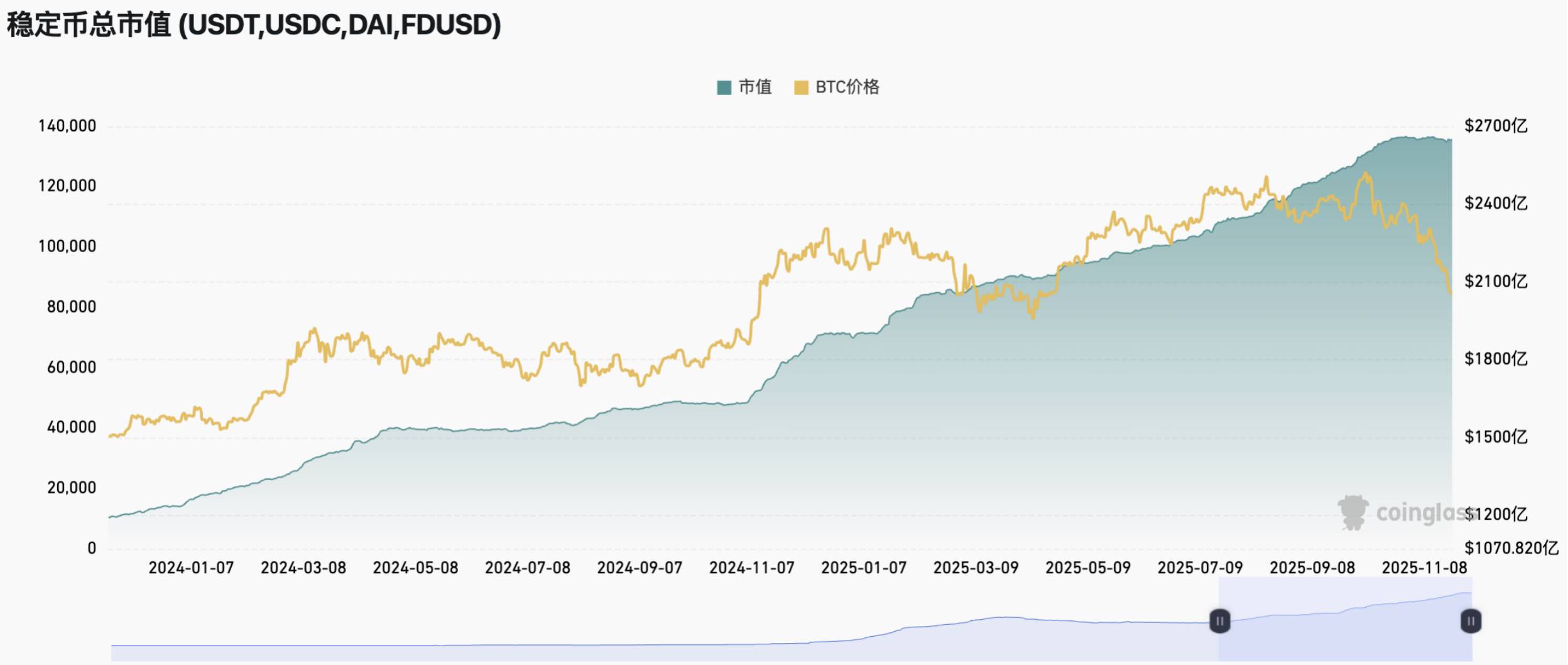

Last week, BTC ETF outflows reached $1.218 billion, up 9.5% week-on-week; ETH ETF outflows were $500 million, down 31.3% week-on-week. Currently, BTC exchange balances are 2.1095 million, down 1.3% week-on-week; ETH exchange balances are 11.7951 million, down 1.76% week-on-week. As of November 16, the stablecoin market cap was $26.4824 billion, down 0.1% week-on-week.

