Bitcoin sentiment has dipped into Fear, but analysts say the downturn is likely temporary; a reclaim of $117,000 by Bitcoin or a US Federal Reserve rate cut would be the fastest paths to restoring positive market confidence.

-

Short-term FUD is rising but often precedes market reversals.

-

Key catalysts for a shift: Bitcoin reclaiming $117,000 and anticipated US rate cuts.

-

Market indicators: Crypto Fear Greed Index moved from Greed to Fear then Neutral; Santiment shows increased sell-talk volume.

Bitcoin sentiment dips into Fear; analysts say reclaiming $117,000 and a US rate cut could restore confidence. Read concise analysis and trader takeaways.

What is driving current Bitcoin sentiment?

Bitcoin sentiment has softened due to a recent price pullback, an altcoin retrace and rising trader talk of selling. Short-term indicators such as on-chain activity and the Crypto Fear Greed Index show increased caution, while analysts view this pullback as a normal correction after peak market euphoria.

How are on‑chain signals and market indicators describing the sell‑off?

Santiment reports elevated chatter about selling and bear scenarios as BTC price fell. The Crypto Fear Greed Index shifted from Greed to Fear and then to Neutral, reflecting rapid sentiment swings. Analysts note that heavy negative sentiment can be contrarian bullish when markets have already shaken out weak hands.

Analysts say Bitcoin reclaiming $117,000 and a Federal Reserve rate cut would be key drivers of positive sentiment after recent weakness.

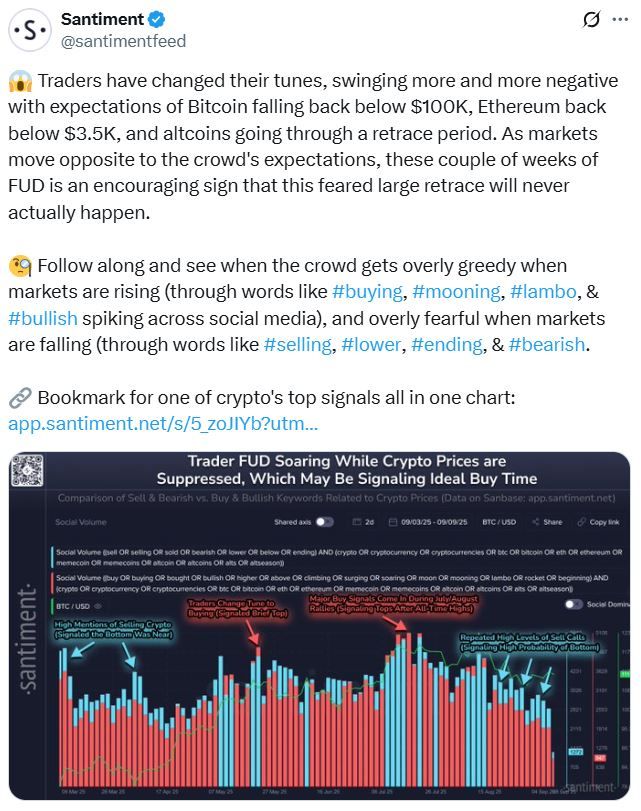

Crypto traders have swung into more negative sentiment and deeper fear, uncertainty and doubt (FUD), according to the on‑chain analytics firm Santiment, though analysts expect the shift to be temporary.

Santiment noted increased talk of selling and bear scenarios as Bitcoin and altcoins retraced. Historically, markets often move opposite to the crowd’s expectations, so recent FUD can signal a potential end to excessive downside pressure.

Market sentiment moved into Fear on Sunday, indicating investors were temporarily stepping back amid volatility.

Source: Santiment

Source: Santiment

Analysts say the negative tone should ease as Bitcoin stabilizes and monetary policy expectations shift toward easing.

How could a US rate cut affect crypto markets?

Many financial institutions and market strategists project at least two US Federal Reserve rate cuts in 2025. Pav Hundal, lead market analyst at Australian crypto broker Swyftx, says the Fed meeting is now the next major focal point and any cut may act as a catalyst for renewed positivity.

Hundal points to bond market dynamics and job‑market data as short‑term concerns, calling the price action a “healthy correction” following elevated sentiment. He adds that a frothy euphoria index showed BTC’s recent peak was driven by overheated demand.

“The rolling 30‑day performance of Bitcoin is negative, suggesting a correction that has shaken out weak hands since the $124,000 top,” Hundal said.

Could Bitcoin reclaiming $117,000 shift trader psychology?

The Crypto Fear Greed Index was Neutral on Monday after several days in Fear and a prior stretch of Greed. Charlie Sherry, head of finance at BTC Markets, notes sentiment extremes often precede reversals.

The Crypto Fear Greed Index returned to neutral territory on Monday. Source: alternative.me

The Crypto Fear Greed Index returned to neutral territory on Monday. Source: alternative.me

“If Bitcoin reclaims $117,000, I think sentiment would swiftly swing back; recent bounces already show early signs of this,” Sherry said. He adds that longer‑term targets like $200,000 remain distant and short‑term uncertainty persists.

Corporate crypto treasuries are another potential positive catalyst. Forward Industries recently disclosed $1.65 billion in cash and stablecoins to pursue a Solana‑focused treasury strategy, an example of firms increasing crypto holdings.

Sherry noted there is upside potential in Solana treasuries, though returns may be more compressed compared with prior Ether gains.

Why are traders more cautious in September?

ZX Squared Capital co‑founder and CIO CK Zheng says September has historically been weaker for equity returns, prompting caution. He expects sentiment to remain reactive to incoming macro data such as the Consumer Price Index and Producer Price Index.

Zheng also highlights geopolitical and trade policy moves as potential volatility drivers, noting past tariff announcements have dented crypto prices when implemented.

Frequently Asked Questions

What does the Crypto Fear Greed Index indicate now?

The Crypto Fear Greed Index recently moved from Greed into Fear, and then returned to Neutral. This rapid swing indicates trader indecision and heightened sensitivity to price moves and macro data.

How quickly can sentiment recover if Bitcoin rises?

Sentiment can flip rapidly—often within days—if Bitcoin reclaims key levels like $117,000, as traders respond to renewed upside momentum and reduced perceived risk.

How should traders respond to elevated FUD?

Traders should reassess risk, use position-sizing controls, and monitor macro indicators (CPI, PPI, Fed guidance). Historical patterns show extreme FUD can coincide with buying opportunities for disciplined strategies.

Key Takeaways

- Sentiment Shift: Short‑term market sentiment has moved into Fear after recent pullbacks.

- Catalysts: Bitcoin reclaiming $117,000 and potential US rate cuts are primary positive triggers.

- Actionable Insight: Monitor on‑chain metrics, the Crypto Fear Greed Index, and macro releases to time risk adjustments.

Conclusion

Current Bitcoin sentiment has cooled into Fear, yet analysts emphasize this appears temporary. Key triggers that could restore optimism are BTC reclaiming $117,000 and an easing Fed policy. Traders should watch on‑chain signals, macro data and corporate treasury moves for signs of a durable shift back to positive sentiment. COINOTAG will continue to monitor developments and report updates.