Tom Lee’s BitMine Immersion Expands Crypto Treasury Holdings, Now Owns $13,236,220,005 Worth of Ethereum

An Ethereum treasury firm run by Fundstrat’s Tom Lee accumulated an additional 179,251 ETH in the past week.

BitMine Immersion Technologies, the largest Ethereum treasury firm in the world, now holds a total of 2,830,151 ETH worth more than $13.23 billion at time of writing.

BitMine also holds 192 Bitcoin ( BTC ), $456 million in unencumbered cash and a $113 million stake in the crypto treasury company Eightco Holdings (ORBS), which represents one of the firm’s “moonshots,” an investment strategy designed to support projects in the Ethereum ecosystem.

Eightco Holdings announced last month that it planned to raise approximately $270 million to fund a treasury strategy focused on Sam Altman’s Worldcoin ( WLD ), an Ethereum-based crypto asset.

BitMine currently owns more than 2.3% of the total ETH supply, and Lee notes the firm aims to reach “the alchemy of 5%.”

“The BitMine team sat down with Ethereum core developers and key ecosystem players and it is clear the community is focused on enabling Wall Street and AI to build the future on Ethereum. We remain confident that the two Supercycle investing narratives remain AI and crypto. Naturally, Ethereum remains the premier choice given its high reliability and 100% uptime. These two powerful macro cycles will play out over decades. Since ETH’s price is a discount to the future, this bodes well for the token and is the reason BitMine’s primary treasury asset is ETH.”

BitMine Immersion stock (BMNR) is up 7.4% on Monday at time of writing.

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MSTR to be "removed" from the index, JPMorgan research report "caught in the crossfire," crypto community calls for "boycott"

JPMorgan warned in a research report that if MicroStrategy is eventually excluded, it could trigger a mandatory sell-off amounting to 2.8 billions USD.

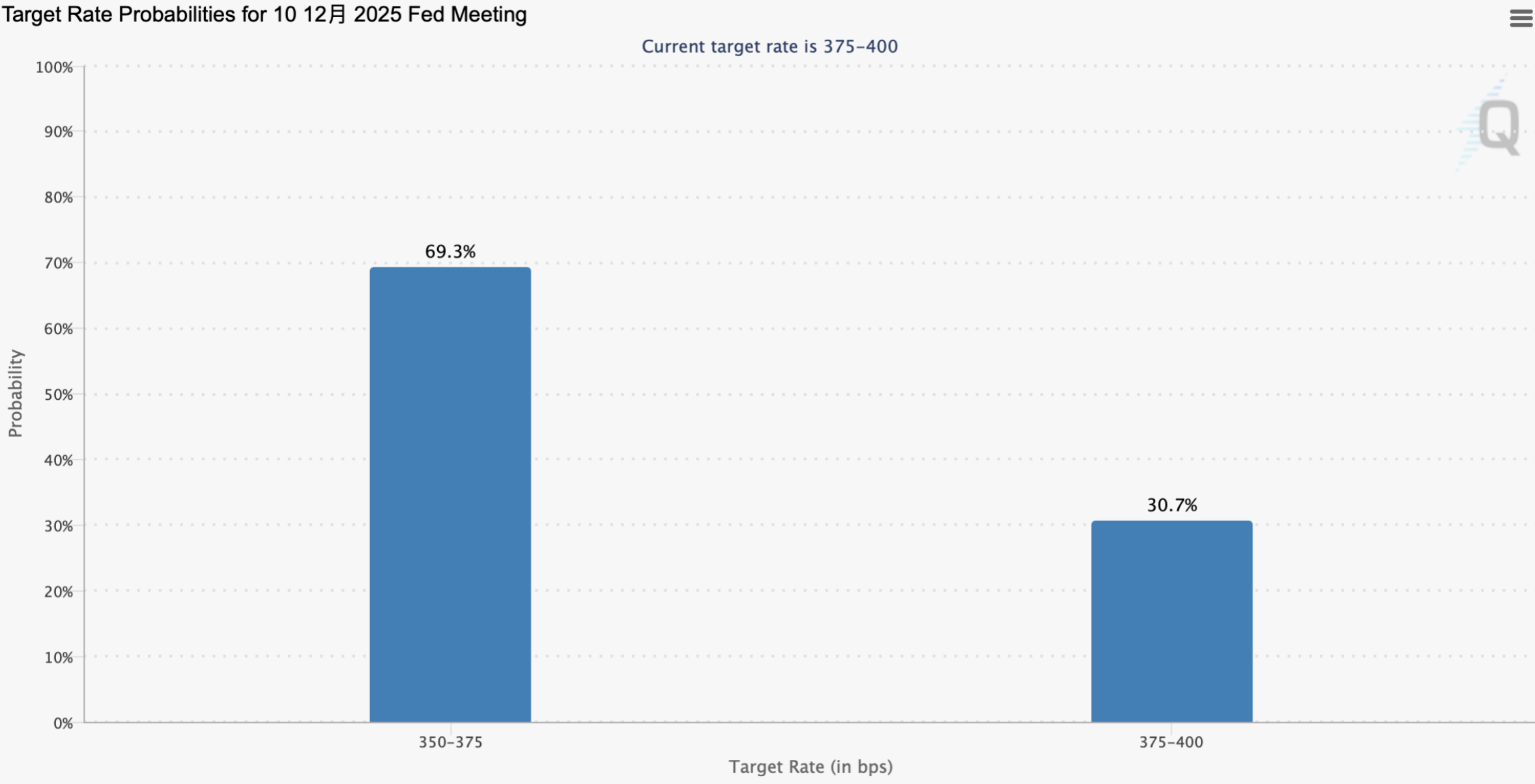

Weekly Crypto Market Watch (11.17-11.24): Market Continues to Decline, Potential for Recovery as Rate Cut Expectations Rise

The reversal of Fed rate cut expectations has led to significant volatility in BTC prices, with the market remaining in a state of extreme fear for 12 consecutive days. ETF funds continue to flow out, the altcoin market is sluggish, and investor trading enthusiasm is waning.

zkFOL: The Bitcoin Soft Fork Promising Native Privacy & DeFi

Crypto ETFs Rebound as Bitcoin, Ether and Solana See Fresh Inflows After Volatile Week