Chart: BTC ETF outflows of $1.218 billion, up 9.5% week-on-week

Data source: Coinglass

Chart: ETH ETF outflows of $500 million, down 31.3% week-on-week

Data source: Coinglass

Chart: BTC exchange balances down 1.3% week-on-week

Data source: Coinglass

Chart: ETH exchange balances down 1.76% week-on-week

Data source: Coinglass

Chart: Stablecoin market cap down 0.1% week-on-week

Data source: Coinglass

II. Local Hotspots

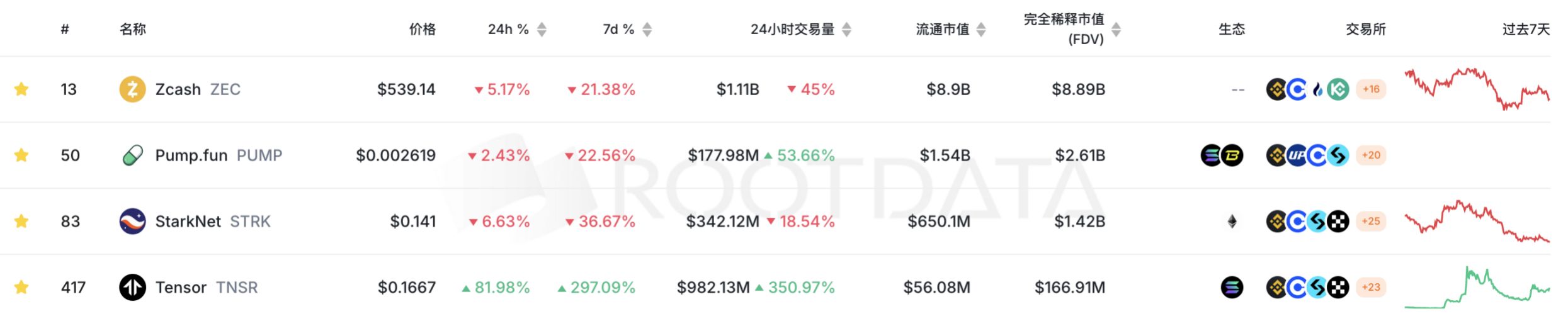

1. The overall market was sluggish last week, and the privacy sector also began to decline. ZEC fell 18% over the week, showing a sideways trend at high levels; STRK plummeted 31% over the week, basically returning to its starting point; HYPE faced a large unlock and fell 18% over the week; the PUMP team continued to sell coins for cash, with the price dropping 26% over the week; small-cap TNSR surged, rising 250% over the week and up 800% at its weekly high. The Tensor Foundation acquired the Tensor marketplace from Tensor labs and burned 22% of TNSR tokens held by Tensor labs.

Chart: Price and volume performance of popular tokens

Data source: Rootdata

2. Last Friday, Base founder Jesse issued his own namesake token "jesse" on the Base chain via the Zora platform. The market cap peaked at $30 million, with opening snipers making about 2-3x profit. Currently, the jesse token market cap has dropped to $13 million, roughly equal to the opening price most investors could buy at initially.

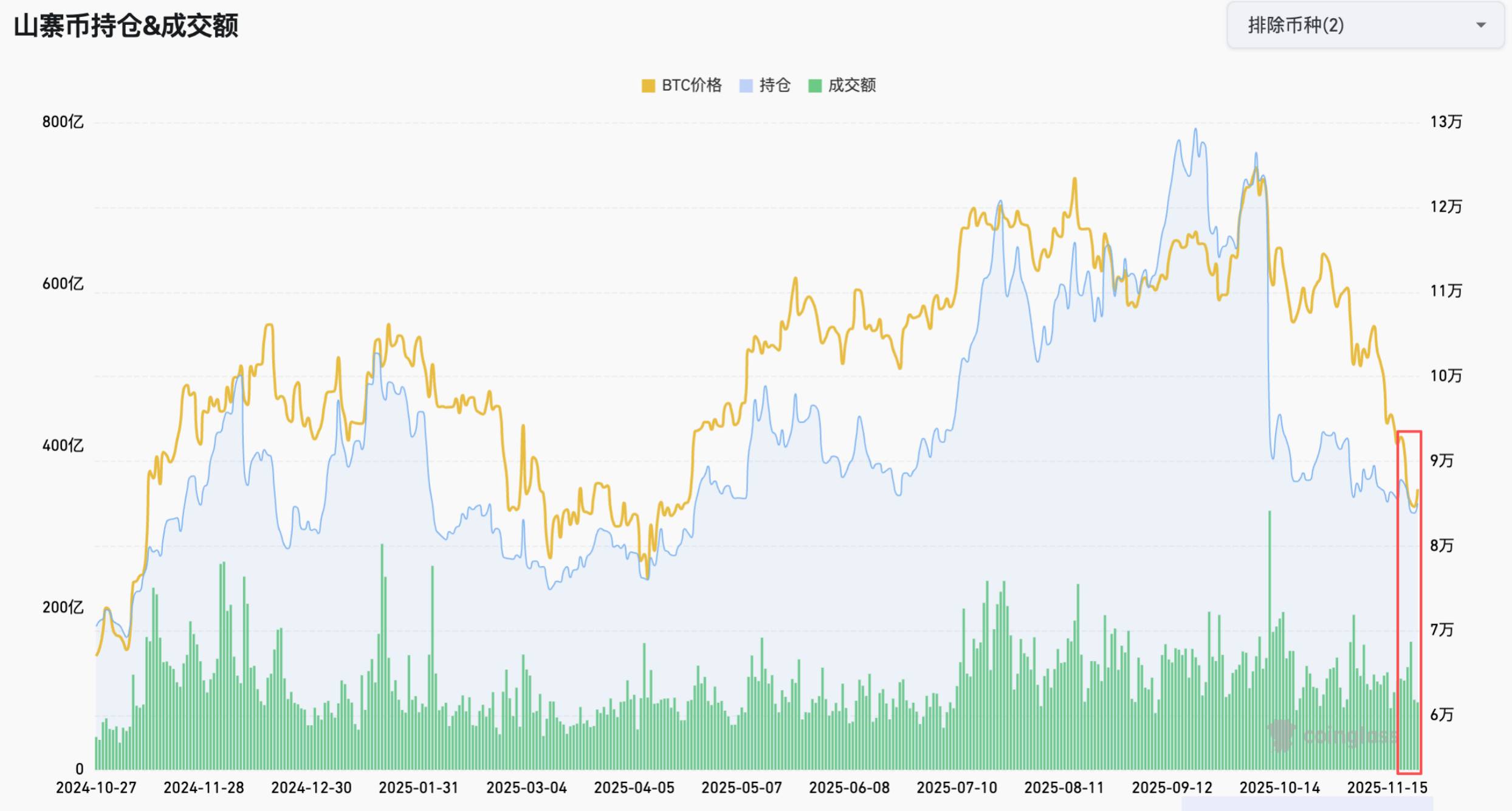

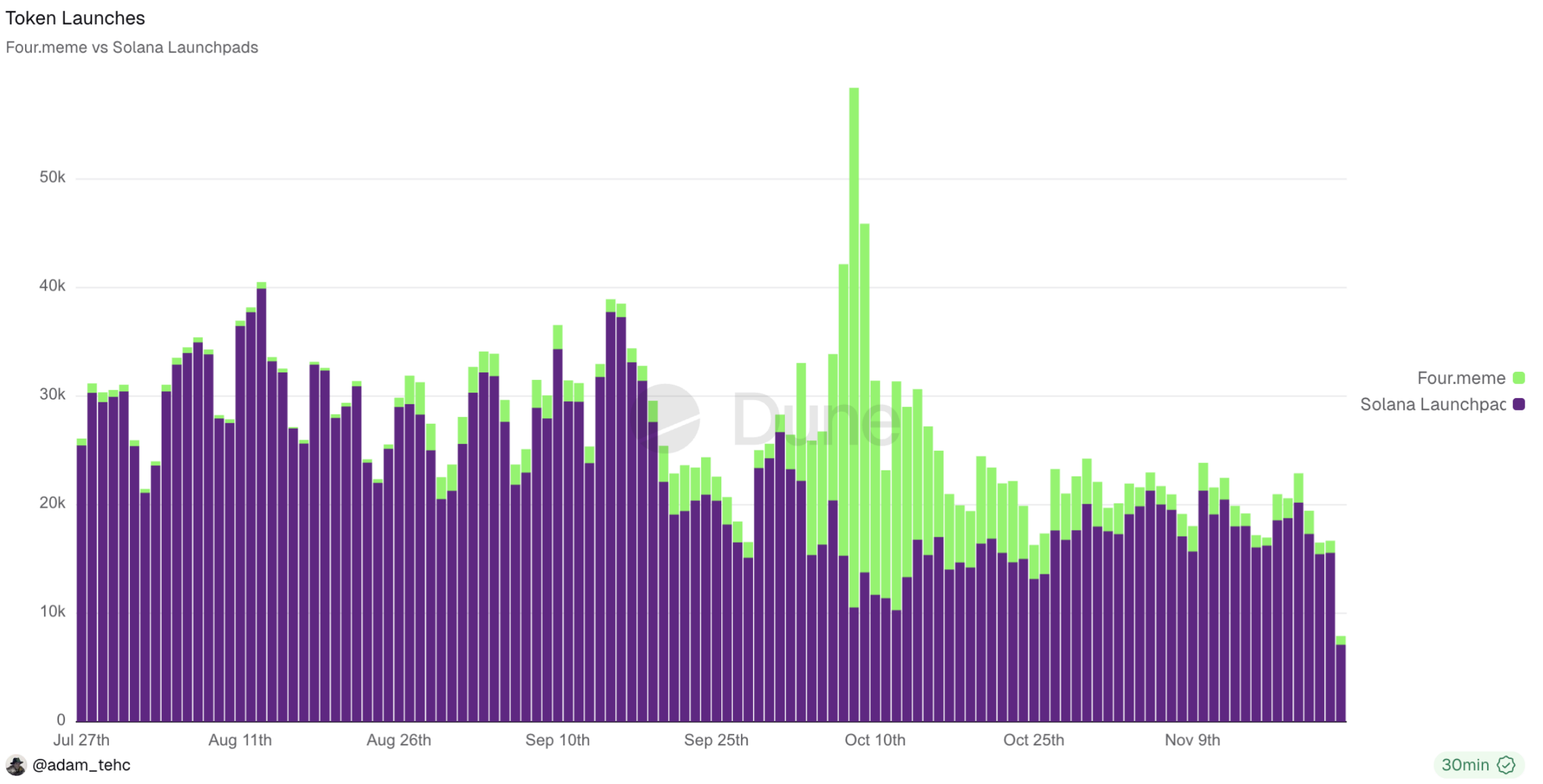

3. Last week, open interest and trading volume of altcoin contracts on exchanges continued to decline, and investor trading enthusiasm waned; the number of tokens minted on Solana and Bsc chains remained low. Solana's official Twitter hinted at major news, but the market still lacks hotspots.

Chart: Altcoin contract open interest and trading volume continue to decline

Data source: Coinglass

Chart: Token issuance on Solana and Bsc chains remains low

Data source: Dune

4. Important news last week:

Fed's Williams: The Fed may still cut rates in the short term;

MSCI is considering removing companies with more than 50% exposure to digital assets from major indices;

According to CryptoSlate, several Wall Street institutions sold off Strategy stocks in Q3, with a sell-off value of about $5.38 billion;

Franklin Templeton's XRP ETF was approved for listing on NYSE Arca, with the trading code XRPZ;

US Treasury Secretary Bessent: Interest rate-sensitive industries are in a period of pain, improvement is expected in 2026, and the overall economy is not facing a recession risk;

US congressmen proposed the "Bitcoin for America" bill, aiming to write strategic bitcoin reserves into law;

Mt.Gox transferred 10,608 BTC, worth $954 million;

Base co-founder Jesse launched the jesse token on November 21.

III. Focus This Week

1. Macro Events:

November 25: US September retail sales month-on-month, US September PPI data;

November 26: US weekly initial jobless claims;

November 28: Japan October unemployment rate;

December 1: Speech by Bank of Japan Governor Kazuo Ueda.

2. Token Unlocks:

See "This week, HYPE, SUI, XPL and other tokens will see large unlocks, with a total value exceeding $400 million"